PwC Scandal: Global Impact Of Accounting Firm's Withdrawals

Table of Contents

The Scale of PwC's Withdrawals and Their Immediate Impact

The sheer number of clients affected by PwC's withdrawals is staggering, spanning diverse sectors including technology, finance, energy, and more. This isn't just about small businesses; the impact extends to multinational corporations and significantly shapes the global financial reporting landscape.

Number of Affected Clients and Industries

Determining the precise number of clients impacted remains challenging, as the fallout is ongoing. However, news reports and official statements indicate a significant number of companies have been forced to find new auditors, leading to considerable disruption.

- Specific Examples: Several high-profile technology companies, including [insert example company names if available and verifiable], were reportedly affected, facing the complex and costly process of switching auditors. Similarly, significant players in the financial sector have also had to navigate the aftermath.

- Financial Implications: The cost of switching auditors is substantial, encompassing legal fees, logistical hurdles, and potential delays in financial reporting. These delays can impact stock prices, investor relations, and overall business operations. The financial implications are felt acutely across all affected industries.

Market Reactions and Investor Sentiment

The news of PwC's withdrawals triggered immediate market reactions. Stock prices of affected companies experienced fluctuations, reflecting investor uncertainty and concerns about the reliability of previously audited financial statements.

- Impact on Investor Trust: The scandal severely damaged investor confidence in the integrity of audited financial statements, prompting questions about the effectiveness of existing regulatory frameworks. The PwC scandal eroded trust in the auditing process itself.

- Regulatory Investigations and Lawsuits: Several regulatory bodies launched investigations into PwC's auditing practices, and investor lawsuits have been filed, seeking compensation for losses stemming from alleged audit failures. The legal battles resulting from the PwC scandal are set to continue for years.

Underlying Causes Contributing to the PwC Scandal

The PwC scandal stems from a confluence of factors, including audit quality concerns, ethical lapses, and the intense pressures of globalization and competition within the accounting industry.

Audit Quality Concerns and Ethical Lapses

Numerous reports highlight specific instances of audit failures, including alleged conflicts of interest, inadequate internal controls, and a lack of independence. These failures directly contradict the fundamental principles of auditing and seriously undermine the credibility of PwC's services.

- Auditing Irregularities: Reports (cite specific, verifiable news sources here) detail instances where PwC auditors allegedly overlooked critical financial irregularities or failed to properly assess risks, contributing to misleading financial reporting.

- Regulatory Oversight: The effectiveness of regulatory oversight in preventing such widespread failures has come under intense scrutiny. Questions are being raised about the adequacy of existing regulations and enforcement mechanisms in addressing the challenges faced by the auditing profession.

Impact of Globalization and Competition

Intense competition within the global accounting industry might have unintentionally incentivized cost-cutting measures, potentially compromising audit quality. Globalization itself creates complexities in enforcing consistent auditing standards across jurisdictions.

- Globalization and Audit Standards: The PwC scandal underscores the challenges of enforcing consistent audit standards across different countries with varying regulatory frameworks. The lack of uniform global standards presents opportunities for loopholes and inconsistencies.

- Race to the Bottom: The pressure to secure clients at competitive rates could incentivize a “race to the bottom,” potentially jeopardizing audit quality in favor of lower fees. This competition is a significant factor contributing to the crisis.

Long-Term Implications and Regulatory Responses

The long-term consequences of the PwC scandal are far-reaching, impacting regulatory landscapes, the reputation of the accounting profession, and the confidence of investors worldwide.

Increased Regulatory Scrutiny and Potential Reforms

The scandal is likely to trigger significant regulatory reforms, including increased scrutiny of accounting firms, stricter enforcement of auditing standards, and tougher penalties for misconduct.

- Legislative Changes: Expect proposals for new legislation to enhance regulatory oversight, improve audit quality controls, and increase the independence of auditing firms. These changes will aim to prevent future PwC scandal-like events.

- Independent Oversight: There's likely to be a push for greater independent oversight of audit firms, potentially involving more robust external reviews and enhanced monitoring of auditing practices.

Impact on the Reputation of the Accounting Profession

The PwC scandal has inflicted significant damage on the public's trust in the accounting profession. This loss of confidence has far-reaching implications for the industry.

- Client Skepticism and Transparency: Clients will demand greater transparency and accountability from their auditors, leading to increased scrutiny of auditing processes and a heightened focus on ethical considerations.

- Rise of Non-Big Four Firms: The scandal may lead to increased demand for services from smaller, non-Big Four auditing firms, potentially reshaping the competitive landscape of the industry.

Conclusion

The PwC scandal serves as a stark reminder of the critical importance of maintaining high ethical standards and robust audit practices within the accounting profession. The global impact of these withdrawals underscores the interconnectedness of the financial system and the urgent need for strong, effective regulatory oversight. The long-term consequences will likely include increased scrutiny, sweeping reforms, and a fundamental reevaluation of the balance between competition and accountability within the industry.

Call to Action: Understanding the far-reaching effects of the PwC scandal is crucial for investors, businesses, and regulators alike. Stay informed about developments in the ongoing investigations and regulatory responses to ensure robust financial reporting and protect investor trust. Continue to follow updates on the evolving landscape of PwC scandal implications and the subsequent reforms.

