Protect Your Portfolio: S&P 500 Volatility And Downside Insurance Strategies

Table of Contents

Understanding S&P 500 Volatility and its Impact

Defining Volatility and its Measurement

Volatility, often measured using standard deviation or beta, quantifies the degree of price fluctuation in an asset or market index. High volatility translates to larger price swings, both positive and negative, impacting your portfolio's value significantly. A high standard deviation indicates greater price variability, while beta measures volatility relative to the overall market (represented by the S&P 500 itself). A beta of 1 means the asset moves in line with the market, while a beta greater than 1 signifies higher volatility than the market.

- Historical Examples: The 2008 financial crisis saw the S&P 500 plummet by over 37%, demonstrating the devastating impact of high volatility. Conversely, the tech bubble burst of the early 2000s also led to significant losses for investors unprepared for such sharp declines.

- Data Point: The average annual standard deviation of the S&P 500 over the past 10 years has been approximately 15%, highlighting the persistent nature of market fluctuations. (Note: This is a hypothetical example; actual data should be sourced from reputable financial data providers).

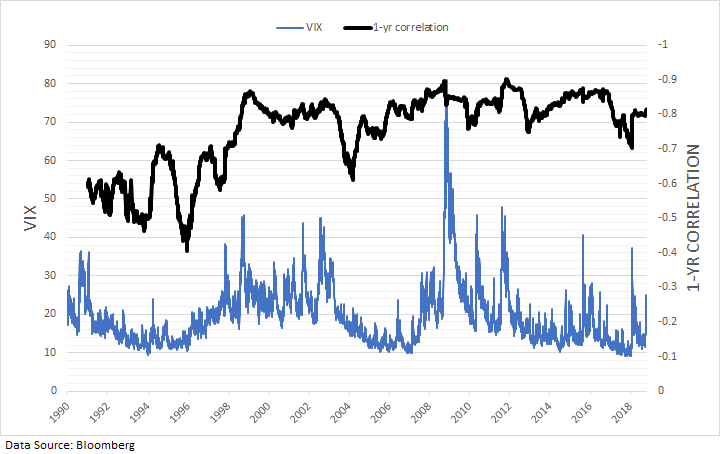

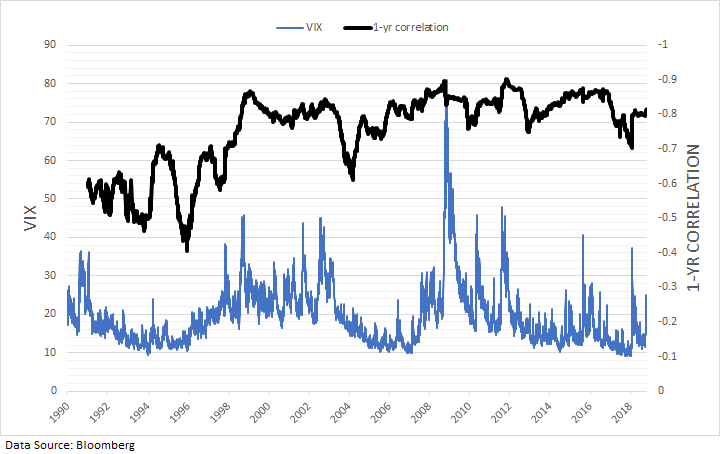

- Chart: (Insert a chart here visually depicting S&P 500 volatility over a specified period, clearly labeled and sourced).

Identifying Sources of S&P 500 Volatility

Several factors contribute to the S&P 500's fluctuating nature. Understanding these sources is critical for anticipating potential market swings and implementing appropriate protective measures.

-

Economic Indicators: Changes in inflation, unemployment rates, GDP growth, and consumer confidence directly impact investor sentiment and market valuations.

-

Geopolitical Events: International conflicts, political instability, and unexpected global events often trigger market uncertainty and increased volatility.

-

Interest Rate Changes: Federal Reserve decisions regarding interest rates significantly influence borrowing costs, corporate profitability, and overall market direction.

-

Examples: The COVID-19 pandemic triggered a sharp market downturn in early 2020, showcasing the impact of unexpected global events. Similarly, the ongoing war in Ukraine has created significant market uncertainty.

Assessing Your Personal Risk Tolerance

Before implementing any downside insurance strategy, it's crucial to honestly assess your risk tolerance. Your investment approach should align with your comfort level regarding potential losses.

- Questions to Ask Yourself:

- What is the maximum percentage loss I can comfortably absorb without significantly altering my long-term financial goals?

- What is my investment time horizon? Longer time horizons generally allow for greater risk-taking.

- How would a significant market downturn affect my overall financial well-being?

- Risk Tolerance and Investment Choices: Investors with low risk tolerance should prioritize capital preservation, while those with higher risk tolerance might accept greater volatility in pursuit of higher returns.

Downside Insurance Strategies for the S&P 500

Options Strategies (Protective Puts)

Protective puts are options contracts that provide insurance against potential losses in your S&P 500 holdings. By purchasing put options, you acquire the right, but not the obligation, to sell your shares at a predetermined price (the strike price) before the option's expiration date.

- Step-by-Step:

- Determine the desired strike price and expiration date.

- Purchase put options with a strike price at or below your desired protection level.

- If the market falls below the strike price, you can exercise the put option to sell your shares at the higher strike price, limiting your losses.

