Private Equity Buys Boston Celtics For $6.1 Billion: What It Means For The Franchise

Table of Contents

The Impact of Private Equity Ownership on the Boston Celtics

Private equity, unlike traditional ownership models in sports which often involve single owners or family groups, involves investment firms pooling capital from various sources to acquire and manage businesses. This approach often focuses on maximizing returns within a defined timeframe. For the Boston Celtics, this translates to potentially significant changes.

The potential benefits of private equity ownership are substantial. Increased capital infusion can lead to:

- Increased investment in player talent: Strategic signings and trades to bolster the team's competitiveness and aim for championship contention. Expect a more aggressive approach in free agency and player trades.

- Modernization of facilities and fan experience: Upgrades to TD Garden, enhanced digital engagement, and improved in-game entertainment for fans. This could include technological advancements and improved fan amenities.

- Expansion into new revenue streams: Exploiting digital marketing, expanding merchandise offerings, and exploring international markets to maximize revenue generation. This could involve targeted advertising campaigns and the development of new products and services.

- Improved financial stability and long-term growth strategy: Private equity firms typically bring sophisticated financial expertise, leading to more robust financial planning and risk management. This should lead to a more sustainable business model.

However, potential drawbacks also exist. The focus on maximizing short-term returns could lead to:

- Cost-cutting measures: Potentially impacting operational budgets or non-player personnel. This could be a concern for long-term team stability.

- A shift in team culture: Prioritizing financial performance over team morale and tradition. This is a delicate balance that will require careful management.

The success of this private equity investment will hinge on careful strategic management, balancing financial goals with the needs of the team and the expectations of its loyal fanbase. Keywords associated with this section include Private Equity Investment, Sports Franchise Ownership, Financial Performance, Return on Investment (ROI), and Strategic Management.

Analysis of the $6.1 Billion Valuation: What Does it Mean?

The $6.1 billion valuation assigned to the Boston Celtics is a testament to the franchise's enduring appeal and market value. Several factors contribute to this impressive figure:

- Consistent playoff appearances and championship contention: The Celtics' history of success and recent playoff runs attract significant viewership and fan engagement. This consistent performance drives up demand and value.

- Strong fanbase and brand loyalty: The Celtics boast one of the most passionate and dedicated fan bases in the NBA, a key driver of revenue generation through ticket sales and merchandise.

- Lucrative media rights deals and broadcasting contracts: The team benefits from substantial revenue streams from television and streaming agreements. These contracts are crucial for profitability.

- Potential for future revenue growth: Expansion into international markets, innovative merchandise, and strategic sponsorships provide ample opportunities for further revenue growth.

Comparing this valuation to other NBA franchises and successful sports teams globally provides context. While specific figures vary, the Celtics' valuation is firmly in the upper echelon, reflecting their strong brand equity and market position. Keywords associated with this section include Franchise Valuation, NBA Finances, Market Value, Brand Equity, Revenue Streams, and Sports Business.

The Role of Debt in the Acquisition

The acquisition likely involved a significant amount of debt financing, a common strategy in leveraged buyouts (LBOs). The level of debt will impact the franchise's financial flexibility and operational capacity. While leveraging debt can amplify returns, it also increases financial risk. The ability to service this debt will be crucial to the long-term success of the private equity ownership. Keywords associated with this section include Leveraged Buyouts (LBOs), Debt Financing, Financial Risk, and Capital Structure.

Future Prospects for the Boston Celtics under New Ownership

The future of the Boston Celtics under private equity ownership presents both opportunities and uncertainties. In the short term, we can expect a focus on maximizing profitability and competitiveness. This might involve:

- Increased competitiveness on the court: Strategic player acquisitions and coaching decisions aimed at building a championship contender.

- Improved fan engagement and community outreach programs: Investing in the fan experience and strengthening the team's connection with the Boston community.

- Potential for long-term financial stability and growth: A well-executed private equity strategy should result in sustained financial health and long-term growth for the franchise.

The long-term implications remain to be seen, but the ownership transition promises a new era for the Boston Celtics. Changes in team management, coaching strategies, and player recruitment are likely. Keywords associated with this section include Team Strategy, Player Acquisition, Fan Engagement, Community Impact, and Long-Term Growth.

Conclusion: The Future of the Boston Celtics after the Private Equity Acquisition

The $6.1 billion private equity acquisition of the Boston Celtics marks a significant turning point for the franchise. While the potential benefits, such as increased investment and improved financial stability, are considerable, the risks associated with a private equity ownership model, such as potential cost-cutting and a short-term focus, require careful consideration. The ultimate success will depend on the strategic management of the new ownership and their ability to balance financial goals with the long-term interests of the team and its loyal fanbase. What are your thoughts on this monumental Boston Celtics private equity acquisition? Share your predictions for the franchise's future in the comments below!

