Refinance Federal Student Loans: A Step-by-Step Guide

Table of Contents

H2: Understanding Federal Student Loan Refinancing

H3: What is Federal Student Loan Refinancing?

Refinancing federal student loans means replacing your existing federal student loans with a new private loan from a private lender. This is different from federal loan consolidation, which combines your federal loans into a single federal loan with the same government backing. When you refinance, you're essentially taking out a new loan to pay off your old ones, often with more favorable terms.

H3: Types of Federal Student Loans Eligible for Refinancing.

Most private lenders will refinance the following federal loan programs:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans (for graduate and professional students)

- Consolidated federal loans (previously consolidated under the Federal Family Education Loan Program)

It's crucial to check with individual lenders to confirm which loan types they accept for refinancing.

H3: Benefits of Refinancing Federal Student Loans.

Refinancing can offer several significant advantages:

- Lower Monthly Payments: A lower interest rate or a longer repayment term can result in significantly lower monthly payments.

- Lower Interest Rates: Private lenders often offer lower interest rates than the federal government, especially for borrowers with good credit.

- Shorter Loan Terms: A shorter loan term can save you money on interest in the long run, although it will result in higher monthly payments.

- Simplified Repayment: Consolidating multiple loans into one simplifies your repayment process, making it easier to track and manage your debt.

- Potential for Fixed Interest Rates: This protects you from fluctuating interest rates, providing predictability in your monthly payments.

H3: Drawbacks of Refinancing Federal Student Loans.

Before you refinance, it's important to consider the potential downsides:

- Loss of Federal Student Loan Benefits: You will lose access to federal student loan benefits such as income-driven repayment plans, deferment, and forbearance options. This is a significant consideration, especially if you anticipate needing flexibility in your repayment schedule in the future.

- Higher Overall Interest Paid (if extending the loan term): While monthly payments may be lower, extending your loan term will typically result in paying more interest overall.

- Potential for Higher Fees: Private lenders may charge origination fees, prepayment penalties, or other fees.

H2: Finding the Right Federal Student Loan Refinance Lender

H3: Comparing Lenders and Interest Rates.

Shopping around and comparing offers from multiple lenders is crucial to securing the best interest rate and terms. Use online comparison tools or contact lenders directly to obtain quotes.

H3: Factors Lenders Consider.

Lenders will consider various factors when evaluating your application:

- Credit Score: A higher credit score typically qualifies you for a lower interest rate.

- Debt-to-Income Ratio: Your debt-to-income ratio (DTI) reflects your ability to manage debt. A lower DTI improves your chances of approval.

- Income: Lenders need to assess your ability to repay the loan.

- Loan Amount: The amount you wish to refinance will also impact interest rates and approval.

H3: Checking Lender Reputation and Reviews.

Thoroughly research potential lenders to ensure they are reputable and have a positive track record of customer satisfaction. Check online reviews and ratings from independent sources.

H3: Understanding Fees and Costs.

Be sure to understand all fees associated with refinancing:

- Origination Fees: A fee charged by the lender to process your loan application.

- Prepayment Penalties: Some lenders charge a penalty if you pay off your loan early.

- Application Fees: Some lenders may charge an application fee.

H2: The Refinance Application Process: A Step-by-Step Guide

H3: Gather Necessary Documents.

Before applying, gather the necessary documents:

- Pay stubs (to verify income)

- Tax returns (to verify income)

- Federal student loan details (loan amounts, interest rates, etc.)

- Proof of identity

H3: Complete the Application.

Most lenders offer online applications. The process typically involves providing your personal information, loan details, and financial information.

H3: Review and Acceptance.

After submitting your application, the lender will review your information and make a decision. This process can take a few days to several weeks.

H3: Loan Disbursement and Repayment.

Once approved, the lender will disburse the funds to pay off your existing federal student loans. Your new monthly payments will begin according to your agreed-upon repayment schedule.

H2: Maintaining Good Credit After Refinancing

H3: Importance of On-Time Payments.

Making on-time payments consistently is crucial for maintaining a good credit score, which can benefit you in the future.

H3: Monitoring Your Credit Report.

Regularly check your credit report for any errors or inaccuracies. This will help ensure your credit score is accurate and reflects your positive payment history.

