Reduce Student Loan Burden: A Financial Planner's Strategies

Table of Contents

Understanding Your Student Loan Landscape

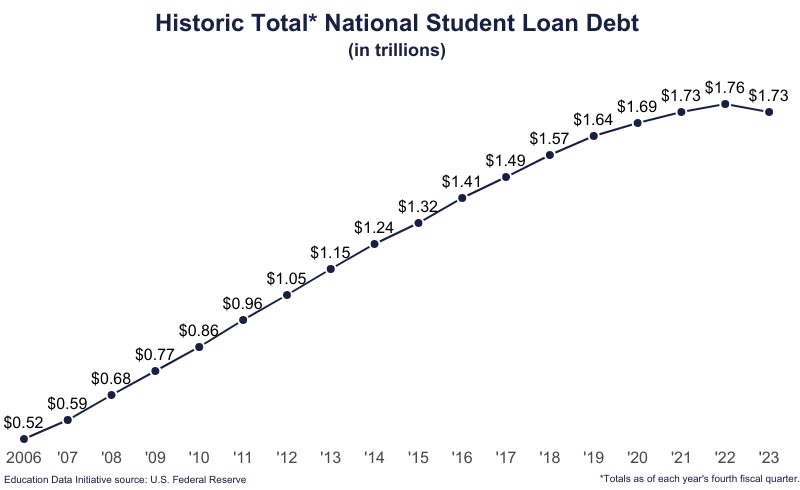

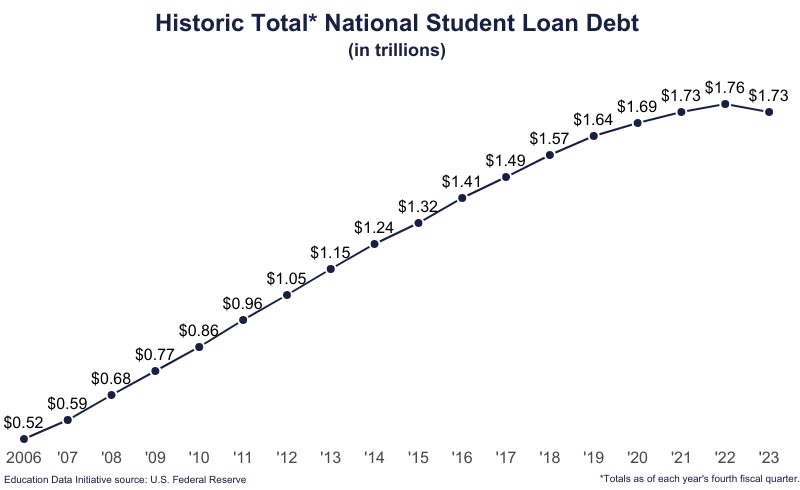

Before you can effectively tackle your student loan debt, you need a clear understanding of your current situation. This involves identifying your loan types, interest rates, and calculating your total debt and monthly payments.

Identify Loan Types and Interest Rates

Knowing the type of loans you have and their interest rates is crucial for effective repayment planning. Federal loans differ significantly from private loans, and interest rates can be fixed or variable.

-

Federal Loan Types:

- Subsidized Loans: The government pays the interest while you're in school (under certain conditions).

- Unsubsidized Loans: Interest accrues while you're in school, and you're responsible for paying it.

- PLUS Loans: Loans available to parents of dependent students or to graduate students.

-

Interest Rates:

- Fixed Interest Rates: Remain the same throughout the life of the loan, providing predictability.

- Variable Interest Rates: Fluctuate based on market conditions, potentially leading to higher payments over time.

It's essential to obtain official loan statements from your lenders (like the National Student Loan Data System (NSLDS) for federal loans) to get a complete picture of your debt. This includes understanding any fees associated with your loans.

Calculate Your Total Debt and Monthly Payments

Use online calculators or work with a financial advisor to determine your total loan amount, accrued interest, and monthly payments under different repayment plans. Understanding this information is vital for developing a realistic repayment strategy.

-

Online Loan Calculators: Many reputable websites offer free student loan calculators. These tools can help you estimate your payments under various scenarios, including different interest rates and repayment terms. [Link to a reputable loan calculator].

-

Interest Capitalization: Be aware of interest capitalization. This is when accumulated interest is added to your principal loan balance, increasing your overall debt and future payments. Understanding this process is crucial for accurate debt projection.