Featured Posts

-

Black Hawk Helicopter Crash In D C Pilots Pre Crash Decisions Scrutinized

Apr 29, 2025

Black Hawk Helicopter Crash In D C Pilots Pre Crash Decisions Scrutinized

Apr 29, 2025 -

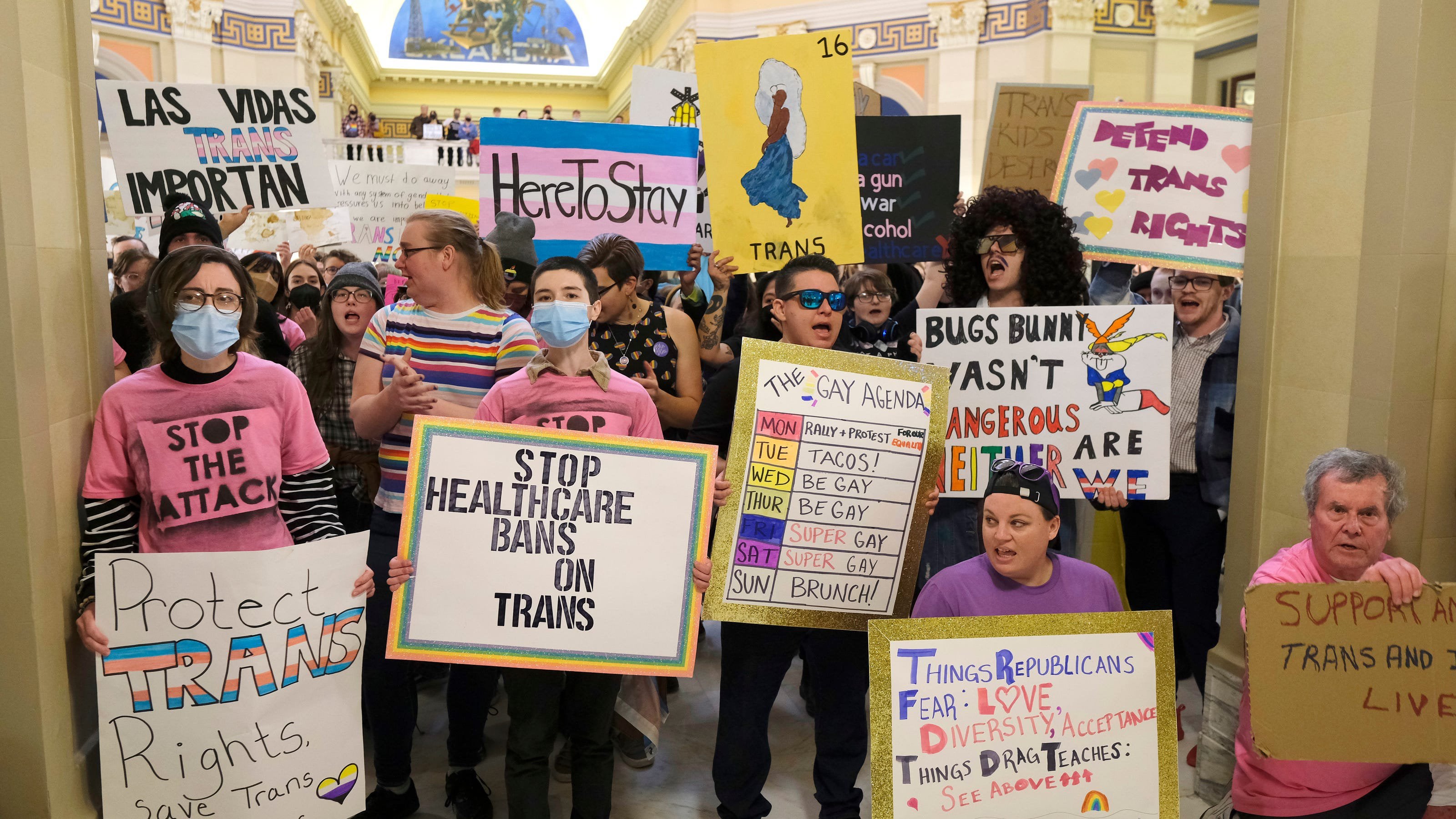

20 000 People Protest For Transgender Rights And Equality

Apr 29, 2025

20 000 People Protest For Transgender Rights And Equality

Apr 29, 2025 -

Sejarah Porsche 356 Asal Usul Dan Pabrik Zuffenhausen Jerman

Apr 29, 2025

Sejarah Porsche 356 Asal Usul Dan Pabrik Zuffenhausen Jerman

Apr 29, 2025 -

Akeso Shares Fall On Negative Cancer Drug Trial Data

Apr 29, 2025

Akeso Shares Fall On Negative Cancer Drug Trial Data

Apr 29, 2025 -

New Music Jeff Goldblum Drops Surprise Album

Apr 29, 2025

New Music Jeff Goldblum Drops Surprise Album

Apr 29, 2025