Real Estate Market Crash: Home Sales Plummet To Crisis Levels

Table of Contents

H2: Factors Contributing to the Real Estate Market Crash

Several intertwined factors have converged to create this perfect storm in the real estate market. Understanding these contributing elements is crucial to grasping the severity of the situation.

H3: Rising Interest Rates

The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, have drastically altered the mortgage landscape. Higher interest rates translate directly into higher monthly mortgage payments, significantly reducing affordability for many potential homebuyers.

- Impact on Mortgage Payments: A 1% increase in interest rates can add hundreds of dollars to a monthly mortgage payment, making homeownership unattainable for many.

- Buyer Behavior: Rising rates are causing many potential buyers to postpone or cancel their home-buying plans, leading to a sharp decrease in demand.

- Interest Rate Scenarios: Different interest rate scenarios predict varying degrees of impact. For example, a continued rise in rates could exacerbate the current crisis, potentially leading to a deeper market correction. Conversely, a stabilization or reduction in rates could help to alleviate the pressure.

H3: Inflation and Economic Uncertainty

Soaring inflation is eroding consumer purchasing power, making it more difficult for households to afford essential expenses, including housing. This, coupled with broader economic uncertainty, is fueling hesitation among potential buyers.

- Reduced Consumer Confidence: High inflation and fears of a recession are dampening consumer confidence, making them less likely to commit to large investments like home purchases.

- Economic Indicators: High inflation rates, rising unemployment figures, and volatile stock markets all contribute to the overall sense of economic instability, impacting buyer sentiment.

- Expert Opinions: Leading economists are warning that the current economic climate poses significant challenges to the housing market, predicting further declines in home sales.

H3: Overvalued Housing Market

In many regions, housing prices had become significantly inflated in the years leading up to the current crisis, creating a potentially unsustainable housing bubble. This overvaluation made the market vulnerable to a correction.

- Inflated Housing Prices: Several major metropolitan areas experienced rapid and substantial price increases, creating pockets of overvaluation.

- Housing Bubble Dynamics: The rapid price increases fueled speculation, contributing to a bubble-like environment. The bursting of this bubble is now a contributing factor to the current crisis.

- Market Cycle Comparisons: Historical data shows that periods of rapid price appreciation are often followed by corrections, making the current downturn somewhat predictable.

H2: Impact of the Real Estate Market Crash on Home Sellers

The real estate market crash is significantly impacting homeowners looking to sell their properties. The reduced demand has created a challenging environment for sellers.

H3: Decreased Demand and Lower Prices

The decrease in buyer demand is forcing many sellers to lower their asking prices to attract potential buyers. This translates into lower profits and potentially even losses for some sellers.

- Price Reductions: Many listings are seeing substantial price reductions, reflecting the decreased demand.

- Longer Selling Times: Properties are staying on the market for significantly longer periods, indicating the difficulty sellers face in finding buyers.

- Seller Strategies: Sellers are adapting their strategies, including offering incentives or staging their homes more effectively.

H3: Increased Inventory and Competition

The slowing sales pace has resulted in an increasing inventory of homes on the market, creating intense competition among sellers. This significantly weakens sellers' negotiating power.

- Implications for Negotiation: Sellers have less leverage to negotiate favorable terms, often having to accept offers below their asking prices.

- Market Analysis Importance: A thorough understanding of the local market conditions is crucial for sellers to price their homes competitively and realistically.

H2: Impact of the Real Estate Market Crash on Home Buyers

While the current situation presents challenges, it also offers some advantages for potential homebuyers.

H3: Increased Negotiating Power

The shift in market dynamics has given buyers significantly more negotiating power, enabling them to secure better deals.

- Lower Prices and Better Terms: Buyers can often negotiate lower purchase prices, concessions from sellers, or more favorable financing terms.

- Buyer Strategies: Buyers should be prepared to make competitive offers, be decisive, and leverage the market conditions to their advantage.

H3: Challenges in Securing Financing

Despite the increased negotiating power, buyers still face challenges in securing mortgages, particularly with higher interest rates and stricter lending criteria.

- Financial Planning: Careful financial planning and a strong credit score are more critical than ever before.

- Mortgage Options: Exploring different mortgage options and understanding their implications is essential for buyers.

