Rio Tinto: Activist Campaign Against Dual Listing Fails

Table of Contents

The Activist Campaign's Objectives and Strategies

The activist investors behind this campaign sought to enhance shareholder value and improve Rio Tinto's corporate governance through a dual listing. They argued that a second listing, perhaps on a major Asian exchange like the Hong Kong Stock Exchange, would increase liquidity, broaden the investor base, and potentially boost the share price. Their strategies involved a multifaceted approach:

- Shareholder Proposals: The activists formally submitted proposals to Rio Tinto's board, demanding a detailed evaluation of a dual listing and a clear timeline for implementation.

- Media Campaigns: They leveraged media outlets to publicize their arguments, highlighting the potential benefits of a dual listing and portraying Rio Tinto's resistance as being against the interests of shareholders.

- Lobbying: The activists engaged in direct lobbying efforts, communicating with major institutional investors and attempting to garner support for their proposal.

Specific actions taken by the activists included:

- Demanding a detailed cost-benefit analysis of a dual listing.

- Publicly questioning the effectiveness of Rio Tinto's current corporate governance structure.

- Highlighting the success of dual listings for other multinational corporations.

These actions demonstrate a sophisticated and well-resourced activist campaign, employing a range of tactics to pressure Rio Tinto's board and management. The campaign leveraged the power of public opinion and shareholder pressure to attempt to force a change in corporate strategy.

Rio Tinto's Response and Counterarguments

Rio Tinto firmly rejected the proposal for a dual listing, arguing that maintaining its single listing on the London Stock Exchange was in the best interests of shareholders. Their counterarguments centered on several key points:

- Significant Costs and Complexities: Rio Tinto highlighted the substantial costs and administrative complexities associated with establishing and maintaining a dual listing, arguing that these expenses would outweigh any potential benefits.

- Regulatory Burden: They emphasized the added regulatory burdens and compliance requirements imposed by a second listing, potentially diverting resources from core business activities.

- Existing Shareholder Base: Rio Tinto argued that their existing investor base was adequately diverse and liquid, rendering a dual listing unnecessary.

Actions taken by Rio Tinto included:

- Issuing detailed public statements explaining their reasons for rejecting the proposal.

- Engaging directly with major institutional investors to address their concerns.

- Emphasizing their strong financial performance and commitment to maximizing shareholder value through existing strategies.

Through a combination of detailed financial analysis, clear communication, and direct engagement with investors, Rio Tinto effectively countered the activist campaign's arguments.

Analysis of the Campaign's Failure

The activist campaign's failure can be attributed to several factors:

- Lack of Significant Shareholder Support: While the activists successfully gained some media attention and generated discussion, they failed to secure sufficient support from other shareholders to force a change in Rio Tinto's strategy. The shareholder vote, or lack of a significant one, ultimately sealed the campaign's fate.

- Effectiveness of Rio Tinto's Counterarguments: Rio Tinto's well-reasoned response, backed by strong financial data and a clear articulation of potential downsides, neutralized many of the activists' arguments.

- Market Conditions: Prevailing market conditions may have also played a role, potentially influencing investor sentiment regarding the perceived risks and rewards associated with a dual listing.

The implications of this failed campaign are significant. It demonstrates the importance of effective communication and strategic countermeasures for companies facing shareholder activism. The outcome likely reinforces the existing corporate governance structure at Rio Tinto and sets a precedent for future activist efforts targeting similar companies in the mining industry.

Conclusion: The Future of Rio Tinto's Listing Strategy and the Implications of the Failed Dual Listing Campaign

The activist campaign to force a dual listing on Rio Tinto ultimately failed due to a combination of insufficient shareholder support and a strong, well-articulated response from the company. Rio Tinto's current strategy of a single listing on the London Stock Exchange remains unchanged. The long-term impact on Rio Tinto's share price will depend on various factors, including broader market trends and the company's continued financial performance. This event highlights the evolving dynamics of corporate governance and shareholder activism in the global mining industry.

Stay informed about Rio Tinto's ongoing efforts to maximize shareholder value and learn more about the complexities of dual listings in the global mining industry. Research Rio Tinto stock, delve into their investor relations reports, and follow future developments surrounding the company's listing strategy and corporate governance best practices.

