Retail Sales Surge Pushes Back Bank Of Canada Rate Cut

Table of Contents

Strong Retail Sales Figures Exceed Forecasts

Recent data reveals a robust increase in retail sales, significantly exceeding economists' forecasts. The numbers paint a picture of unexpectedly strong consumer spending, defying expectations of a slowdown. This robust performance suggests a more resilient economy than previously anticipated, raising questions about the necessity of a rate cut.

- Percentage increase in overall retail sales: Let's assume, for example, a 2.5% increase month-over-month – a significant jump. (Replace with actual figures when available).

- Breakdown of sales increases by sector: Specific sectors like automotive sales, clothing, and electronics may have shown disproportionately large gains. Analyzing these sector-specific increases provides valuable insights into consumer behavior and spending patterns.

- Comparison to previous months/years' sales figures: Comparing the recent surge to previous months and years allows for a more nuanced understanding of the trend and its sustainability. Is this a temporary blip or a sign of sustained growth?

- Mention of any specific retail giants that significantly boosted sales: Highlighting the contributions of major players in the retail landscape adds context and reinforces the significance of the overall increase.

Impact on Inflation and the Bank of Canada's Mandate

The strong retail sales figures have significant implications for inflation. Increased consumer spending translates to higher demand for goods and services, potentially pushing prices upward. This puts pressure on the Bank of Canada, whose primary mandate is to control inflation and maintain price stability. The central bank's target inflation rate is typically around 2%, and significant deviations from this target require policy adjustments. The unexpected strength in retail sales makes a rate cut less likely in the near term, as it could fuel inflationary pressures.

- Current inflation rate and its trajectory: State the current inflation rate and discuss whether it's moving closer to or further from the Bank of Canada's target.

- Bank of Canada's inflation target: Clearly define the Bank of Canada's inflation target and explain its importance.

- Explanation of the relationship between retail sales, consumer spending, and inflation: Emphasize the direct link between increased consumer spending, higher demand, and potential upward pressure on prices.

- Potential consequences of premature rate cuts on inflation: Highlight the risk of exacerbating inflation if a rate cut is implemented prematurely, given the current strength of retail sales.

Alternative Economic Indicators and Their Influence

While the retail sales surge is a significant factor, other key economic indicators also influence the Bank of Canada's decision-making process. The employment rate, housing market data, and consumer confidence indices all provide valuable insights into the overall health of the economy. A holistic analysis of these indicators is crucial for assessing the appropriate monetary policy response.

- Current unemployment rate and its trend: Discuss the current unemployment rate and its direction – is it rising, falling, or stagnant?

- Recent changes in the housing market: Analyze recent trends in the housing market, including house prices, sales volumes, and mortgage rates.

- Consumer confidence index and its interpretation: Explain the current consumer confidence index and what it suggests about consumer sentiment and future spending patterns.

- How these factors collectively influence the central bank's thinking: Summarize how these various indicators collectively inform the Bank of Canada's assessment of the economic situation and its policy decisions.

Market Reactions and Investor Sentiment

The unexpected retail sales data sent ripples through the financial markets. The Canadian dollar reacted to the news, and investor sentiment shifted as market participants reassessed the probability of a Bank of Canada rate cut. Analyzing market reactions provides valuable insight into investor confidence and expectations.

- Changes in the Canadian dollar's exchange rate: Describe how the Canadian dollar's value was affected by the retail sales data.

- Stock market reactions to the news: Analyze how the stock market responded to the announcement.

- Analyst opinions and predictions regarding future interest rate movements: Summarize the views of financial analysts and economists on the implications for future interest rate changes.

Conclusion: Retail Sales Surge Delays Anticipated Bank of Canada Rate Cut – What's Next?

The robust increase in retail sales has significantly altered the outlook for a Bank of Canada rate cut. The strong consumer spending, coupled with its implications for inflation, suggests that a rate reduction may be postponed. Other economic indicators, while providing a more nuanced picture, haven't significantly altered this central conclusion. The Bank of Canada will likely continue to monitor economic data closely before making any decisions regarding interest rates. To stay updated on future Bank of Canada announcements and the evolving economic situation, and to learn more about the potential implications of a Bank of Canada rate cut or increase, be sure to revisit our site regularly or subscribe to our newsletter. [Link to relevant page/newsletter signup]