3. Conclusion

The real estate market crash, driven by rising interest rates, inflation, economic uncertainty, and overvaluation in certain regions, is profoundly affecting both buyers and sellers. The decreased demand has led to lower prices, increased inventory, and a shift in negotiating power towards buyers. However, securing financing remains a challenge. To navigate this volatile market, staying informed is key. Subscribe to reputable real estate newsletters, follow industry experts, and regularly check for updates on the real estate market downturn. Whether you are a buyer or a seller, understanding the current realities of this housing market crisis is crucial for making informed decisions. Take advantage of the resources available to navigate the current real estate market crash and make the best choices for your individual circumstances.

Featured Posts

-

Bts Tiempo De Regreso Tras El Servicio Militar

May 30, 2025

Bts Tiempo De Regreso Tras El Servicio Militar

May 30, 2025 -

Analyzing Novo Nordisks Position In The Weight Loss Market After Ozempics Launch

May 30, 2025

Analyzing Novo Nordisks Position In The Weight Loss Market After Ozempics Launch

May 30, 2025 -

Alasan Harga Kawasaki Z900 Dan Z900 Se Lebih Murah Di Indonesia

May 30, 2025

Alasan Harga Kawasaki Z900 Dan Z900 Se Lebih Murah Di Indonesia

May 30, 2025 -

Tolyatti Otkrytiy Seminar Russkoy Inzhenernoy Shkoly

May 30, 2025

Tolyatti Otkrytiy Seminar Russkoy Inzhenernoy Shkoly

May 30, 2025 -

The Untold Story Daniel Cormier And Jon Jones Explosive Post Fight Confrontation

May 30, 2025

The Untold Story Daniel Cormier And Jon Jones Explosive Post Fight Confrontation

May 30, 2025

Latest Posts

-

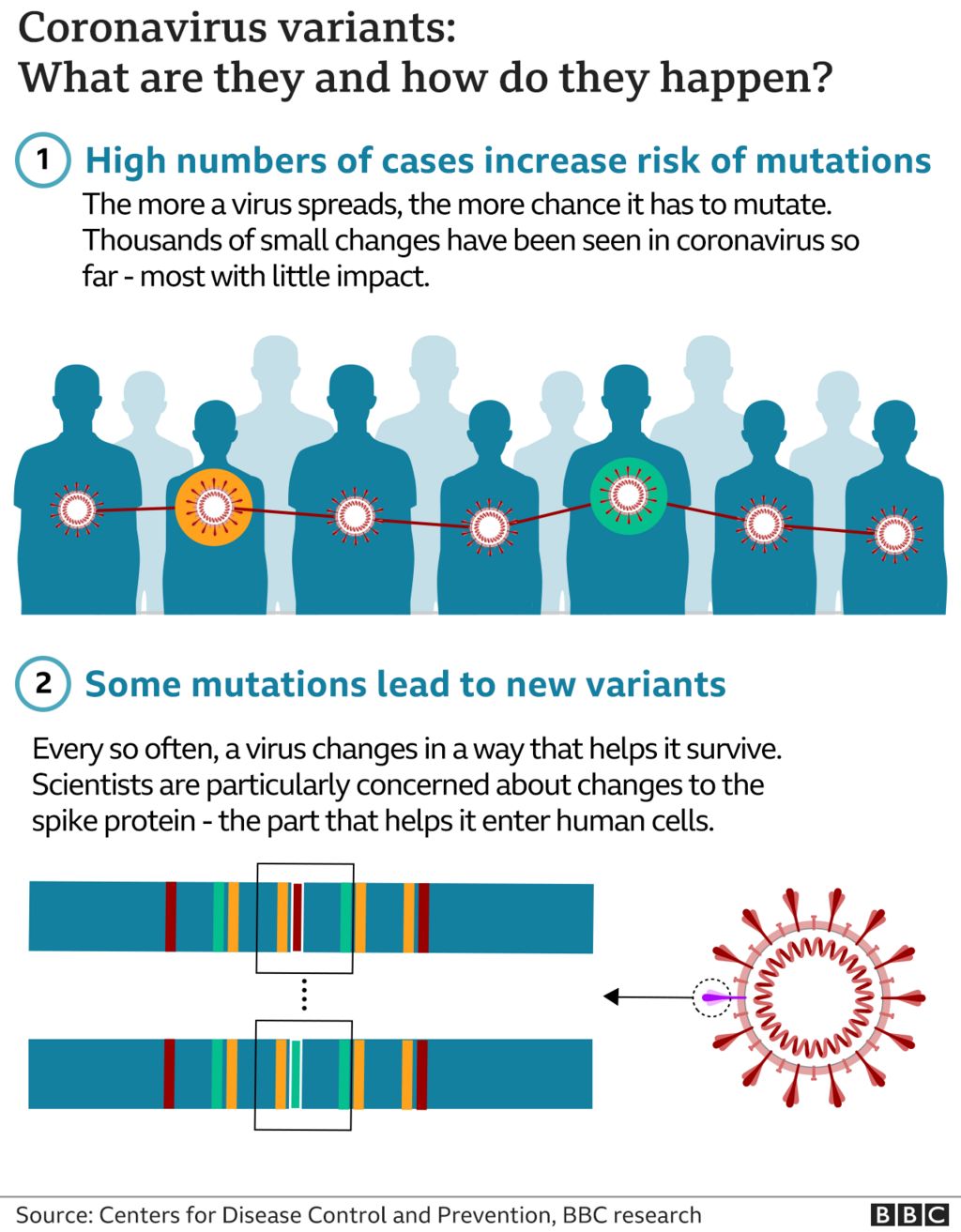

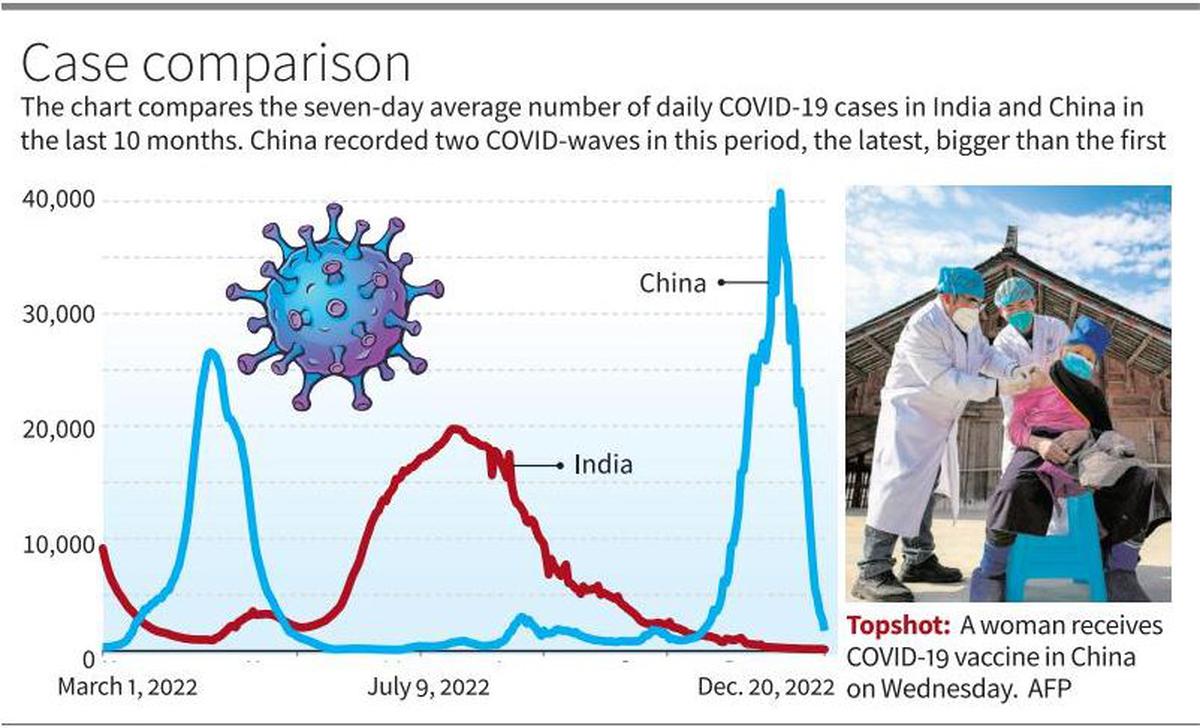

Rising Covid 19 Cases Is A New Variant To Blame

May 31, 2025

Rising Covid 19 Cases Is A New Variant To Blame

May 31, 2025 -

New Covid 19 Variant A Global Health Concern

May 31, 2025

New Covid 19 Variant A Global Health Concern

May 31, 2025 -

Who Warns New Covid 19 Variant Fueling Case Surges Globally

May 31, 2025

Who Warns New Covid 19 Variant Fueling Case Surges Globally

May 31, 2025 -

Tracking The Spread New Covid 19 Variant And Rising Case Numbers Nationally

May 31, 2025

Tracking The Spread New Covid 19 Variant And Rising Case Numbers Nationally

May 31, 2025 -

National Increase In Covid 19 Cases A New Variant Emerges

May 31, 2025

National Increase In Covid 19 Cases A New Variant Emerges

May 31, 2025