Recordati's Strategic M&A Moves Amidst Tariff Uncertainty In Italy

Table of Contents

Recordati's M&A History in Italy

Recordati's history is marked by strategic acquisitions that have significantly shaped its presence in the Italian pharmaceutical market. These deals haven't been solely focused on size, but rather on strategic fit and synergistic potential. Analyzing past M&A activity provides valuable insights into Recordati's current approach.

-

Specific examples of successful acquisitions in the Italian market: While specific details of all acquisitions may not be publicly available due to confidentiality agreements, analyzing publicly available financial reports and press releases can reveal significant acquisitions and their intended strategic purpose. For instance, acquisitions targeting specific therapeutic areas with high growth potential within Italy would be key indicators of a strategic approach to market share expansion.

-

Analysis of target companies (size, therapeutic area, market share): Recordati's acquisitions have likely targeted companies with varying sizes, focusing on market leaders in niche therapeutic areas rather than solely pursuing large-scale acquisitions. This approach allows for faster integration and potentially higher returns. The therapeutic area of the acquired company likely aligned with Recordati's existing portfolio or offered opportunities for diversification and expansion.

-

Assessment of the financial performance following each acquisition: Post-acquisition performance is critical. Successful integrations result in improved revenue, profitability, and market share. Analyzing financial statements, post-acquisition, can reveal how effectively Recordati has integrated these companies and achieved synergistic benefits.

-

Identification of any synergistic effects created by the mergers: Synergies can include cost reductions (through operational efficiencies), revenue enhancements (through cross-selling opportunities), and improved market reach. Identifying these synergies is key to understanding the overall success of Recordati’s M&A strategy within Italy.

Tariff Uncertainty and its Impact on Recordati's Strategy

The Italian pharmaceutical market, like many others, is subject to fluctuations in tariffs and trade policies impacting import and export costs. This uncertainty significantly influences strategic decision-making within the industry.

