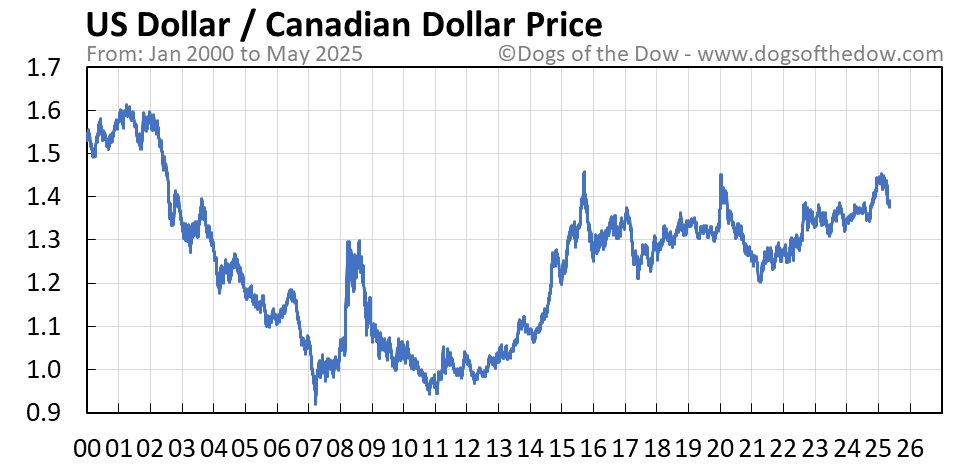

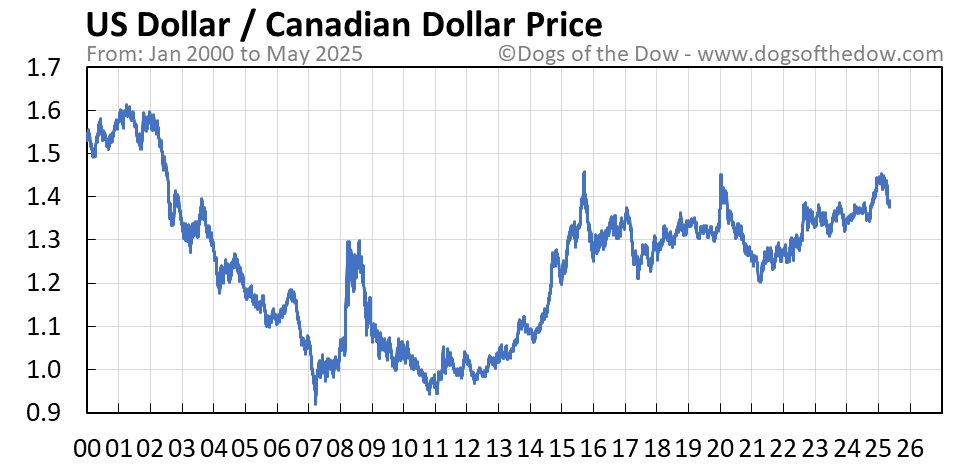

Recent Shifts In The Canadian Dollar Exchange Rate: An In-depth Look

Table of Contents

Impact of Global Economic Factors on the CAD

The Canadian dollar exchange rate is significantly influenced by global economic events. Understanding these influences is key to predicting future movements in the CAD.

Influence of the US Dollar

The USD/CAD exchange rate exhibits a strong correlation, meaning fluctuations in the US dollar directly impact the Canadian dollar. A strengthening US dollar typically leads to a weakening Canadian dollar, and vice versa.

- Recent USD movements and their impact on the CAD: The recent interest rate hikes by the Federal Reserve (the US central bank) have strengthened the USD, consequently putting downward pressure on the CAD. Conversely, periods of weaker US economic growth can lead to a stronger CAD.

- Related keywords: USD/CAD exchange rate, US interest rates, US economic growth, US dollar strength.

Commodity Prices and their Effect

Canada is a major exporter of commodities, particularly oil and lumber. Changes in global commodity prices directly affect the CAD's value. Higher commodity prices generally strengthen the Canadian dollar as increased exports boost the country's economy.

