Recent D-Wave Quantum (QBTS) Stock Market Activity Explained

Table of Contents

Recent QBTS Stock Price Movements and Volatility

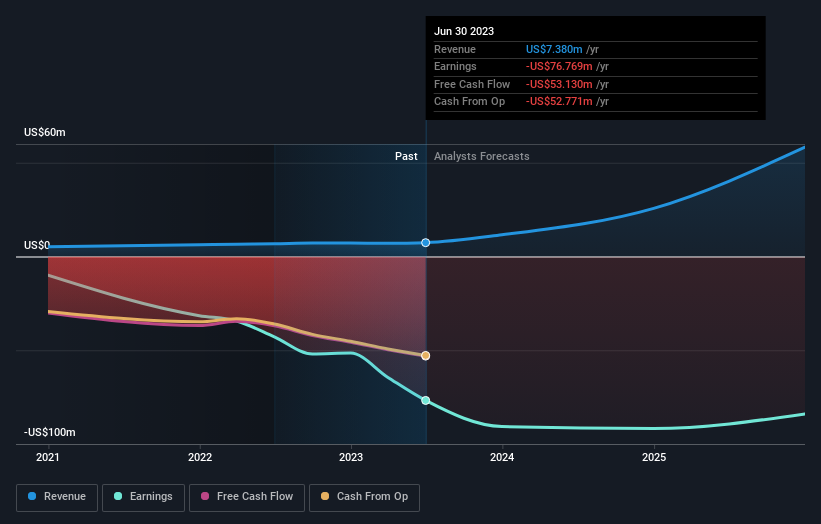

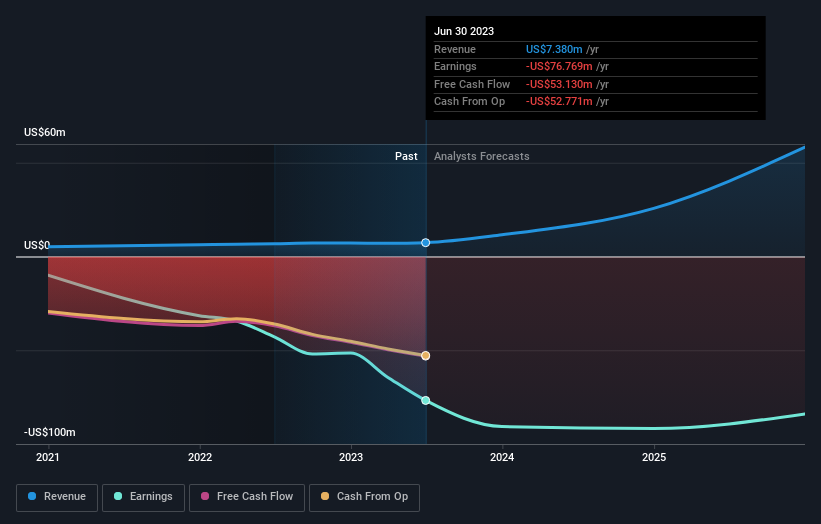

The QBTS stock price has displayed considerable volatility in recent months. [Insert a chart here showing QBTS stock price movements over the relevant period]. For example, the stock experienced a sharp rise following [mention a specific news event, e.g., a successful product launch or strategic partnership], followed by a period of consolidation and subsequent dips related to [mention another event, e.g., broader market downturns or negative analyst reports].

- Highs and Lows: Detail the specific high and low points of the stock price within the chosen timeframe. Include the dates for context.

- Volatility Compared to the Market: Analyze QBTS's volatility relative to the Nasdaq Composite Index or other comparable tech stocks. Use quantifiable metrics like beta to illustrate the difference. For example, "QBTS's beta of X indicates it is Y times more volatile than the overall market."

- Trading Volume: Include data on trading volume to show periods of high investor interest and activity. This adds depth to your analysis.

The high volatility underscores the inherent risks associated with investing in a company operating in the relatively nascent quantum computing sector. Understanding this volatility is crucial for both short-term traders and long-term investors considering QBTS.

Factors Influencing QBTS Stock Performance

Several interconnected factors contribute to QBTS's fluctuating stock performance. A nuanced understanding of these factors is critical for making informed investment decisions.

Company News and Announcements

Press releases, partnerships, and financial reports significantly impact QBTS's stock price.

- Product Launches: Discuss the impact of any new product releases or advancements in D-Wave's quantum computing technology. Mention any customer wins or significant milestones achieved.

- Partnerships and Collaborations: Analyze the influence of partnerships with other companies in the tech sector. Detail the strategic implications and potential market impact.

- Financial Reports: Review the company's financial performance, including revenue growth, profitability, and future guidance. Analyze how these factors have affected investor sentiment.

Industry Trends in Quantum Computing

The broader quantum computing market landscape heavily influences QBTS's performance.

