Recordati's Strategic M&A Approach Amidst Italian Tariff Fluctuations

Table of Contents

Recordati's M&A History and its Focus

Recordati boasts a history of successful mergers and acquisitions, strategically shaping its portfolio and market presence. Their acquisition strategy is characterized by a focus on specific therapeutic areas and geographical markets, resulting in significant growth and improved market share.

-

Examples of successful acquisitions and their strategic rationale: Recordati's acquisitions haven't been random; they've been carefully selected to fill gaps in their product portfolio, expand into new therapeutic areas, or strengthen their presence in key markets. For example, (insert specific example of a successful acquisition, including the target company and the strategic rationale behind the acquisition). This move significantly broadened Recordati's reach in [mention specific therapeutic area or geographic region]. Another successful example is (insert another specific example).

-

Key performance indicators (KPIs) demonstrating the success of past M&A deals: The success of these acquisitions is reflected in key performance indicators such as increased revenue, improved profitability, and expanded market share. (Insert specific KPIs, if available, with quantifiable data like percentage increases). This data clearly demonstrates the value Recordati extracts from its strategic acquisitions.

-

Recordati's focus on specific therapeutic areas or geographical markets through acquisitions: Recordati's acquisition strategy is not haphazard. They clearly prioritize specific therapeutic areas, such as (list examples, e.g., cardiovascular, central nervous system) and geographical markets, allowing them to build expertise and market dominance. This targeted approach minimizes risk and maximizes returns on their M&A investments.

Impact of Italian Tariff Fluctuations on Recordati's M&A Decisions

Italian tariff fluctuations significantly impact Recordati's M&A decisions, influencing the attractiveness of potential acquisition targets and the overall cost of transactions. This economic uncertainty necessitates a sophisticated risk assessment approach.

-

Explanation of how tariff changes impact import/export costs for acquired products: Changes in Italian tariffs directly affect the import and export costs of pharmaceutical products, influencing both the profitability of acquired assets and the overall cost of the acquisition. Increases in tariffs can significantly reduce the profitability of a target company, making it less attractive to acquire.

-

Discussion of hedging strategies Recordati might employ to mitigate tariff risks: To mitigate these risks, Recordati likely employs various hedging strategies, including currency hedging and potentially entering into long-term contracts with suppliers to lock in prices. They may also diversify their sourcing and distribution channels to reduce reliance on any single supplier or market, minimizing their exposure to tariff shocks.

-

Analysis of how tariff uncertainty influences the valuation of potential acquisition targets: The uncertainty surrounding future tariff changes makes it more challenging to accurately value potential acquisition targets. Recordati needs to incorporate a thorough analysis of potential tariff scenarios into its valuation models, potentially resulting in lower valuations for target companies to account for this increased risk.

Due Diligence and Risk Mitigation Strategies

Recordati's due diligence process is likely enhanced to thoroughly assess the risks associated with Italian tariff fluctuations. This involves rigorous analysis and proactive risk management strategies.

-

Examples of specific risk factors considered, such as political and regulatory changes impacting tariffs: Recordati’s due diligence would go beyond financial analysis to include a thorough review of political and regulatory risks, including the likelihood of future tariff changes and the potential impact on their operations. This involves assessing the political climate, potential policy shifts, and the stability of the regulatory environment.

-

Methods for quantifying the potential financial impact of tariff changes: Sophisticated financial modeling is critical. Recordati would use various scenarios to simulate the potential impact of different tariff levels on the profitability of the target company. Sensitivity analysis would highlight how changes in tariffs impact key financial metrics.

-

Strategies for mitigating those risks, including contractual agreements and diversification: Risk mitigation might involve negotiating long-term contracts with suppliers to protect against price increases, diversifying their supply chain to reduce reliance on any single source of supply, and possibly even establishing manufacturing facilities in other countries to circumvent tariffs.

Recordati's Future M&A Outlook and Growth Prospects

Recordati’s future M&A strategy will likely continue to be shaped by the ongoing tariff challenges, but their focus on strategic acquisitions will remain. This approach promises continued growth.

-

Predictions about the types of acquisitions Recordati might pursue: Recordati may focus on acquisitions that offer greater geographical diversification, reducing their reliance on the Italian market and its associated tariffs. Acquisitions of companies with established international distribution networks could be a key strategic focus.

-

Assessment of the potential for geographic expansion or diversification through M&A: Geographic expansion into markets less susceptible to Italian tariff fluctuations is highly probable. Acquisitions in other European countries or even globally are likely to feature prominently in their future strategy.

