Reliance Industries Shares Jump After Strong Earnings Announcement

Table of Contents

Strong Performance Across Key Business Segments

The remarkable surge in Reliance Industries shares is a direct result of the company's exceptional performance across its key business segments. Let's delve into the specifics.

Refinery Business Booms

Reliance's refinery business delivered an outstanding performance, driven by increased refining margins, robust product demand, and enhanced operational efficiency.

- Profit increase: Profits in the refining segment surged by 25% compared to the previous quarter, exceeding initial projections by 10%.

- Strategic initiatives: The implementation of advanced technologies and strategic partnerships contributed significantly to optimizing production and reducing operational costs.

- Year-over-year comparison: Compared to the same period last year, the refinery business showed a remarkable 30% growth in profitability, indicating a sustained upward trend. This strong performance in the petrochemicals sector significantly boosted the overall earnings. Increased fuel demand globally also played a key role.

Telecom Sector Shows Robust Growth

Jio Platforms, Reliance's telecom arm, continued its impressive growth trajectory, demonstrating significant expansion and market dominance.

- Subscriber growth: Jio added 15 million new subscribers during the quarter, solidifying its position as a market leader in the Indian telecom sector.

- ARPU increase: Average revenue per user (ARPU) also saw a healthy increase of 10%, driven by higher data consumption and adoption of premium services.

- Market position: Jio's strategic partnerships and expansion into new digital services have significantly strengthened its competitive advantage in the crowded telecom market.

Retail Division Demonstrates Resilience

Reliance Retail maintained its strong performance, showcasing resilience and sustained growth amidst challenging economic conditions.

- Sales growth: Retail sales grew by 18% compared to the previous quarter, demonstrating strong consumer demand and the effectiveness of the company’s strategic initiatives.

- Expansion: The company continued its aggressive expansion strategy, opening numerous new stores across various formats and locations.

- E-commerce strategy: Reliance Retail’s successful e-commerce integration and marketing campaigns contributed substantially to its overall growth.

Investor Reaction and Market Analysis

The outstanding earnings report triggered a significant positive reaction in the market, impacting both share price and trading volume.

Share Price Surge and Trading Volume

Reliance Industries shares witnessed a dramatic surge, with the stock price increasing by 15% in a single day following the earnings announcement.

- Share price movement: The stock reached an all-time high, reflecting the market's enthusiastic response to the robust financial results. Trading volume also soared, indicating intense investor interest and activity.

- Market sentiment: The overall market sentiment remained positive, further contributing to the share price increase.

- Expert opinions: Financial analysts widely praised the company's performance, highlighting the strong growth across all segments and the promising future outlook.

Analyst Ratings and Future Outlook

Following the earnings release, several leading financial analysts upgraded their ratings and price targets for Reliance Industries shares.

- Positive outlook: Analysts cited the company's strong financial position, diversified business model, and aggressive growth strategy as key drivers for future growth.

- Potential challenges: Analysts also identified potential risks, including global economic uncertainty and competition within various market segments. However, the overall consensus remains overwhelmingly positive.

- Investment recommendations: Many analysts issued "buy" or "strong buy" recommendations, emphasizing the attractive valuation and significant growth potential of Reliance Industries stock.

Conclusion: Reliance Industries Shares – A Promising Investment Opportunity?

The robust earnings report and the subsequent surge in Reliance Industries shares highlight the company's exceptional performance across its key business segments. The strong growth in refining, telecom, and retail, coupled with positive analyst ratings and a promising future outlook, positions Reliance Industries shares as a potentially attractive investment. The significant share price increase and high trading volume reflect investor confidence in the company's continued success. Learn more about investing in Reliance Industries shares and Reliance Industries stock by [link to relevant resource]. Consider exploring investment opportunities in Reliance Industries and diversify your portfolio with this promising company.

