Republican Divisions Could Sink Trump's Tax Bill

Table of Contents

Factional Fights Within the GOP

The Republican party, despite its unified control at the time of the bill's proposal, is far from a monolith. Internal disagreements over specific tax provisions are creating major roadblocks in the path of this ambitious legislation. These disagreements are not simply about the details; they expose fundamental ideological fissures within the party.

Conservative vs. Moderate Republicans

A deep chasm separates the party's conservative wing, demanding significant tax cuts across the board, from more moderate Republicans concerned about the potential impact on the national debt and social programs. This ideological conflict is central to the bill's uncertain future.

- Conservative push for drastic corporate tax cuts: Conservatives advocate for substantial reductions in corporate tax rates, believing this will stimulate economic growth. They argue that lower taxes incentivize investment and job creation.

- Moderates prioritizing deficit reduction and targeted tax relief: Moderates express concern over the potential long-term impact on the national debt. They favor more targeted tax relief, focusing on middle-class families rather than broad-based cuts.

- Internal negotiations and compromises proving difficult to achieve: The differing priorities have made negotiations extremely challenging. Finding common ground between these two factions requires significant compromise, which has proven elusive.

The Freedom Caucus and Their Influence

The Freedom Caucus, a group of highly conservative Republicans, wields significant influence within the party. Known for their opposition to compromise and adherence to strict conservative principles, their demands could be deal-breakers for the bill's passage.

- Demand for even deeper tax cuts than the initial proposal: The Freedom Caucus pushed for even more aggressive tax cuts than those initially proposed by the administration, further complicating negotiations.

- Potential for filibustering or blocking the bill entirely: Their willingness to obstruct the legislative process through tactics like filibustering poses a serious threat to the bill's success.

- Negotiating with the Freedom Caucus is a delicate balancing act for leadership: Republican leadership faces the difficult task of appeasing the Freedom Caucus without alienating moderate Republicans or jeopardizing the bill's overall viability.

Economic Concerns and Potential Consequences

The proposed tax cuts have sparked intense debate over their long-term economic implications. Concerns about the national debt and income inequality are fueling opposition from both within and outside the Republican party. These concerns extend beyond party lines, highlighting the broad-based impact of the proposed legislation.

Impact on the National Debt

The projected increase in the national debt due to the tax cuts is a major source of contention. This concern is particularly acute amongst moderate Republicans and some independent senators who are wary of long-term fiscal instability.

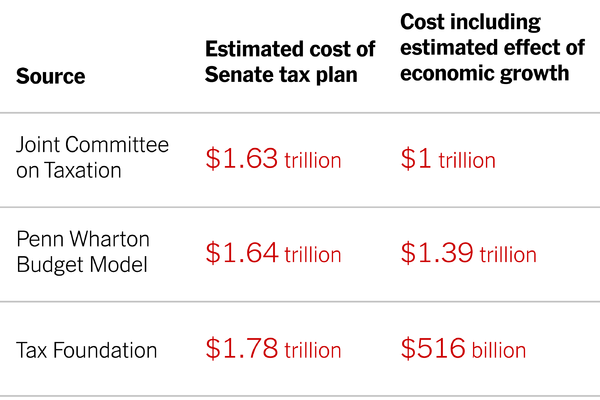

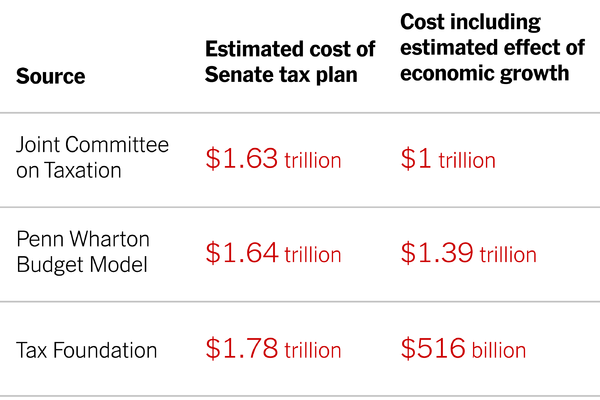

- Analysis of the bill's long-term impact on the deficit: Independent analyses have projected a significant increase in the national debt under the proposed tax cuts, raising serious concerns about the country's fiscal future.

