Rio Tinto's Dual Listing Survives Activist Investor Challenge

Table of Contents

The Activist Investor's Argument Against the Dual Listing

The challenge to Rio Tinto's dual listing structure stemmed from concerns raised by activist investors (though specific names are omitted here for brevity and to avoid focusing on any specific individual investor, this can be fleshed out with specific information if available). Their core argument centered on the perceived inefficiencies and complexities associated with maintaining two separate listings.

Perceived Disadvantages of a Dual Listing

Activist investors presented a case built on several perceived drawbacks:

- Increased Costs: Maintaining two listings significantly increases operational costs. These include higher regulatory compliance expenses, duplicated reporting requirements, and elevated administrative fees. The argument was that these costs directly impact shareholder value.

- Complex Corporate Governance: A dual listing introduces complexities in corporate governance, potentially leading to inconsistencies in shareholder communication and decision-making processes across different jurisdictions.

- Conflicting Regulatory Requirements: Navigating the regulatory landscapes of both the UK and Australia can present challenges and potential conflicts in interpretation and compliance. This added layer of complexity was presented as a burden.

- Reduced Shareholder Value: The central argument was that consolidating to a single listing would streamline operations, reduce costs, and ultimately boost shareholder value.

Rio Tinto's Defense of its Dual Listing Structure

Rio Tinto countered the activist investors' arguments by highlighting the strategic advantages of maintaining its dual listing. Their defense emphasized the long-term benefits outweighing the perceived disadvantages.

Strategic Advantages of Maintaining Two Listings

Rio Tinto’s response focused on the following key strategic advantages:

- Enhanced Access to Capital Markets: The dual listing provides access to two major capital markets – London and Australia – offering greater flexibility and diversification in raising capital.

- Broader Investor Base: A dual listing significantly expands the potential investor base, attracting a wider range of shareholders with diverse investment strategies and risk appetites. This diversification mitigates reliance on any single market.

- Shareholder Base Diversification: Maintaining a presence on both exchanges reduces dependence on any single market's fluctuations and sentiment, improving overall stability.

- Improved Investor Relations: A dual listing allows for more effective investor relations and communication with key stakeholders in both the UK and Australia, fostering stronger relationships.

The Role of Shareholder Voting and Market Sentiment

The fate of Rio Tinto's dual listing ultimately rested on the outcome of a shareholder vote. The results demonstrated strong support for maintaining the existing structure.

Shareholder Support for the Dual Listing

A significant majority of shareholders voted to retain the dual listing. While the exact percentage may vary depending on the source, the outcome decisively demonstrated investor confidence in the company's strategy. This support likely reflects a belief in the long-term strategic benefits outlined by Rio Tinto's management, outweighing the short-term cost concerns.

Market Reaction to the Outcome

The market reacted positively to the news of the shareholder vote, indicating a shared confidence in Rio Tinto's decision. While the immediate impact on the share price might have been subtle, the overall positive sentiment reflects investor approval and expectation of future stability and growth. This reinforces the perception that the dual listing strategy is viewed favorably by the market.

Implications for Future Dual Listings in the Mining Industry

The Rio Tinto case sets a significant precedent for other mining companies considering or currently maintaining dual listings.

Increased Scrutiny of Dual Listing Structures

The challenge from activist investors highlights the potential for increased scrutiny of dual listing structures in the future. Mining companies will need to be prepared to justify their dual listing strategies more rigorously.

Re-evaluation of Cost-Benefit Analysis

This event emphasizes the importance of a thorough cost-benefit analysis when deciding on a dual listing strategy. Companies must carefully weigh the long-term strategic benefits against the inherent costs and complexities involved.

Conclusion

Rio Tinto's successful defense of its dual listing demonstrates the importance of a clearly articulated strategy, strong shareholder communication, and a compelling case for the long-term benefits of a dual listing. The outcome underscores that a well-executed dual listing strategy can provide significant advantages for mining companies, despite the increased complexities. This event will undoubtedly influence future decisions regarding dual listings within the mining industry. To stay informed about developments concerning Rio Tinto's dual listing strategy and the broader implications for dual listings in the mining industry, subscribe to reputable financial news sources and follow Rio Tinto's official announcements regarding their corporate structure. Understanding the complexities of Rio Tinto's dual listing and similar strategies is crucial for investors navigating this sector.

