Rethinking Foreign Investment: Canada's Path To Economic Independence

Table of Contents

Analyzing Current Foreign Investment Trends in Canada

Sectors Dominated by Foreign Investment

Foreign investment significantly shapes various sectors of the Canadian economy. Key areas, such as energy (oil and gas, renewables), mining (precious metals, potash), and technology (software, AI), see substantial foreign ownership.

- Energy: Foreign-owned companies control a large percentage of oil sands production and pipeline infrastructure. This provides capital influx but raises concerns about resource control and potential price volatility influenced by global markets.

- Mining: Many Canadian mining operations, particularly in the resource-rich provinces, have significant foreign investment. This provides expertise and capital, but also increases dependence on global commodity prices and exposes Canada to geopolitical risks linked to the countries of origin of the investors.

- Technology: The Canadian tech sector benefits from foreign investment in startups and established companies. This infusion of capital fosters innovation, but also raises issues of intellectual property and potential foreign control over crucial technological advancements.

The benefits of foreign direct investment (FDI) include capital influx, technology transfer, job creation, and increased competition. However, excessive reliance on it can lead to a loss of control over strategic assets, vulnerability to global economic downturns, and potential exploitation of natural resources.

The Impact of Foreign Direct Investment (FDI) on Canadian Economic Growth

A positive correlation generally exists between FDI and Canadian GDP growth. However, this relationship isn't uniform across all regions or sectors.

- Multiplier Effect: FDI often stimulates economic activity through ripple effects, boosting employment and related industries.

- Regional Disparities: The impact of FDI is unevenly distributed geographically, with certain provinces benefiting more than others.

- Statistical Data: [Insert relevant statistical data from credible sources like Statistics Canada, showing the correlation between FDI and GDP growth, highlighting any regional variations]. This data needs to be carefully analyzed to account for other contributing factors.

Understanding this complex relationship requires a nuanced approach, acknowledging limitations and potential biases in interpreting the data.

Assessing the Risks Associated with Over-Reliance on Foreign Investment

Over-dependence on foreign investment exposes Canada to various risks.

- Geopolitical Risks: Changes in global political landscapes or strained international relations can significantly impact investment flows and economic stability.

- Economic Shocks: Global economic downturns can trigger capital flight, negatively impacting Canadian businesses and the overall economy. The 2008 financial crisis serves as a stark reminder.

- Resource Exploitation: Concerns exist about the potential for foreign investors to prioritize profit maximization over sustainable resource management and environmental protection.

- National Security: Foreign ownership in critical infrastructure or strategic industries raises concerns about national security and potential vulnerabilities.

Diversifying investment sources and strengthening domestic capabilities are crucial to mitigating these risks.

Strategies for Promoting Economic Independence

Strengthening Domestic Investment and Entrepreneurship

Boosting domestic investment and entrepreneurship is paramount for reducing reliance on foreign capital.

- Tax Incentives: Implementing attractive tax policies to encourage domestic investment in strategic sectors.

- Funding Programs: Expanding funding programs for startups and SMEs, providing access to venture capital and grants.

- Access to Capital: Improving access to credit and financing for Canadian businesses through government-backed loan programs and initiatives.

- Innovation Support: Investing in research and development (R&D) to foster innovation and technological advancement.

Developing Strategic Industries and Diversification

Diversifying the Canadian economy is crucial to reduce dependence on specific sectors or foreign partners.

- Renewable Energy: Investing heavily in renewable energy sources reduces reliance on fossil fuels and creates new economic opportunities.

- Advanced Manufacturing: Supporting the growth of advanced manufacturing through automation, AI, and sustainable practices.

- Technology: Promoting the growth of domestic technology companies and fostering innovation in key areas like AI, biotechnology, and cleantech.

- Policies to Support Growth: Implementing targeted subsidies, R&D funding, and skills development programs to support the growth of these strategic industries.

Promoting Fair and Reciprocal Trade Agreements

Negotiating fair and reciprocal trade agreements is essential to ensuring Canadian businesses have a level playing field in international markets.

- Balanced Trade Agreements: Focusing on trade agreements that promote balanced trade relationships, reducing reliance on specific foreign markets.

- Negotiation Strategies: Adopting robust negotiation strategies to ensure Canadian interests are protected and that trade agreements are mutually beneficial.

The Role of Government Policy in Shaping Foreign Investment

Regulatory Frameworks for Foreign Investment

The government plays a vital role in shaping the landscape of foreign investment through regulations.

- Investment Screening: Strengthening investment screening mechanisms to ensure foreign investments align with national interests and don't compromise national security.

- Regulatory Reform: Regular review and reform of existing regulations to ensure they remain effective in promoting economic independence while attracting beneficial FDI.

