Private Equity Buys Boston Celtics For Record $6.1 Billion

Table of Contents

The Buyers: Unveiling the Private Equity Firm Behind the Boston Celtics Sale

The Boston Celtics sale was finalized by [Insert Name of Private Equity Firm Here], a prominent player in the world of private equity investment. This firm boasts a rich history of successful investments, including [mention previous significant investments, ideally with some connection to sports or entertainment]. Their investment strategy typically focuses on [describe their investment strategy, e.g., long-term growth, portfolio diversification, etc.].

This acquisition of the Boston Celtics signifies several key aspects of their investment philosophy:

- Expansion into the sports sector: The purchase represents a significant foray into the lucrative world of professional sports.

- High-growth potential: The Celtics possess considerable brand recognition and earning potential, aligning with the firm's pursuit of high-return investments.

- Strategic portfolio diversification: Adding a major sports franchise diversifies their investment portfolio, mitigating risks associated with focusing on a single sector.

Potential synergies exist with [mention potential synergies, e.g., existing marketing networks, expertise in media and entertainment]. Future investment plans likely include strategic upgrades to infrastructure, marketing campaigns, and potentially player acquisitions, all aimed at enhancing the team's performance and market value.

The Sale Price: A Record-Breaking Deal in the NBA

The $6.1 billion price tag attached to the Boston Celtics sale shatters previous records for NBA team sales. This surpasses the previous record held by [mention previous record holder and sale price] by a substantial margin. Several factors contributed to this unprecedented valuation:

- Consistent on-court success: The Celtics have a history of strong performance, consistently attracting large viewership and fan engagement.

- Lucrative media rights: The value of NBA media rights continues to climb, representing a significant revenue stream for the franchise.

- Strong brand and fanbase: The Celtics boast a fiercely loyal fanbase and a strong global brand recognition, contributing to high merchandise sales and sponsorship revenue.

This record-breaking Boston Celtics sale has profound implications for future NBA team valuations. We can expect other franchises to command significantly higher prices in future sales, reflecting the rising value of sports assets in the current market.

Impact on the Boston Celtics: Changes and Expectations

The Boston Celtics sale inevitably leads to several anticipated changes:

- Potential Management Restructuring: The new owners may restructure the team's management to align with their strategic vision.

- Coaching Staff Adjustments: Changes to the coaching staff could occur based on the new owners’ evaluation of the team's needs and direction.

- Player Acquisitions: The influx of capital could facilitate significant investments in new talent and player acquisitions, potentially boosting the team's competitiveness.

The impact on the fan experience will be closely watched. Changes to ticket pricing, stadium amenities, and community engagement initiatives are all possible. The long-term strategic vision of the new owners will largely determine the trajectory of the franchise and its relationship with its fanbase.

The Broader Implications for Professional Sports

The Boston Celtics sale underscores a growing trend: the increasing involvement of private equity firms in acquiring major sports franchises. This trend reflects the attractiveness of sports teams as high-value, stable investments.

- Increased financialization of sports: The influx of private equity capital is reshaping the financial landscape of professional sports, leading to higher valuations and increased competition for ownership.

- Impact on league dynamics: The consolidation of ownership by large financial entities could potentially influence league policies and competitive balance.

- Potential impact on player salaries: While increased revenue may lead to higher salaries, the financial focus of private equity may also influence salary negotiations.

This trend will likely continue to impact the NBA and other professional leagues, demanding closer scrutiny of the implications for team competitiveness, fan engagement, and the overall integrity of the sport.

Conclusion

The Boston Celtics sale, a record-breaking $6.1 billion transaction involving a prominent private equity firm, marks a significant turning point in the history of the franchise and professional basketball. This deal highlights the increasing value of sports franchises as investment assets, the growing influence of private equity in the industry, and the significant financial implications for the NBA and beyond. The success of this new ownership model remains to be seen, but the impact of this monumental Boston Celtics sale will undoubtedly shape the future of professional sports ownership. Stay tuned for further updates on the evolving story of the Boston Celtics sale and the implications for the future of professional basketball. Learn more about the impact of private equity investment on the Boston Celtics and other major sports franchises.

