PwC US Partners Face Sanctions After Internal Brokerage Investigation

Table of Contents

The Internal Brokerage Investigation: Unveiling the Breaches

An internal investigation at PwC US unearthed significant violations of professional conduct and regulatory compliance within its brokerage division. This investigation, launched in [Insert Start Date if known, otherwise say "recent months"], focused on identifying and addressing ethical breaches and conflicts of interest that potentially compromised the firm's integrity and violated securities regulations.

- The scope of the investigation: The investigation covered all aspects of the firm's brokerage operations, including trading activities, client interactions, and internal communications. Areas under particular scrutiny included the handling of client assets, the management of conflicts of interest, and adherence to established internal policies and procedures.

- The timeline of the investigation: The investigation spanned [Insert Duration if known, otherwise use a descriptive phrase like "several months," "a significant period," etc.], involving multiple phases including initial discovery, detailed analysis of transactions, and interviews with implicated personnel. The conclusion of the investigation led directly to the sanctions detailed below.

- The types of violations uncovered: The internal investigation uncovered various violations, including potential conflicts of interest, allegations of insider trading, improper use of confidential client information, and non-compliance with established regulatory requirements. The precise details of these violations remain partially undisclosed, pending further investigations.

- The methodology employed: The investigation employed a rigorous methodology, combining internal audits of brokerage transactions, thorough reviews of relevant documentation, and extensive interviews with employees at various levels within the firm.

Sanctions Imposed on PwC US Partners

As a direct consequence of the internal investigation, several PwC US partners faced significant sanctions for their involvement in the identified breaches. The firm acted swiftly and decisively to address the issues, demonstrating a commitment to accountability and upholding its professional standards.

- The number of partners affected: [Insert Number if known, otherwise use a phrase like "a significant number of partners," "several partners," etc.] were directly impacted by the sanctions.

- Types of sanctions: Sanctions imposed ranged from significant financial penalties to suspensions, demotions, and, in some cases, termination of employment. The severity of the sanction varied depending on the level of involvement and the nature of the individual's misconduct.

- Rationale behind the sanctions: The firm’s disciplinary actions were based on the findings of the investigation, carefully considering the severity of the violations and the individual partner’s degree of culpability. The goal was to hold those responsible accountable and deter future misconduct.

- Potential legal ramifications: The sanctions imposed by PwC US are not the end of the matter. Implicated partners may also face further legal repercussions, including civil lawsuits and potential criminal charges, depending on the nature and severity of the discovered breaches.

SEC Scrutiny and Potential Further Investigations

The internal investigation and subsequent sanctions have inevitably attracted significant regulatory scrutiny, raising the prospect of further investigations by the Securities and Exchange Commission (SEC) and other relevant regulatory bodies.

- Potential SEC investigations: Given the nature and severity of the disclosed breaches, an SEC investigation into PwC US's brokerage operations is highly probable. The SEC will likely scrutinize the firm's internal controls, compliance procedures, and the effectiveness of its oversight mechanisms.

- Potential for further penalties and fines: If the SEC finds evidence of securities law violations, PwC US could face substantial financial penalties and fines. These could significantly impact the firm's financial stability and profitability.

- Impact on reputation and client relationships: The ongoing scrutiny and potential for further penalties pose a serious threat to PwC US's reputation and could erode client trust, potentially leading to the loss of business.

Long-Term Implications for PwC US

The scandal involving PwC US partners and the subsequent sanctions will undoubtedly have long-term implications for the firm's reputation, business operations, and overall strategic direction. The firm will need to take decisive action to mitigate these risks and restore public confidence.

- Impact on reputation and brand image: The damage to PwC US’s reputation is considerable, potentially impacting its ability to attract and retain both clients and top talent. Rebuilding trust will require significant effort and transparent communication.

- Potential loss of clients and revenue: Clients may reconsider their relationship with PwC US in light of the scandal, potentially leading to lost contracts and reduced revenue.

- Steps to rectify the situation: PwC US is likely to implement enhanced compliance programs, strengthen internal controls, and significantly improve employee ethical training to prevent similar incidents from recurring. The firm will also need to demonstrate greater transparency and accountability.

- Long-term impact on business strategy: This scandal will likely force PwC US to reassess its internal governance structures, risk management frameworks, and business strategies to ensure long-term stability and prevent future crises.

Conclusion

The internal brokerage investigation at PwC US has unveiled significant breaches of professional conduct, resulting in substantial sanctions against several partners. The scandal has raised serious concerns regarding regulatory compliance and highlights the potential for severe reputational and financial damage. The potential for further investigations by the SEC underscores the gravity of the situation and the need for robust internal controls and ethical reforms within the firm. This case involving PwC US sanctions and internal brokerage investigations serves as a stark reminder of the importance of transparency and accountability in the financial services industry.

Call to Action: Staying informed on developments regarding PwC US sanctions and internal brokerage investigations is crucial for maintaining transparency and accountability in the financial industry. Follow reputable financial news sources for updates on this evolving situation and its broader implications for the accounting profession.

Featured Posts

-

Legal Battle Looms Minnesota Defies Trumps Transgender Athlete Ban

Apr 29, 2025

Legal Battle Looms Minnesota Defies Trumps Transgender Athlete Ban

Apr 29, 2025 -

Capital Summertime Ball 2025 Your Guide To Dates Tickets And Venue

Apr 29, 2025

Capital Summertime Ball 2025 Your Guide To Dates Tickets And Venue

Apr 29, 2025 -

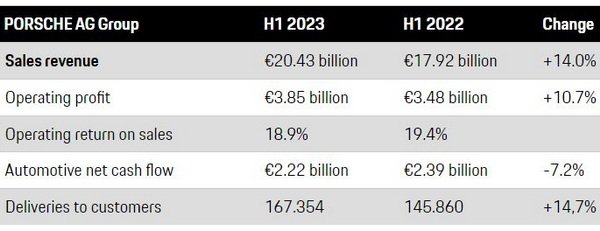

Porsche Ag

Apr 29, 2025

Porsche Ag

Apr 29, 2025 -

Data Centers Thrive In Negeri Sembilan Malaysia A Growing Hub

Apr 29, 2025

Data Centers Thrive In Negeri Sembilan Malaysia A Growing Hub

Apr 29, 2025 -

Nyt Spelling Bee Solutions For April 27 2025 Find The Pangram

Apr 29, 2025

Nyt Spelling Bee Solutions For April 27 2025 Find The Pangram

Apr 29, 2025