Proposed Changes To Bond Forward Regulations For Indian Insurers

Table of Contents

Current Bond Forward Regulations for Indian Insurers

Currently, Indian insurers face significant restrictions when participating in bond forward markets. These limitations directly influence their investment strategies and overall profitability.

Existing Restrictions and Limitations

The existing regulatory framework imposes several constraints on insurers' involvement in bond forwards. These limitations include:

- Strict Limits on Investment Amounts: Insurers are often restricted to a small percentage of their total assets for bond forward investments.

- Restricted Counterparty Selection: Insurers are typically only allowed to transact with specific, pre-approved counterparties, limiting their options.

- Limited Eligible Instruments: The range of bonds eligible for forward contracts is currently narrow, hindering diversification efforts.

- Complex Reporting and Compliance Requirements: The current regulatory framework mandates extensive reporting and compliance procedures, increasing operational costs.

These restrictions create several challenges:

- Reduced Portfolio Diversification: Insurers are unable to effectively diversify their portfolios, increasing their overall risk exposure.

- Limited Access to Hedging Opportunities: The inability to utilize bond forwards restricts insurers’ ability to effectively hedge against interest rate risk.

- Lower Potential Returns: The restricted access to bond forward markets limits the potential for higher returns that could be achieved through more sophisticated investment strategies.

Impact on Investment Strategies

Existing bond forward regulations significantly constrain the investment strategies of Indian insurers. This leads to:

- Conservative Investment Approaches: Insurers tend to adopt more conservative strategies, limiting their exposure to potentially higher-yielding but riskier assets.

- Suboptimal Risk Management: The inability to effectively hedge interest rate risk leaves insurers vulnerable to significant losses.

- Reduced Competitive Advantage: International insurers with greater access to bond forward markets gain a competitive edge over their Indian counterparts.

Proposed Changes and their Rationale

The IRDAI's proposed changes aim to address the limitations of the current framework, fostering greater participation by Indian insurers in the bond forward market.

Increased Investment Limits

The proposed amendments suggest a significant increase in the permissible investment limits in bond forwards for Indian insurers. This is primarily driven by:

- Enhanced Diversification: Higher limits allow insurers to diversify their investments and reduce overall portfolio risk.

- Improved Risk Management: Access to bond forwards allows for more effective hedging against interest rate fluctuations.

- Increased Investment Opportunities: Greater investment flexibility opens doors to more sophisticated investment strategies and higher potential returns.

The specific proposed increase in investment limits will likely be phased in gradually to ensure a smooth transition and minimize any potential risks.

Expansion of Eligible Instruments

The proposed changes also intend to expand the range of eligible instruments for bond forward contracts. This will include:

- Inclusion of a Wider Range of Government and Corporate Bonds: This will increase liquidity and provide insurers with more options for investment and hedging strategies.

- Potentially Adding Inflation-Linked Bonds: This would offer insurers protection against inflation risk, a crucial factor in long-term investment planning.

Broadening the range of eligible instruments brings several benefits:

- Improved Market Liquidity: A wider range of instruments will increase the overall trading volume in the bond forward market, creating more efficient price discovery.

- Greater Investment Choice: Insurers will gain more flexibility in constructing their investment portfolios, aligning with their specific risk and return objectives.

Enhanced Risk Management Framework

The proposed changes include a strengthened risk management framework to mitigate potential risks associated with increased bond forward activity. This entails:

- Strengthened Internal Risk Management Systems: Insurers will be required to implement robust internal risk management systems to monitor and control their bond forward exposures.

- Increased Reporting and Transparency: More stringent reporting requirements will improve transparency and oversight of insurers' bond forward activities.

- Regular Stress Testing and Scenario Analysis: Insurers will be mandated to conduct regular stress tests to evaluate their resilience to various market scenarios.

These changes should enhance the stability of the Indian insurance sector and reduce systemic risk.

Potential Impacts of Proposed Changes

The proposed changes are expected to have far-reaching implications for both the Indian bond market and the insurance sector.

Impact on the Bond Market

The proposed changes are likely to significantly boost the Indian bond market by:

- Increased Market Liquidity: Greater participation by insurers will enhance liquidity, making it easier to buy and sell bonds.