- Competitive Landscape: Discuss the competitive landscape within the quantum computing industry, mentioning key competitors and their advancements. This helps investors assess QBTS's relative position.

- Investment Sentiment: Gauge the overall investor sentiment toward the quantum computing industry. Are investors optimistic about its long-term potential, or are concerns about technological hurdles impacting confidence?

- Government Funding and Regulation: Analyze the role of government funding and regulatory frameworks on the industry’s development and growth.

Overall Market Conditions

Macroeconomic factors significantly impact QBTS, just as they do with any publicly traded stock.

- Interest Rates: Discuss the effect of interest rate hikes or cuts on investor sentiment and investment decisions regarding QBTS.

- Inflation: Analyze the impact of inflation on investor confidence and its influence on the valuation of growth stocks like QBTS.

- Geopolitical Events: Consider the influence of geopolitical uncertainty on overall market sentiment and its impact on the QBTS stock price.

Analyst Ratings and Recommendations

Financial analysts' ratings and recommendations play a crucial role in shaping investor perceptions.

- Buy/Sell/Hold Ratings: Summarize the consensus view among financial analysts regarding QBTS. Cite specific examples of analyst reports and their rationale.

- Price Targets: Mention any price targets set by analysts for QBTS stock, providing context to their recommendations.

Potential Risks and Opportunities for QBTS Investors

Investing in QBTS presents both significant risks and substantial long-term opportunities.

Risks

- Technological Hurdles: Acknowledge the inherent risks associated with investing in a technology still under development. Mention potential delays or setbacks in achieving technological milestones.

- Competition: Highlight the competitive landscape and the risk of being overtaken by competitors with superior technology or market strategies.

- Regulatory Changes: Discuss the potential impact of future regulatory changes on the quantum computing industry and QBTS's business operations.

Opportunities

- Long-Term Growth Potential: Emphasize the vast long-term growth potential of the quantum computing market and QBTS's potential to become a leading player.

- First-Mover Advantage: Discuss the potential benefits of being an early entrant in the quantum computing space.

- Strategic Partnerships: Highlight the potential for significant growth through strategic collaborations and alliances with industry leaders.

Long-term vs. Short-term Investment Strategies

- Long-term investors: Suggest that long-term investors might view the current volatility as a buying opportunity, focusing on the long-term potential of the quantum computing market.

- Short-term traders: Caution short-term traders about the high volatility and the associated risks.

Conclusion: Making Informed Decisions about D-Wave Quantum (QBTS) Stock

The recent QBTS stock market activity reflects a complex interplay of company-specific factors, industry trends, and broader macroeconomic conditions. While the potential for long-term growth in the quantum computing sector is significant, investing in QBTS also carries substantial risks due to the inherent volatility of the sector and the company's relatively early stage of development. Before making any investment decisions related to D-Wave Quantum (QBTS) stock, it is crucial to conduct thorough due diligence and consider seeking advice from a qualified financial advisor. Understanding the QBTS stock outlook requires careful analysis of the quantum computing investment opportunities and inherent QBTS risk assessment. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Ryujinx Switch Emulator Development Ends After Nintendo Contact

May 20, 2025

Ryujinx Switch Emulator Development Ends After Nintendo Contact

May 20, 2025 -

A Hell Of A Run Examining The Ftv Live Report

May 20, 2025

A Hell Of A Run Examining The Ftv Live Report

May 20, 2025 -

Agatha Christies Poirot A Critical Examination Of The Stories And Characters

May 20, 2025

Agatha Christies Poirot A Critical Examination Of The Stories And Characters

May 20, 2025 -

New Drone Truck Technology Could Revolutionize Usmc Tomahawk Launch

May 20, 2025

New Drone Truck Technology Could Revolutionize Usmc Tomahawk Launch

May 20, 2025 -

Dispute With Oxford Report Canada Maintains Us Tariffs

May 20, 2025

Dispute With Oxford Report Canada Maintains Us Tariffs

May 20, 2025

Latest Posts

-

Wwes Aj Styles Contract Status And Future Speculation

May 20, 2025

Wwes Aj Styles Contract Status And Future Speculation

May 20, 2025 -

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025 -

Wwe Report Card Assessing Tony Hinchcliffes Segment Performance

May 20, 2025

Wwe Report Card Assessing Tony Hinchcliffes Segment Performance

May 20, 2025 -

Backstage Buzz Why Tony Hinchcliffes Wwe Segment Didnt Work

May 20, 2025

Backstage Buzz Why Tony Hinchcliffes Wwe Segment Didnt Work

May 20, 2025 -

Tony Hinchcliffes Wwe Report A Detailed Account Of The Backstage Response

May 20, 2025

Tony Hinchcliffes Wwe Report A Detailed Account Of The Backstage Response

May 20, 2025