Republican Tax Plan: House Unveils Trump-Backed Proposals

Table of Contents

Individual Income Tax Changes Under the Republican Tax Plan

The Republican tax plan proposes several key changes to individual income taxes, potentially altering the tax burden for millions of Americans. Understanding these changes is crucial for effectively managing your personal finances.

Proposed Changes to Tax Brackets

The plan proposes adjustments to the existing tax brackets. While specific numbers would need to be referenced from the official proposal (as plans can change), the general idea may involve increasing or decreasing the number of brackets, altering the income thresholds, or modifying the tax rates within each bracket. This could lead to:

- Tax increases for higher-income earners: Some proposals suggest higher tax rates for individuals earning above a certain threshold.

- Tax cuts for lower-income earners: Conversely, some proposals may lower rates for lower-income taxpayers, potentially providing tax relief for those most in need.

- Changes to the tax burden: The overall impact on the tax burden will depend heavily on the specifics of the proposed changes to individual tax rates and the income thresholds that define each tax bracket.

Analyzing the impact requires careful consideration of your specific income level and the details of the proposed changes to individual tax rates within each tax bracket.

Standard Deduction and Itemized Deductions

Significant changes to the standard deduction and itemized deductions are also proposed under the Republican Tax Plan. These could include:

- Increased standard deduction: This could simplify tax filing for many individuals, potentially eliminating the need for itemizing.

- Limitations on itemized deductions: This could affect deductions for mortgage interest, charitable donations, and state and local taxes (SALT), impacting taxpayers who currently benefit from these deductions. The impact of the changes to itemized deductions will vary greatly by individual circumstance. The SALT deduction, in particular, is a contentious point.

Understanding the proposed alterations to both the standard deduction and itemized deductions is critical to assess the potential impact on your individual tax liability.

Child Tax Credit Modifications

The Republican tax plan may also include modifications to the Child Tax Credit (CTC). Potential changes could involve:

- Increased credit amount: This could provide greater tax relief for families with children.

- Modified eligibility requirements: Changes to income limits or other eligibility criteria could impact who qualifies for the credit.

- Expansion of the credit: The plan might broaden the definition of qualifying dependents, potentially impacting more families.

These changes to the child tax credit could significantly impact families with children, affecting their overall tax burden and financial planning.

Corporate Tax Rate Adjustments in the Republican Tax Plan

The Republican tax plan often focuses on significant adjustments to the corporate tax rate, potentially influencing business investment and economic growth.

Proposed Corporate Tax Rate

The proposed corporate tax rate is a central element of the Republican Tax Plan. A lower corporate tax rate could:

- Boost business investment: Lower taxes could incentivize companies to invest more in expansion, research and development, and job creation.

- Increase competitiveness: A more competitive corporate tax rate could attract foreign investment and boost the domestic economy.

- Impact on different sized businesses: The effects may vary depending on the size and structure of a business. Small businesses might experience different benefits than large multinational corporations.

However, a lower corporate tax rate could also lead to concerns about its potential impact on the national debt and income inequality.

Impact on Business Investment and Growth

Changes to the corporate tax rate are expected to have a significant influence on business investment and economic growth. Potential effects include:

- Increased capital expenditures: Lower taxes could free up capital for businesses to invest in new equipment, technology, and expansion projects.

- Job creation: Increased investment could lead to the creation of new jobs.

- Global competitiveness: A lower tax rate could improve the competitiveness of US businesses in the global market.

However, the actual impact will depend on various economic factors and the overall business environment.

Potential Economic and Social Consequences of the Republican Tax Plan

The Republican Tax Plan's long-term economic and social consequences are subjects of considerable debate.

Impact on the National Debt

A major concern surrounding the Republican tax plan is its potential impact on the national debt. Tax cuts, especially if not offset by spending cuts, could:

- Increase the budget deficit: Lower tax revenues could widen the gap between government spending and revenue.

- Lead to higher interest rates: Increased borrowing to finance the deficit could drive up interest rates, impacting both consumers and businesses.

- Long-term economic consequences: A growing national debt could lead to slower economic growth and reduced long-term economic stability.

These are important considerations when assessing the overall fiscal responsibility of the plan.

Income Inequality and Social Equity Implications

The Republican tax plan's potential impact on income inequality is a key point of discussion. The effects could vary significantly depending on the specific details:

- Exacerbating inequality: Tax cuts disproportionately benefiting higher-income earners could widen the gap between the rich and the poor.

- Improved economic mobility: Conversely, tax cuts that stimulate economic growth could potentially improve opportunities for lower-income individuals.

- Fairness concerns: Arguments about fairness and equity will center on how the tax burden is distributed across different income levels.

These social equity implications must be carefully examined when assessing the overall impact of the plan.

Conclusion

The proposed Republican tax plan represents a significant overhaul of the US tax code. Understanding the specifics of the changes—from individual tax brackets and deductions to the corporate tax rate—is vital for anyone affected by the legislation. The potential economic and social consequences, including impacts on the national debt and income inequality, are complex and require careful consideration. Further research into the Republican Tax Plan and its potential impact on your personal finances is strongly recommended. Stay informed about the evolving details of this Republican Tax Plan to make informed decisions.