- Improved Price Discovery: Increased trading volume will lead to more efficient price discovery, reflecting accurate market valuations.

- Enhanced Market Depth: The expanded market will attract more investors, creating a more robust and resilient bond market.

The changes might also influence bond yields, potentially leading to a more competitive pricing environment.

Impact on Insurers' Investment Performance

The proposed modifications are anticipated to improve the investment performance of Indian insurers by:

- Higher Potential Returns: Access to a wider range of investment opportunities and better risk management tools should increase the potential for higher returns.

- Improved Risk-Adjusted Returns: Effective hedging strategies could enhance risk-adjusted returns.

However, it's also important to acknowledge that increased participation in the bond forward market also introduces higher potential risks, requiring careful risk management.

Systemic Implications

These changes hold broader implications for the Indian financial system:

- Enhanced Financial Stability: Improved risk management within the insurance sector contributes to greater stability of the overall financial system.

- Increased Economic Growth: Greater investment efficiency can stimulate economic growth by channeling capital into productive investments.

- Greater Global Integration: Improved access to global bond markets can enhance India's integration with the international financial system.

However, careful monitoring and risk mitigation strategies are crucial to minimize any potential systemic risks.

Conclusion

The proposed changes to bond forward regulations for Indian insurers represent a significant step towards modernizing the Indian insurance and bond markets. By increasing investment limits, expanding eligible instruments, and enhancing the risk management framework, these changes aim to unlock greater investment opportunities, improve risk management, and increase market liquidity. While potential benefits are substantial, careful consideration of potential risks is paramount. Staying informed about further developments in the IRDAI's regulatory framework concerning bond forward investments for Indian insurers is crucial. Consult with financial advisors for informed investment decisions related to the Proposed Changes to Bond Forward Regulations for Indian Insurers. Regularly review updates from the IRDAI and other credible financial news sources to stay abreast of the evolving regulatory landscape.

Featured Posts

-

Stock Market Valuation Concerns A Balanced View From Bof A

May 09, 2025

Stock Market Valuation Concerns A Balanced View From Bof A

May 09, 2025 -

Palantir Stock Analysts Adjust Forecasts After Price Rally

May 09, 2025

Palantir Stock Analysts Adjust Forecasts After Price Rally

May 09, 2025 -

Romantiki Komenti Materialists Deite To Neo Treiler Me Toys Dakota Johnson Pedro Pascal Kai Chris Evans

May 09, 2025

Romantiki Komenti Materialists Deite To Neo Treiler Me Toys Dakota Johnson Pedro Pascal Kai Chris Evans

May 09, 2025 -

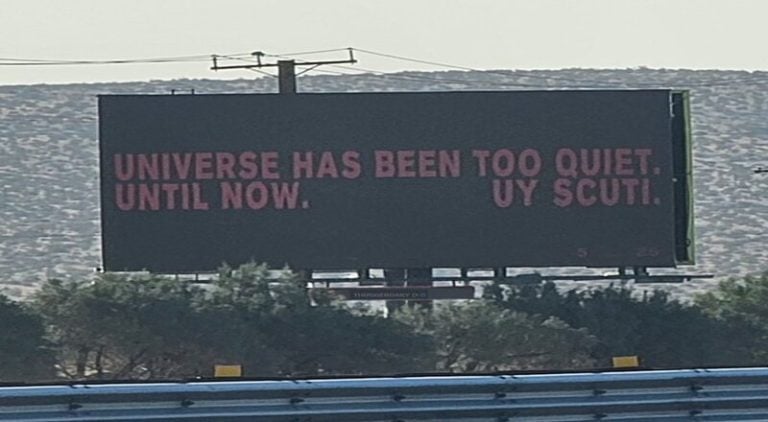

Uy Scuti Release Date Young Thugs Latest Update

May 09, 2025

Uy Scuti Release Date Young Thugs Latest Update

May 09, 2025 -

Zelenskiy 9 Maya Odin Pochemu Nikto Ne Priekhal

May 09, 2025

Zelenskiy 9 Maya Odin Pochemu Nikto Ne Priekhal

May 09, 2025