Featured Posts

-

The Porsche Paradox International Love Vs Australian Reception

Apr 29, 2025

The Porsche Paradox International Love Vs Australian Reception

Apr 29, 2025 -

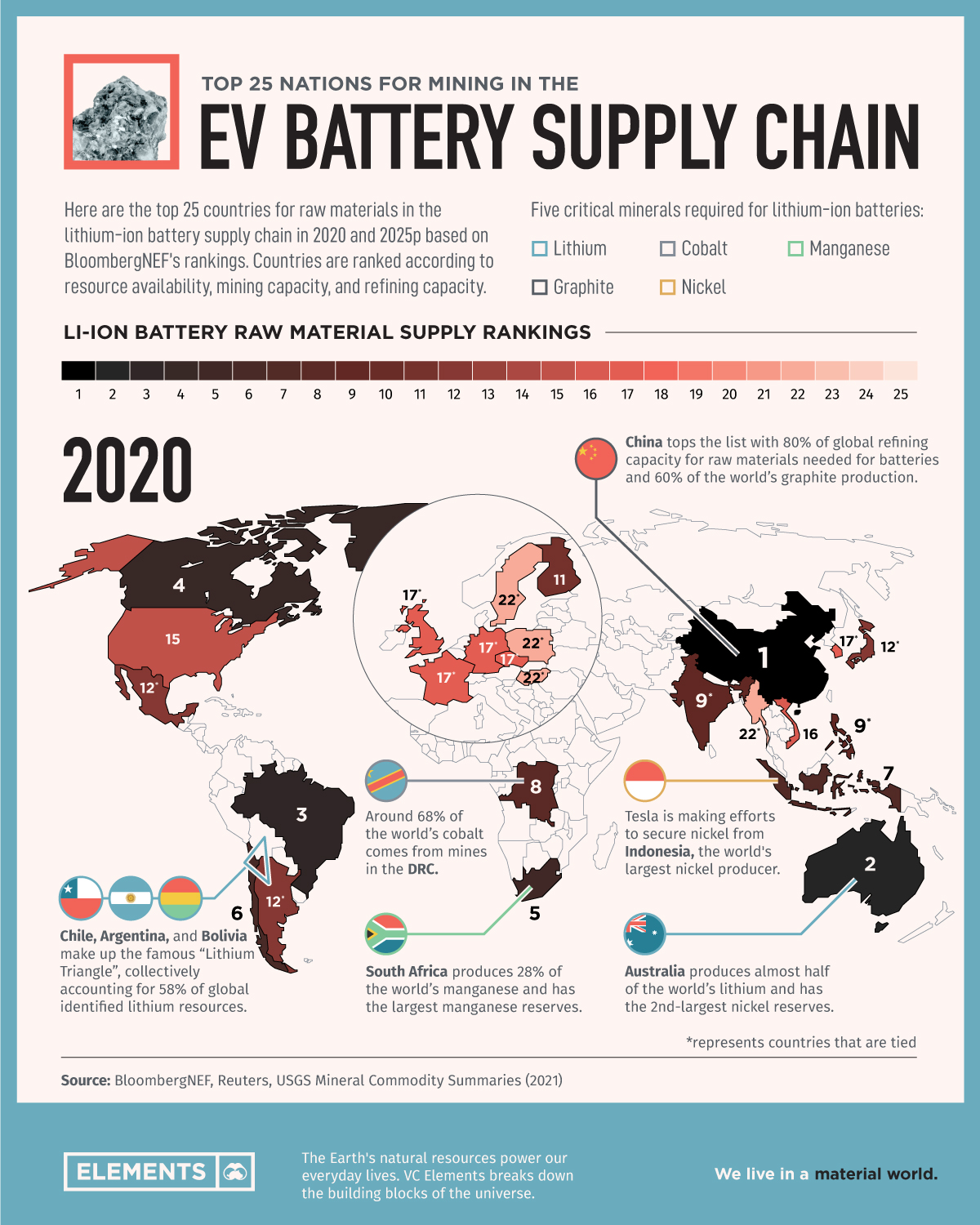

Dysprosiums Growing Importance In Electric Vehicles A Supply Chain Crisis

Apr 29, 2025

Dysprosiums Growing Importance In Electric Vehicles A Supply Chain Crisis

Apr 29, 2025 -

You Tubes Expanding Older Audience Growth Strategies And Demographics