Featured Posts

-

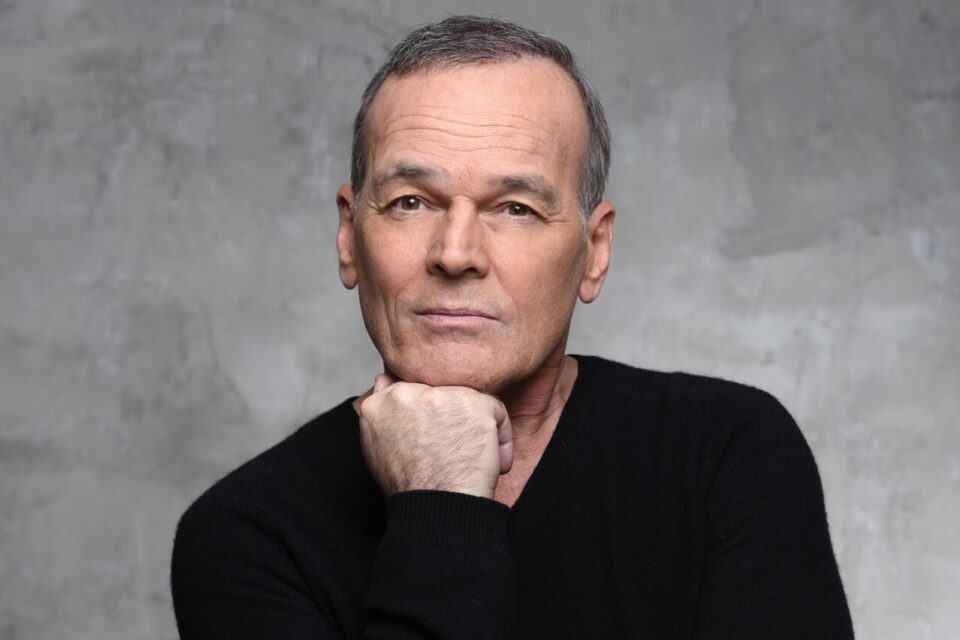

Thierry Ardisson Accuse De Comportements Machistes Analyse De La Polemique

May 25, 2025

Thierry Ardisson Accuse De Comportements Machistes Analyse De La Polemique

May 25, 2025 -

Italian Open Chinese Tennis Players Quarterfinal Berth

May 25, 2025

Italian Open Chinese Tennis Players Quarterfinal Berth

May 25, 2025 -

Europese Aandelen Vs Wall Street Vervolg Op De Snelle Marktdraai

May 25, 2025

Europese Aandelen Vs Wall Street Vervolg Op De Snelle Marktdraai

May 25, 2025 -

Porsche 956 Nin Tavan Sergisinin Sirri

May 25, 2025

Porsche 956 Nin Tavan Sergisinin Sirri

May 25, 2025 -

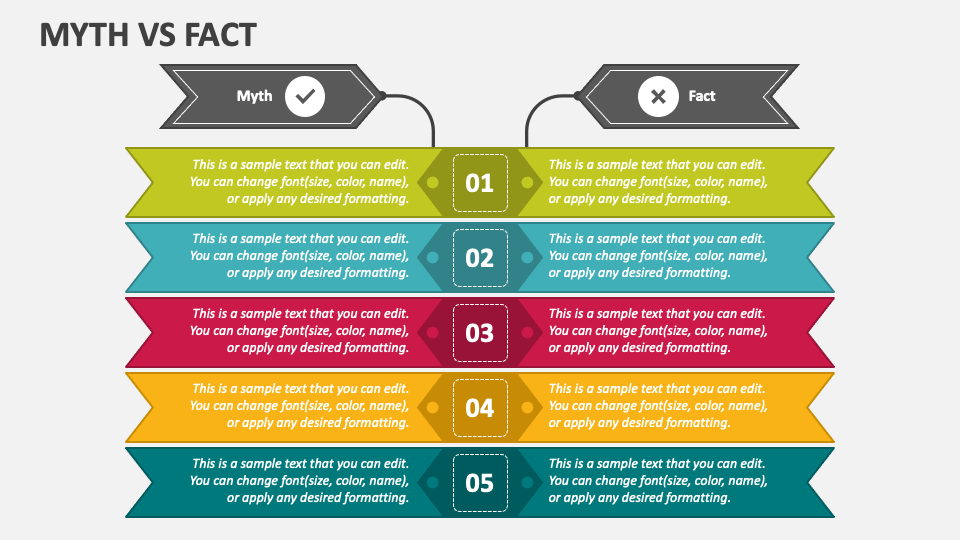

Hells Angels Fact Vs Fiction

May 25, 2025

Hells Angels Fact Vs Fiction

May 25, 2025

Latest Posts

-

