Quantum Computing Stocks: Is D-Wave (QBTS) A Smart Buy?

Table of Contents

Understanding D-Wave Systems (QBTS) and its Technology

D-Wave Systems is a publicly traded company at the forefront of quantum computing development. However, its approach differs significantly from that of many competitors.

D-Wave's Quantum Annealing Approach

Unlike gate-based quantum computers that perform computations using qubits in a sequence of logic gates, D-Wave utilizes a unique approach called quantum annealing. This adiabatic quantum computation method excels at solving specific optimization problems by finding the lowest energy state of a quantum system. The D-Wave quantum computer uses this process to tackle complex calculations that are intractable for even the most powerful classical computers. Key terms like "quantum annealing," "D-Wave quantum computer," and "adiabatic quantum computation" are essential to understanding this unique technology.

- Strengths of Quantum Annealing: Speed advantages for specific optimization problems, potential for scalability through advancements in chip design, and established track record of deployment in various industries.

- Weaknesses of Quantum Annealing: Limited applicability compared to gate-based models, challenges in verifying the quantum advantage over classical algorithms, and ongoing development required to expand its computational power.

- Real-World Applications: D-Wave's technology is currently being explored for applications in logistics optimization, financial modeling, materials discovery, and artificial intelligence.

D-Wave's Business Model and Revenue Streams

D-Wave's primary revenue stream comes from providing cloud access to its quantum computers through Leap™, a cloud-based quantum computing platform. The company also generates revenue through strategic partnerships and collaborations with various organizations seeking to leverage quantum computing capabilities. Analyzing D-Wave revenue, its quantum computing market share, and QBTS financials is crucial for assessing its investment potential.

