Representatives Aim To Recover $1.231 Billion In Oil Company Funds

Table of Contents

The Allegations of Financial Misconduct

The core of this $1.231 billion lawsuit rests on allegations of widespread financial misconduct within [Name of Oil Company, if available, otherwise use "the unnamed oil company"]. The representatives claim that the company engaged in a pattern of deceptive practices designed to systematically siphon off billions of dollars. These alleged irregularities include:

- Embezzlement: Funds were allegedly diverted from company accounts into private accounts controlled by senior executives and their associates.

- Fraudulent Accounting: The representatives allege the company manipulated its financial records to conceal losses and inflate profits, misleading investors and stakeholders.

- Insider Trading: Information about upcoming projects and market fluctuations was allegedly used to conduct illicit trades, generating substantial personal profits at the expense of the company.

- Money Laundering: The representatives allege that the misappropriated funds were laundered through complex offshore accounts to obscure their origin and intended use.

Evidence presented by the representatives includes meticulously documented financial records, internal memos detailing fraudulent transactions, witness testimonies from former employees, and expert analyses confirming the scale of the alleged financial irregularities. This oil company fraud investigation has uncovered a complex web of deceit.

The Representatives Leading the Legal Charge

A coalition of legal representatives is leading the charge to recover the $1.231 billion. This includes [List names of law firms and/or government agencies involved, if known. Otherwise, provide a general description, e.g., "prominent law firms specializing in large-scale financial fraud," and "relevant government regulatory bodies"]. These legal representatives bring extensive experience in handling complex financial fraud cases, often involving asset recovery specialists and financial fraud lawyers. Their strategies for recovering the funds involve:

- Civil Lawsuit: A major civil lawsuit has been filed seeking the recovery of the misappropriated funds, with punitive damages also being sought.

- Criminal Charges: Investigations are underway to determine if criminal charges are warranted against individuals involved in the alleged misconduct.

- Asset Seizure: Representatives are actively pursuing legal avenues to seize assets believed to have been purchased with the misappropriated oil company funds.

The legal team is leveraging precedents set in similar cases of corporate malfeasance to strengthen their case and navigate the complex legal landscape of recovering oil company funds.

The Potential Impact of the Case

The potential impact of this $1.231 billion lawsuit extends far beyond the immediate financial implications. The case could significantly impact the oil industry as a whole, potentially leading to:

- Increased Regulatory Scrutiny: The case is likely to trigger increased scrutiny of corporate governance practices within the oil and gas industry.

- Corporate Governance Reform: This could lead to the implementation of stricter regulations and reforms to prevent similar incidents of financial misconduct.

- Investor Protection: The outcome of the case could enhance investor protection measures and increase transparency in financial reporting by oil companies.

Furthermore, the economic impact of this alleged fraud is considerable, potentially affecting investor confidence, shareholder value and potentially the broader economy. Depending on the outcome, environmental consequences relating to potential underinvestment in sustainable practices resulting from diverted funds could also come to light.

The Timeline and Next Steps

The case has unfolded over several months/years (Insert relevant timeframe). Key events include [Insert key dates and milestones, e.g., "filing of the initial lawsuit," "discovery phase," etc.]. The anticipated next steps in the legal proceedings include [List upcoming court dates, hearings, or significant milestones]. The oil company has issued statements [Summarize the oil company's response to the allegations].

- [Bullet point listing of future events, dates etc.]

The ongoing legal proceedings will determine the ultimate outcome of this significant case and its impact on the oil industry and beyond.

Conclusion

The $1.231 billion oil company funds recovery case represents a crucial fight for justice and accountability within the energy sector. The alleged scale of financial misconduct highlights the urgent need for enhanced transparency and stricter regulations to prevent future occurrences. This case’s outcome will have far-reaching consequences for corporate governance, investor protection, and the overall integrity of the oil and gas industry. Follow the ongoing developments in the $1.231 billion oil company funds recovery case to stay informed about the efforts to recover these oil company funds and learn more about fighting financial misconduct in the energy sector.