- Examples of how changes in oil prices have affected the CAD: A surge in global oil prices, driven by geopolitical instability or increased demand, typically leads to a stronger CAD. Conversely, a drop in oil prices weakens the Canadian dollar.

- Related keywords: oil prices, commodity markets, Canadian exports, crude oil prices, lumber prices.

Global Risk Aversion and Safe-Haven Currencies

During times of global uncertainty, investors often move towards safe-haven currencies like the Japanese Yen or Swiss Franc. This "risk-off" sentiment can lead to a weakening of riskier currencies, including the Canadian dollar.

- Examples of global events leading to fluctuations in the CAD: Geopolitical tensions, global recession fears, or major financial market crises often cause investors to flee riskier assets, weakening the CAD.

- Related keywords: global economic uncertainty, risk-off sentiment, safe-haven currencies, global market volatility.

Domestic Economic Factors Affecting the Canadian Dollar Exchange Rate

In addition to global factors, domestic economic conditions significantly influence the Canadian Dollar Exchange Rate.

Bank of Canada Monetary Policy

The Bank of Canada's monetary policy, particularly its interest rate decisions, directly impact the CAD. Higher interest rates generally attract foreign investment, strengthening the currency.

- Recent interest rate decisions by the Bank of Canada and their impact on the CAD: Recent increases in the Bank of Canada's key interest rate aimed at curbing inflation have, in the short term, strengthened the CAD by attracting foreign capital seeking higher returns.

- Related keywords: Bank of Canada interest rates, monetary policy, inflation in Canada, interest rate hikes, Canadian inflation rate.

Canadian Economic Growth and Performance

Strong Canadian economic growth, reflected in indicators like GDP and employment rates, typically supports a stronger Canadian dollar. Positive economic data signals confidence in the Canadian economy, attracting foreign investment.

- Recent economic indicators and their impact on the CAD: Positive employment numbers and rising consumer confidence generally contribute to a stronger CAD. Conversely, weak economic data can lead to a weakening of the currency.

- Related keywords: Canadian GDP, Canadian economic growth, employment rate, consumer confidence, Canadian economic indicators.

Government Policies and Regulations

Government policies, such as trade agreements and fiscal policy decisions, can also subtly influence the Canadian Dollar Exchange Rate. Major shifts in trade policy or significant fiscal changes can impact investor sentiment and, in turn, the CAD.

- Examples of recent government policies that may have influenced the exchange rate: New trade agreements or changes in tax policies can affect the attractiveness of the Canadian economy to foreign investors, influencing the CAD.

- Related keywords: Canadian government policies, trade agreements, fiscal policy, government spending, tax policy.

Forecasting Future Trends in the Canadian Dollar Exchange Rate

Predicting future movements in the Canadian Dollar Exchange Rate is complex and involves analyzing a multitude of interwoven factors. Expert opinions vary, but several key areas will likely continue to shape the CAD's trajectory. Factors such as future US interest rate decisions, the trajectory of global commodity prices, and the overall health of the Canadian economy will all play crucial roles in determining the future outlook for CAD. Continued monitoring of these indicators is vital for informed decision-making.

- Related keywords: CAD forecast, currency predictions, future outlook for CAD, Canadian dollar forecast 2024, CAD exchange rate prediction.

Conclusion: Understanding Recent Shifts in the Canadian Dollar Exchange Rate

Recent shifts in the Canadian dollar exchange rate have been driven by a complex interplay of global and domestic factors, including fluctuations in the US dollar, commodity prices, global risk sentiment, Bank of Canada monetary policy, and the overall performance of the Canadian economy. Understanding these factors is essential for businesses and individuals involved in international trade, investment, or currency management. Stay informed about the latest developments in the Canadian Dollar Exchange Rate and make informed decisions for your financial future by subscribing to reputable financial news sources and consulting with financial experts.

