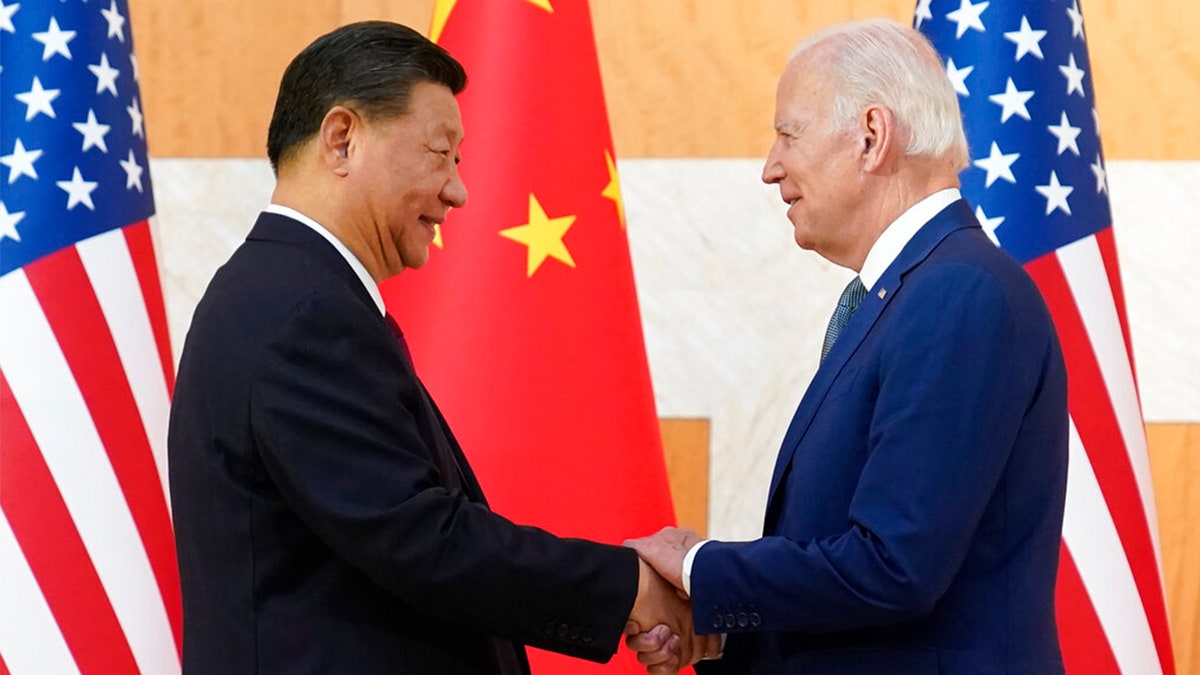

Rare Earths And Tariffs: Key Demands In Trump Administration's China Talks

Table of Contents

The Strategic Importance of Rare Earths

What are Rare Earths and Why are they Important?

Rare earth elements (REEs) are a group of 17 chemically similar elements crucial for modern technology. Their unique magnetic, luminescent, and catalytic properties make them indispensable in various high-tech applications. The strategic importance of rare earths stems from their critical role in numerous industries.

- Smartphones and Consumer Electronics: REEs are essential components in screens, magnets, and other internal components.

- Electric Vehicles: REEs are crucial for the powerful magnets used in electric vehicle motors.

- Military Equipment: REEs are integral to advanced weaponry systems, including guided missiles and radar.

- Green Energy Technologies: REEs are used in wind turbines, solar panels, and energy-efficient lighting.

China's dominance in rare earth mining and processing gives it significant leverage in the global market, raising concerns about supply chain security and geopolitical stability.

China's Dominance in the Rare Earth Market

China controls a significant majority of the global rare earth market, encompassing mining, processing, and refining. This dominance has profound implications for global supply chains, as it grants China considerable influence over the availability and price of these critical materials. China's potential use of rare earths as a geopolitical weapon adds another layer of complexity to this issue.

- China processes over 80% of the world's rare earth output.

