Reshaping India's Insurance Landscape: Ind AS 117's Transformative Impact

Table of Contents

Enhanced Transparency and Financial Reporting in Indian Insurance

Ind AS 117 dramatically improves transparency in financial reporting for Indian insurance companies. By standardizing accounting practices for insurance contracts, it provides a more accurate and reliable picture of an insurer's financial position. This enhanced transparency is crucial for all stakeholders, including investors seeking reliable financial data, regulators ensuring market stability and consumer protection, and policyholders needing assurance about their insurer's solvency.

The improvements brought about by Ind AS 117 include:

- Improved disclosure requirements: Greater detail on insurance liabilities and the assumptions underpinning their valuation, leading to more informed decision-making.

- Standardized accounting practices: Elimination of inconsistencies in how insurance contracts are accounted for, fostering better comparability between insurers.

- Greater comparability of financial statements: Facilitates easier analysis and benchmarking of insurers' performance, boosting investor confidence and market efficiency.

- Reduced ambiguity in reporting insurance contracts: Clearer and more consistent reporting reduces the risk of misinterpretations and facilitates more accurate risk assessment.

These improvements in insurance reporting standards contribute to greater stakeholder confidence and more effective regulatory scrutiny.

Impact on Insurance Product Design and Pricing

Ind AS 117's influence extends beyond financial reporting; it significantly impacts insurance product design and pricing strategies. The need for more accurate risk assessment and liability valuation necessitates a reassessment of product offerings. Actuaries and underwriters now require more sophisticated models and data analysis techniques to comply with the new standards.

Key implications include:

- More accurate risk assessment and pricing: Insurers must refine their pricing models to reflect a more comprehensive understanding of the risks associated with their products.

- Changes in product offerings: Some products may be redesigned or discontinued to align with the new accounting requirements and risk assessment methodologies.

- Impact on capital adequacy requirements: The new accounting standards may lead to changes in capital adequacy requirements, potentially affecting insurers' investment strategies and financial planning.

This shift towards more precise actuarial science and underwriting methodologies will influence profitability and ultimately shape the competitive landscape within the Indian insurance sector.

Challenges in Implementing Ind AS 117 in India

Despite its transformative potential, the implementation of Ind AS 117 has presented significant challenges for Indian insurers. Adapting to these new accounting standards requires substantial investment in technology and human capital.

Key hurdles include:

- Data migration and system upgrades: Insurers need to migrate their legacy data systems to platforms capable of handling the complexities of Ind AS 117.

- Training and development of staff: Significant investment in training is crucial to equip staff with the skills needed to understand and apply the new standards.

- Cost of implementation: The overall cost of compliance, including IT infrastructure upgrades, staff training, and consulting fees, can be substantial, particularly for smaller insurers.

- Potential disruption to business operations: The transition to Ind AS 117 can disrupt business operations, potentially impacting efficiency and productivity during the implementation phase.

Overcoming these implementation challenges requires a strategic approach, combining technological solutions with targeted human capital development initiatives.

Future Outlook and the Long-Term Effects of Ind AS 117

The long-term impact of Ind AS 117 on the Indian insurance sector is expected to be overwhelmingly positive. The increased transparency and improved financial reporting will attract more foreign investment, contributing to the sector's growth and competitiveness. Moreover, the improved accuracy of financial information will better protect consumers and enhance market stability.

The future implications include:

- Increased foreign investment: Greater transparency and reliability in financial reporting will attract more foreign investors, boosting the sector's growth.

- Improved consumer protection: More accurate financial information enables regulators to more effectively monitor insurers' solvency and protect policyholders' interests.

- Enhanced market stability: Improved transparency and standardized accounting practices contribute to greater market stability and reduce systemic risk.

- Alignment with global accounting standards: Adoption of Ind AS 117 aligns the Indian insurance sector with global best practices, enhancing its integration into the international financial system.

Further regulatory changes are likely to build upon the foundation laid by Ind AS 117, further shaping the evolving landscape of Indian insurance.

Conclusion: Navigating the Transformed Indian Insurance Landscape with Ind AS 117

Ind AS 117 represents a landmark development in the Indian insurance sector. While implementation has presented challenges, the long-term benefits – enhanced transparency, improved financial reporting, and greater market stability – are substantial. Understanding Ind AS 117's impact is crucial for all stakeholders, from insurers navigating the new landscape to investors seeking opportunities in this dynamic market. To learn more about mastering Ind AS 117 compliance and its implications for your business or investments, consult relevant resources from the Institute of Chartered Accountants of India (ICAI) and other professional accounting bodies. Navigating this transformed landscape requires proactive adaptation and a commitment to embracing these new standards.