- Break-Even Point and Maximum Loss: The break-even point is the strike price minus the premium paid for the puts. Your maximum loss is limited to the premium paid for the puts.

- Other Options Strategies: Covered calls (selling call options on shares you own) and collars (combining protective puts and covered calls) offer alternative risk management approaches.

Hedging with Inverse ETFs

Inverse exchange-traded funds (ETFs) aim to deliver the opposite performance of a benchmark index like the S&P 500. Investing in inverse ETFs can act as a hedge against market declines.

- Risks and Benefits: While inverse ETFs can protect against losses during market downturns, they can significantly amplify gains during market rallies. Moreover, they are designed for short-term trading, not long-term holding.

- Amplified Losses: Holding inverse ETFs during sustained market uptrends can lead to substantial losses.

- Examples: (Mention specific examples of inverse S&P 500 ETFs, such as those with ticker symbols like SH or SDS. Disclaimer: This is for informational purposes only and not financial advice).

Diversification

Diversification is a cornerstone of risk management. By spreading your investments across various asset classes, you reduce the overall volatility of your portfolio.

- Asset Classes: Bonds, real estate, commodities, and international stocks can help balance the risk associated with S&P 500 exposure.

- Correlation: Asset classes with low or negative correlation with stocks can help buffer portfolio losses during market downturns.

Stop-Loss Orders

Stop-loss orders instruct your broker to sell your shares when they reach a predetermined price, limiting potential losses.

- Types of Stop-Loss Orders: Market orders execute at the next available price, while limit orders specify a price at which the sale must occur.

- Slippage and Limitations: Stop-loss orders don't guarantee a specific sale price. Market volatility can cause slippage, where the actual sale price is lower than the stop price.

Building a Robust Portfolio Protection Plan

Developing a Personalized Strategy

Your portfolio protection strategy should be tailored to your individual risk tolerance, investment goals, and time horizon.

- Steps:

- Define your investment goals and time horizon.

- Assess your risk tolerance honestly.

- Choose appropriate downside insurance strategies.

- Regularly monitor and rebalance your portfolio.

- Professional Advice: Seeking guidance from a qualified financial advisor is strongly recommended to develop a customized plan.

Regular Monitoring and Rebalancing

Ongoing portfolio management is crucial. Regularly review your investments and rebalance your portfolio to maintain your desired asset allocation.

- Frequency: The frequency of reviews should depend on your risk tolerance and market conditions. At a minimum, an annual review is recommended.

- Rebalancing: Rebalancing involves selling some assets that have outperformed and buying others that have underperformed to restore your target asset allocation.

Conclusion

Protecting your portfolio from S&P 500 volatility is essential for long-term investment success. By understanding downside risk and implementing appropriate downside insurance strategies such as options, hedging, diversification, and stop-loss orders, you can significantly enhance your portfolio's resilience. Remember, a personalized S&P 500 downside insurance strategy tailored to your risk tolerance and investment goals is paramount. Consult with a financial advisor to create a comprehensive plan that effectively protects your portfolio from S&P 500 volatility and helps you achieve your financial objectives. Don't delay in exploring different S&P 500 downside insurance strategies to find the best fit for your individual needs.

Featured Posts

-

15 000 And Counting Is Ripple Xrp Your Next Millionaire Maker Investment

May 01, 2025

15 000 And Counting Is Ripple Xrp Your Next Millionaire Maker Investment

May 01, 2025 -

Simple Shrimp Ramen Stir Fry Recipe For Beginners

May 01, 2025

Simple Shrimp Ramen Stir Fry Recipe For Beginners

May 01, 2025 -

Wkrns Nikki Burdine Departs After Seven Years As Morning Anchor

May 01, 2025

Wkrns Nikki Burdine Departs After Seven Years As Morning Anchor

May 01, 2025 -

Jalen Hurts Skips White House Visit Amidst Trumps Controversial Remarks

May 01, 2025

Jalen Hurts Skips White House Visit Amidst Trumps Controversial Remarks

May 01, 2025 -

Canadian Election 2024 Poilievres Unexpected Defeat

May 01, 2025

Canadian Election 2024 Poilievres Unexpected Defeat

May 01, 2025

Latest Posts

-

Leo Carlssons Two Goal Performance Overshadowed By Ducks Ot Loss To Stars

May 01, 2025

Leo Carlssons Two Goal Performance Overshadowed By Ducks Ot Loss To Stars

May 01, 2025 -

Anaheim Ducks Vs Dallas Stars Carlssons Two Goals In Overtime Defeat

May 01, 2025

Anaheim Ducks Vs Dallas Stars Carlssons Two Goals In Overtime Defeat

May 01, 2025 -

La Kings Kevin Fiala Leads Team To Shootout Win Against Dallas Stars

May 01, 2025

La Kings Kevin Fiala Leads Team To Shootout Win Against Dallas Stars

May 01, 2025 -

Kevin Fiala Extends Point Streak As La Kings Defeat Dallas Stars

May 01, 2025

Kevin Fiala Extends Point Streak As La Kings Defeat Dallas Stars

May 01, 2025 -

Ducks Carlsson Scores Twice But Overtime Loss To Stars

May 01, 2025

Ducks Carlsson Scores Twice But Overtime Loss To Stars

May 01, 2025