PwC Exits Nine African Nations: Implications For The African Market

Table of Contents

Impact on Audit and Assurance Services in Affected Nations

The departure of PwC significantly alters the audit and assurance services market in the affected African nations.

Reduced competition and potential for increased fees for remaining firms

- Price Increases: With fewer major players, remaining audit firms may have increased leverage to raise their fees, potentially impacting smaller businesses and startups significantly. This could disproportionately affect those with limited financial resources.

- Market Power Concentration: The reduction in competition concentrates market power, potentially leading to less choice and less competitive pricing for clients.

- Service Delays: Increased workload for remaining firms could lead to delays in audit completion, potentially impacting businesses' financial reporting timelines and access to capital.

- Seeking Alternatives: Businesses now need to proactively identify and vet alternative audit providers, ensuring they select firms with the necessary expertise and capacity.

Increased scrutiny on remaining audit firms

- Heightened Regulatory Oversight: Regulatory bodies will likely increase their scrutiny of the remaining firms to ensure the continued integrity and quality of audit services. This could involve more frequent inspections and stricter compliance measures.

- Ethical Standards and Transparency: Maintaining the highest ethical standards and transparent practices is paramount for the remaining firms to regain and maintain investor and public confidence.

Implications for Tax Advisory and Consulting Services

PwC's exit also creates substantial shifts in the tax advisory and consulting sectors.

Loss of expertise and potentially higher costs for businesses seeking these services

- Scarcity of Expertise: In some regions, specialized tax expertise is already limited. PwC's departure exacerbates this scarcity, making it more challenging for businesses to navigate complex tax regulations and ensure compliance.

- Increased Compliance Challenges: Businesses may face increased difficulties in understanding and complying with evolving tax laws, potentially leading to penalties and legal issues.

Opportunities for local and regional firms to expand their services

- Growth for Indigenous Firms: The gap left by PwC presents a significant opportunity for local and regional firms to expand their services and attract new clients. This could lead to substantial growth and job creation.

- Foreign Investment in African Consulting: The increased demand for consulting services might attract foreign investment, further boosting the capabilities of African firms.

Effects on Foreign Direct Investment (FDI)

The withdrawal of such a prominent global player could have a noticeable impact on Foreign Direct Investment (FDI).

Potential negative impact on investor confidence

- Reduced Trust and Increased Risk Perception: PwC's departure could negatively impact investor confidence, potentially deterring new investment and leading to a reassessment of existing investments. Investors may perceive increased risks in operating in these countries.

- Maintaining a Robust Business Environment: Governments need to actively work to maintain a transparent, stable, and predictable business environment to reassure investors and attract future FDI.

Increased reliance on local expertise and networks

- Strengthening Local Partnerships: Businesses will increasingly need to rely on local expertise and build strong relationships with local business partners and advisors.

- Understanding Local Regulations: A deep understanding of the local regulatory landscape is crucial for companies operating in these markets.

The Broader Economic Impact

The ramifications of "PwC Exits Nine African Nations" extend beyond individual businesses, impacting the broader economic landscape.

Job losses and its ripple effects

- Direct and Indirect Job Losses: PwC's withdrawal will result in direct job losses within the firm and potentially trigger indirect job losses in related sectors.

- Reduced Economic Activity: Decreased employment and reduced spending power can lead to lower economic activity and slower growth in the affected regions.

The need for proactive government responses

- Government Support for Businesses: African governments must take proactive steps to support businesses affected by PwC's withdrawal, potentially through financial assistance programs or regulatory relief.

- Improving Investment Climate: Governments need to implement policies that create a more stable, attractive, and predictable investment climate to mitigate the negative impact and attract new investors.

Conclusion: Navigating the Aftermath of PwC's Departure from Nine African Nations

The decision of "PwC Exits Nine African Nations" presents both challenges and opportunities for the African market. The implications are far-reaching, affecting audit and assurance services, tax advisory, FDI, and the overall economic landscape. The reduced competition in professional services could lead to higher costs and potential delays for businesses. Simultaneously, it presents a chance for local firms to expand and potentially attract foreign investment. Governments need to respond proactively by supporting businesses and creating a more attractive investment climate. Businesses must proactively assess their risk exposure, explore alternative service providers, and adapt to this changing business environment. Further research and analysis are crucial to understanding the long-term consequences of this significant development. We encourage readers to share their thoughts and perspectives on the matter, contributing to a comprehensive understanding of the implications of PwC's withdrawal from these nine African nations.

