Real Estate Market Crisis: Realtors Report Record Low Home Sales

Table of Contents

Factors Contributing to the Record Low Home Sales

Several interconnected factors have contributed to the dramatic decrease in home sales, creating a significant real estate market crisis.

Rising Interest Rates

The Federal Reserve's aggressive interest rate hikes have significantly impacted mortgage affordability. Increased interest rates translate directly into higher monthly mortgage payments, reducing the borrowing power of potential homebuyers. This affordability crisis is severely limiting the number of qualified buyers in the market.

- Increased monthly payments: Even a small increase in interest rates can lead to hundreds, or even thousands, of dollars more in monthly mortgage payments.

- Reduced borrowing power: Higher rates mean buyers can afford to borrow less, shrinking the pool of properties they can consider.

- Fewer qualified buyers: Lenders are tightening lending requirements, making it more difficult for potential buyers to qualify for a mortgage. The number of pre-approved buyers has significantly decreased in the past year, further contributing to the decline in sales. Data from the National Association of Realtors shows a [insert statistic on pre-approved buyers if available] percent decrease in pre-approved buyers since [insert date].

High Inflation and Economic Uncertainty

Rampant inflation has eroded consumer purchasing power, leaving less disposable income for large purchases like homes. Coupled with fears of a looming recession, economic uncertainty is driving many potential buyers to postpone their home-buying plans.

- Reduced consumer confidence: High inflation and economic uncertainty have significantly dampened consumer confidence, making them hesitant to commit to large financial investments.

- Fear of recession: The possibility of a recession is weighing heavily on consumer minds, prompting many to prioritize saving and avoid taking on significant debt.

- Decreased disposable income: The rising cost of everyday goods and services is leaving less money available for home purchases, exacerbating the affordability crisis.

Limited Inventory

A persistent shortage of homes on the market is fueling the crisis. The combination of strong demand and constrained supply has created a highly competitive environment, driving up prices and making it challenging for buyers to secure a property.

- Increased demand: Despite the economic headwinds, demand for housing remains relatively strong, particularly in desirable locations.

- Fewer new builds: Supply chain issues and rising construction costs have hampered new home construction, further limiting the available inventory.

- Constrained supply chain: Delays and increased costs in obtaining building materials have slowed down the construction of new homes, contributing to the low inventory.

Impact on Different Market Segments

The real estate market crisis is affecting various market segments differently.

First-Time Homebuyers

First-time homebuyers are arguably the hardest hit by the current market conditions. The combination of rising interest rates, reduced affordability, and intense competition makes homeownership an even more distant dream for many.

- Difficulty saving for down payments: Inflation and economic uncertainty make it challenging to save the necessary funds for a down payment.

- Stricter lending requirements: Lenders are increasingly scrutinizing applications, making it harder for first-time buyers to qualify for a mortgage.

- Competition with cash buyers: Cash buyers are increasingly prevalent in the market, outcompeting those relying on financing.

Existing Homeowners

Homeowners looking to sell are also facing challenges, including lower sales prices and longer selling times compared to the recent past.

- Reduced equity: In some markets, home values are declining, reducing the equity homeowners have built up over the years.

- Difficulty finding buyers: The low number of qualified buyers means it takes longer to find a suitable purchaser.

- Potential for loss: In some cases, sellers may have to accept lower offers than anticipated, potentially resulting in a financial loss.

Real Estate Professionals

Real estate agents and brokers are also feeling the impact of the market slowdown. Lower sales volume translates into reduced commissions and increased competition among professionals.

- Reduced commissions: Fewer transactions mean less income for real estate professionals.

- Increased competition: With less business available, competition among real estate agents is intensifying.

- Need for adaptation and diversification: Real estate professionals are having to adapt their strategies and diversify their services to maintain their businesses.

Potential Solutions and Future Outlook

Addressing the real estate market crisis requires a multi-pronged approach.

Government Intervention

Government intervention could play a crucial role in stabilizing the market. Policies like tax incentives for first-time homebuyers or mortgage relief programs could help boost affordability and stimulate demand.

- Tax incentives: Government could offer tax breaks or credits to first-time homebuyers to make homeownership more accessible.

- Mortgage relief programs: Government-backed programs could help homeowners facing financial hardship due to rising interest rates. However, these measures often come with limitations and might not be sufficient to solve the crisis entirely.

Market Adjustments

The market may eventually adjust through price corrections or shifts in buyer demand. A cooling of prices could make homes more affordable, and shifts in demand could increase inventory in certain segments of the market.

- Market correction: A decline in home prices could improve affordability and attract more buyers.

- Price adjustment: Sellers may need to become more realistic about pricing their properties to attract buyers in this challenging market.

- Market recovery: While a timeline for recovery is uncertain, market forces will eventually lead to a rebalancing of supply and demand.

