Riot Platforms Stock (RIOT): A Deep Dive Into Recent Performance

Table of Contents

Recent Financial Performance of Riot Platforms (RIOT)

Riot Platforms' financial health is crucial for understanding its stock performance. Analyzing key metrics provides insights into the company's operational efficiency and profitability within the competitive Bitcoin mining landscape.

Revenue Growth and Trends

Riot Platforms' revenue is directly tied to Bitcoin's price and its mining operation's efficiency. Analyzing quarterly and annual reports reveals trends in revenue generation.

- Q[Insert Latest Quarter]: [Insert Revenue Figure]. This represents a [Percentage]% increase/decrease compared to the same period last year. Factors contributing to this growth/decline include [mention specific factors like Bitcoin price, mining hash rate, operational costs].

- Annual Revenue (202[Insert Year]): [Insert Revenue Figure]. [Explain trends and highlight significant changes compared to previous years]. This showcases the company's overall revenue performance in the context of the broader cryptocurrency market. Further analysis of earnings per share (EPS) and profitability metrics will offer a more complete picture.

- Key Performance Indicators (KPIs): Tracking KPIs such as mining hash rate, which measures the computational power dedicated to Bitcoin mining, is essential to understanding RIOT's capacity to generate Bitcoin and, consequently, revenue.

Mining Efficiency and Costs

Mining efficiency and energy costs are paramount for Bitcoin mining companies like Riot Platforms. Higher efficiency translates to lower operational costs and increased profitability.

- Megahash per Second (MH/s): RIOT's reported MH/s reflects its mining capacity. Higher MH/s generally indicates greater Bitcoin production potential. [Insert data on MH/s growth or decline and explain reasons].

- Kilowatt-hour (kWh) Consumption: The energy consumption per Bitcoin mined is a crucial efficiency metric. Lower kWh consumption implies reduced operational costs and higher profitability. [Provide data and analysis on RIOT's energy consumption].

- Impact of Energy Prices: Fluctuations in electricity prices significantly impact the profitability of Bitcoin mining. [Discuss how energy costs have affected RIOT's financial performance]. Strategic location choices and energy procurement agreements are key factors to consider.

Bitcoin Production and Holdings

The amount of Bitcoin mined and held by Riot Platforms directly impacts its financial position and market valuation.

- Bitcoin Mined (Recent Quarter/Year): [Insert data on Bitcoin mined]. This indicates the success of the mining operations and its contribution to overall revenue.

- Bitcoin Holdings: [Insert data on Bitcoin holdings]. These reserves represent a significant asset, influencing the company’s overall net worth and providing a buffer against market fluctuations. The strategic decisions regarding holding versus selling mined Bitcoin are crucial to consider.

- Bitcoin Mining Output Growth: Analyze the growth (or decline) in Bitcoin production over time to gauge the performance of RIOT’s mining operations.

Market Factors Influencing RIOT Stock Price

Several external factors significantly influence the price of RIOT stock, beyond the company's internal performance.

Bitcoin Price Volatility

The correlation between Bitcoin's price and RIOT's stock price is strong. Bitcoin's price volatility directly affects Riot Platform’s revenue and profitability.

- Price Correlation: A rising Bitcoin price generally leads to higher revenue and a positive impact on RIOT's stock price, while a decline has the opposite effect.

- Market Sentiment: Investor sentiment towards Bitcoin significantly impacts RIOT's stock price. Positive market sentiment can drive up the stock price, while negative sentiment can cause a decline.

- Market Capitalization: The overall cryptocurrency market capitalization affects the valuation of Bitcoin mining stocks like RIOT.

Regulatory Landscape

The regulatory environment surrounding cryptocurrencies has a considerable impact on Bitcoin mining companies.

- SEC Regulations: Regulations from the Securities and Exchange Commission (SEC) and other regulatory bodies can impact the operations and profitability of Bitcoin mining companies.

- Regulatory Uncertainty: Uncertainty regarding future regulations can cause volatility in the stock price.

- Compliance: Riot Platform’s adherence to regulatory requirements is essential for its continued operation and investor confidence.

Competition in the Bitcoin Mining Industry

Riot Platforms operates in a competitive Bitcoin mining industry. Understanding its competitive position is vital for assessing its future prospects.

- Market Share: RIOT's market share compared to its competitors offers insights into its relative success.

- Competitive Advantages: Factors such as access to low-cost energy, efficient mining hardware, and strong management contribute to RIOT's competitive edge.

- Industry Growth: The overall growth of the Bitcoin mining industry directly impacts the opportunities available to RIOT.

Future Outlook and Investment Implications for RIOT Stock

Predicting the future of RIOT stock requires analyzing its growth potential and associated risks.

Growth Projections and Potential Risks

Several factors influence RIOT's future growth potential.

- Technological Advancements: Advancements in mining hardware and energy efficiency can influence RIOT's operational costs and profitability.