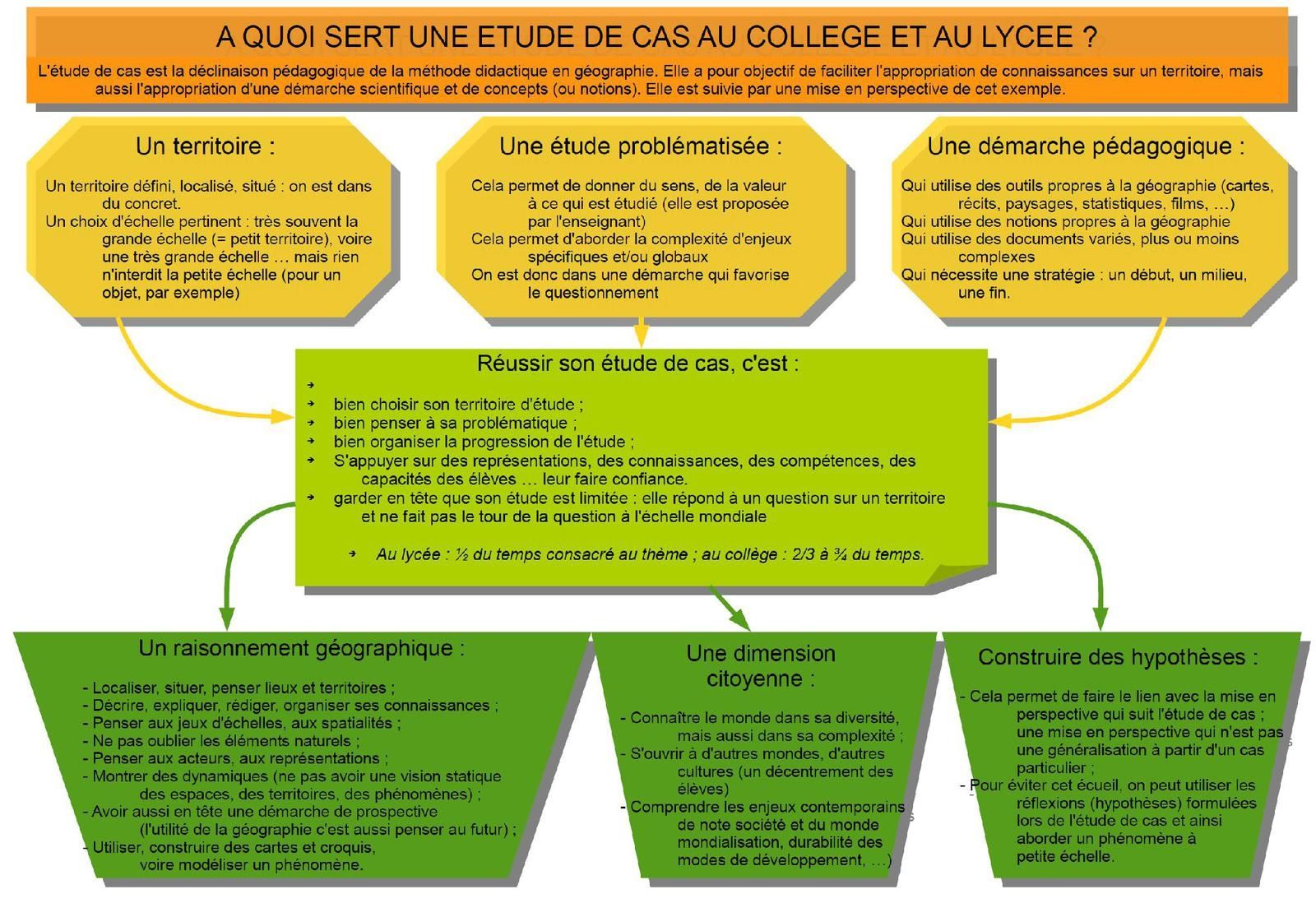

Melanie Thierry Une Etude De Son Talent Et De Son Evolution

May 25, 2025

Melanie Thierry Une Etude De Son Talent Et De Son Evolution

May 25, 2025 -

Thierry Ardisson Accuse De Comportements Machistes Analyse De La Polemique

May 25, 2025

Thierry Ardisson Accuse De Comportements Machistes Analyse De La Polemique

May 25, 2025 -

Les Films De Melanie Thierry A Ne Pas Manquer

May 25, 2025

Les Films De Melanie Thierry A Ne Pas Manquer

May 25, 2025 -

Michael Schumachers Driving Style Aggressive Or Unfair

May 25, 2025

Michael Schumachers Driving Style Aggressive Or Unfair

May 25, 2025 -

Le Temoignage De Laurent Baffie Nouvelles Revelations Sur Thierry Ardisson

May 25, 2025

Le Temoignage De Laurent Baffie Nouvelles Revelations Sur Thierry Ardisson

May 25, 2025