Protect Your Portfolio: S&P 500 Downside Risk Management

Table of Contents

Understanding S&P 500 Volatility and Downside Risk

Historical Performance Analysis

Analyzing the historical performance of the S&P 500 reveals a pattern of cyclical booms and busts. Understanding these market corrections is critical for effective S&P 500 downside risk management.

- The 2008 Financial Crisis: This event saw the S&P 500 plummet by over 50%, highlighting the potential for severe market downturns. Recovery took several years.

- The Dot-com Bubble (2000-2002): A significant technology-driven market crash resulted in substantial losses for many investors.

- The COVID-19 Pandemic (2020): The pandemic triggered a sharp and swift market correction, although a relatively quick recovery followed.

These examples demonstrate the importance of considering historical market data and S&P 500 volatility when planning your investment strategy. Understanding these fluctuations is a foundational aspect of S&P 500 downside risk management. Analyzing historical data helps in predicting potential future corrections and formulating robust risk mitigation strategies.

Identifying Risk Factors

Several factors contribute to S&P 500 downside risk. Identifying these risks is a crucial step in developing a comprehensive risk assessment.

- Economic Recessions: Economic downturns often lead to decreased corporate profits and lower stock prices, impacting the S&P 500.

- Geopolitical Events: International conflicts, political instability, and unexpected global events can trigger market uncertainty and volatility.

- Interest Rate Hikes: Increases in interest rates can impact borrowing costs for businesses and consumers, potentially slowing economic growth and affecting stock prices.

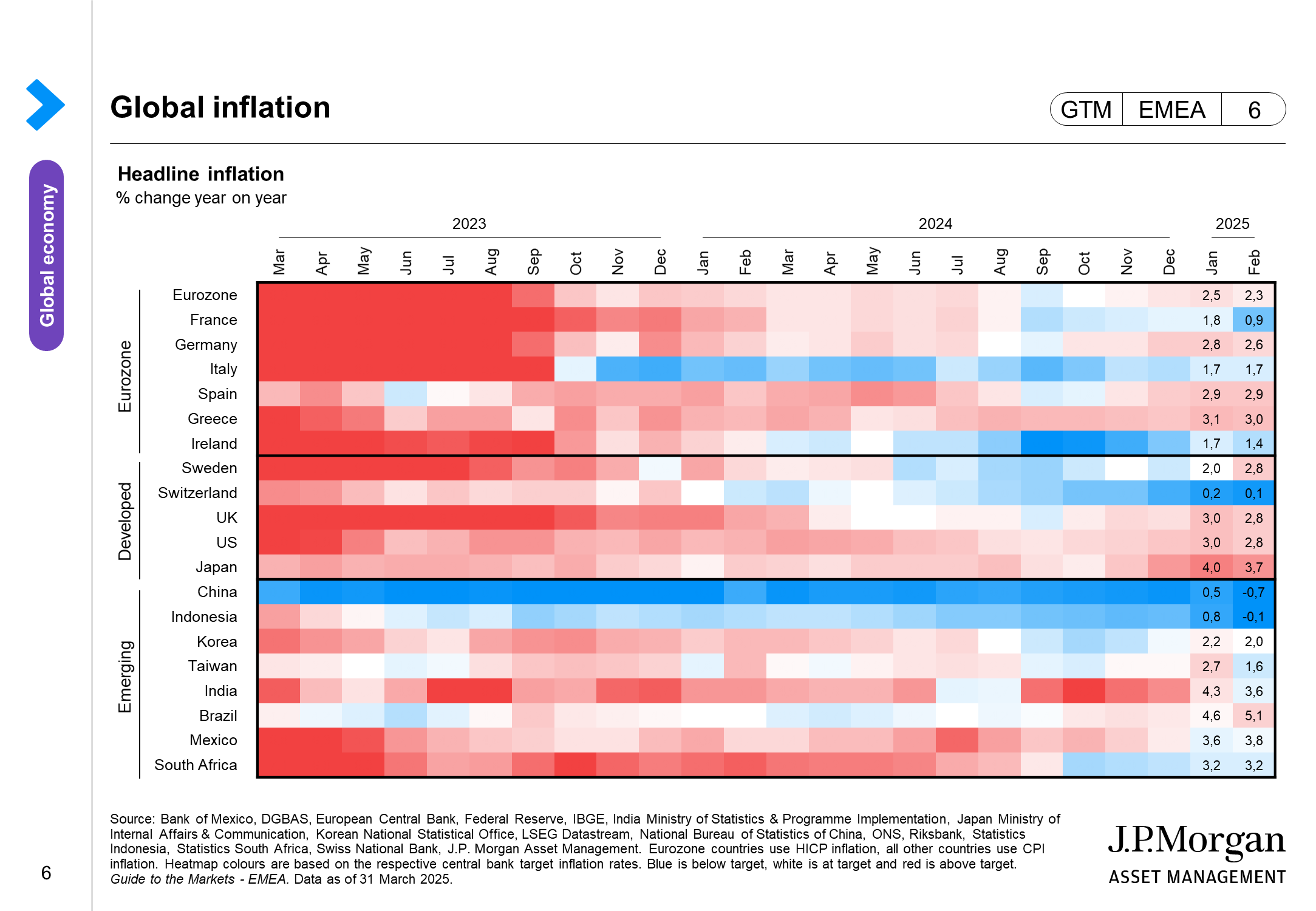

- Inflation: High and unexpected inflation erodes purchasing power and can lead to market corrections.