Featured Posts

-

Meeting The Urgent Mental Health Needs Of Young Canadians A Call To Action

May 03, 2025

Meeting The Urgent Mental Health Needs Of Young Canadians A Call To Action

May 03, 2025 -

Is Reform Uk Doomed Five Reasons For Worry

May 03, 2025

Is Reform Uk Doomed Five Reasons For Worry

May 03, 2025 -

Blue Origin Scraps Rocket Launch Due To Technical Issue

May 03, 2025

Blue Origin Scraps Rocket Launch Due To Technical Issue

May 03, 2025 -

Joseph Sur Tf 1 Avis Complet Sur La Nouvelle Serie Policiere

May 03, 2025

Joseph Sur Tf 1 Avis Complet Sur La Nouvelle Serie Policiere

May 03, 2025 -

Great Yarmouth Public Opinion The Rupert Lowe Controversy

May 03, 2025

Great Yarmouth Public Opinion The Rupert Lowe Controversy

May 03, 2025

Latest Posts

-

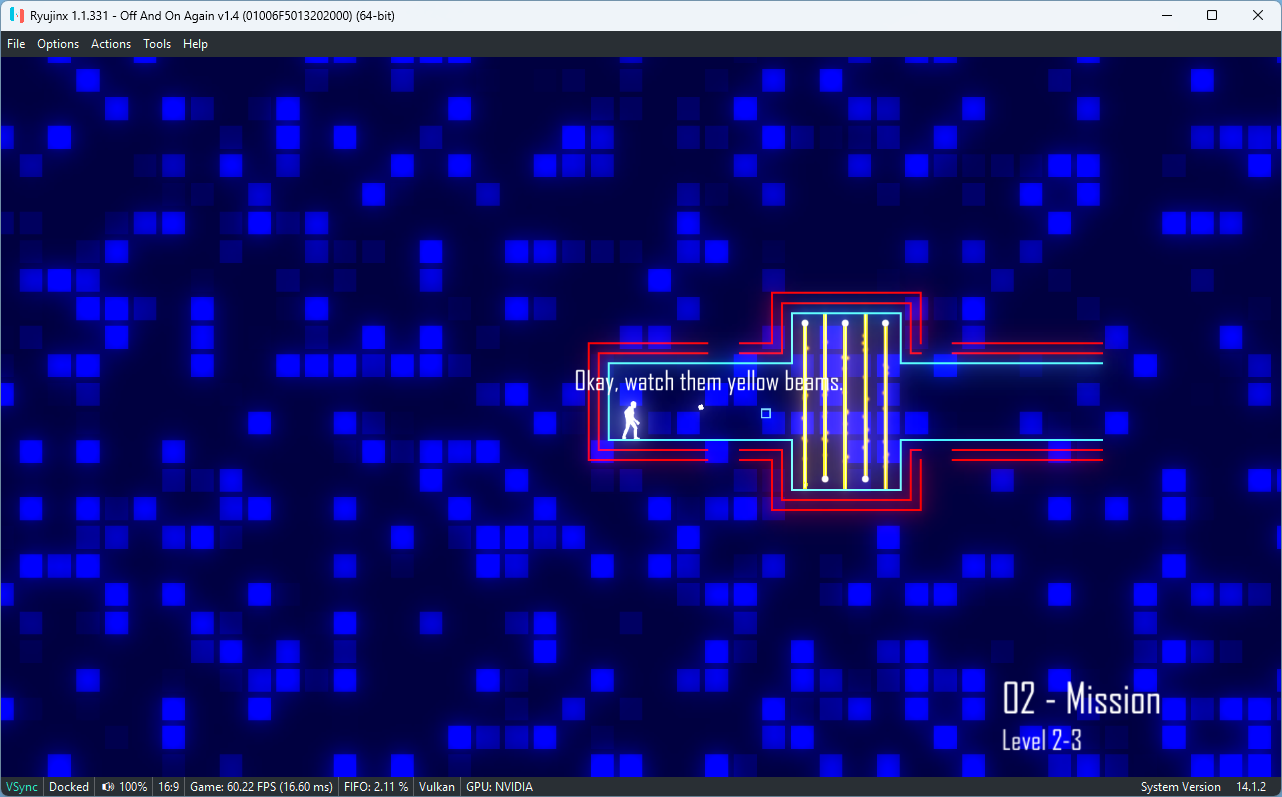

Ryujinx Emulator Development Ends After Reported Nintendo Contact

May 04, 2025

Ryujinx Emulator Development Ends After Reported Nintendo Contact

May 04, 2025 -

Nintendos Action Forces Ryujinx Emulator To Cease Development

May 04, 2025

Nintendos Action Forces Ryujinx Emulator To Cease Development

