Private Equity Buys Celtics For $6.1 Billion: What This Means For Fans

Table of Contents

Potential Impacts on Ticket Prices and Fan Accessibility

The $6.1 billion price tag raises immediate concerns about ticket prices and fan accessibility. The private equity firm will naturally seek a substantial return on their investment, leading to speculation about potential price increases.

Increased Ticket Costs?

The sheer magnitude of the purchase price creates pressure to generate revenue. This could translate into higher ticket prices, potentially pricing some loyal fans out of attending games. However, the owners might also implement strategies to mitigate these price hikes.

- Higher demand potentially driving up secondary market prices. The increased interest in the team following the buyout could lead to inflated prices on resale ticket platforms.

- Potential for tiered ticket pricing strategies. The team might introduce a variety of ticket options, ranging from affordable seats to premium experiences, to cater to different budgets.

- Increased focus on luxury suites and premium experiences. To maximize revenue, the organization might focus on upgrading and selling more luxury suites and premium seating options.

Enhanced Fan Experience Initiatives?

While increased costs are a valid concern, the private equity investment could also lead to improvements in the fan experience. This could be a strategy to justify higher ticket prices and maintain fan loyalty.

- Investment in improved stadium technology and amenities. Upgrades to TD Garden, including improved Wi-Fi, concessions, and overall comfort, are possibilities.

- Enhanced fan engagement through interactive experiences. New technologies and in-arena entertainment could create a more immersive and engaging experience for fans.

- Potentially more family-friendly initiatives. The new owners may invest in making games more appealing and accessible for families, through discounted family packages or dedicated family sections.

Implications for Player Recruitment and Team Performance

The deep pockets of a private equity firm can significantly impact player recruitment and the team's on-court performance. This infusion of capital offers unprecedented opportunities, but also brings potential challenges.

Increased Spending on Player Salaries?

The substantial financial resources available following the Private Equity Celtics Buyout could allow the team to compete aggressively for top free agents and make strategic trades.

- Attraction of top free agents. The Celtics could become a more attractive destination for top players seeking lucrative contracts.

- Potential for strategic trades to improve the roster. The team could be more willing to acquire players through trades to fill specific roster needs.

- Impact on the team's salary cap. Increased spending on player salaries will need to be carefully managed to remain within the NBA’s salary cap regulations.

Pressure for Immediate Results?

With such a significant investment, the private equity firm will likely demand a quick return, putting pressure on the team's management to deliver immediate results.

- Increased scrutiny from ownership. The team's performance will be under intense scrutiny from the new owners.

- Potential for higher turnover in coaching and management staff. If the team fails to meet expectations, there might be changes in coaching and management.

- A more aggressive approach to player acquisitions. The pressure for quick success might lead to more aggressive strategies in player acquisition.

Long-Term Vision and Franchise Stability

The Private Equity Celtics Buyout has significant implications for the long-term financial stability and future of the franchise. While short-term gains are a priority, maintaining the Celtics' legacy is crucial.

Financial Stability and Future Investments

The injection of capital through this private equity deal drastically improves the team’s financial stability, reducing the risk of insolvency and allowing for long-term investments.

- Reduced risk of financial insolvency. The massive influx of cash provides a substantial financial cushion for the organization.

- Potential for expansion into related businesses. The private equity firm might explore expanding the Celtics' brand into other related businesses.

- Long-term investment in youth development programs. Significant investments in youth basketball development programs could solidify the team's future success.

Maintaining the Celtics' Legacy

The new owners must balance profit maximization with preserving the Celtics' rich history and tradition. This includes engaging with the community and fostering a connection with fans.

- Preservation of team culture and traditions. Maintaining the team's identity and values is crucial for preserving its legacy.

- Community engagement and charitable initiatives. Continued engagement with the Boston community is vital for maintaining the team's positive image.

- Balancing profit with the team’s legacy. The challenge for the new owners will be finding the right balance between profitability and upholding the team's legacy.

