PwC US: Partner Brokerage Links Severed After Internal Investigation

Table of Contents

The Internal Investigation: Unveiling the Issues

PwC US initiated a comprehensive internal investigation to address concerns regarding potential conflicts of interest within its partner network. While the exact details remain confidential, reports suggest the investigation was prompted by concerns about the propriety of certain brokerage relationships. The scope of the investigation was extensive, encompassing various aspects of partner activities related to brokerage services.

- Potential violations of internal policies concerning client confidentiality and independent professional judgment were reportedly under scrutiny.

- The investigation's scope involved a significant portion of the firm, though the exact number of partners and employees affected hasn't been publicly disclosed.

- The timeframe of the investigation spanned several months, indicating a thorough and rigorous process.

The Severed Brokerage Links: Consequences and Implications

The culmination of the investigation resulted in the severance of numerous PwC US partner brokerage links. This means that certain partners are no longer permitted to engage in specific brokerage activities, either directly or indirectly, on behalf of the firm or its clients. The impact is significant:

- The brokerage services involved likely encompassed executive placement, mergers and acquisitions advisory, and potentially other related services.

- The financial implications are substantial, impacting both the affected partners' income and potentially PwC US's revenue streams from related brokerage activities. Potential legal ramifications are also a significant concern.

- The damage to PwC US's reputation and the erosion of client trust are undeniable. Maintaining client confidence is paramount in the professional services industry, and this incident necessitates swift and decisive remedial actions.

PwC US's Response and Future Actions

In response to the investigation's findings, PwC US issued a formal statement emphasizing its commitment to ethical conduct and transparency. The firm has taken proactive measures to prevent similar occurrences in the future.

- Significant enhancements to internal policies and procedures surrounding conflict of interest management and brokerage activities are being implemented.

- Disciplinary actions, including potential terminations, against involved partners and employees are being considered or have already been enacted, although details remain undisclosed.

- PwC US has engaged in extensive communication with clients, employees, and stakeholders to address concerns and reassure them of the firm's dedication to ethical business practices.

Long-Term Effects on PwC US's Business Practices

The long-term repercussions of this incident extend far beyond immediate financial consequences. The severing of PwC US partner brokerage links signals a potential paradigm shift in the firm's operational approach.

- The firm will likely strengthen risk management and compliance protocols, implementing more stringent oversight and monitoring systems for partner activities.

- Future partnerships and collaborations may be subject to more rigorous due diligence to prevent similar conflicts of interest in the future.

- PwC US's market standing and competitiveness could be affected, particularly if client confidence is not fully restored through transparent and credible actions.

Conclusion: Understanding the Fallout of PwC US Partner Brokerage Links

The internal investigation and subsequent severance of PwC US partner brokerage links highlight the critical need for robust ethical frameworks and comprehensive compliance programs within large professional services firms. The ramifications for PwC US are substantial, encompassing financial losses, reputational damage, and operational restructuring. The long-term effects on its business practices and industry standing remain to be seen. To stay updated on PwC US partner brokerage developments, follow the latest news on PwC US internal investigations and learn more about the impact of the PwC US partner brokerage link severances. Understanding these developments is crucial for anyone interested in corporate governance and ethical business practices within the professional services sector.

Featured Posts

-

Aiims Opd Sees Rise In Young People With Adhd Whats The Cause

Apr 29, 2025

Aiims Opd Sees Rise In Young People With Adhd Whats The Cause

Apr 29, 2025 -

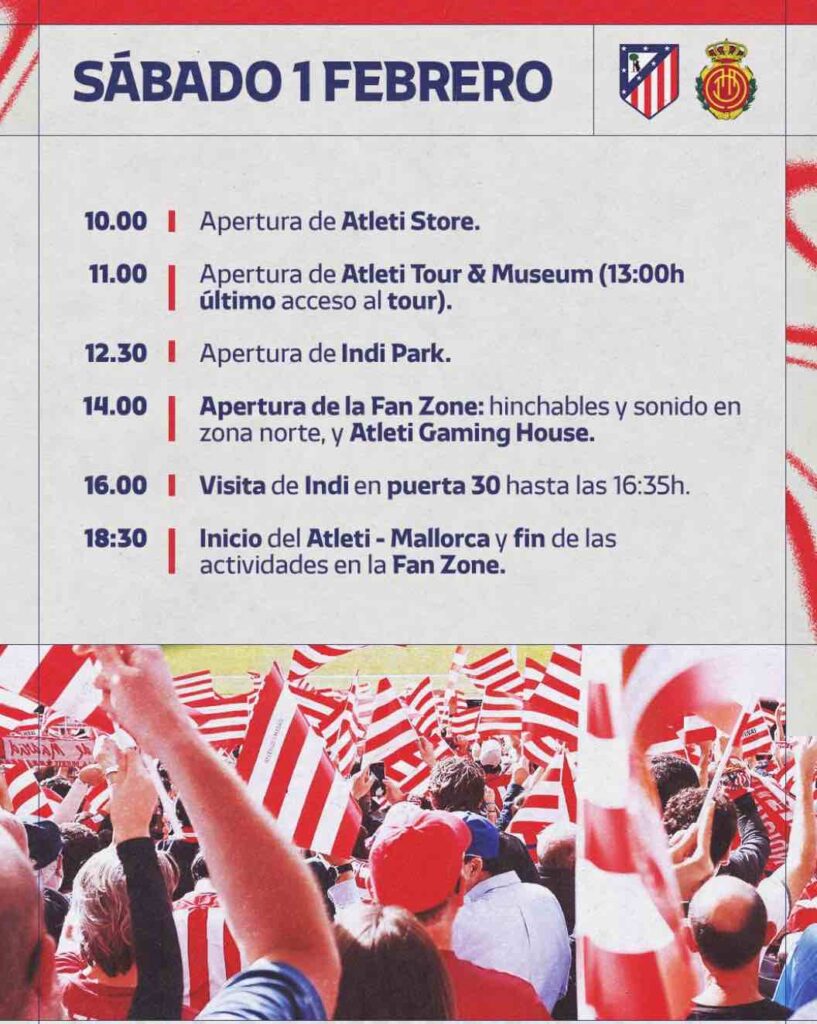

Alberto Ardila Olivares Que Tan Confiable Es Su Capacidad Goleadora

Apr 29, 2025

Alberto Ardila Olivares Que Tan Confiable Es Su Capacidad Goleadora

Apr 29, 2025 -

How Npr Explains You Tubes Increasing Popularity With Older Generations

Apr 29, 2025

How Npr Explains You Tubes Increasing Popularity With Older Generations

Apr 29, 2025 -

The Role Of Group Support In Adhd Treatment And Management

Apr 29, 2025

The Role Of Group Support In Adhd Treatment And Management

Apr 29, 2025 -

Update Search Continues For Missing British Paralympian In Las Vegas

Apr 29, 2025

Update Search Continues For Missing British Paralympian In Las Vegas

Apr 29, 2025