Private Credit Jobs: 5 Do's And Don'ts To Get Hired

Table of Contents

5 Do's to Secure Your Private Credit Job

Do 1: Network Strategically

Building a strong network is paramount in the competitive world of private credit. Don't underestimate the power of personal connections.

- Build relationships with professionals in private credit: Attend industry events, connect with people on LinkedIn, and reach out for informational interviews.

- Attend industry conferences and networking events: SuperReturn, industry-specific conferences, and even smaller, local meetups can be excellent networking opportunities. These events provide a chance to meet recruiters and potential employers directly.

- Leverage LinkedIn effectively: Optimize your profile with relevant keywords like "Private Credit Analyst," "Credit Underwriting," and "Direct Lending." Actively engage with posts and join relevant groups.

- Informational interviews: These are invaluable. Reach out to professionals in your target firms and ask for a brief informational interview to learn about their experience and the industry. This demonstrates initiative and can lead to unexpected opportunities.

- Keyword Optimization: Private Credit Networking, Finance Networking, Private Equity Networking, Investment Banking Networking

Do 2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count.

- Highlight relevant skills and experience: Emphasize skills like financial modeling, credit analysis, due diligence, portfolio management, and any experience with LBO modeling or DCF analysis.

- Use keywords from job descriptions: Carefully review job descriptions and incorporate relevant keywords such as "credit underwriting," "portfolio management," and specific software like "Bloomberg Terminal."

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, "increased portfolio returns by 15%" is far more impactful than "managed portfolio."

- Tailor your resume and cover letter to each specific job application: Generic applications rarely succeed. Show you understand the specific firm and role.

- Keyword Optimization: Resume Optimization, Cover Letter, Finance Resume, Private Credit Resume, Investment Banking Resume

Do 3: Master the Interview Process

The interview is your chance to shine. Preparation is key.

- Practice behavioral questions: Prepare answers to common behavioral questions like "Tell me about a time you failed," and "Describe a challenging situation and how you overcame it." Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Prepare technical questions related to financial modeling, valuation, and credit analysis: Expect questions on DCF analysis, LBO modeling, credit risk assessment, and industry trends.

- Research the firm and interviewer thoroughly: Demonstrate your genuine interest by showing you've done your homework.

- Ask insightful questions: Asking thoughtful questions demonstrates your engagement and understanding. Prepare a few questions beforehand.

- Follow up with a thank-you note: A timely thank-you note reinforces your interest and professionalism.

- Keyword Optimization: Interview Skills, Finance Interview Questions, Private Credit Interview, Investment Banking Interview

Do 4: Showcase your Financial Modeling Skills

Proficiency in financial modeling is non-negotiable for most private credit jobs.

- Develop proficiency in financial modeling software: Master Excel, and ideally, the Bloomberg Terminal.

- Demonstrate your ability to build and interpret financial models: Be prepared to discuss your modeling experience in detail.

- Highlight your experience with LBO modeling, DCF analysis, and other relevant techniques: Showcase your ability to use these tools to analyze investments and assess risk.

- Prepare case studies: Having examples of your work ready to discuss will impress interviewers.

- Keyword Optimization: Financial Modeling Skills, LBO Modeling, DCF Analysis, Financial Modeling Certification

Do 5: Highlight your Understanding of Private Credit

Demonstrate a deep understanding of the private credit market.

- Demonstrate knowledge of different private credit strategies: Familiarize yourself with direct lending, mezzanine financing, and other strategies.

- Stay updated on industry trends and news: Read industry publications and follow key players.

- Show understanding of credit risk assessment and portfolio management: Explain how you would assess the creditworthiness of a borrower and manage a portfolio of private credit investments.

- Read industry publications: Stay informed by regularly reading publications such as PEI Media and PitchBook.

- Keyword Optimization: Direct Lending, Mezzanine Financing, Credit Risk, Private Debt Investing

5 Don'ts to Avoid When Seeking Private Credit Jobs

Don't 1: Neglect Networking

Networking is crucial. Don't underestimate its importance in securing a private credit job.

Don't 2: Submit Generic Applications

Avoid submitting generic resumes and cover letters. Tailor each application to the specific firm and role.

Don't 3: Underprepare for Interviews

Thorough preparation is crucial for success in any private credit interview.

Don't 4: Overlook Financial Modeling Proficiency

Mastering financial modeling is essential for most private credit roles.

Don't 5: Lack Understanding of Private Credit Markets

Demonstrate a deep understanding of the private credit landscape and its complexities.

Conclusion

Securing a position in the competitive field of private credit jobs requires a strategic approach. By following these do's and don'ts, focusing on networking, tailoring your applications, mastering the interview process, and showcasing your expertise in financial modeling and private credit, you will significantly increase your chances of success. Start implementing these strategies today and take the first step towards your dream career in private credit. Don't delay; your ideal private credit job awaits!

