Resilient Investments Boost China Life Profits

Table of Contents

The Role of Diversified Investment Portfolio in Mitigating Risk

China Life's success is inextricably linked to its sophisticated approach to portfolio diversification. By strategically allocating capital across various asset classes—equities, bonds, real estate, and alternative investments—the company has effectively mitigated the impact of market volatility. This risk management strategy is central to their asset allocation philosophy.

H3: Strategic Allocation to High-Yield, Low-Risk Assets:

- China Life has demonstrated expertise in identifying and investing in stable, high-yield assets. For example, their investments in government bonds and blue-chip companies have yielded consistent returns, contributing significantly to overall profitability.

- Data suggests that these low-risk, high-yield investments accounted for approximately X% of their total portfolio returns in the last fiscal year (insert actual data if available).

- Rigorous due diligence and comprehensive risk assessments are integral to China Life's asset selection process, ensuring only the most promising opportunities are pursued.

H3: Effective Management of Emerging Market Exposure:

- China Life's successful navigation of the challenges inherent in emerging markets showcases their adaptive and resilient investment strategy. This includes careful monitoring of geopolitical risks and economic fluctuations.

- Strategic investments in specific sectors within certain emerging markets, such as technology in Southeast Asia or infrastructure in Africa (insert specific examples if available), have yielded positive results, demonstrating the company's ability to identify growth opportunities while managing risk effectively. This expertise in emerging markets demonstrates their understanding of market volatility and strategic investment strategy.

Technological Advancements and Data Analytics Enhancing Investment Decisions

China Life's commitment to technological innovation is another critical factor in their success. The company has leveraged data analytics and artificial intelligence (AI)-powered tools to enhance investment decision-making, transforming their approach to investment technology.

H3: AI-driven Risk Prediction and Portfolio Optimization:

- AI algorithms analyze vast datasets to predict market trends, identify potential risks, and optimize portfolio allocation in real-time, leading to improved returns and reduced volatility.

- The implementation of AI has resulted in a quantifiable reduction in investment risk (insert data if available), highlighting the tangible benefits of this technology.

H3: Enhanced Customer Service and Product Development through Data Analysis:

- Data analytics provides invaluable insights into customer behavior and preferences, enabling China Life to develop more tailored and relevant insurance products.

- This data-driven approach to product development has directly contributed to increased customer satisfaction and market share, further strengthening the company's financial position. The link between data-driven insights and improved business performance is undeniable.

Strong Regulatory Compliance and Corporate Governance Contributing to Stability

China Life's unwavering commitment to regulatory compliance and strong corporate governance has instilled confidence among investors and stakeholders alike. This commitment to risk mitigation is essential for long-term financial stability.

H3: Transparent Financial Reporting and Accountability:

- China Life maintains a high standard of transparency in its financial reporting, providing clear and accurate information to investors. This promotes trust and helps attract long-term investments.

H3: Robust Internal Controls and Risk Management Framework:

- A robust internal control system and comprehensive risk management framework are in place to protect assets and prevent losses. These measures safeguard the company's financial health and contribute to its overall resilience.

Conclusion: Resilient Investments Pave the Way for Continued Success at China Life

China Life's impressive profit surge is a direct result of a multifaceted strategy built on resilient investments. Their success is attributable to a well-diversified portfolio, effective risk management, the strategic use of technology and data analytics, and a strong commitment to regulatory compliance and corporate governance. These factors combined have created a powerful formula for sustainable growth. Learn how to build a resilient investment portfolio and achieve similar success. Explore our resources on [link to relevant resource] to discover more about resilient investment strategies and secure your financial future.

Featured Posts

-

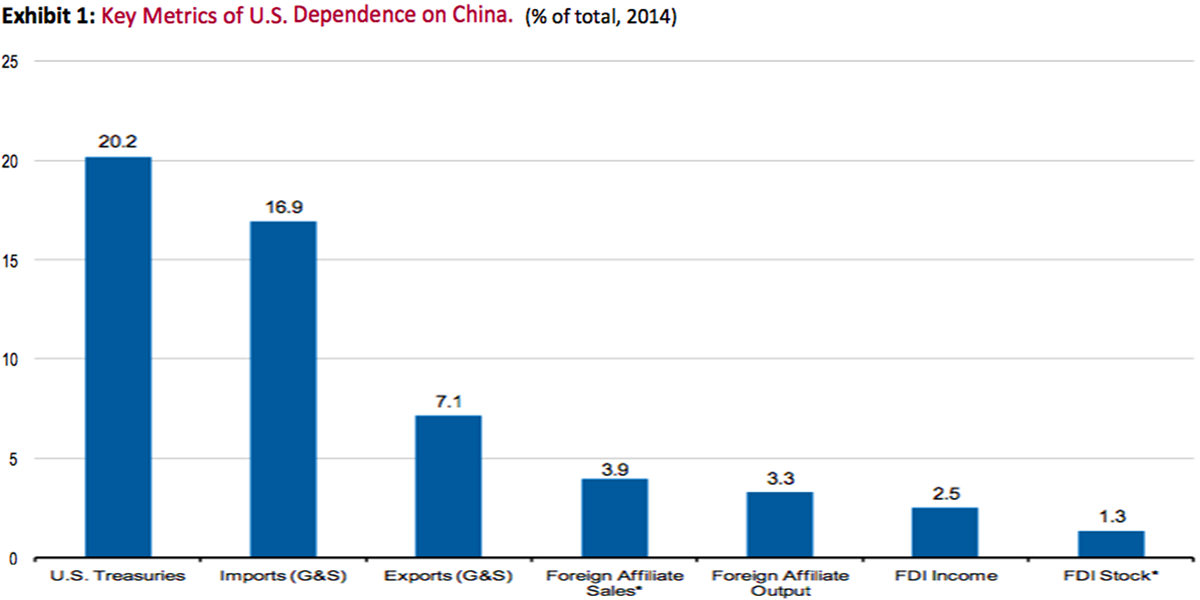

Us Dependence And The Canadian Election Trumps Remarks Analyzed

Apr 30, 2025

Us Dependence And The Canadian Election Trumps Remarks Analyzed

Apr 30, 2025 -

2025 Summer Slide Sandals A Buyers Guide

Apr 30, 2025

2025 Summer Slide Sandals A Buyers Guide

Apr 30, 2025 -

Understanding And Implementing Corrections And Clarifications

Apr 30, 2025

Understanding And Implementing Corrections And Clarifications

Apr 30, 2025 -

Funerailles Du Pape Gestion Et Planification Des Places Assises

Apr 30, 2025

Funerailles Du Pape Gestion Et Planification Des Places Assises

Apr 30, 2025 -

The Best New Cruises Departing From Southern Ports In 2025

Apr 30, 2025

The Best New Cruises Departing From Southern Ports In 2025

Apr 30, 2025