Conclusion

The $6.1 billion Private Equity Celtics Buyout presents a complex scenario with both significant opportunities and potential challenges. While the increased financial resources offer the potential for improved player acquisition, enhanced fan experiences, and greater financial stability, it also raises concerns about ticket pricing and the pressure for immediate results. Ultimately, the long-term success of this acquisition will hinge on the private equity firm's long-term vision and its ability to effectively manage the delicate balance between financial success and the preservation of the Celtics' storied legacy. Stay informed about the future of your favorite team by following further updates on the Private Equity Celtics Buyout and its impact on the team and its fans.

Featured Posts

-

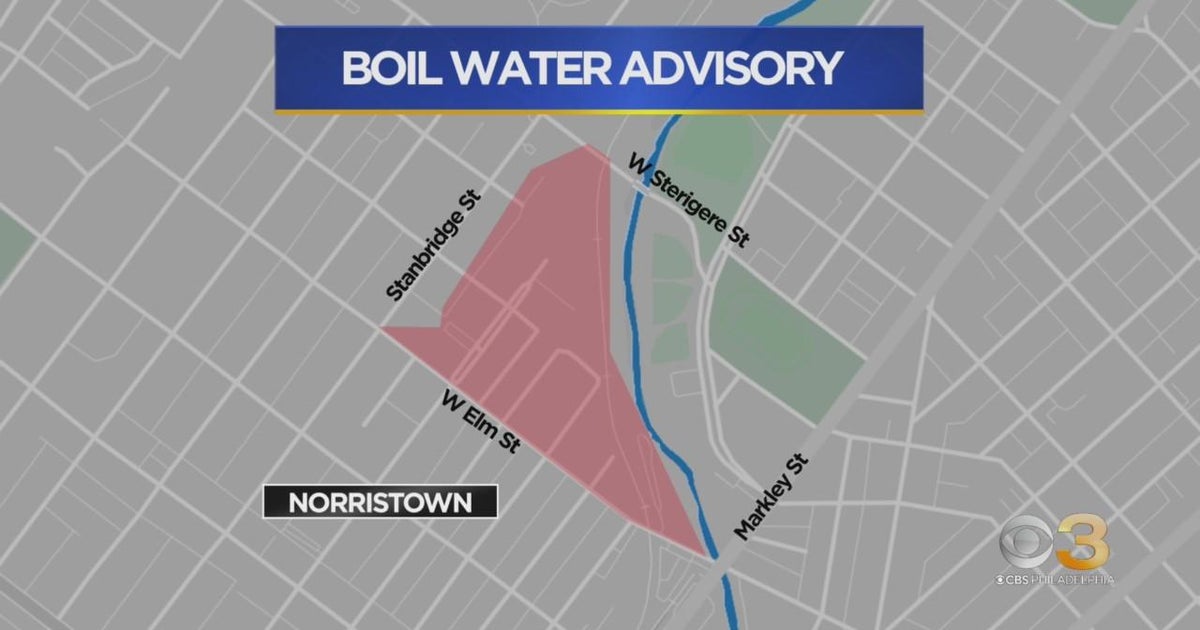