Featured Posts

-

The Complex Interplay Between Apple And Googles Market Strategies

May 10, 2025

The Complex Interplay Between Apple And Googles Market Strategies

May 10, 2025 -

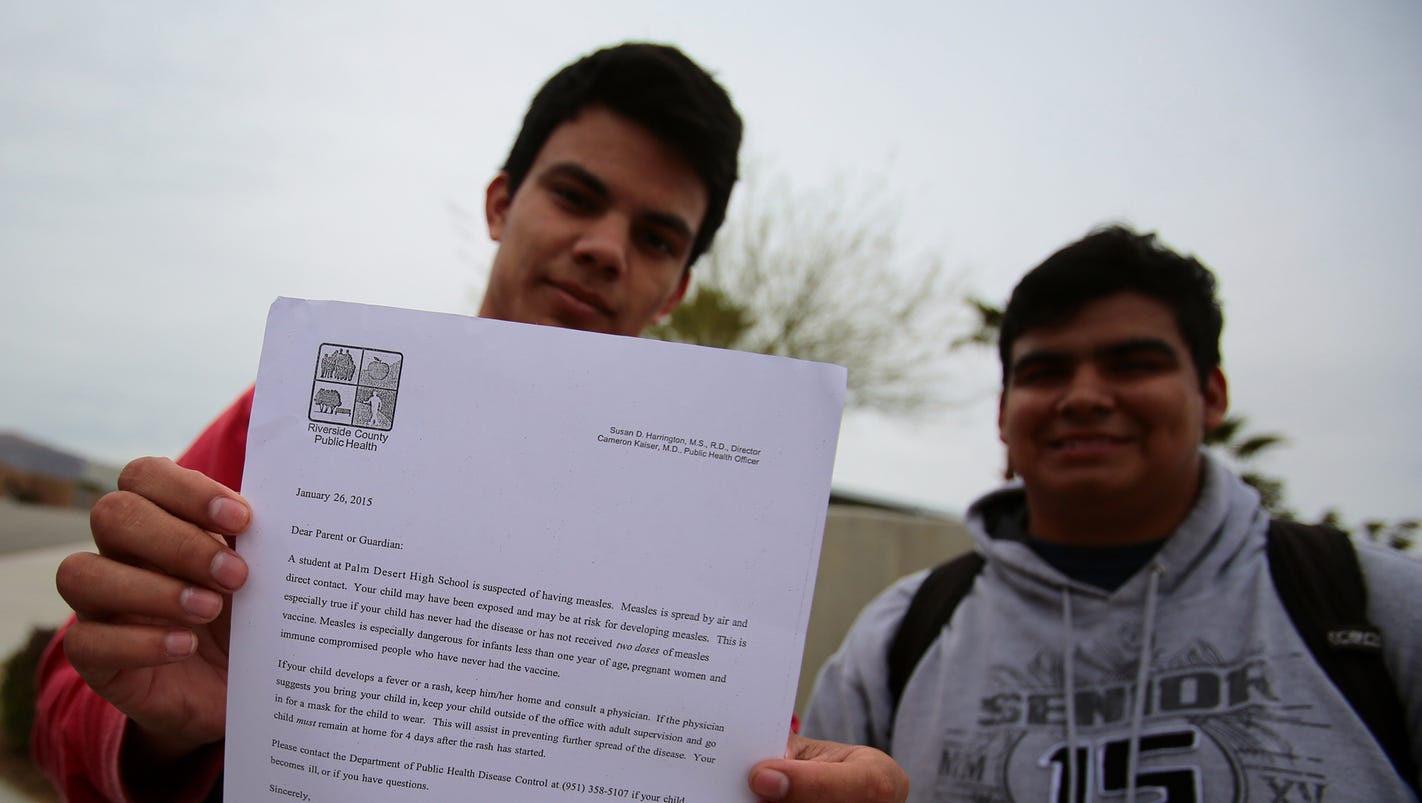

North Dakota Measles Outbreak Leads To Unvaccinated Student Quarantine

May 10, 2025

North Dakota Measles Outbreak Leads To Unvaccinated Student Quarantine

May 10, 2025 -

Dakota Johnson Supported By Family At Materialist Premiere

May 10, 2025

Dakota Johnson Supported By Family At Materialist Premiere

May 10, 2025 -

Whoop Under Fire Reneged Free Upgrade Promises Spark User Outrage

May 10, 2025

Whoop Under Fire Reneged Free Upgrade Promises Spark User Outrage

May 10, 2025 -

Lac Kir Dijon Violente Agression De Trois Hommes

May 10, 2025

Lac Kir Dijon Violente Agression De Trois Hommes

May 10, 2025