Rate Cut Optimism Among Bond Traders Wanes After Powell Speech

Table of Contents

Powell's Hawkish Stance and its Impact on Rate Cut Expectations

Powell's address delivered a decidedly hawkish message, starkly contrasting with the prevailing expectations of imminent rate cuts. He emphasized the Federal Reserve's unwavering commitment to controlling inflation, even at the cost of potential economic slowdown. This firm stance significantly dampened the rate cut optimism that had been building among bond traders.

Key statements from Powell that contributed to this shift in sentiment include:

- "We are prepared to raise rates further if needed to bring inflation down to our 2% target." This strong assertion directly contradicted the hopes of many bond traders anticipating rate reductions.

- "The labor market remains very tight, suggesting continued inflationary pressures." This observation solidified the Fed's concern about persistent inflation, diminishing the likelihood of immediate rate cuts.

- "We are data-dependent, but our current assessment suggests further tightening may be appropriate." This carefully worded statement, while leaving some room for maneuver, reinforced the Fed's preference for a cautious approach, further eroding rate cut optimism.

The Bond Market's Reaction: Shifting Yields and Investor Sentiment

The immediate aftermath of Powell's speech witnessed a significant reaction in the bond market. Treasury yields, which move inversely to bond prices, surged, indicating a sell-off in bonds. This reflects a shift in investor sentiment as diminished rate cut expectations reduced the attractiveness of bonds as an investment.

The consequences were clear:

- Treasury yields surged following Powell's comments. The increased expectation of higher interest rates in the future decreased the value of existing bonds paying lower yields.

- Increased demand for longer-term bonds decreased. Investors became less willing to lock in lower yields for extended periods, fearing future rate hikes.

- Market volatility increased. The uncertainty surrounding the future path of interest rates led to increased trading activity and price fluctuations, reflecting the heightened anxiety among investors. This heightened market volatility underscores the impact of Powell's speech on investor confidence.

Alternative Perspectives and Future Outlook for Rate Cuts

While Powell's speech dominated the narrative, it's crucial to acknowledge alternative perspectives. Some economists argue that inflation may cool more rapidly than the Fed anticipates, potentially paving the way for rate cuts sooner than currently projected. Furthermore, unexpected economic data releases could significantly influence the Fed's decision-making process.

Factors that could still influence the Fed's decisions include:

- A sharper-than-anticipated slowdown in economic growth. This could prompt the Fed to reconsider its hawkish stance and potentially ease monetary policy.

- A significant decline in inflation. If inflation shows clear signs of cooling, the pressure for further rate hikes might lessen.

- Geopolitical events. Unexpected global events could also influence the Fed's assessment of the economic outlook and its monetary policy decisions.

However, uncertainty remains a key driver in the bond market. The current consensus points towards a prolonged period of higher interest rates, but the future path remains unclear.

Conclusion: The Future of Rate Cut Optimism Among Bond Traders

In conclusion, Powell's recent speech significantly diminished rate cut optimism among bond traders, triggering notable shifts in bond yields and investor sentiment. His hawkish stance and emphasis on controlling inflation overshadowed earlier expectations of imminent rate cuts. While alternative perspectives exist, the immediate future looks less favorable for those anticipating significant rate reductions. The evolving situation regarding "Rate Cut Optimism Among Bond Traders" warrants close monitoring. Stay informed about further developments by subscribing to our newsletter or following us on social media for regular updates. Understanding the nuances of this dynamic market is critical for navigating the complexities of bond investing.

Featured Posts

-

Bayern Legend Thomas Mueller Bids Farewell After 25 Years

May 12, 2025

Bayern Legend Thomas Mueller Bids Farewell After 25 Years

May 12, 2025 -

Pole Vault Powerhouse Duplantis Kicks Off Diamond League Season

May 12, 2025

Pole Vault Powerhouse Duplantis Kicks Off Diamond League Season

May 12, 2025 -

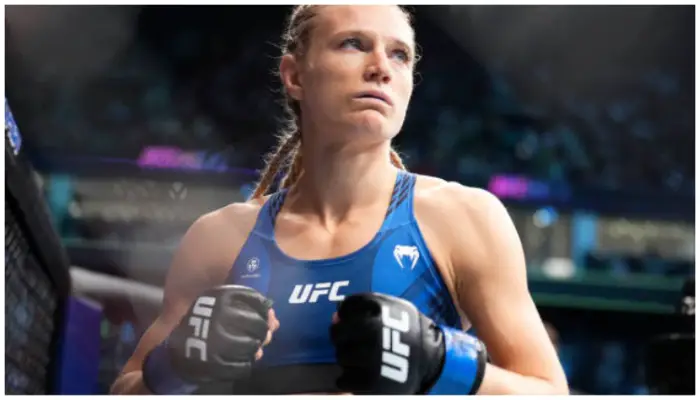

Who Is Manon Fiorot A Deep Dive Into The French Ufc Fighter

May 12, 2025

Who Is Manon Fiorot A Deep Dive Into The French Ufc Fighter

May 12, 2025 -

The Story Behind Payton Pritchards Recent Success A Childhood Perspective

May 12, 2025

The Story Behind Payton Pritchards Recent Success A Childhood Perspective

May 12, 2025 -

John Wick 5 New Developments But The Release Date Remains A Secret

May 12, 2025

John Wick 5 New Developments But The Release Date Remains A Secret

May 12, 2025