-

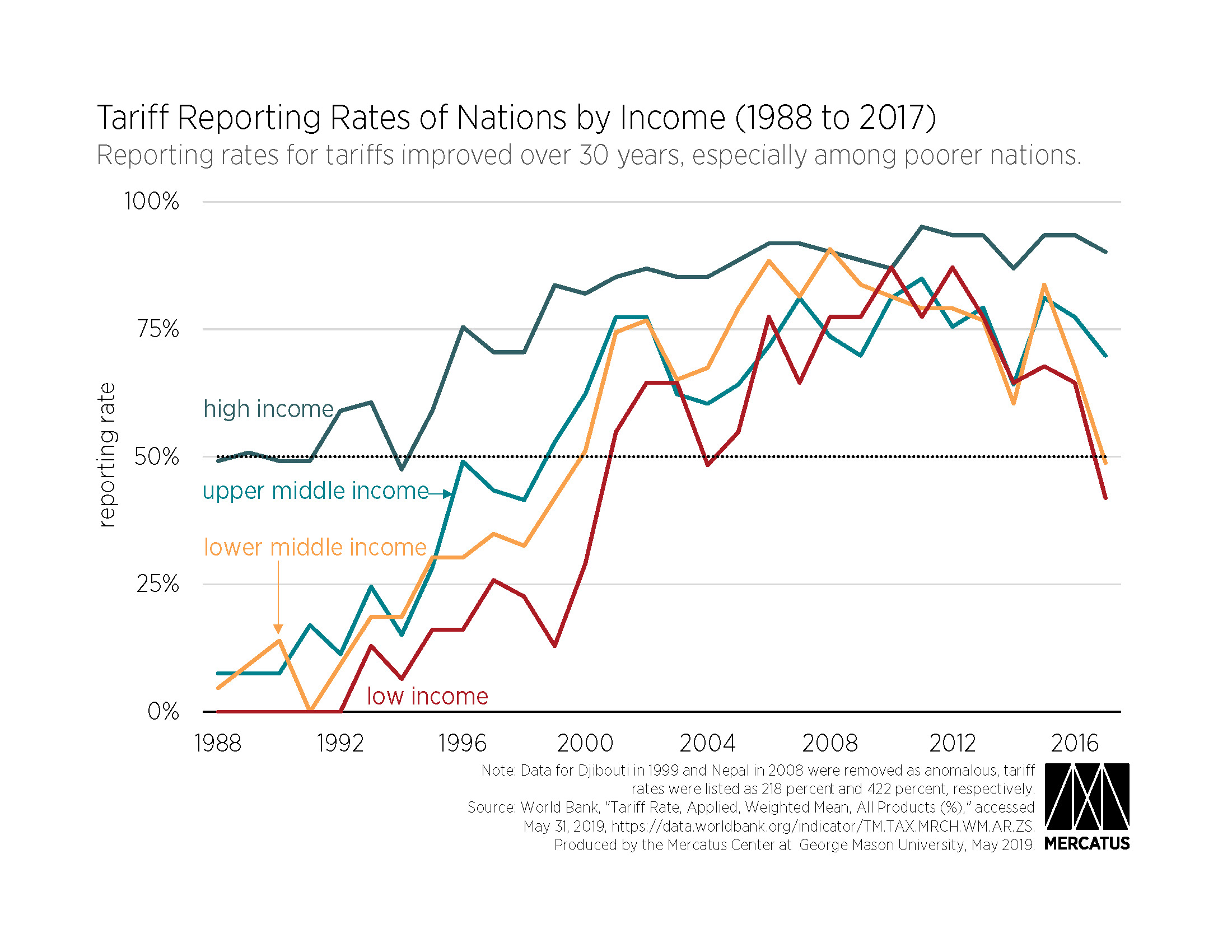

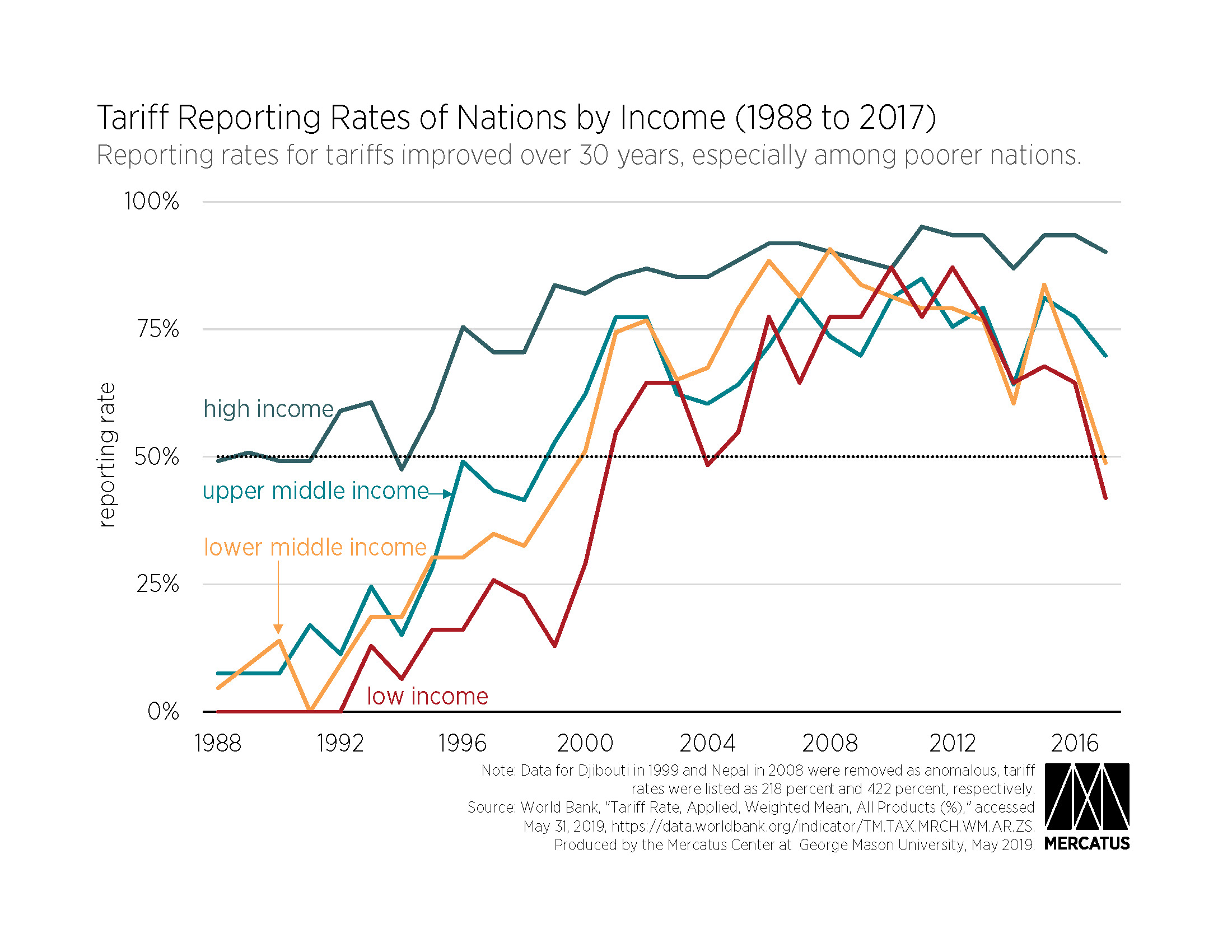

Explanation of relevant tariffs affecting the pharmaceutical industry in Italy: Italian tariffs on pharmaceutical products, both imported and exported, directly influence pricing and profitability for companies like Recordati. Understanding the specific tariffs impacting key product lines is vital for complete analysis.

-

Impact of these tariffs on import/export costs for Recordati: Fluctuating tariffs can lead to unpredictable costs, making it difficult to forecast profitability. This unpredictability directly affects Recordati’s investment strategies and may necessitate a more conservative approach in some instances.

-

Analysis of how tariff uncertainty influenced Recordati's investment decisions: This uncertainty likely led Recordati to favor acquisitions of companies with established Italian distribution networks, minimizing reliance on imports and reducing exposure to tariff risks.

-

Examples of how Recordati might have adapted its supply chain in response to tariffs: Recordati might have diversified its sourcing of raw materials or intermediate products, reducing dependency on specific suppliers in regions with volatile tariff regimes. This would enhance supply chain resilience and mitigate potential disruptions.

Strategic Rationale Behind Recordati's M&A Activity

Recordati's M&A decisions are driven by a multi-faceted strategy designed to navigate the challenges of tariff uncertainty and enhance its long-term competitiveness.

-

Diversification of product portfolio to mitigate tariff risks: Acquisitions can broaden Recordati's product range, reducing dependence on specific products vulnerable to tariff changes. This risk mitigation strategy helps stabilize revenue streams.

-

Acquisition of companies with established distribution networks in Italy: This provides immediate access to the Italian market, bypassing the challenges and costs associated with establishing new distribution channels.

-

Strengthening market position and competitive advantage in specific therapeutic areas: Targeted acquisitions allow Recordati to consolidate its position in high-growth therapeutic segments within the Italian market, increasing market share and profitability.

-

Gaining access to new technologies or intellectual property: Acquisitions can offer access to innovative technologies or patents that enhance Recordati's product portfolio and competitive advantage, fostering long-term growth.

Financial Performance and Market Share Analysis

Assessing the financial success of Recordati's M&A activity requires a detailed examination of several key performance indicators.

-

Analysis of revenue growth and profitability post-acquisitions: Analyzing financial reports will reveal whether acquisitions have resulted in the anticipated revenue growth and improved profitability.

-

Assessment of Recordati's market share in key therapeutic areas: Tracking Recordati's market share after acquisitions provides insight into the effectiveness of its integration strategies and market penetration efforts.