Apr 29, 2025

You Tubes Expanding Older Audience Growth Strategies And Demographics

Apr 29, 2025 -

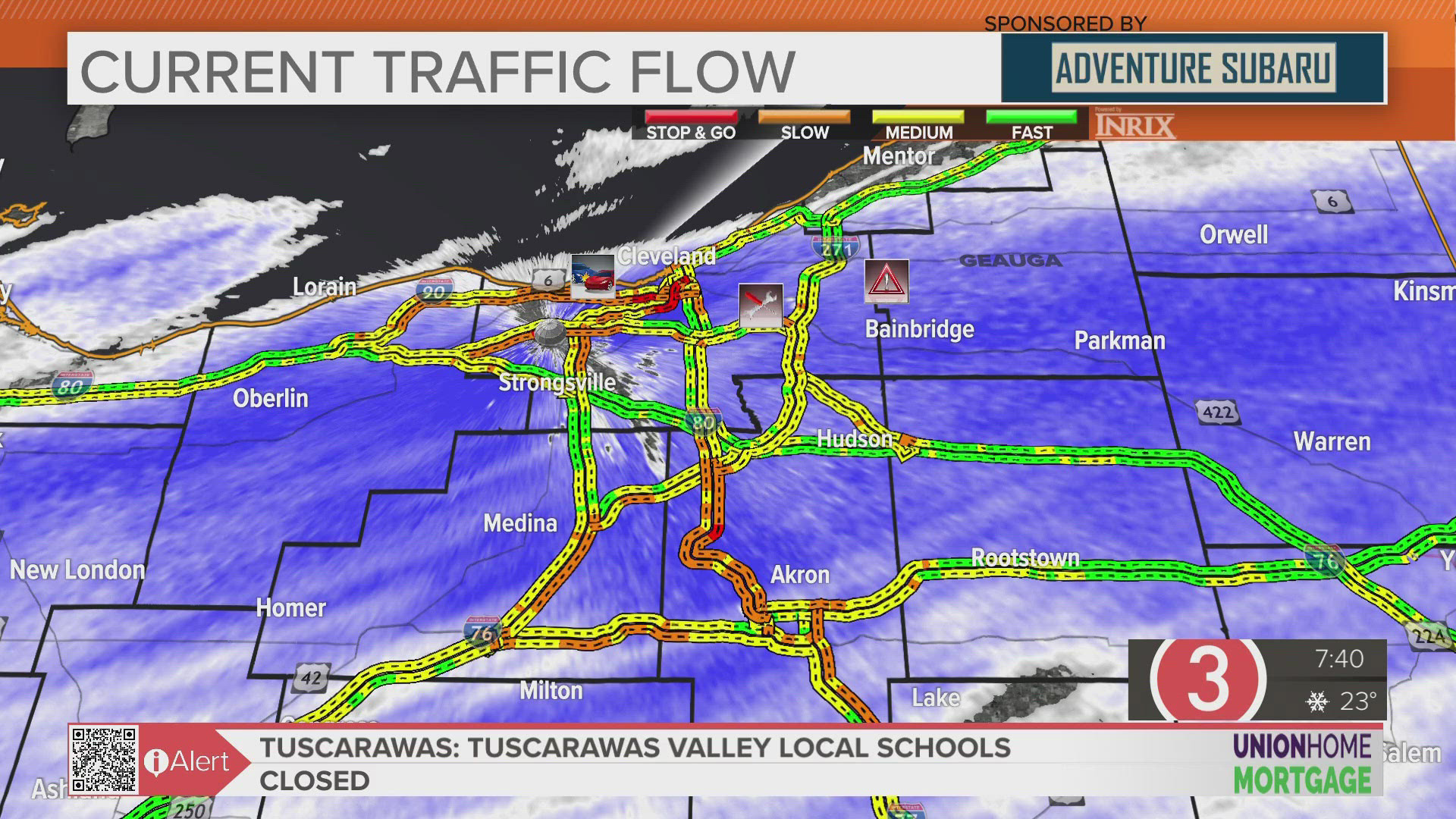

Snow Fox Delays And Closings Tuesday February 11th Updates

Apr 29, 2025

Snow Fox Delays And Closings Tuesday February 11th Updates

Apr 29, 2025 -

Underground Nightclub Bust Over 100 Immigrants Detained

Apr 29, 2025

Underground Nightclub Bust Over 100 Immigrants Detained

Apr 29, 2025