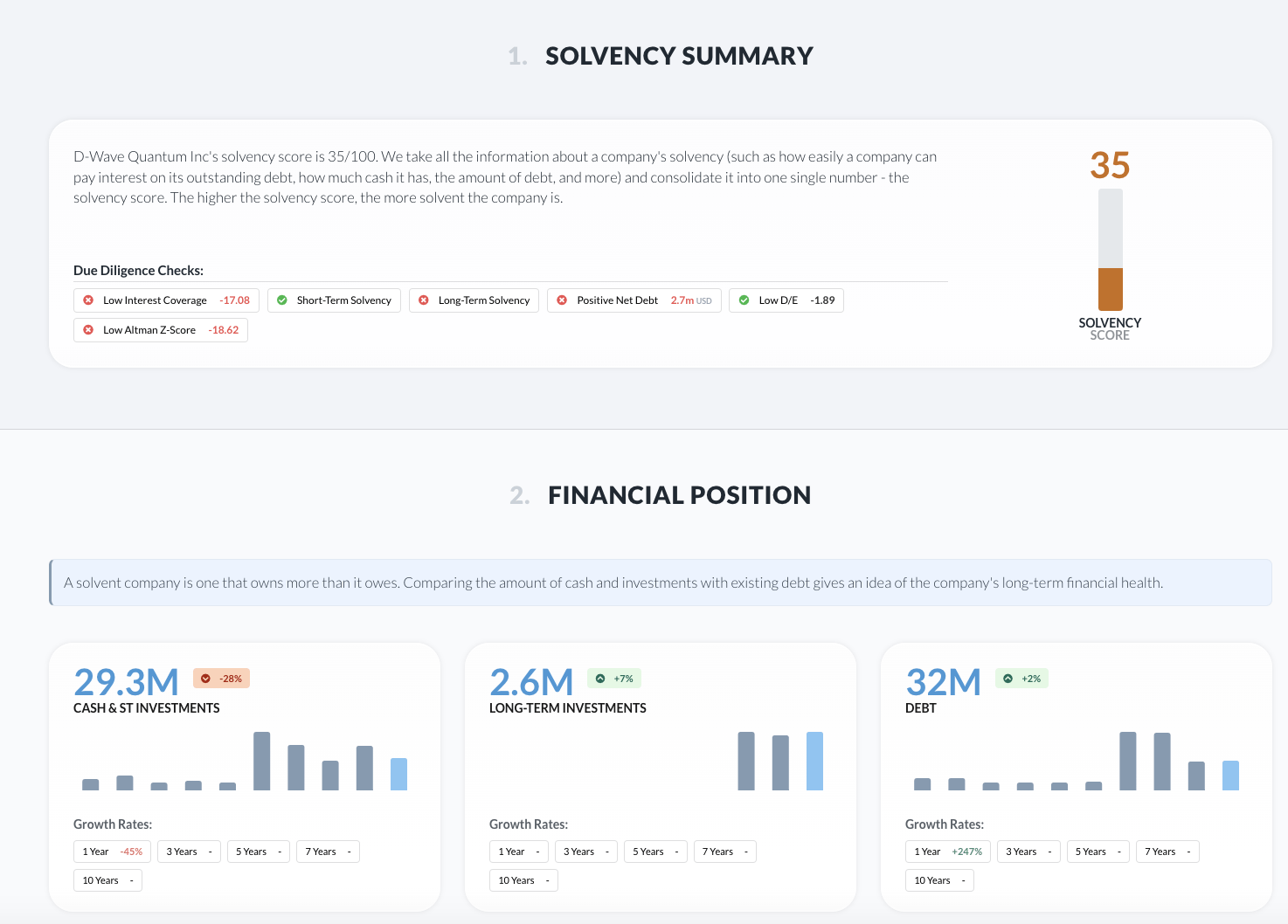

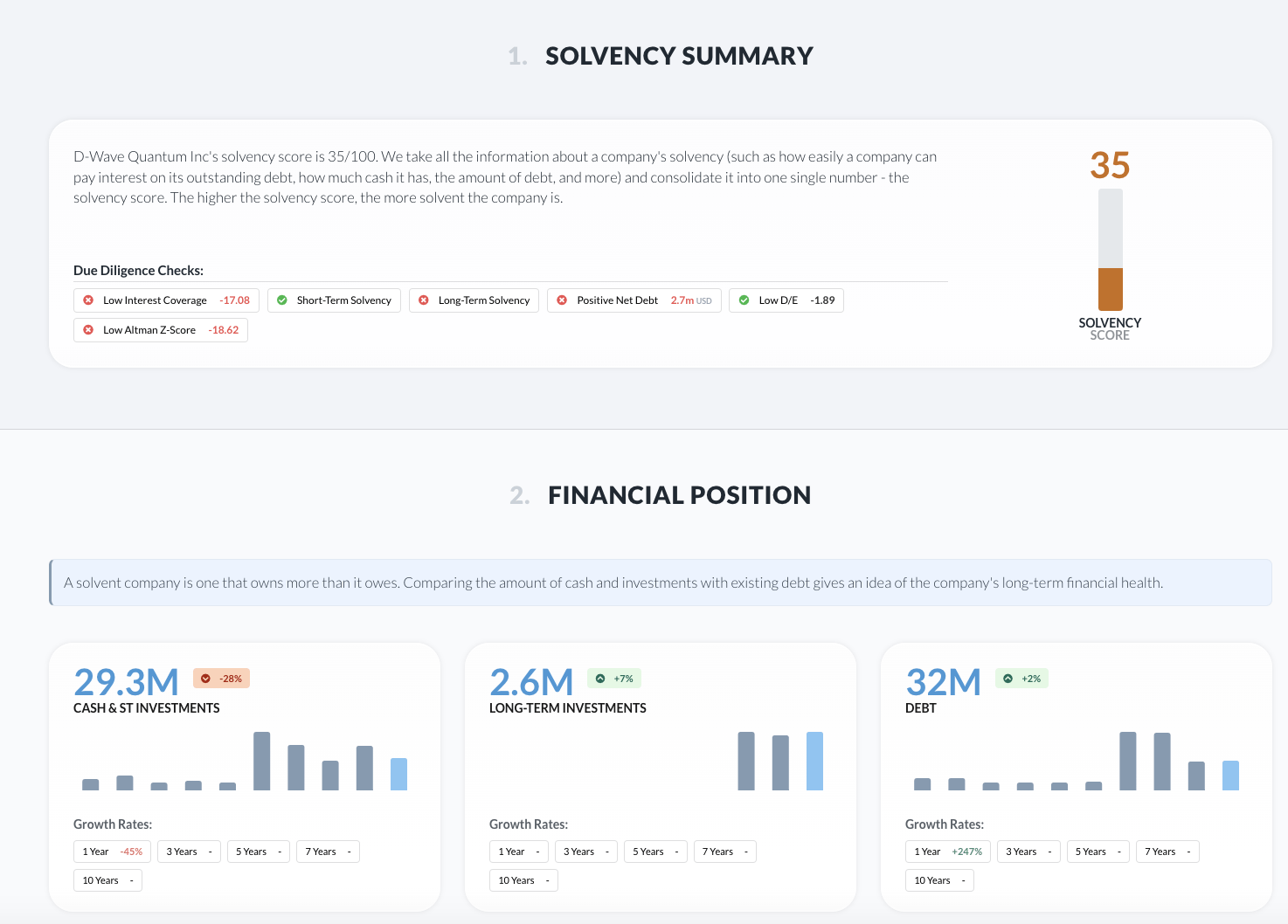

- Current Financial Performance: While still in its early stages, D-Wave's financial performance needs careful evaluation. Investors should analyze revenue growth, operating expenses, and overall profitability.