-

Comparison of Recordati’s performance against competitors in the Italian market: Benchmarking Recordati’s performance against its competitors reveals its relative success within the Italian pharmaceutical market and the impact of its M&A activity.

-

Examination of any cost synergies realized from mergers: Identifying and quantifying cost synergies resulting from economies of scale or streamlining of operations is crucial in assessing the long-term financial benefits of Recordati's M&A strategy.

Future Outlook for Recordati's M&A Strategy in Italy

Predicting the future is inherently challenging, but several factors suggest potential directions for Recordati's future M&A activity.

-

Potential target areas for future acquisitions: Recordati might target companies specializing in areas with high unmet medical needs or strong growth potential within Italy.

-

Likely strategies to mitigate future tariff risks: Recordati will likely continue to favor acquisitions of companies with established local distribution networks to further reduce tariff exposure.

-

Predictions for Recordati's market position in the coming years: Continued successful M&A activity, coupled with strong organic growth, could significantly enhance Recordati’s market position within Italy and solidify its leadership.

-

Assessment of the company's long-term growth prospects in Italy: The long-term growth prospects of Recordati depend on a range of factors, including the success of its M&A strategy, macroeconomic conditions, and regulatory changes affecting the Italian pharmaceutical market.

Conclusion

Recordati's strategic M&A moves in Italy reflect a proactive response to tariff uncertainty and competitive pressures within the Italian pharmaceutical market. Its focus on diversification, market share expansion, and synergistic acquisitions has positioned it favorably for sustained growth. However, continuous monitoring of its integration efforts and adaptation to evolving market dynamics remain crucial for achieving long-term success. To stay updated on Recordati’s M&A strategy and its impact on the Italian pharmaceutical sector, continue following industry news and financial reports concerning Recordati. Understanding Recordati’s M&A strategy is key to comprehending the competitive dynamics of the Italian pharmaceutical market.