Fiscal Policies and Incentives

Tax policies and incentives significantly influence investment decisions.

- Tax Incentives Review: Reviewing and potentially restructuring tax incentives to ensure they align with national economic goals, prioritizing strategic industries and domestic businesses.

- Strategic Tax Policy: Using tax policy to attract investment in sectors critical for long-term economic growth and independence.

Conclusion: Rethinking Foreign Investment for a More Independent Canada

Canada's current reliance on foreign investment presents both advantages and vulnerabilities. While FDI has contributed to economic growth, excessive dependence poses risks to national security, economic stability, and resource control. Strategies to foster greater economic independence include strengthening domestic investment and entrepreneurship, developing strategic industries, promoting fair trade agreements, and implementing effective government policies that balance attracting beneficial FDI with protecting national interests. A balanced approach, embracing strategic foreign investment while simultaneously building domestic strength and pursuing sustainable, diversified growth, is crucial for a more independent and resilient Canadian economy. Learn more about shaping Canada's economic future by exploring resources from [link to relevant government websites, e.g., Innovation, Science and Economic Development Canada] and engaging in discussions on rethinking foreign investment strategies. Let's work together to build a more economically independent Canada.

Featured Posts

-

Mamardashvili Una Sorpresa O Un Talento Previsible

May 29, 2025

Mamardashvili Una Sorpresa O Un Talento Previsible

May 29, 2025 -

Cuaca Bali Besok Denpasar Diprediksi Hujan

May 29, 2025

Cuaca Bali Besok Denpasar Diprediksi Hujan

May 29, 2025 -

Finding Shiny Pokemon In Pokemon Tcg Pocket A Comprehensive Guide

May 29, 2025

Finding Shiny Pokemon In Pokemon Tcg Pocket A Comprehensive Guide

May 29, 2025 -

Meet The Competitors Eurovision Song Contest 2025

May 29, 2025

Meet The Competitors Eurovision Song Contest 2025

May 29, 2025 -

Liverpool News Real Madrids Speed Demon Move To Anfield Imminent

May 29, 2025

Liverpool News Real Madrids Speed Demon Move To Anfield Imminent

May 29, 2025

Latest Posts

-

L Impact D Arnarulunguaq Sur La Culture Inuit

May 31, 2025

L Impact D Arnarulunguaq Sur La Culture Inuit

May 31, 2025 -

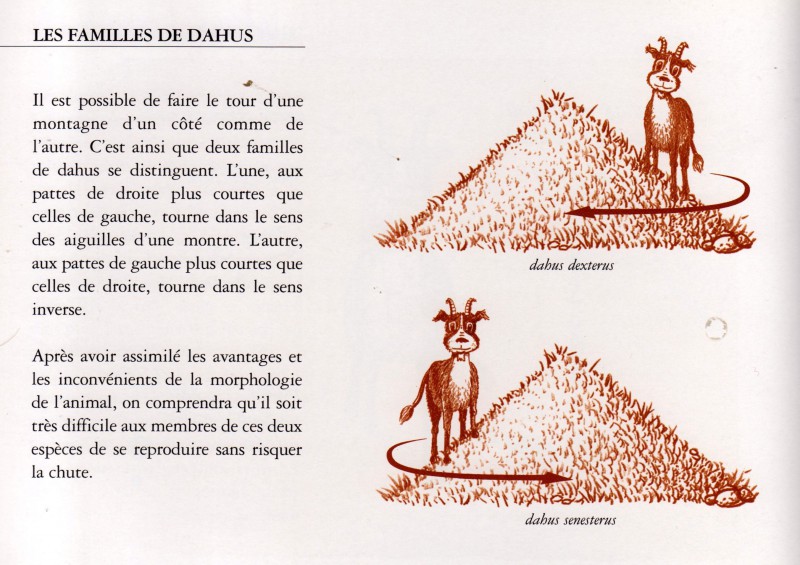

Game De Dahu 1 Jeu Et Concours A Saint Die Des Vosges

May 31, 2025

Game De Dahu 1 Jeu Et Concours A Saint Die Des Vosges

May 31, 2025 -

Decouvrir La Vie Et L Uvre D Arnarulunguaq Une Pionniere Inuit

May 31, 2025

Decouvrir La Vie Et L Uvre D Arnarulunguaq Une Pionniere Inuit

May 31, 2025 -

Arnarulunguaq L Histoire D Une Femme Inuit Remarquable

May 31, 2025

Arnarulunguaq L Histoire D Une Femme Inuit Remarquable

May 31, 2025 -

Partir En Mer Pour Une Journee Equipement Et Precautions

May 31, 2025

Partir En Mer Pour Une Journee Equipement Et Precautions

May 31, 2025