- Future Revenue Streams: Potential future revenue streams include expanded cloud access offerings, software and consulting services tailored to specific industries, and potential advancements in quantum hardware that could command premium pricing.

Assessing the Risks and Rewards of Investing in D-Wave (QBTS)

Investing in D-Wave, or any quantum computing stock, involves inherent risks. Understanding these is crucial before making any investment decision.

Market Volatility and Investment Risks

The quantum computing market is highly volatile, characterized by rapid technological advancements, intense competition, and significant uncertainty about the timeframe for widespread commercial adoption. Investing in QBTS carries risks inherent in early-stage tech stock volatility.

- Downsides of Investing in Early-Stage Companies: Significant financial losses are possible, particularly given the uncertain timeline for widespread quantum computing adoption.

- Competition in the Quantum Computing Sector: D-Wave faces competition from other quantum computing companies pursuing different technological approaches.

- Dependence on Technological Advancements: D-Wave's success hinges on its ability to continue to innovate and improve its quantum annealing technology.

Potential for High Returns and Long-Term Growth

Despite the risks, the potential for high returns associated with quantum computing investment is substantial. The transformative potential of this technology promises enormous long-term growth prospects. Analyzing the quantum computing investment returns and QBTS potential is a key part of the decision-making process.

- Long-Term Growth Potential: The global market for quantum computing is projected to experience significant expansion over the next decade.

- Strategic Partnerships and Market Leadership: D-Wave's strategic partnerships position the company well to capitalize on growing market demand.

- Comparison to Other Quantum Computing Stocks: Investors should compare D-Wave's potential against competitors to make informed investment decisions.

Comparing D-Wave (QBTS) to Other Quantum Computing Stocks

While D-Wave is a prominent player, it's important to compare it to other publicly traded quantum computing companies. A direct comparison with competitors, considering their respective technologies (e.g., gate-based versus annealing), business models, and market positioning, is vital for a comprehensive investment analysis. This comparison, using keywords like "quantum computing competitors," "QBTS vs [competitor]," and "quantum computing stock comparison," should highlight the relative strengths and weaknesses of each company as an investment opportunity.

Conclusion: Is D-Wave (QBTS) Right for Your Investment Portfolio?

D-Wave Systems (QBTS) operates in a high-growth but highly volatile market. Its unique quantum annealing approach offers advantages for specific types of problems, but also carries limitations compared to other quantum computing technologies. While the long-term potential for high returns is significant, investing in QBTS involves considerable risk. A thorough understanding of the company's financials, technological advancements, and competitive landscape is crucial before considering this investment. Before making any decisions regarding quantum computing stocks, particularly D-Wave (QBTS), conduct thorough due diligence and consider diversifying your portfolio to mitigate risk. Remember to consult with a qualified financial advisor before investing in any stock.

Featured Posts

-

Nyt Mini Crossword Answers April 13

May 20, 2025

Nyt Mini Crossword Answers April 13

May 20, 2025 -

Qbts Stock Predicting The Earnings Report Impact

May 20, 2025

Qbts Stock Predicting The Earnings Report Impact

May 20, 2025 -

Maiara E Maraisa No Festival Da Cunha Confirmacao De Isabelle Nogueira

May 20, 2025

Maiara E Maraisa No Festival Da Cunha Confirmacao De Isabelle Nogueira

May 20, 2025 -

Huuhkajien Yllaetykset Avauskokoonpanoon Merkittaeviae Muutoksia

May 20, 2025

Huuhkajien Yllaetykset Avauskokoonpanoon Merkittaeviae Muutoksia

May 20, 2025 -

Radostna Novina Dzhenifr Lorns Otnovo Stana Mayka

May 20, 2025

Radostna Novina Dzhenifr Lorns Otnovo Stana Mayka

May 20, 2025

Latest Posts

-

Matt Lucas And David Walliams Cliff Richard Musical The One Big Snag

May 20, 2025

Matt Lucas And David Walliams Cliff Richard Musical The One Big Snag

May 20, 2025 -

Sandylands U Tv Guide Your Complete Episode Guide

May 20, 2025

Sandylands U Tv Guide Your Complete Episode Guide

May 20, 2025 -

Sandylands U Full Tv Schedule And Viewing Information

May 20, 2025

Sandylands U Full Tv Schedule And Viewing Information

May 20, 2025 -

Gangsta Granny A Teachers Guide To Classroom Activities

May 20, 2025

Gangsta Granny A Teachers Guide To Classroom Activities

May 20, 2025 -

Complete Sandylands U Tv Guide Air Dates And Channel Info

May 20, 2025

Complete Sandylands U Tv Guide Air Dates And Channel Info

May 20, 2025