Understanding these market risk factors and their potential impact allows for proactive risk management planning. Monitoring economic indicators and geopolitical developments is crucial for informed decision-making.

Assessing Your Risk Tolerance

Before investing in the S&P 500, honestly assess your risk tolerance. This is a crucial step in developing a suitable S&P 500 risk management plan.

- How much potential loss can you absorb without significantly impacting your financial goals?

- What is your investment time horizon? Longer time horizons generally allow for greater risk-taking.

- What is your emotional response to market volatility?

Answering these questions helps determine your investment risk profile:

- Conservative: Prefers lower risk and potentially lower returns.

- Moderate: Balances risk and return, accepting some volatility.

- Aggressive: Willing to accept higher risk for potentially higher returns.

Using a risk tolerance questionnaire can further refine your understanding of your risk profile and inform your investment decisions. This is a vital component of effective risk management planning.

Strategies for S&P 500 Downside Risk Management

Diversification

Diversifying your investments beyond the S&P 500 is a cornerstone of effective portfolio diversification. By spreading your investments across various asset classes, you reduce your reliance on a single market's performance.

- International Stocks: Investing in companies outside the US can help reduce exposure to US-specific economic risks.

- Bonds: Bonds typically offer lower returns but less volatility than stocks, providing a cushion during market downturns.

- Real Estate: Real estate can offer diversification and potential for long-term growth, often acting as a hedge against inflation.

- Commodities: Investing in commodities like gold can act as a hedge against inflation and market uncertainty.

A well-diversified investment strategy is vital for mitigating risk and enhancing the resilience of your portfolio. Proper asset allocation is crucial in achieving this diversification.

Hedging Strategies

Hedging strategies, such as put options or inverse ETFs, can help protect against market declines. However, it's crucial to understand the associated risks.

- Put Options: These give the holder the right, but not the obligation, to sell an asset at a specified price (the strike price) before a certain date. They can limit downside risk.

- Inverse ETFs: These exchange-traded funds (ETFs) aim to deliver the opposite return of a specific index, providing potential gains when the market declines.

While hedging strategies can offer downside protection, they also incur costs and involve inherent risks. Careful consideration and understanding are necessary before implementing them. Understanding the intricacies of these risk mitigation techniques is critical.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy can reduce the impact of market volatility.

- DCA reduces the risk of investing a large sum at a market peak. By averaging your purchase price over time, you minimize the impact of short-term market fluctuations.

- DCA is a passive strategy that requires less market timing. It simplifies the investment process and reduces the emotional decision-making often associated with market volatility.

This DCA strategy is a simple yet powerful tool for mitigating S&P 500 downside risk. It requires discipline and a long-term perspective.

