Rio Tinto Successfully Weathers Activist Investor Challenge To Dual Listing

Table of Contents

The Activist Investor Pressure

The pressure on Rio Tinto stemmed from concerns raised by activist investors, though specific names may not always be publicly disclosed in such situations to protect the interests of all parties. These investors argued that the dual listing structure presented unnecessary complexities and inefficiencies. Their core concerns centered on several key areas:

- Governance Complexities: Maintaining two separate listings introduces complexities in corporate governance, potentially leading to inconsistencies in regulatory compliance and shareholder communication. The burden of managing two separate reporting structures was a major point of contention.

- Shareholder Dilution: Some investors argued that the dual listing structure diluted shareholder influence, making it harder for smaller shareholders to effectively engage with the company's management. This concern related to the potential for different voting rights or access to information across the two exchanges.

- Lack of Efficiency: The dual listing was criticized for creating operational inefficiencies, leading to increased administrative costs and potentially impacting the company's overall profitability. This included higher legal and accounting fees, as well as potential complications with capital allocation decisions.

Bullet Points:

- Critics highlighted the added expense and administrative burden associated with dual reporting.

- Concerns were raised about the potential for conflicting regulatory requirements across jurisdictions.

- The activist investors ultimately aimed for a simplification of the listing structure, potentially advocating for a single primary listing on either the London or Australian exchange.

Rio Tinto's Defense Strategy

In response to the activist pressure, Rio Tinto employed a multi-pronged defense strategy. This involved direct engagement with investors, highlighting the benefits of their dual listing and addressing concerns about governance, efficiency, and shareholder value. While Rio Tinto might not have made major concessions, they likely engaged in extensive dialogue and demonstrated a commitment to transparency and shareholder engagement.

- Highlighting Access to Diverse Investor Pools: Rio Tinto likely emphasized the benefits of accessing a wider pool of international investors through its dual listing, leading to increased liquidity and potentially better valuation.

- Emphasizing Regulatory Benefits: They probably showcased the advantages of maintaining a presence on both exchanges in terms of regulatory compliance and access to different capital markets.

- Presenting a Strong Historical Context: Rio Tinto likely presented a compelling case for the historical significance of the dual listing and its contribution to the company's long-term success.

Bullet Points:

- Rio Tinto likely presented data demonstrating the efficiency of its dual listing structure.

- They probably emphasized their commitment to strong corporate governance practices across both listings.

- The company likely utilized detailed financial modeling to counter claims of inefficiency and shareholder dilution.

The Outcome and its Implications

The outcome of the activist investor challenge saw Rio Tinto successfully maintain its dual listing structure. While there may have been internal adjustments or enhanced communication strategies implemented to improve investor relations, the core dual-listing framework remained intact. This reinforces the value the company places on maintaining access to both the London and Australian markets.

Bullet Points:

- The resolution likely led to a short-term stabilization of Rio Tinto’s share price after the initial volatility caused by the activist pressure.

- The successful defense may encourage more robust corporate governance practices and increased transparency to preemptively address investor concerns.

- This case study provides valuable insights for other multinational corporations operating with dual or multiple listings, demonstrating that a well-articulated defense of a seemingly complex structure can be successful.

Future Outlook for Rio Tinto's Dual Listing

Despite the successful defense, the future of Rio Tinto's dual listing is not without potential challenges. Changes in global regulations, evolving investor preferences, and shifting market dynamics could all impact the long-term viability of this structure.

Bullet Points:

- Future regulatory changes, especially concerning cross-border listings and corporate governance, could impact the cost and efficiency of maintaining a dual listing.

- Changing investor sentiment towards dual listings in a globally fluctuating market could increase pressure.

- Rio Tinto will need to continue to demonstrate the strategic benefits of its dual listing, actively engaging with investors to maintain support.

Conclusion

Rio Tinto's successful defense against activist investor pressure regarding its dual listing demonstrates the company’s ability to effectively manage complex corporate structures and navigate challenging shareholder relations. The strategies employed, including transparent communication and a strong justification for the dual listing, proved effective in maintaining its current structure. Understanding Rio Tinto’s successful defense of its dual listing provides valuable insight into managing shareholder relations and navigating complex corporate structures. Further research into this case study will provide valuable insights and highlight the complexities of managing a dual listing successfully.