Conclusion: Navigating the Real Estate Market Crisis

The real estate market crisis, marked by record low home sales, is a complex issue driven by rising interest rates, high inflation, limited inventory, and overall economic uncertainty. This downturn is significantly impacting first-time homebuyers, existing homeowners, and real estate professionals alike. Understanding this situation and its ramifications is crucial. Staying informed about housing market trends, seeking professional real estate advice, and adapting strategies accordingly are vital steps in navigating this challenging environment. The future of the real estate market remains uncertain, but a combination of market adjustments and potential government interventions may eventually lead to a recovery.

Featured Posts

-

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025 -

The Difference Between Rosemary And Thyme A Detailed Comparison

May 31, 2025

The Difference Between Rosemary And Thyme A Detailed Comparison

May 31, 2025 -

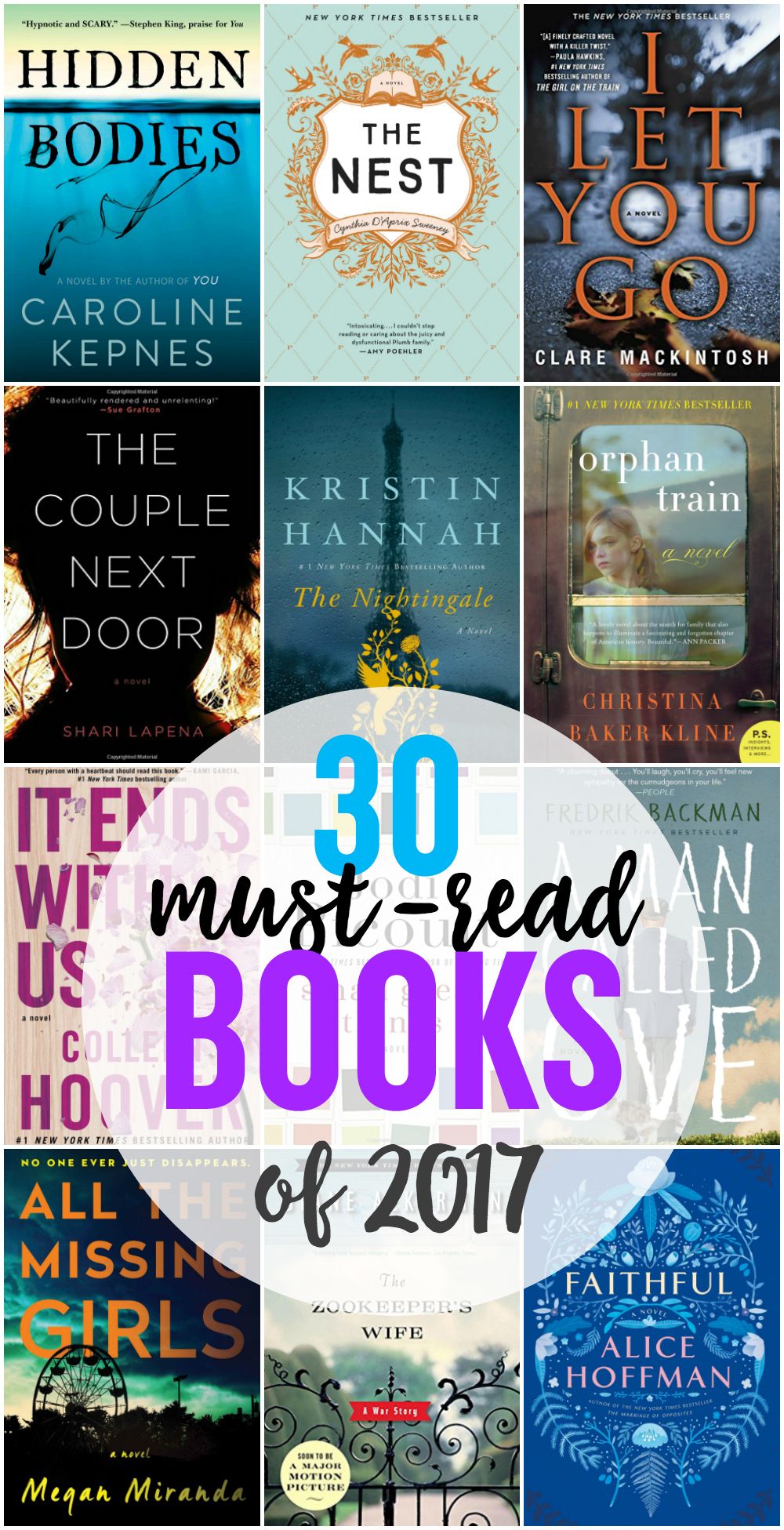

30 Must Read Books This Summer Critics Choices

May 31, 2025

30 Must Read Books This Summer Critics Choices

May 31, 2025 -

Rome Masters Alcaraz And Passaro Shine At Italian International

May 31, 2025

Rome Masters Alcaraz And Passaro Shine At Italian International

May 31, 2025 -

Pw Talks With Molly Jong A Conversation About Tomorrow Is A New Day

May 31, 2025

Pw Talks With Molly Jong A Conversation About Tomorrow Is A New Day

May 31, 2025