3. Conclusion:

Refinancing federal student loans can be a powerful tool for managing your student loan debt. By carefully understanding the process, comparing lenders, and maintaining good credit, you can significantly reduce your monthly payments and potentially save money on interest over the life of your loan. However, remember to weigh the benefits against the loss of federal student loan protections before making a decision. Ready to take control of your student loan debt? Start exploring your options for refinancing federal student loans today! [Link to reputable lender comparison site]

Featured Posts

-

Midair Collision Averted An Exclusive Account From The Air Traffic Controller Involved

May 17, 2025

Midair Collision Averted An Exclusive Account From The Air Traffic Controller Involved

May 17, 2025 -

Trottinette Electrique Pas Chere Moins De 200 E Sur Cdiscount

May 17, 2025

Trottinette Electrique Pas Chere Moins De 200 E Sur Cdiscount

May 17, 2025 -

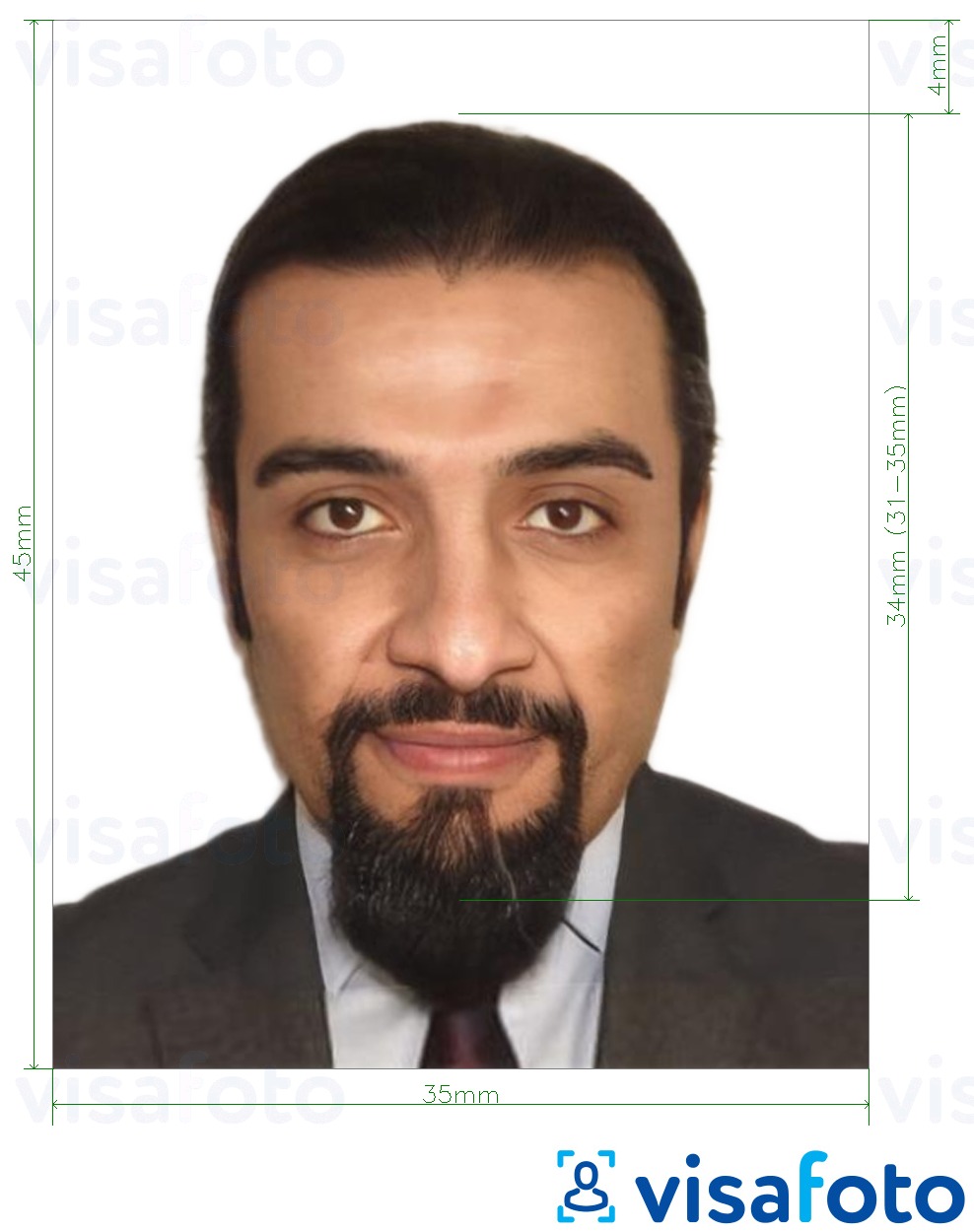

Uae Newborn Emirates Id Fees And Application Process March 2025

May 17, 2025

Uae Newborn Emirates Id Fees And Application Process March 2025

May 17, 2025 -

Ace Your Midday Interview Fountain City Classic Scholarship Tips

May 17, 2025

Ace Your Midday Interview Fountain City Classic Scholarship Tips

May 17, 2025 -

Drakes Ben Mc Collum Named New Iowa Coach

May 17, 2025

Drakes Ben Mc Collum Named New Iowa Coach

May 17, 2025