Featured Posts

-

European Union Trade Policy Macron Advocates For Prioritizing European Products

May 21, 2025

European Union Trade Policy Macron Advocates For Prioritizing European Products

May 21, 2025 -

Love Monster For Children And Adults

May 21, 2025

Love Monster For Children And Adults

May 21, 2025 -

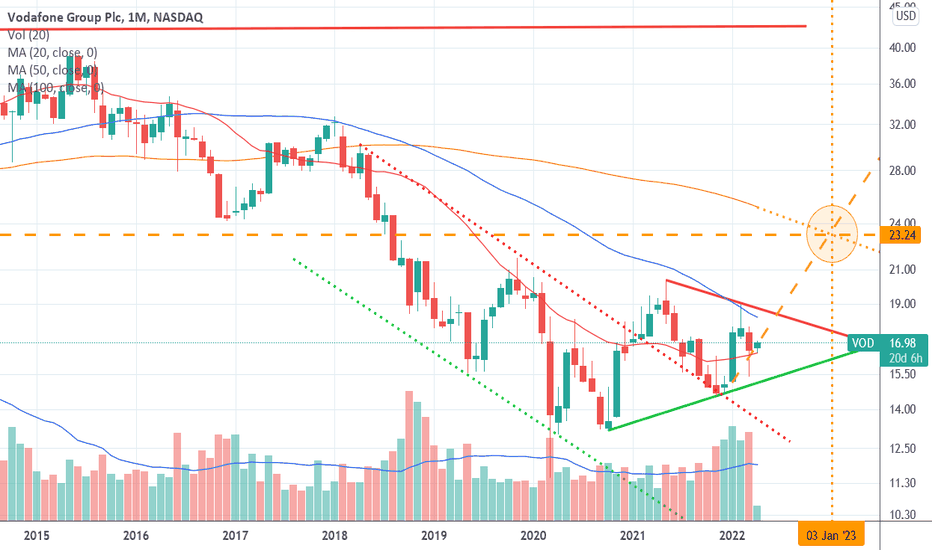

Vodacoms Vod Improved Earnings Drive Higher Than Expected Payout

May 21, 2025

Vodacoms Vod Improved Earnings Drive Higher Than Expected Payout

May 21, 2025 -

Abn Amro Rapport De Kwetsbaarheid Van De Voedingssector Door Goedkope Arbeidsmigranten

May 21, 2025

Abn Amro Rapport De Kwetsbaarheid Van De Voedingssector Door Goedkope Arbeidsmigranten

May 21, 2025 -

Connaissez Vous Vraiment La Loire Atlantique Un Quiz Defi

May 21, 2025

Connaissez Vous Vraiment La Loire Atlantique Un Quiz Defi

May 21, 2025

Latest Posts

-

Abn Amro Facing Investigation Dutch Central Bank Scrutinizes Bonus Practices

May 22, 2025

Abn Amro Facing Investigation Dutch Central Bank Scrutinizes Bonus Practices

May 22, 2025 -

Pivdenniy Mist Detali Pro Remont Pidryadnikiv Ta Finansuvannya

May 22, 2025

Pivdenniy Mist Detali Pro Remont Pidryadnikiv Ta Finansuvannya

May 22, 2025 -

Remont Pivdennogo Mostu Khto Skilki Ta Koli

May 22, 2025

Remont Pivdennogo Mostu Khto Skilki Ta Koli

May 22, 2025 -

Remont Pivdennogo Mostu Pidryadniki Vartist Ta Termini

May 22, 2025

Remont Pivdennogo Mostu Pidryadniki Vartist Ta Termini

May 22, 2025 -

Finansovi Kompaniyi Ukrayini Reyting Za Dokhodami 2024

May 22, 2025

Finansovi Kompaniyi Ukrayini Reyting Za Dokhodami 2024

May 22, 2025