Featured Posts

-

Judges Cant Review Trumps Tariffs He Argues

May 03, 2025

Judges Cant Review Trumps Tariffs He Argues

May 03, 2025 -

La Nouvelle Loi Sur Les Partis Algeriens Reactions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025

La Nouvelle Loi Sur Les Partis Algeriens Reactions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025 -

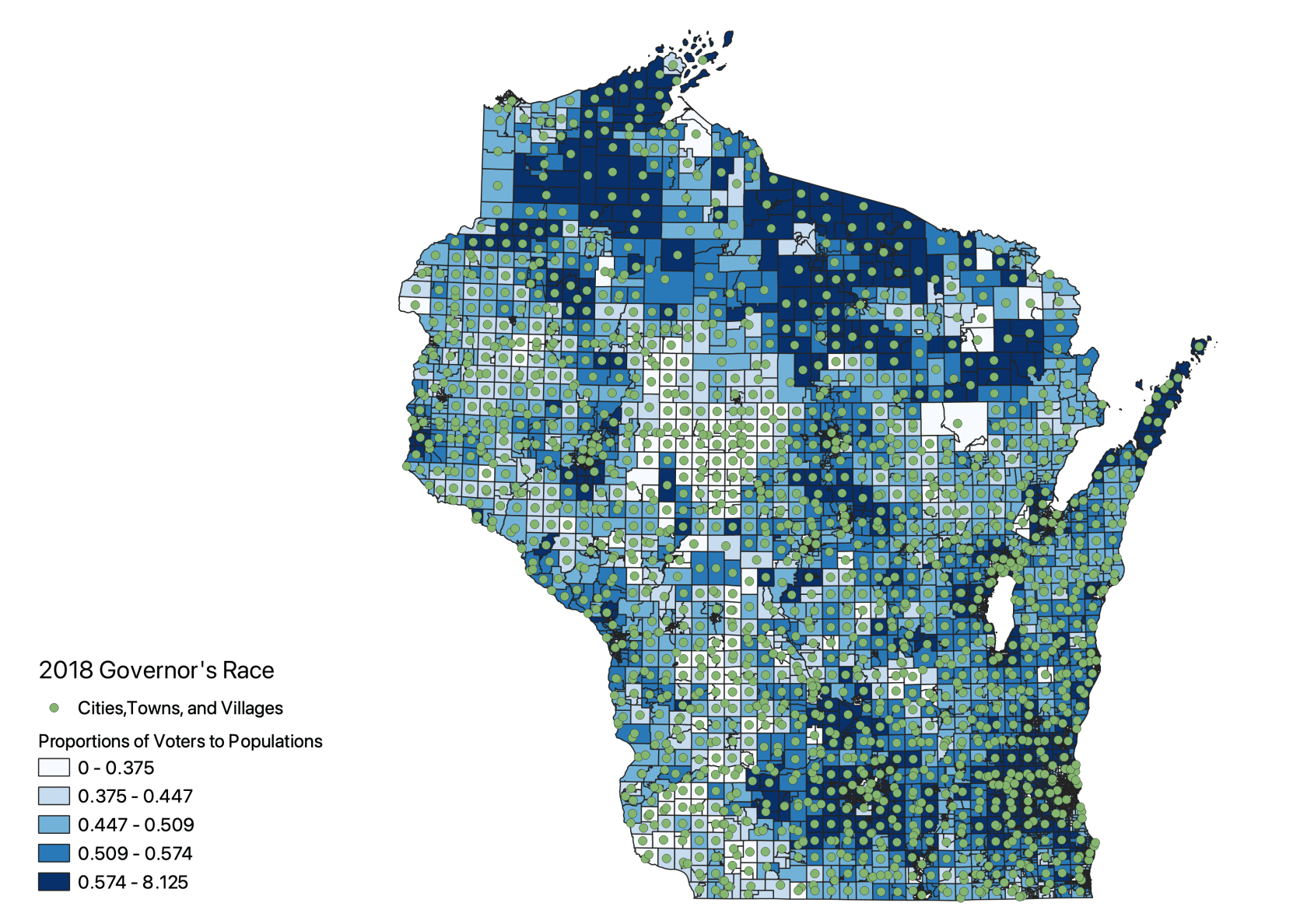

Analyzing Voter Turnout In Florida And Wisconsin Understanding The Political Landscape