Featured Posts

-

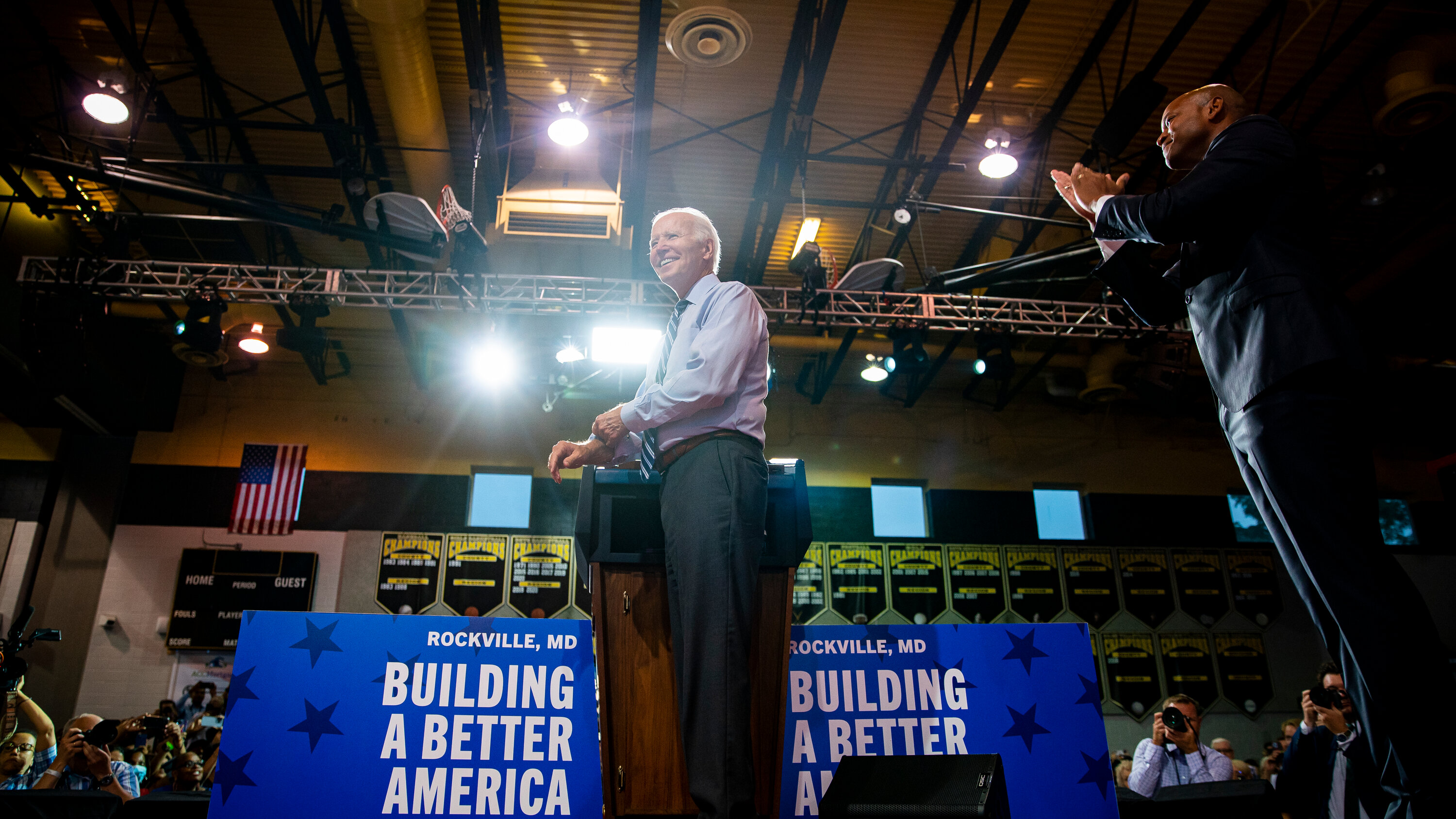

Examining President Bidens Responses To Allegations And Criticism

May 15, 2025

Examining President Bidens Responses To Allegations And Criticism

May 15, 2025 -

Kim Kardashian Recounts Paris Robbery In Court

May 15, 2025

Kim Kardashian Recounts Paris Robbery In Court

May 15, 2025 -

Black Decker Steam Irons Choosing The Right Model For Your Needs

May 15, 2025

Black Decker Steam Irons Choosing The Right Model For Your Needs

May 15, 2025 -

Dasanis Uk Absence Reasons Behind The Bottled Water Gap

May 15, 2025

Dasanis Uk Absence Reasons Behind The Bottled Water Gap

May 15, 2025 -

2025 Steam Sales A Comprehensive Guide To Dates And Deals

May 15, 2025

2025 Steam Sales A Comprehensive Guide To Dates And Deals

May 15, 2025