Featured Posts

-

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025 -

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025 -

Us Lawyers Ordered To Cease Stonewalling Judge Abrego Garcias Ruling

Apr 24, 2025

Us Lawyers Ordered To Cease Stonewalling Judge Abrego Garcias Ruling

Apr 24, 2025 -

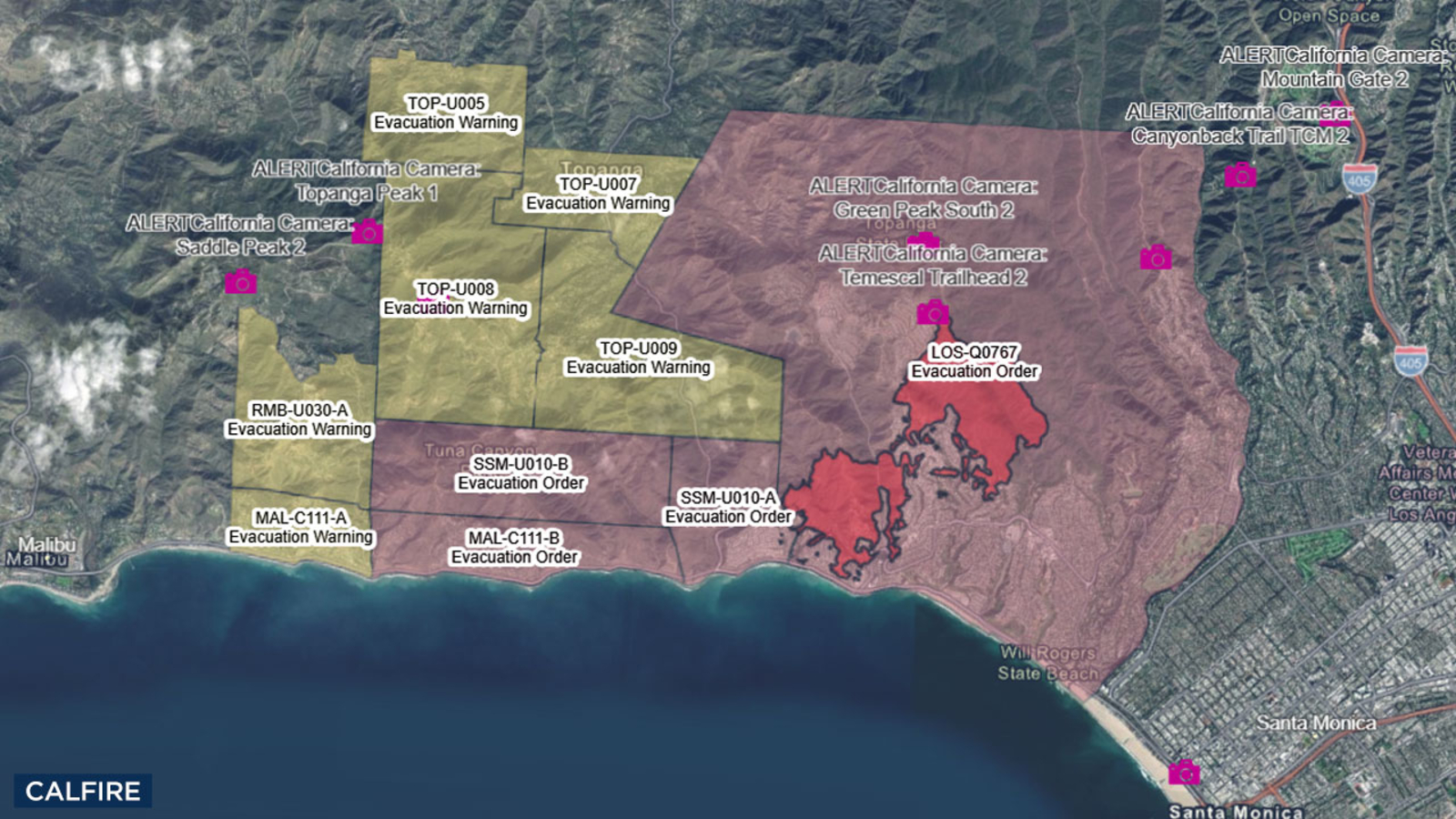

La Palisades Fire Victims A List Of Affected Celebrities

Apr 24, 2025

La Palisades Fire Victims A List Of Affected Celebrities

Apr 24, 2025 -

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025