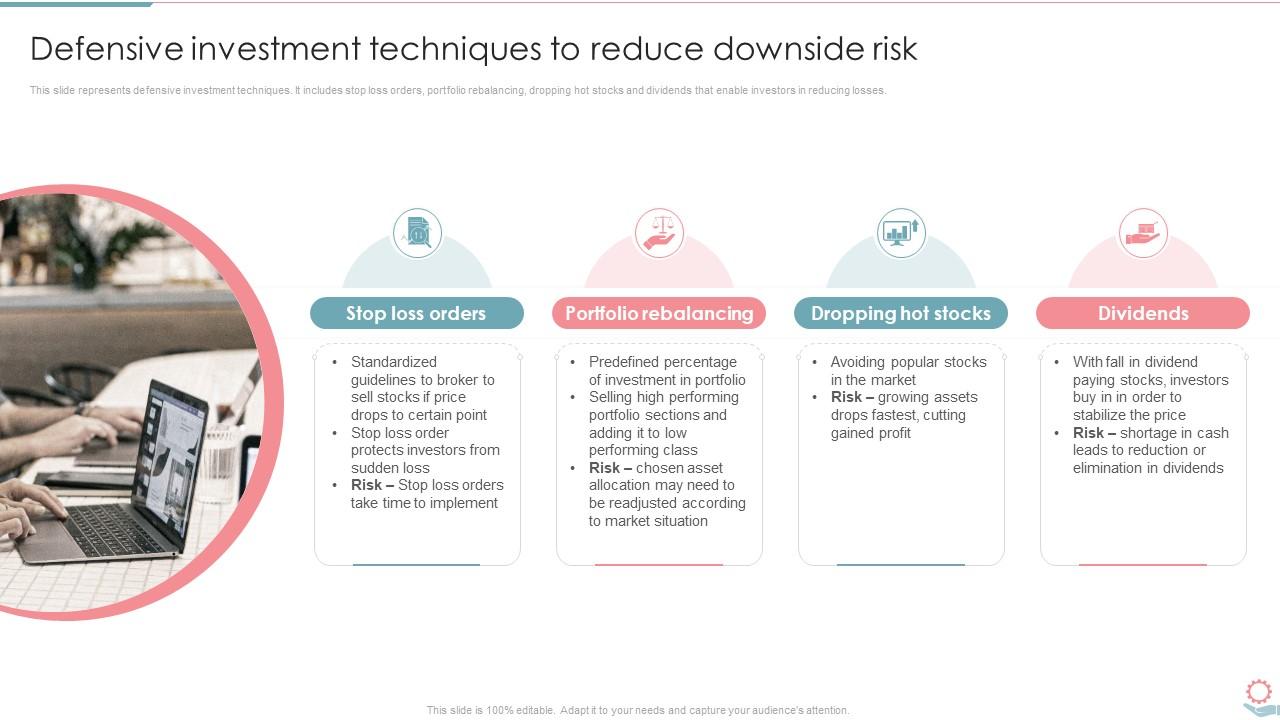

Stop-Loss Orders

Stop-loss orders automatically sell your investments when they reach a predetermined price, limiting potential losses.

- Trailing stop-loss orders adjust the stop price as the asset price rises, locking in profits while still providing downside protection.

- Stop-limit orders allow for a more controlled exit strategy, providing a safety net while potentially allowing for some price recovery.

While stop-loss orders offer risk management tools, they also carry risks, such as the possibility of being triggered by temporary market fluctuations. Carefully setting the stop price is vital for effective risk management.

Monitoring and Adjusting Your S&P 500 Portfolio

Regular Portfolio Reviews

Regularly reviewing and rebalancing your portfolio is crucial for maintaining your desired asset allocation and managing S&P 500 downside risk.

- Annual or semi-annual reviews allow you to assess your portfolio's performance, adjust your asset allocation based on your risk tolerance, and make necessary changes based on market conditions.

- Rebalancing involves selling some assets that have performed well and buying those that have underperformed, restoring your target asset allocation.

This helps maintain your desired risk level and prevents you from becoming overexposed to any single asset class.

Staying Informed

Stay informed about market trends and economic news to anticipate potential risks and adjust your investment strategy accordingly.

- Follow reputable financial news sources to stay updated on market developments and economic forecasts.

- Consider consulting with a financial advisor to gain personalized guidance on managing your portfolio and navigating market volatility.

Staying informed empowers you to make better investment decisions and proactively manage potential risks. Staying updated on market analysis is vital for effective portfolio management.

Safeguarding Your Investments with Effective S&P 500 Downside Risk Management

This article has outlined several key strategies for managing S&P 500 downside risk: diversification, hedging, dollar-cost averaging, stop-loss orders, and regular portfolio reviews. Implementing these strategies can significantly improve your portfolio's resilience to market fluctuations. Start protecting your portfolio today by implementing effective S&P 500 downside risk management strategies. Begin by assessing your risk tolerance and diversifying your investments. By proactively mitigating S&P 500 risk, you can pave the way for long-term investment success and safeguard your financial future. Remember, S&P 500 risk management is an ongoing process, requiring consistent monitoring and adjustments to maintain a well-protected portfolio.

Featured Posts

-

A Chocolate Bars Journey From Pregnancy Craving To Global Inflation Driver

Apr 30, 2025

A Chocolate Bars Journey From Pregnancy Craving To Global Inflation Driver

Apr 30, 2025 -

Eurovision 2025 Who Are The Favourites With Weeks To Go

Apr 30, 2025

Eurovision 2025 Who Are The Favourites With Weeks To Go

Apr 30, 2025 -

Lich Thi Dau Vong Chung Ket Giai Bong Da Thaco Cup 2025 Thoi Gian And Dia Diem Xem Truc Tiep

Apr 30, 2025

Lich Thi Dau Vong Chung Ket Giai Bong Da Thaco Cup 2025 Thoi Gian And Dia Diem Xem Truc Tiep

Apr 30, 2025 -

Documentario Mostra Festas Luxuosas De P Diddy Com Beyonce Jay Z E Donald Trump

Apr 30, 2025

Documentario Mostra Festas Luxuosas De P Diddy Com Beyonce Jay Z E Donald Trump

Apr 30, 2025 -

Canadas Federal Election Carneys Liberal Victory And The Trump Factor

Apr 30, 2025

Canadas Federal Election Carneys Liberal Victory And The Trump Factor

Apr 30, 2025