Featured Posts

-

Celebrity Traitors Bbc Faces Star Departures

May 02, 2025

Celebrity Traitors Bbc Faces Star Departures

May 02, 2025 -

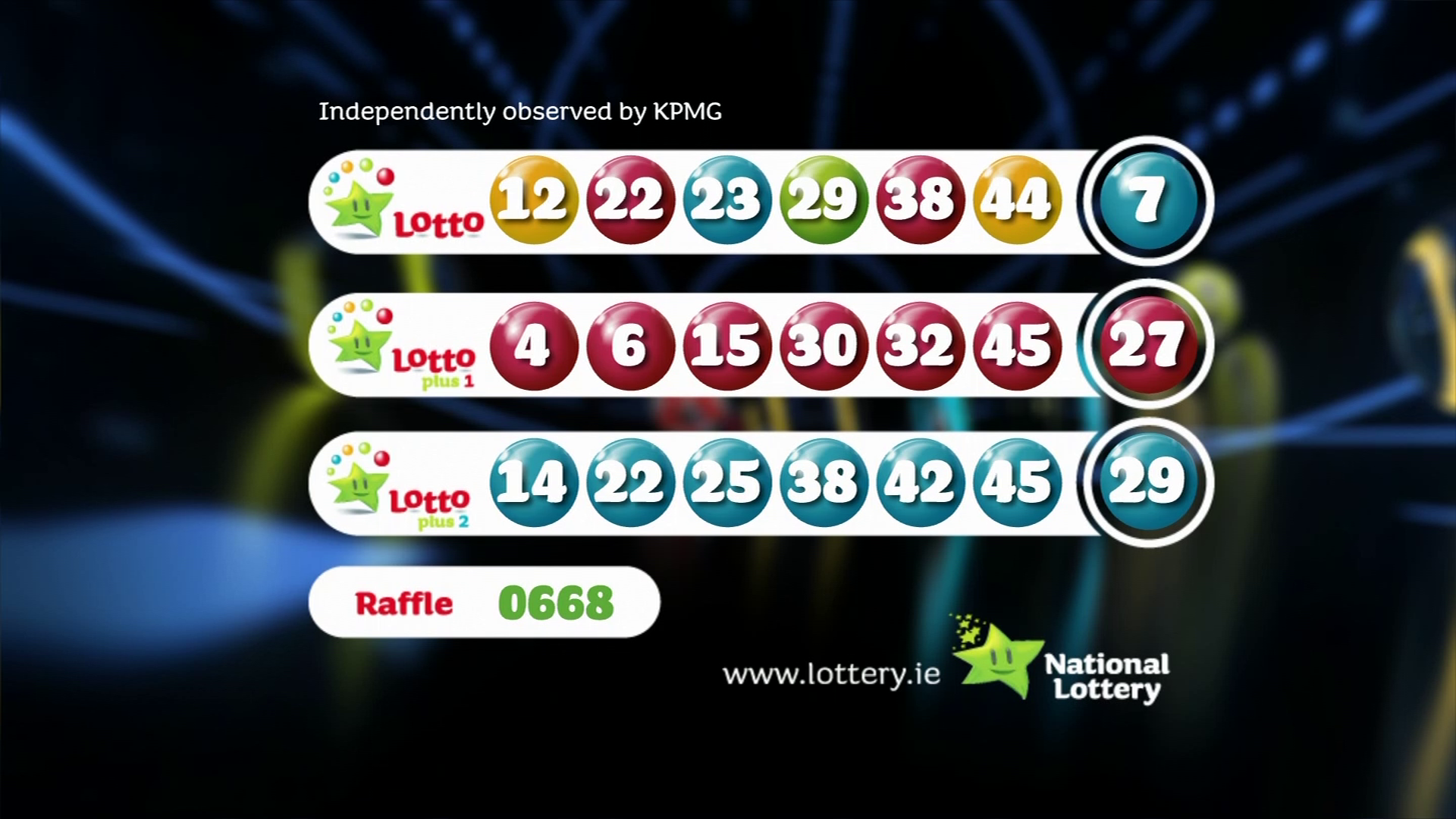

Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 02, 2025

Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 02, 2025 -

Pancake Day Understanding The History And Significance Of Shrove Tuesday

May 02, 2025

Pancake Day Understanding The History And Significance Of Shrove Tuesday

May 02, 2025 -

Play Station Network E Giris Adim Adim Kilavuz

May 02, 2025

Play Station Network E Giris Adim Adim Kilavuz

May 02, 2025 -

The Measles Outbreak Spurring Action On Us Vaccine Watchdog Efforts

May 02, 2025

The Measles Outbreak Spurring Action On Us Vaccine Watchdog Efforts

May 02, 2025

Latest Posts

-

La Matinale De Mathieu Spinosi Le Violon En Direct

May 03, 2025

La Matinale De Mathieu Spinosi Le Violon En Direct

May 03, 2025 -

La Matinale Avec Mathieu Spinosi Un Violon A L Ecran

May 03, 2025

La Matinale Avec Mathieu Spinosi Un Violon A L Ecran

May 03, 2025 -

Official Announcement Grant Assistance For Mauritius

May 03, 2025

Official Announcement Grant Assistance For Mauritius

May 03, 2025 -

Lakazet 157 Gola I Presledvane Na Vrkha Vv Frantsiya

May 03, 2025

Lakazet 157 Gola I Presledvane Na Vrkha Vv Frantsiya

May 03, 2025 -

Rekord Za Lakazet Lion Se Bori Za Vtoroto Myasto V Liga 1

May 03, 2025

Rekord Za Lakazet Lion Se Bori Za Vtoroto Myasto V Liga 1

May 03, 2025