May 03, 2025

Analyzing Voter Turnout In Florida And Wisconsin Understanding The Political Landscape

May 03, 2025 -

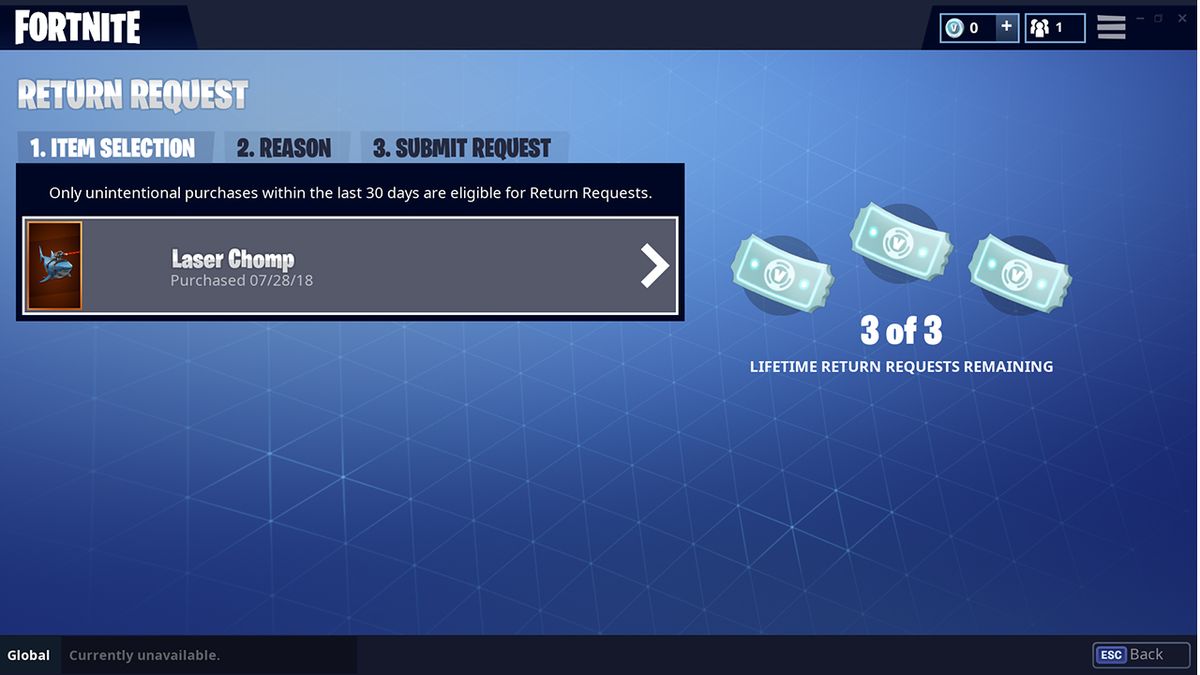

Fortnite Refund Signals Potential Cosmetic Changes

May 03, 2025

Fortnite Refund Signals Potential Cosmetic Changes

May 03, 2025 -

Testing Lower Energy Prices A Dutch Utilitys Solar Power Initiative

May 03, 2025

Testing Lower Energy Prices A Dutch Utilitys Solar Power Initiative

May 03, 2025

Latest Posts

-

The Australian Election A Litmus Test For Global Opposition To Trumpism

May 04, 2025

The Australian Election A Litmus Test For Global Opposition To Trumpism

May 04, 2025 -

The Allure Of The Special Little Bag Functionality And Style Combined

May 04, 2025

The Allure Of The Special Little Bag Functionality And Style Combined

May 04, 2025 -

Rewatching The Gta Vi Trailer What We Know So Far

May 04, 2025

Rewatching The Gta Vi Trailer What We Know So Far

May 04, 2025 -

53 Year Sentence For Hate Crime Against Palestinian American Boy And Mother

May 04, 2025

53 Year Sentence For Hate Crime Against Palestinian American Boy And Mother

May 04, 2025 -

Kentucky Derby 2024 Bob Bafferts Return And The Sports Ongoing Struggle

May 04, 2025

Kentucky Derby 2024 Bob Bafferts Return And The Sports Ongoing Struggle

May 04, 2025