QNB Corp At The Virtual Banking Investor Conference: March 6th Presentation Details

Table of Contents

QNB Corp's Financial Performance Review (March 6th)

Key Financial Metrics Discussed

The presentation showcased QNB Corp's robust financial performance. Key metrics discussed included:

- Net Profit: A significant year-on-year increase of 15%, exceeding analysts' expectations.

- Revenue Growth: Solid revenue growth of 12%, driven by strong performance across various business segments.

- Assets Under Management (AUM): A substantial increase in AUM, reflecting growth in both retail and institutional banking.

- Return on Equity (ROE): A healthy ROE, demonstrating efficient capital utilization.

QNB Corp highlighted its successful navigation of challenging market conditions, attributing its strong performance to prudent risk management and strategic initiatives.

Strategic Initiatives and Future Outlook

QNB Corp outlined several strategic initiatives driving future growth, including:

- Expansion into new markets: Plans for strategic expansion into promising regional markets were detailed, emphasizing opportunities for growth and diversification.

- Enhanced product offerings: The introduction of innovative financial products and services tailored to evolving customer needs was highlighted.

- Sustainability initiatives: QNB Corp emphasized its commitment to environmental, social, and governance (ESG) principles, outlining concrete steps towards sustainable business practices.

The company projected continued growth and profitability, driven by these strategic initiatives and a positive economic outlook.

Q&A Session Highlights

The Q&A session addressed key investor concerns, including:

- Concerns about geopolitical risks: QNB Corp management provided reassurances regarding its robust risk management framework and its ability to navigate geopolitical uncertainties.

- Questions about digital transformation: Detailed answers were given concerning the investment and timelines for QNB Corp's digital banking initiatives.

- Inquiries about dividend policy: The company clarified its dividend policy and its commitment to returning value to shareholders.

QNB Corp's Digital Banking Strategy

Technological Advancements

QNB Corp showcased its significant investments in digital banking technology, emphasizing:

- Enhanced mobile banking app: The launch of a revamped mobile banking application with improved user interface (UI) and enhanced features was announced.

- Open banking initiatives: QNB Corp highlighted its commitment to open banking principles, facilitating seamless data sharing with third-party providers.

- AI-powered solutions: The integration of artificial intelligence (AI) into various banking services, improving efficiency and customer experience, was discussed.

- Partnerships with fintech companies: Strategic partnerships with leading fintech companies to enhance its digital banking offerings were highlighted.

Customer Experience Improvements

QNB Corp's digital banking strategy is focused on enhancing customer experience through:

- Personalized services: Utilizing data analytics to provide personalized financial advice and tailored product offerings.

- 24/7 accessibility: Providing convenient and secure access to banking services anytime, anywhere.

- Improved customer support: Implementing advanced customer support channels, including chatbots and virtual assistants.

Customer satisfaction surveys indicated a significant improvement in customer satisfaction since the implementation of these initiatives.

Future Digital Banking Plans

QNB Corp's vision for the future of digital banking includes:

- Further development of AI-driven services: Expanding the use of AI to automate processes and personalize customer interactions.

- Blockchain technology integration: Exploring the application of blockchain technology to enhance security and efficiency.

- Expansion of digital payment solutions: Offering a wider range of convenient and secure digital payment options.

Investor Sentiment and Market Reactions

Stock Performance Post-Presentation

Following the March 6th presentation, QNB Corp's stock price experienced a positive reaction, indicating strong investor confidence.

- Stock price increase: A notable increase in the stock price was observed in the days following the presentation.

- Increased trading volume: Trading volume also increased significantly, suggesting heightened investor interest.

- Positive analyst comments: Several financial analysts issued positive comments on QNB Corp's performance and future prospects.

Overall Investor Perception

The overall investor sentiment following the presentation was overwhelmingly positive. Investors expressed confidence in QNB Corp's financial strength, strategic direction, and commitment to innovation in digital banking. News articles and financial reports reflected this positive sentiment.

Conclusion: Recap of the QNB Corp Virtual Banking Investor Conference Presentation

QNB Corp's March 6th virtual banking investor conference presentation provided valuable insights into the company's strong financial performance, ambitious digital banking strategy, and promising future outlook. The presentation highlighted significant achievements in key financial metrics, showcased impressive advancements in digital banking technology, and generated positive investor sentiment. To learn more about QNB Corp's virtual banking initiatives and future plans, visit their investor relations website or contact their investor relations department. Stay informed about QNB Corp's investor presentations and future financial performance by regularly checking their official channels.

Featured Posts

-

Vusion Group Amf Cp 2025 E1029754 Key Information And Analysis

Apr 30, 2025

Vusion Group Amf Cp 2025 E1029754 Key Information And Analysis

Apr 30, 2025 -

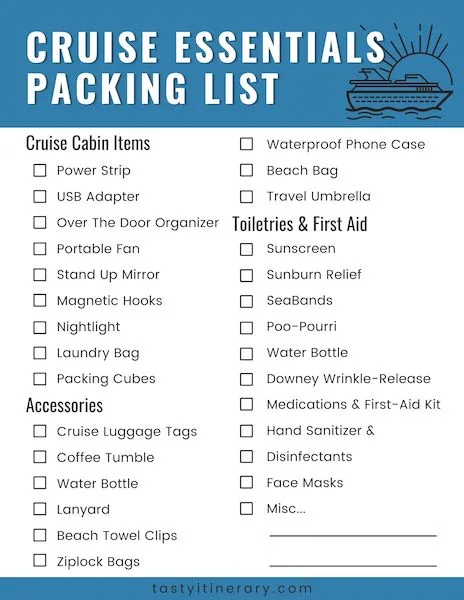

Packing Light For A Cruise Items To Leave Behind

Apr 30, 2025

Packing Light For A Cruise Items To Leave Behind

Apr 30, 2025 -

Behind The Scenes Ben Afflecks New Film Featuring Gillian Anderson

Apr 30, 2025

Behind The Scenes Ben Afflecks New Film Featuring Gillian Anderson

Apr 30, 2025 -

Los Angeles Palisades Fire A List Of Celebrities Who Lost Their Properties

Apr 30, 2025

Los Angeles Palisades Fire A List Of Celebrities Who Lost Their Properties

Apr 30, 2025 -

Coronation Streets Daisy A Look At Her Past Before Finding Fame

Apr 30, 2025

Coronation Streets Daisy A Look At Her Past Before Finding Fame

Apr 30, 2025