- Expansion Plans: RIOT's future expansion plans, including new mining facilities and infrastructure investments, will influence its growth trajectory.

- Market Downturns: Cryptocurrency market downturns pose a significant risk to RIOT's profitability.

Analyst Ratings and Price Targets

Financial analysts provide insights into RIOT stock's future performance.

- Consensus Price Target: [Insert consensus price target from reputable sources]. This represents the average price target set by analysts.

- Buy/Sell Ratings: [Summarize the buy, sell, and hold ratings from various analysts]. This reflects the overall sentiment of analysts toward RIOT stock.

Conclusion: Should You Invest in Riot Platforms Stock (RIOT)?

Investing in Riot Platforms stock (RIOT) involves a careful assessment of its financial performance, the impact of market factors such as Bitcoin price volatility and regulatory changes, and the inherent risks associated with the cryptocurrency market. While the company's mining operations and Bitcoin holdings offer potential for significant returns, the volatility of the cryptocurrency market and the regulatory uncertainty present substantial challenges. This analysis provides a foundation for your investment decision, but it is crucial to conduct thorough independent research, including reviewing Riot Platforms' financial reports and staying updated on industry news before making any investment choices. Remember that investing in Riot Platforms stock (RIOT) or any Bitcoin mining stock involves significant risk.