- China has historically restricted rare earth exports, influencing global prices and availability.

- Concerns exist regarding China's potential to use its rare earth dominance for strategic advantage in international relations.

Tariffs as a Leveraging Tool in Trade Negotiations

The Trump Administration's Tariff Strategy

The Trump administration employed tariffs as a primary negotiating tactic in its trade disputes with China. The rationale behind this strategy was to pressure China into making concessions on trade imbalances and intellectual property theft. These tariffs, however, impacted various sectors of both the US and Chinese economies, leading to increased costs for consumers and businesses.

- The Trump administration imposed tariffs on hundreds of billions of dollars worth of Chinese goods.

- These tariffs led to increased prices for consumers in the US and retaliatory tariffs from China.

- Specific examples include tariffs on steel, aluminum, and various consumer electronics.

Rare Earths and the Tariff Debate

The potential for tariffs specifically targeting Chinese rare earth exports was a significant point of contention during the trade talks. While such tariffs could theoretically reduce US reliance on Chinese supplies, they also risked significant economic and political consequences.

- Tariffs on rare earths could increase the cost of numerous high-tech products in the US.

- China could retaliate with tariffs on other US exports or restrict rare earth supply to other countries.

- The impact on global markets would likely be significant, leading to price volatility and supply chain disruptions.

The Outcome of the Trade Talks and their Implications for Rare Earths

Negotiation Outcomes and Agreements Related to Rare Earths

The trade negotiations under the Trump administration did not result in a comprehensive agreement specifically addressing rare earths. While some progress was made on broader trade issues, the core problem of China's dominance in the rare earth market remained largely unaddressed.

- The "Phase One" trade deal focused more on agricultural purchases and intellectual property than on rare earths.

- No specific quotas or restrictions on rare earth exports from China were established.

- The long-term implications remain uncertain, requiring ongoing monitoring of the global rare earth market.

Diversification Efforts and the Future of Rare Earth Supply Chains

The US and other countries have initiated efforts to diversify their sources of rare earths and reduce reliance on China. These initiatives include increased investment in domestic mining and processing, as well as exploring alternative sources and technologies.

- The US government has invested in research and development to improve domestic rare earth processing capabilities.

- Other countries are exploring alternative rare earth sources in Africa and Australia.

- Recycling of rare earth materials is becoming increasingly important for improving supply chain resilience.

Conclusion: Rare Earths, Tariffs, and the Future of US-China Relations

The Trump administration's trade negotiations with China highlighted the strategic importance of rare earths and the challenges posed by China's market dominance. While tariffs were used as a negotiating tool, the outcome fell short of significantly altering the global rare earth landscape. The future of US-China relations will continue to be intertwined with the complexities of rare earth supply chains. It is crucial to continue monitoring developments in this sector. Further research into rare earths and tariffs, and the broader context of US-China trade relations, is essential for understanding this ongoing geopolitical challenge. Learn more about the implications of rare earth tariffs and their impact on global trade.

Featured Posts

-

Grand Slam Delight Jamaica Observers Coverage

May 11, 2025

Grand Slam Delight Jamaica Observers Coverage

May 11, 2025 -

Jessica Simpson And Eric Johnson Recent Sightings Fuel Split Rumors

May 11, 2025

Jessica Simpson And Eric Johnson Recent Sightings Fuel Split Rumors

May 11, 2025 -

Henry Cavill As Cyclops Fake Marvel Trailer Takes The Internet By Storm

May 11, 2025

Henry Cavill As Cyclops Fake Marvel Trailer Takes The Internet By Storm

May 11, 2025 -

80 Game Ban For Jurickson Profar Details And Impact

May 11, 2025

80 Game Ban For Jurickson Profar Details And Impact

May 11, 2025 -

Szokujace Opowiesci Masazystki Ksiaze Andrzej Rozebrany Na Zabiegu

May 11, 2025

Szokujace Opowiesci Masazystki Ksiaze Andrzej Rozebrany Na Zabiegu

May 11, 2025