Featured Posts

-

China Life Investment Success Profits Up Despite Market Challenges

May 01, 2025

China Life Investment Success Profits Up Despite Market Challenges

May 01, 2025 -

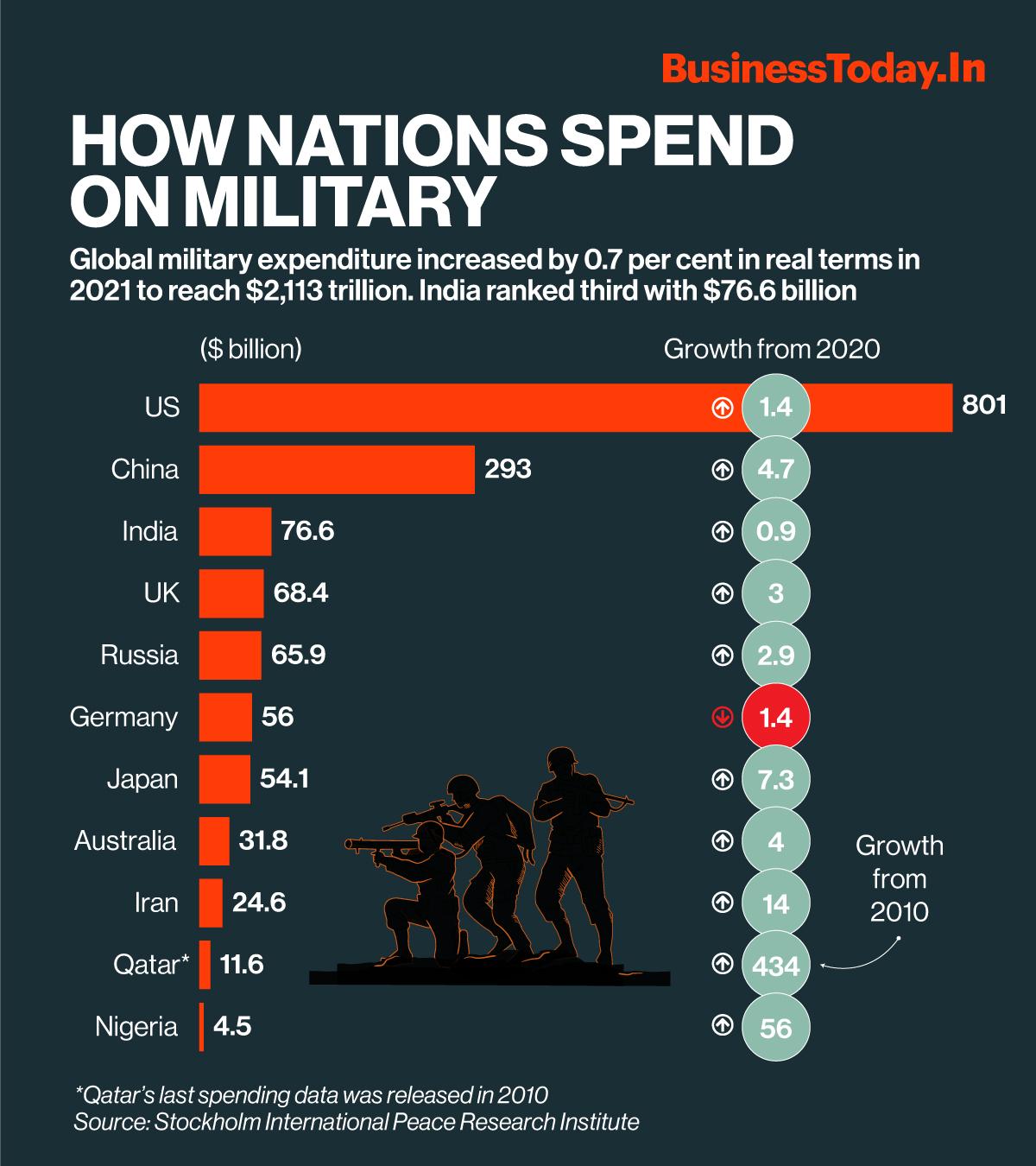

Global Military Spending Surge Europes Response To Russia

May 01, 2025

Global Military Spending Surge Europes Response To Russia

May 01, 2025 -

Thong Tin Chi Tiet Ve Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Va Doi Vo Dich

May 01, 2025

Thong Tin Chi Tiet Ve Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Va Doi Vo Dich

May 01, 2025 -

Prince Williams Scottish Visit A Warm Embrace And A Crusade Against Homelessness

May 01, 2025

Prince Williams Scottish Visit A Warm Embrace And A Crusade Against Homelessness

May 01, 2025 -

Should You Invest In Xrp After A 400 Price Jump In 3 Months

May 01, 2025

Should You Invest In Xrp After A 400 Price Jump In 3 Months

May 01, 2025

Latest Posts

-

Leo Carlssons Two Goal Performance Overshadowed By Ducks Ot Loss To Stars

May 01, 2025

Leo Carlssons Two Goal Performance Overshadowed By Ducks Ot Loss To Stars

May 01, 2025 -

Anaheim Ducks Vs Dallas Stars Carlssons Two Goals In Overtime Defeat

May 01, 2025

Anaheim Ducks Vs Dallas Stars Carlssons Two Goals In Overtime Defeat

May 01, 2025 -

La Kings Kevin Fiala Leads Team To Shootout Win Against Dallas Stars

May 01, 2025

La Kings Kevin Fiala Leads Team To Shootout Win Against Dallas Stars

May 01, 2025 -

Kevin Fiala Extends Point Streak As La Kings Defeat Dallas Stars

May 01, 2025

Kevin Fiala Extends Point Streak As La Kings Defeat Dallas Stars

May 01, 2025 -

Ducks Carlsson Scores Twice But Overtime Loss To Stars

May 01, 2025

Ducks Carlsson Scores Twice But Overtime Loss To Stars

May 01, 2025