Featured Posts

-

160km Mlb

Apr 29, 2025

160km Mlb

Apr 29, 2025 -

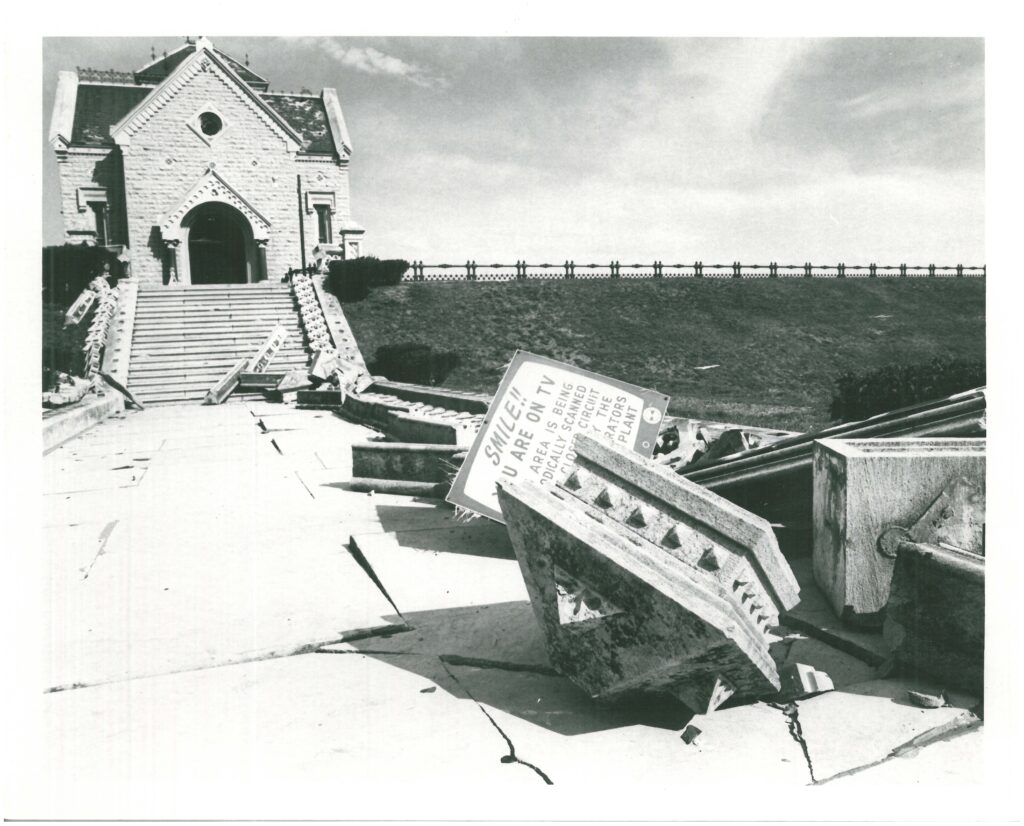

Remembering The Louisville Tornado A Communitys Strength

Apr 29, 2025

Remembering The Louisville Tornado A Communitys Strength

Apr 29, 2025 -

Struggling With Nyt Spelling Bee 360 Hints And Answers For February 26th

Apr 29, 2025

Struggling With Nyt Spelling Bee 360 Hints And Answers For February 26th

Apr 29, 2025 -

Black Hawk Helicopter Crash Pilot Ignored Instructors Warnings

Apr 29, 2025

Black Hawk Helicopter Crash Pilot Ignored Instructors Warnings

Apr 29, 2025 -

Preview Ru Pauls Drag Race Season 17 Episode 11 The Ducks Take Flight

Apr 29, 2025

Preview Ru Pauls Drag Race Season 17 Episode 11 The Ducks Take Flight

Apr 29, 2025