Strategies to Reduce Your Student Loan Burden

Once you understand your student loan landscape, you can explore various strategies to reduce your burden. These strategies include refinancing, income-driven repayment plans, and student loan forgiveness programs.

Refinancing Your Student Loans

Refinancing your student loans involves replacing your existing loans with a new loan from a private lender at a potentially lower interest rate. This can significantly reduce your monthly payments and save you thousands of dollars over the life of the loan.

-

The Refinancing Process: This typically involves applying with a private lender and providing documentation such as your credit score, income, and loan details.

-

Credit Score Importance: A good credit score is crucial for securing favorable refinancing terms.

-

Federal vs. Private Loan Refinancing: Refinancing federal loans means you lose access to federal protections and benefits, such as income-driven repayment plans and potential forgiveness programs. Carefully weigh the pros and cons before making a decision.

Exploring Income-Driven Repayment Plans (IDRs)

Income-driven repayment plans adjust your monthly payments based on your income and family size. This can make your payments more manageable, particularly during periods of lower income.

-

Types of IDR Plans: Several IDR plans are available, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). Each plan has its own eligibility requirements and calculation methods.

-

Long-Term Implications: While IDRs offer lower monthly payments, they often extend the repayment period, leading to higher overall interest paid. They may also qualify you for loan forgiveness after a specified number of payments (typically 20 or 25 years).

Student Loan Forgiveness Programs

Some programs offer partial or full loan forgiveness based on specific career paths or public service. These programs can provide significant relief, but eligibility requirements are strict.

-

Public Service Loan Forgiveness (PSLF): Forgives the remaining balance of your federal student loans after 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization.

-

Teacher Loan Forgiveness: Provides forgiveness for up to $17,500 of your federal student loans if you teach full-time for five consecutive academic years in a low-income school or educational service agency.

Carefully research the eligibility criteria for each program, as they can change.

Seeking Professional Financial Advice

Navigating the complexities of student loan debt can be overwhelming. Working with a financial planner can provide invaluable support and guidance.

The Benefits of Working with a Financial Planner

A financial planner can create a personalized strategy to tackle your student loan debt, considering your overall financial situation and goals. They can help with:

- Personalized Budgeting: Creating a budget that accounts for your student loan payments and other financial obligations.

- Debt Management Strategies: Developing a comprehensive plan to manage and reduce your debt.

- Investment Planning: Helping you build a solid financial foundation for the future, even with student loan debt.

A financial planner's expertise can save you time, money, and stress.

Finding a Qualified Financial Advisor

When choosing a financial advisor, look for a certified financial planner (CFP) or another qualified professional with experience in student loan debt management.

-

Finding Resources: Websites like the Financial Planning Association and the Certified Financial Planner Board of Standards offer resources to find qualified advisors. Seek recommendations from trusted sources, such as friends, family, or colleagues.

-

Checking Credentials: Always verify the credentials and experience of any financial advisor you consider working with.

Conclusion

Reducing your student loan burden requires a strategic approach. By understanding your loans, exploring available repayment options, and seeking professional guidance, you can create a path toward financial freedom. Don't let student loan debt define your future. Take control of your finances and start working towards a brighter tomorrow by implementing the strategies outlined in this article to effectively reduce your student loan burden. Contact a financial planner today to create a personalized plan to tackle your student loan debt effectively and significantly reduce your student loan burden.

Featured Posts

-

Ankle Injury Recovery Mitchell Robinson Back In Action For The New York Knicks

May 17, 2025

Ankle Injury Recovery Mitchell Robinson Back In Action For The New York Knicks

May 17, 2025 -

Worldwide Reddit Outage Leaves Thousands Unable To Access The Platform

May 17, 2025

Worldwide Reddit Outage Leaves Thousands Unable To Access The Platform

May 17, 2025 -

Ontario Online Casinos Ranked Mirax Casinos Position As A Top Payout Casino In 2025

May 17, 2025

Ontario Online Casinos Ranked Mirax Casinos Position As A Top Payout Casino In 2025

May 17, 2025 -

Reese Shows Family Pride Emotional Message After Brothers Ncaa Win

May 17, 2025

Reese Shows Family Pride Emotional Message After Brothers Ncaa Win

May 17, 2025 -

Donald Trump Family Tree Tiffany And Michaels Baby Alexander Expands The Dynasty

May 17, 2025

Donald Trump Family Tree Tiffany And Michaels Baby Alexander Expands The Dynasty

May 17, 2025