May 04, 2025 -

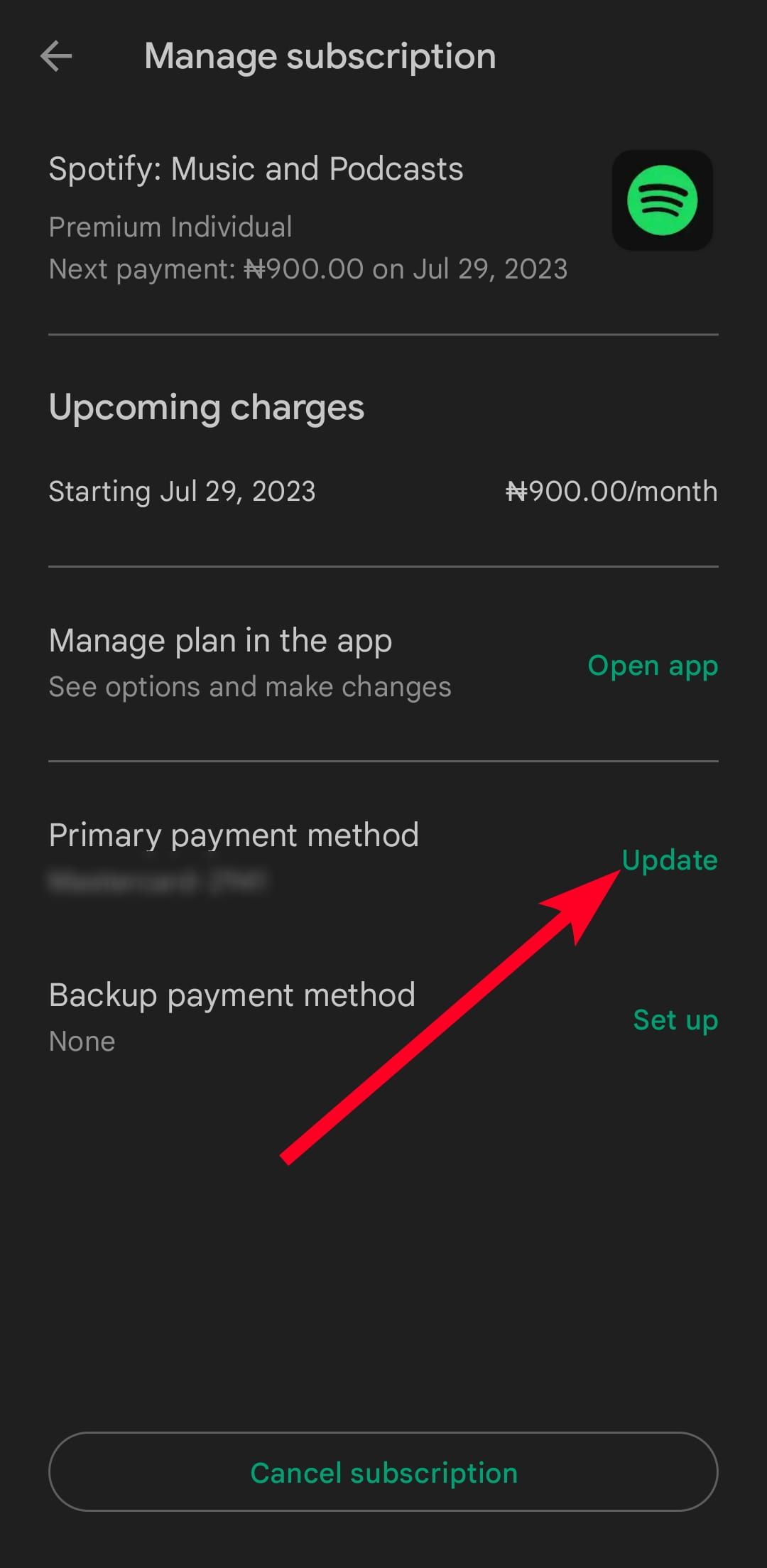

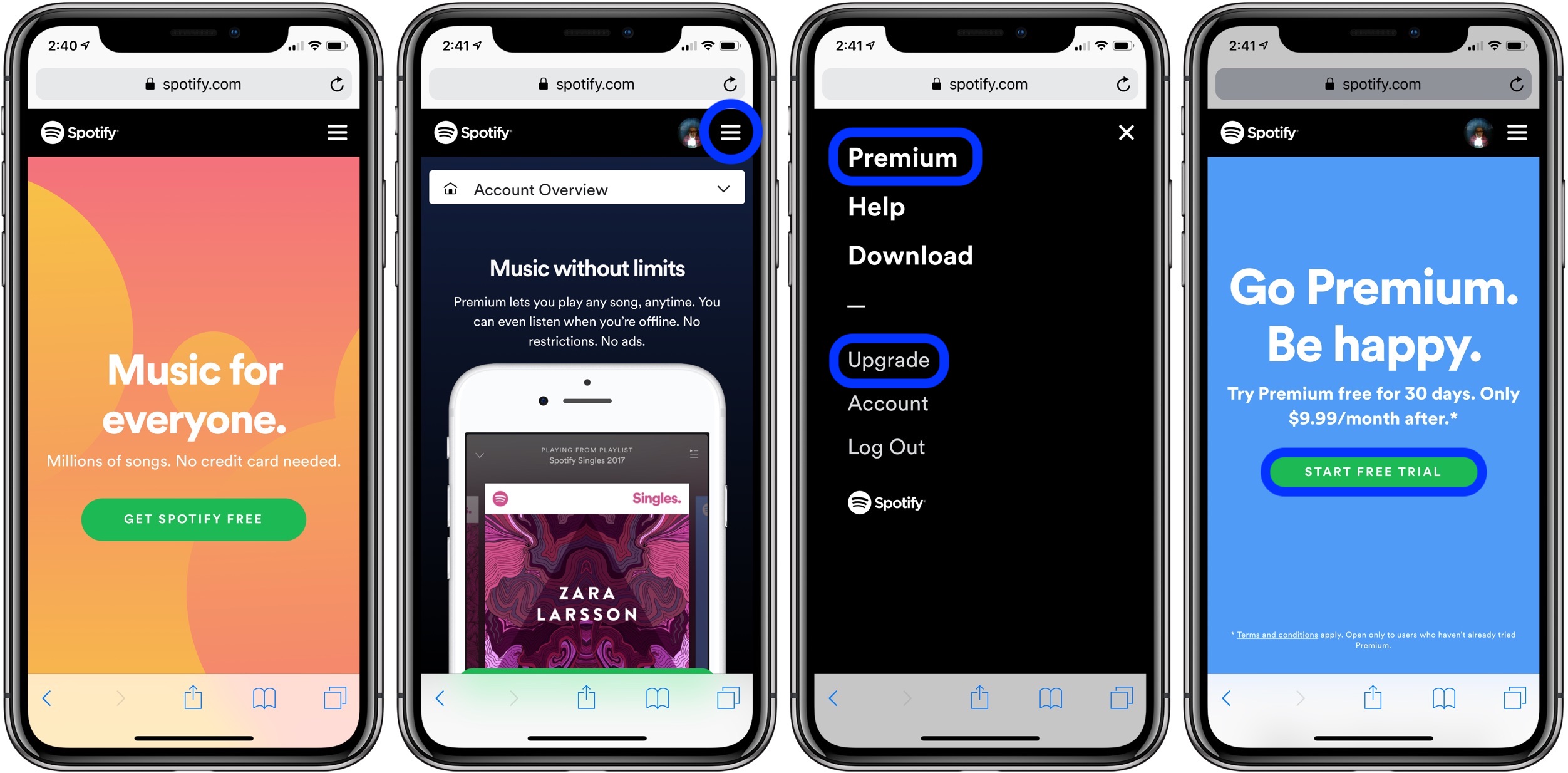

Enhanced Payment Flexibility On Spotifys I Phone App

May 04, 2025

Enhanced Payment Flexibility On Spotifys I Phone App

May 04, 2025 -

How To Pay For Spotify On I Phone New Payment Options Explained

May 04, 2025

How To Pay For Spotify On I Phone New Payment Options Explained

May 04, 2025 -

Pay Your Way Spotify Updates I Phone App Payment Options

May 04, 2025

Pay Your Way Spotify Updates I Phone App Payment Options

May 04, 2025