Featured Posts

-

John Roberts And The Erosion Of Church State Separation Will He Go Further

May 02, 2025

John Roberts And The Erosion Of Church State Separation Will He Go Further

May 02, 2025 -

Englands Six Nations Triumph Dalys Late Show Decides Close Match Against France

May 02, 2025

Englands Six Nations Triumph Dalys Late Show Decides Close Match Against France

May 02, 2025 -

England Womens World Cup Clash Against Spain Preview And Key Players

May 02, 2025

England Womens World Cup Clash Against Spain Preview And Key Players

May 02, 2025 -

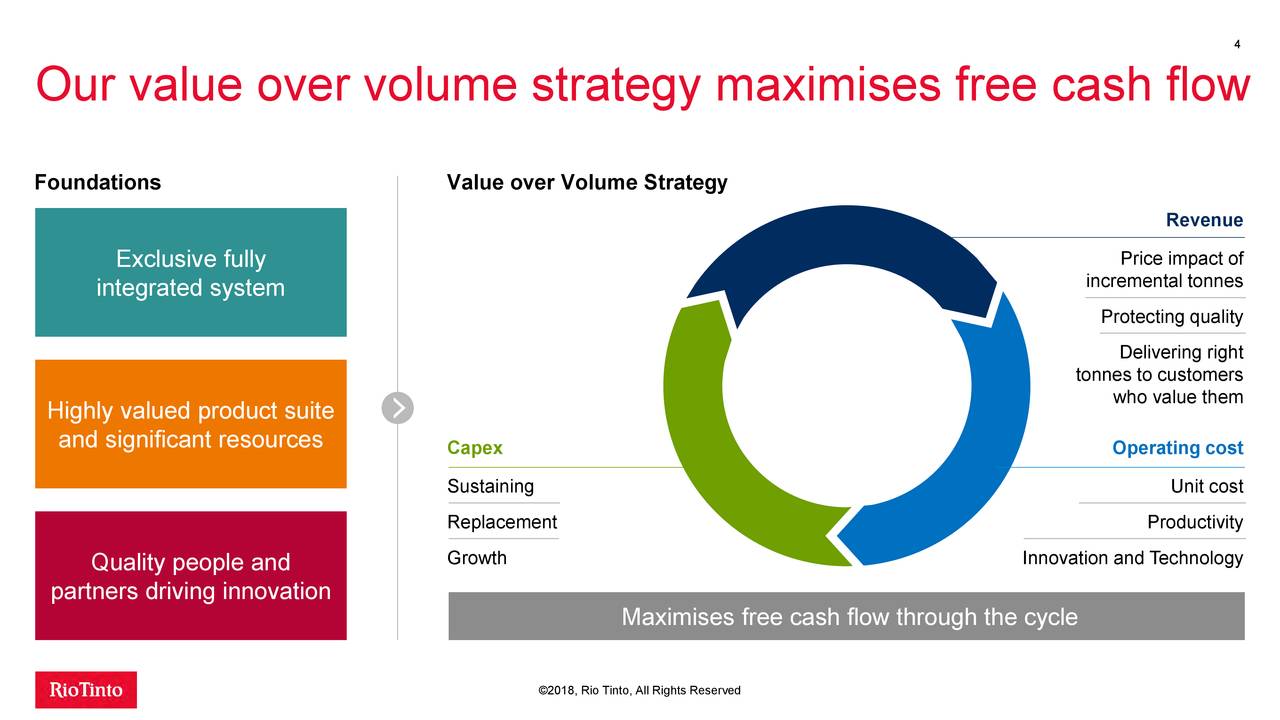

Activist Investor Push Fails Rio Tinto Maintains Dual Listing Structure

May 02, 2025

Activist Investor Push Fails Rio Tinto Maintains Dual Listing Structure

May 02, 2025 -

Tulsa Day Center Winter Clothing Drive Keep The Vulnerable Warm

May 02, 2025

Tulsa Day Center Winter Clothing Drive Keep The Vulnerable Warm

May 02, 2025

Latest Posts

-

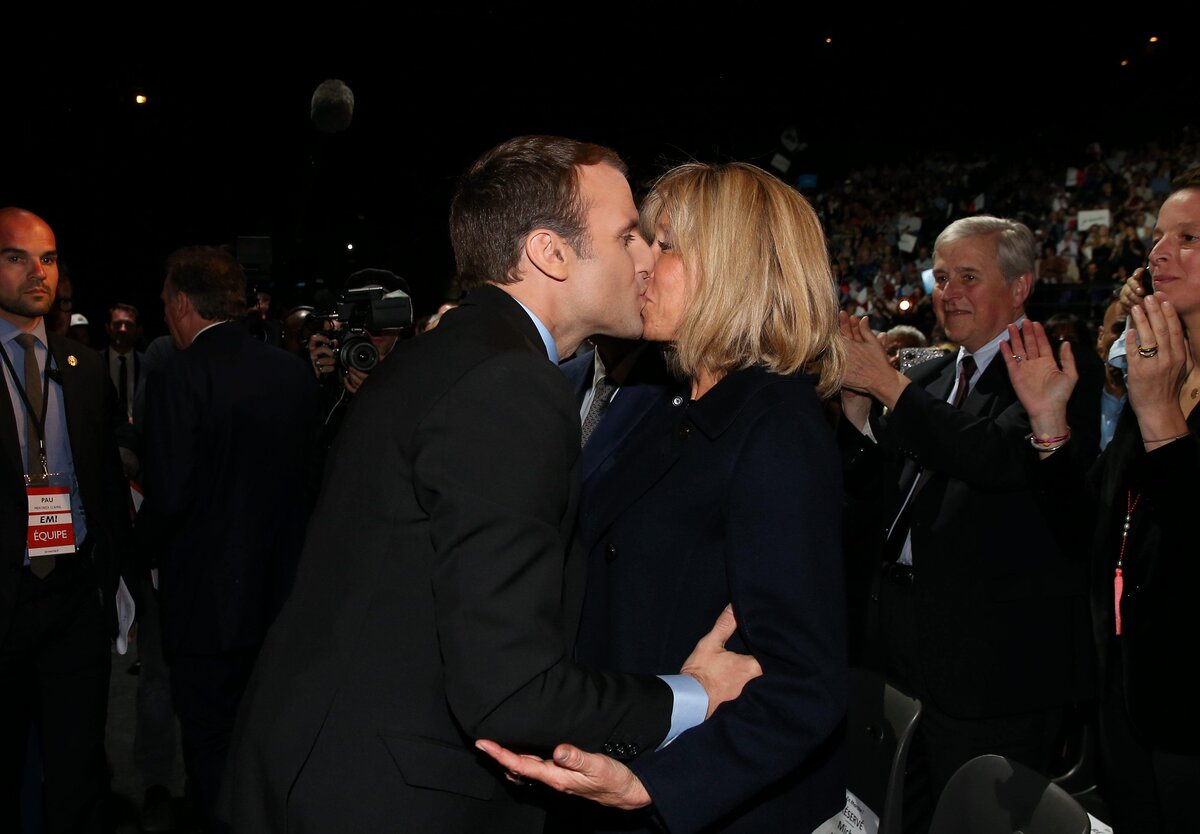

Zakharova O Makronakh Kommentariy K Situatsii Vokrug Emmanuelya I Brizhit

May 03, 2025

Zakharova O Makronakh Kommentariy K Situatsii Vokrug Emmanuelya I Brizhit

May 03, 2025 -

Tensions Au Diner Sardou Et Macron S Affrontent Sur Ca Vient Du Ventre

May 03, 2025

Tensions Au Diner Sardou Et Macron S Affrontent Sur Ca Vient Du Ventre

May 03, 2025 -

Emmanuel Macron Face A La Critique De Michel Sardou Ca Vient Du Ventre

May 03, 2025

Emmanuel Macron Face A La Critique De Michel Sardou Ca Vient Du Ventre

May 03, 2025 -

Diner Houleux Michel Sardou Critique Emmanuel Macron

May 03, 2025

Diner Houleux Michel Sardou Critique Emmanuel Macron

May 03, 2025 -

Ca Vient Du Ventre Sardou Remonte Les Bretelles A Macron

May 03, 2025

Ca Vient Du Ventre Sardou Remonte Les Bretelles A Macron

May 03, 2025