-

Discussion of Recordati’s overall long-term strategic goals and how M&A contributes: Recordati’s long-term strategic goals will likely center on maintaining consistent growth and market leadership. M&A remains a crucial tool for achieving these goals, driving expansion and providing access to new technologies and therapeutic areas.

Conclusion

Recordati's success in navigating the complexities of the Italian pharmaceutical market, amidst fluctuating tariffs, depends heavily on its careful and strategic approach to mergers and acquisitions. Meticulous due diligence, coupled with proactive risk management strategies, forms the bedrock of their successful M&A history. This allows Recordati to continue executing strategic acquisitions that drive growth and strengthen its position in the competitive pharmaceutical landscape.

Call to Action: Stay informed about Recordati's future strategic M&A moves and the ongoing impact of Italian tariff fluctuations. Further research into Recordati's M&A activity and Italian economic policy will provide a richer understanding of their success in navigating this challenging environment. Continue to follow the latest developments in Recordati's M&A approach to gain a deeper understanding of their strategic growth plans.

Featured Posts

-

The Significance Of Hudsons Bay Artifacts To Manitobas Cultural Heritage

Apr 30, 2025

The Significance Of Hudsons Bay Artifacts To Manitobas Cultural Heritage

Apr 30, 2025 -

Amanda Owen And Family Navigate Challenges At Ravenseat Farm

Apr 30, 2025

Amanda Owen And Family Navigate Challenges At Ravenseat Farm

Apr 30, 2025 -

Processo Becciu 22 Settembre Data Chiave Per L Appello E La Sua Difesa

Apr 30, 2025

Processo Becciu 22 Settembre Data Chiave Per L Appello E La Sua Difesa

Apr 30, 2025 -

Pacers Vs Cavs Game Schedule How To Watch Predictions And Analysis

Apr 30, 2025

Pacers Vs Cavs Game Schedule How To Watch Predictions And Analysis

Apr 30, 2025 -

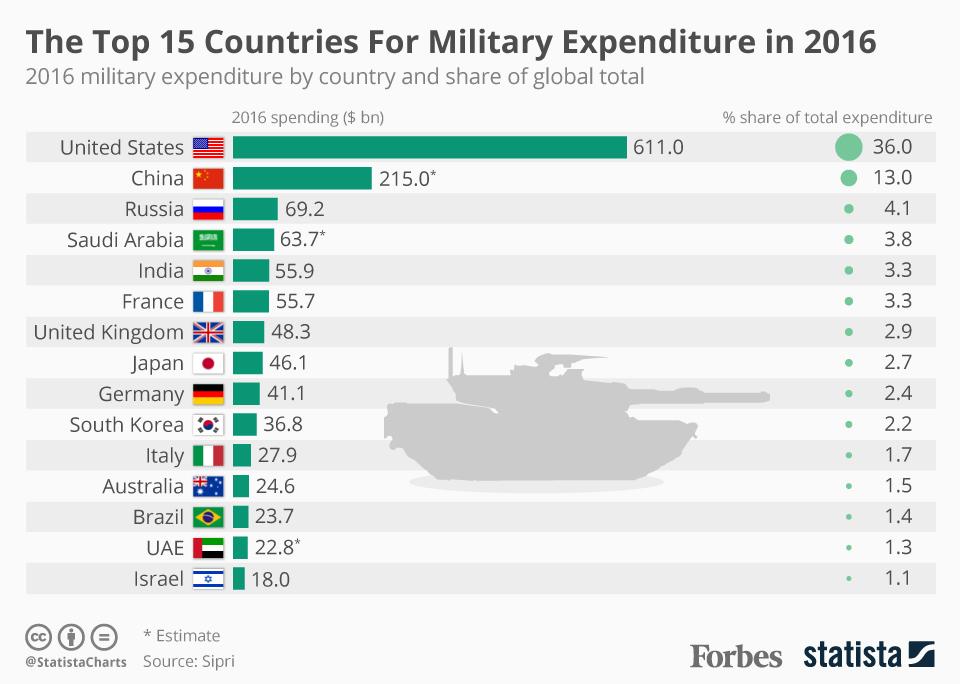

Rising Global Military Expenditure The Impact Of The Ukraine Conflict

Apr 30, 2025

Rising Global Military Expenditure The Impact Of The Ukraine Conflict

Apr 30, 2025