Featured Posts

-

Real Madrid Legt E50 Miljoen Op Tafel Voor Huijsen

May 14, 2025

Real Madrid Legt E50 Miljoen Op Tafel Voor Huijsen

May 14, 2025 -

Alkaras Inspiracija Za Decu Poput Nadala I Federera

May 14, 2025

Alkaras Inspiracija Za Decu Poput Nadala I Federera

May 14, 2025 -

Klarna Ipo Filing Shows 24 Revenue Increase In Us Market

May 14, 2025

Klarna Ipo Filing Shows 24 Revenue Increase In Us Market

May 14, 2025 -

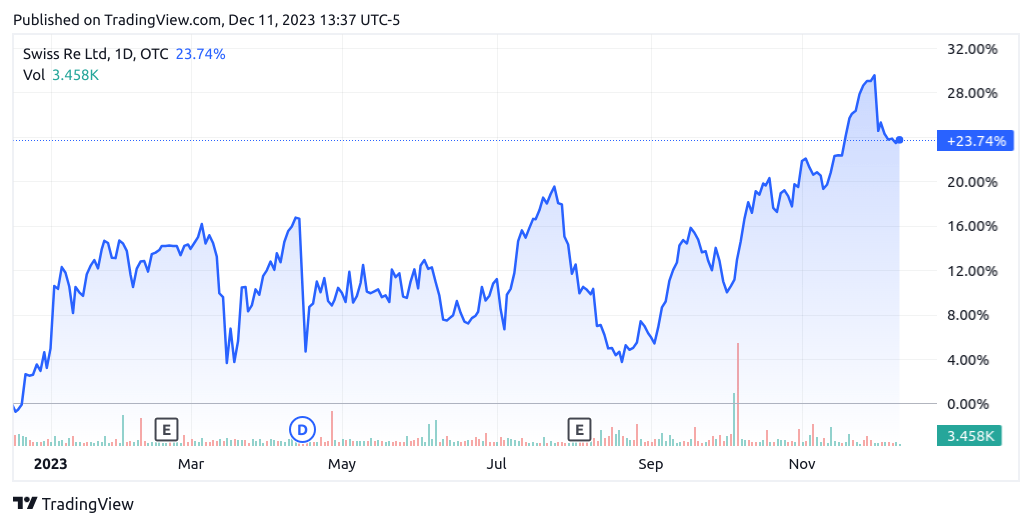

Swiss Sneaker Firm Stock Soars On Global Sales Growth

May 14, 2025

Swiss Sneaker Firm Stock Soars On Global Sales Growth

May 14, 2025 -

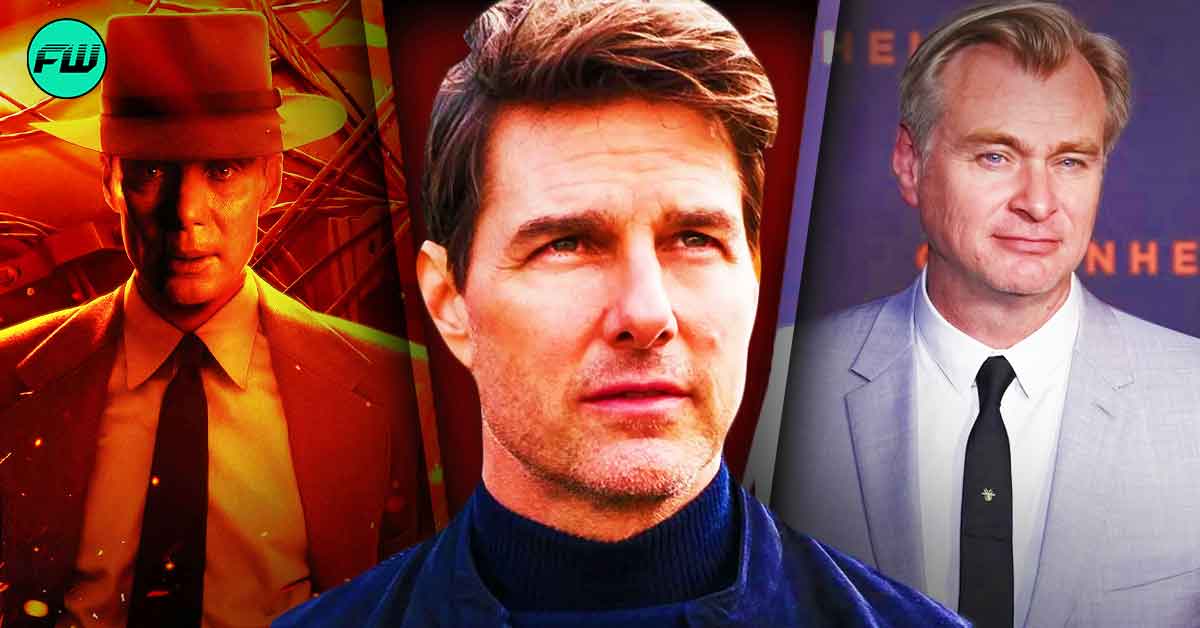

Mission Impossible 8 Box Office Projections A Franchise Defining Challenge

May 14, 2025

Mission Impossible 8 Box Office Projections A Franchise Defining Challenge

May 14, 2025