- Concerns about future interest rates and economic stability: A rising national debt could lead to higher interest rates, potentially stifling economic growth and impacting the stability of the US dollar.

- Potential for credit rating downgrades: A significantly increased national debt could result in credit rating downgrades, increasing borrowing costs for the government and potentially harming the US economy.

Income Inequality and Distributional Effects

Critics argue that the proposed tax cuts disproportionately benefit the wealthy, thereby exacerbating income inequality. This argument resonates with a significant segment of the population and adds to the political pressure against the bill.

- Analysis of the tax bill's impact on different income brackets: Studies show that the benefits of the tax cuts are concentrated at the higher income levels, raising concerns about fairness and equity.

- Arguments for and against progressive taxation: The debate over the tax bill highlights the ongoing discussion surrounding progressive versus regressive taxation, with proponents of progressive taxation criticizing the bill's lack of focus on income inequality.

- Public perception of the tax bill's fairness: Public opinion polls reveal significant skepticism about the fairness of the proposed tax cuts, further undermining support for the bill.

The Role of Lobbying and External Pressure

Powerful lobbying groups are exerting significant influence on the legislative process, adding further complexity to the already strained negotiations. This external pressure is a crucial element in understanding the challenges facing the bill.

Corporate Lobbying and Influence

Corporations are heavily lobbying for favorable tax provisions, potentially swaying the votes of key lawmakers. This corporate influence raises concerns about the potential for conflicts of interest and the undue sway of special interests.

- Identification of key corporate lobbyists and their influence: Various corporations have invested significant resources in lobbying efforts aimed at shaping the final version of the tax bill.

- Analysis of corporate lobbying strategies and their effectiveness: Corporate lobbying strategies include direct engagement with lawmakers, campaign contributions, and public relations campaigns.

- Potential conflict of interest for lawmakers: The influence of corporate lobbying raises concerns about potential conflicts of interest for lawmakers who might be swayed by financial contributions or promises of future employment.

Public Opinion and Grassroots Activism

Public opinion is divided on the tax bill, with vocal opposition from various groups putting pressure on lawmakers. This grassroots activism plays a significant role in shaping public discourse and influencing the political debate.

- Analysis of public opinion polls on the tax bill: Polls reveal significant public skepticism and opposition to the tax bill, indicating that the political landscape surrounding the bill is complex.

- Impact of grassroots activism and protests: Grassroots activism and protests have played a role in shaping public opinion and applying pressure on lawmakers to reconsider certain aspects of the bill.

- The influence of social media and public discourse: Social media has become a powerful tool for shaping public opinion and mobilizing grassroots activism around the issue of the tax bill.

Conclusion

The Republican party's internal divisions represent a significant threat to the passage of President Trump's tax bill. The combination of factional fighting, economic concerns, and external pressures created a highly volatile situation. Whether the bill survives hinges on the ability of Republican leadership to navigate these treacherous waters and secure sufficient votes. The outcome will have far-reaching implications for the American economy and political landscape. Understanding these intricate political dynamics is crucial to grasping the future trajectory of Republican tax legislation and its potential impact on the national debt and the American people. Stay informed about the latest developments in Trump's tax plan to understand the implications for you and the future of the US economy.

Featured Posts

-

Missing British Paralympian Las Vegas Police Investigate Disappearance

Apr 29, 2025

Missing British Paralympian Las Vegas Police Investigate Disappearance

Apr 29, 2025 -

Nintendos Action Leads To Ryujinx Emulator Development Cease

Apr 29, 2025

Nintendos Action Leads To Ryujinx Emulator Development Cease

Apr 29, 2025 -

Bundesliga News Lask In Der Krise Klagenfurt Im Freien Fall

Apr 29, 2025

Bundesliga News Lask In Der Krise Klagenfurt Im Freien Fall

Apr 29, 2025 -

Investment Opportunities In Negeri Sembilans Data Center Sector

Apr 29, 2025

Investment Opportunities In Negeri Sembilans Data Center Sector

Apr 29, 2025 -

Ny Times Reporting On January 29th Dc Air Disaster A Critical Analysis

Apr 29, 2025

Ny Times Reporting On January 29th Dc Air Disaster A Critical Analysis

Apr 29, 2025