Featured Posts

-

Jalen Brunsons Disappointment Missing Cm Punk Vs Seth Rollins On Raw

May 17, 2025

Jalen Brunsons Disappointment Missing Cm Punk Vs Seth Rollins On Raw

May 17, 2025 -

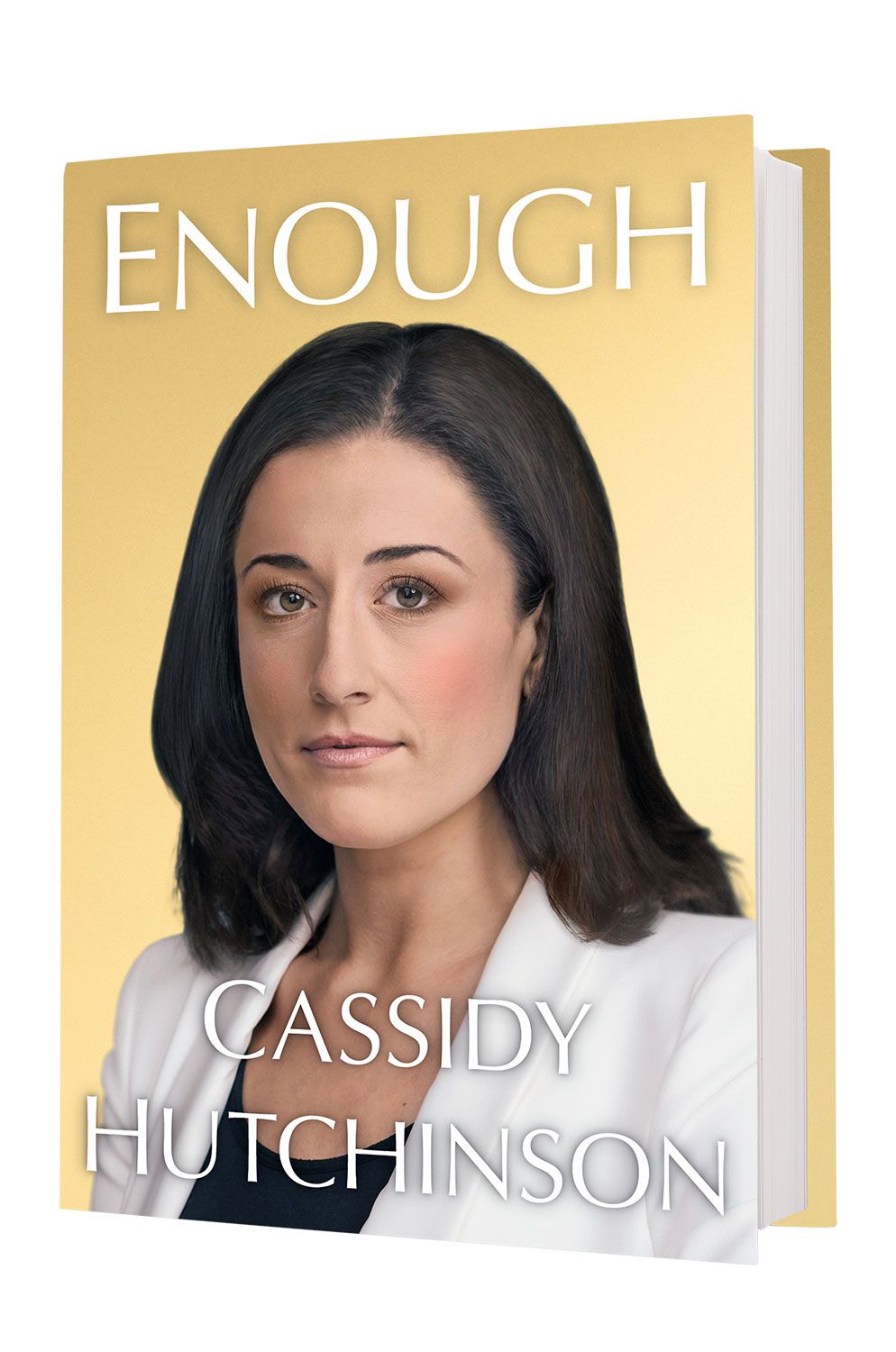

Cassidy Hutchinson Memoir A Look Inside The January 6th Hearings

May 17, 2025

Cassidy Hutchinson Memoir A Look Inside The January 6th Hearings

May 17, 2025 -

Nba Admits Missed Call Cost Pistons Game 4 What Now

May 17, 2025

Nba Admits Missed Call Cost Pistons Game 4 What Now

May 17, 2025 -

Track And Field Roundup Celebrating All Conference Athletes

May 17, 2025

Track And Field Roundup Celebrating All Conference Athletes

May 17, 2025 -

All Fortnite Tmnt Skins A Complete Guide To Obtaining Them

May 17, 2025

All Fortnite Tmnt Skins A Complete Guide To Obtaining Them

May 17, 2025