Russell County Town Issues Boil Water Advisory

May 16, 2025

Russell County Town Issues Boil Water Advisory

May 16, 2025 -

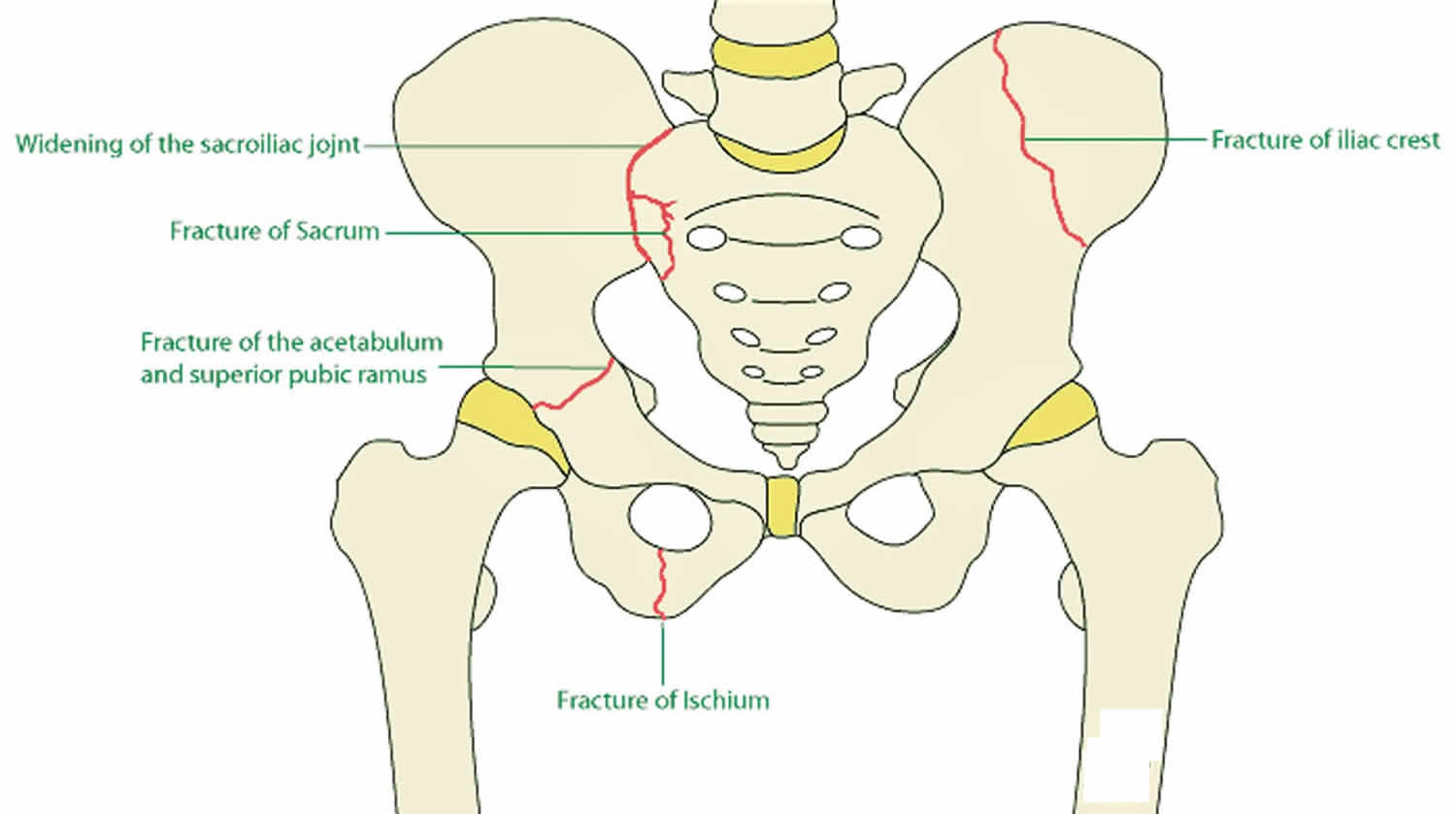

Butlers Pelvic Contusion Impact On Playoffs And Recovery Timeline

May 16, 2025

Butlers Pelvic Contusion Impact On Playoffs And Recovery Timeline

May 16, 2025 -

Padres Vs Yankees Series Prediction San Diegos 7 Game Winning Streak On The Line

May 16, 2025

Padres Vs Yankees Series Prediction San Diegos 7 Game Winning Streak On The Line

May 16, 2025 -

Neal Pionk Injury Report Game Highlights And Contract Status

May 16, 2025

Neal Pionk Injury Report Game Highlights And Contract Status

May 16, 2025 -

Dallas Stars Clinch 3 2 Series Lead Johnstons Quick Goal Sets The Pace

May 16, 2025

Dallas Stars Clinch 3 2 Series Lead Johnstons Quick Goal Sets The Pace

May 16, 2025