Featured Posts

-

Economic Downturn Slams Atlantic Canadas Lobster Fishing Industry

May 17, 2025

Economic Downturn Slams Atlantic Canadas Lobster Fishing Industry

May 17, 2025 -

Below Deck Down Under Season 2 Meet Anthonys Replacement

May 17, 2025

Below Deck Down Under Season 2 Meet Anthonys Replacement

May 17, 2025 -

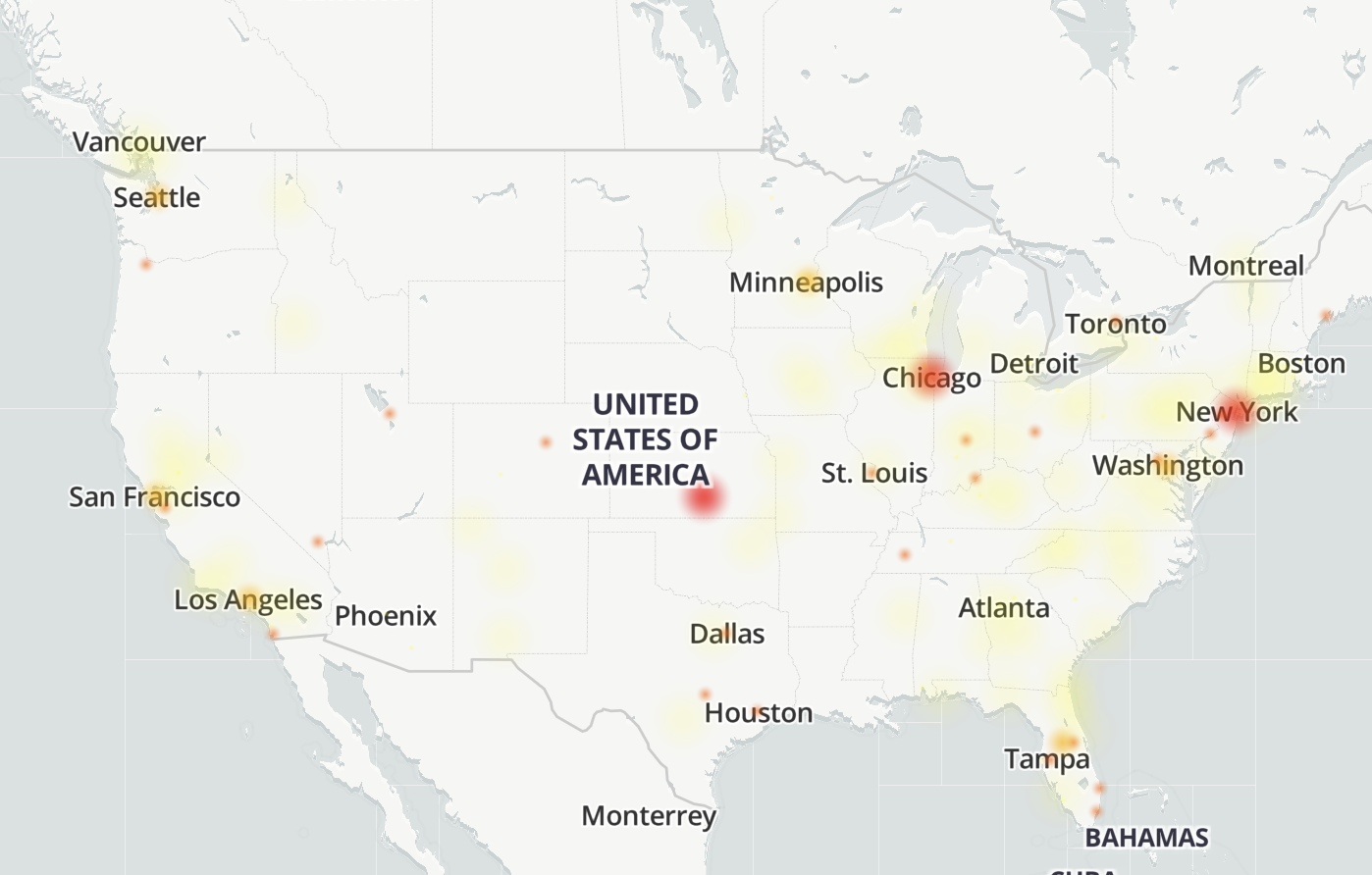

Is Reddit Down Thousands Report Problems Worldwide

May 17, 2025

Is Reddit Down Thousands Report Problems Worldwide

May 17, 2025 -

La Liga Hyper Motion Almeria Vs Eldense En Directo

May 17, 2025

La Liga Hyper Motion Almeria Vs Eldense En Directo

May 17, 2025 -

New York Daily News Back Pages May 2025 A Guide

May 17, 2025

New York Daily News Back Pages May 2025 A Guide

May 17, 2025