Riot Stock Price Analysis: Navigating The 52-Week Low

Table of Contents

Analyzing the 52-Week Low: Factors Contributing to the Decline

Market Volatility and Crypto Winter

The cryptocurrency market's downturn significantly impacted Riot's stock price. Bitcoin's price and Riot's stock share a strong correlation; when Bitcoin's value falls, so does Riot's.

- Correlation: A 10% drop in Bitcoin's price often translates to a considerable decrease in Riot's stock value, reflecting the company's reliance on Bitcoin mining profitability.

- Negative Sentiment: Negative sentiment surrounding cryptocurrencies generally impacts investor confidence, leading to sell-offs across the board, including Riot Platforms.

- Crypto Risk: Investing in cryptocurrency-related companies inherently carries significant risk. Market fluctuations are rapid and unpredictable, impacting both short-term and long-term returns. For example, the recent crypto winter saw Bitcoin fall by X%, directly impacting Riot's revenue and share price.

Rising Energy Costs and Operational Expenses

Increased energy costs heavily impact Riot's profitability and subsequent stock valuation. Bitcoin mining is energy-intensive, making Riot particularly vulnerable to rising electricity prices.

- Energy Consumption: Bitcoin mining requires substantial electricity; fluctuations in energy prices directly affect operational costs.

- Inflationary Pressures: Inflation and potential government regulations aimed at curbing energy consumption can significantly raise Riot's operational expenses.

- Alternative Energy: While Riot Platforms is exploring alternative energy solutions to mitigate these costs, the transition is ongoing and doesn't fully offset the impact of fluctuating energy prices. (Illustrative chart showing correlation between energy costs and Riot's profit margins could be inserted here.)

Regulatory Uncertainty and its Influence

Evolving regulations surrounding Bitcoin mining significantly influence investor confidence and the Riot stock price. Uncertainty about future regulations creates volatility.

- Regulatory Changes: Changes in environmental regulations, taxation policies, or specific laws governing cryptocurrency mining directly impact the operational landscape for Riot.

- Risk and Opportunity: While regulatory clarity can bring stability, uncertain regulations present risks and opportunities. Stricter regulations might increase operational costs while favorable regulations could boost the industry.

- Legal Challenges: Any legal challenges faced by Riot or the broader Bitcoin mining industry can create negative sentiment and pressure on the stock price. (Links to relevant news articles and official regulatory documents should be included here).

Strategies for Navigating the Low: Investor Perspectives

Long-Term Investment Potential

Despite the current downturn, Riot Platforms possesses long-term investment potential. The future of Bitcoin and the growing adoption of Bitcoin as a store of value remain key factors.

- Bitcoin Price Recovery: Many analysts predict Bitcoin's price will recover over the long term, boosting Riot's profitability.

- Bitcoin Adoption: Increasing institutional and individual adoption of Bitcoin as a store of value and a hedge against inflation fuels long-term growth in the Bitcoin mining industry.

- Future of Mining: Technological advancements in mining efficiency could also improve Riot's profitability and its long-term prospects. (Include expert opinions and forecasts to support this perspective).

Risk Management and Diversification

Investing in Riot stock requires a robust risk management strategy. The cryptocurrency market is inherently volatile, necessitating diversification.

- Market Volatility: Investors must acknowledge the significant price swings in the cryptocurrency market.

- Portfolio Diversification: Diversifying your investment portfolio across different asset classes reduces the overall risk associated with investing in a single, volatile stock like Riot.

- Stop-Loss Orders: Implementing stop-loss orders can limit potential losses by automatically selling your shares if the price falls below a predetermined level. (Provide links to resources on risk management and investment strategies).

Technical Analysis of Riot Stock

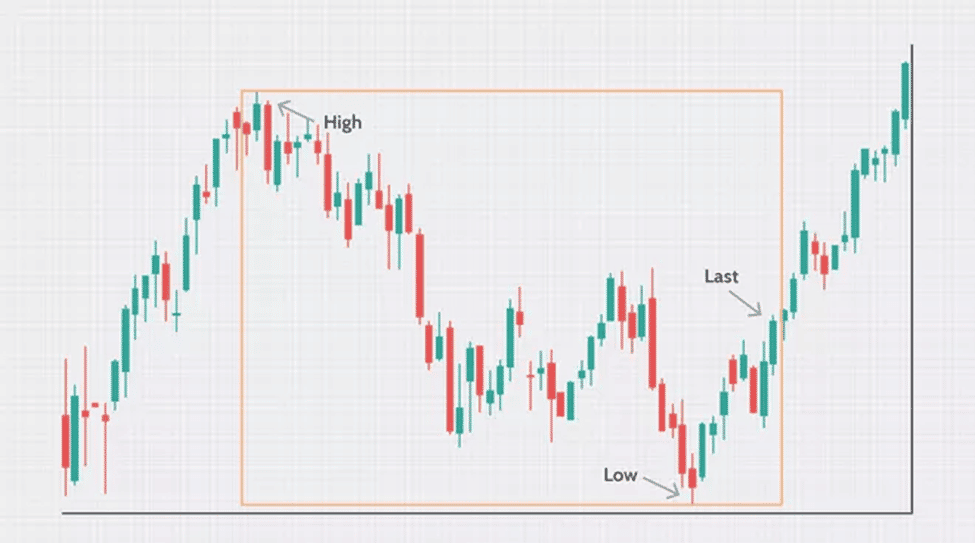

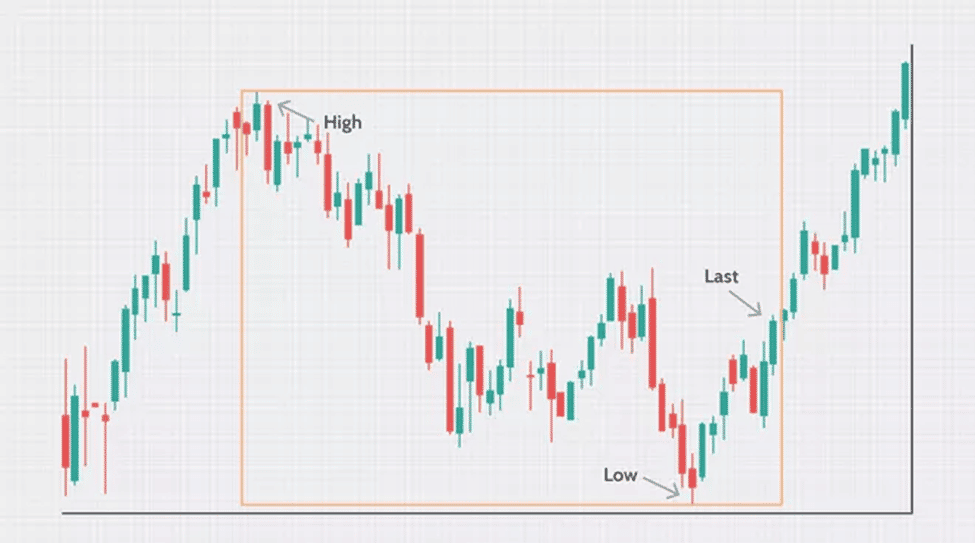

Basic technical analysis can aid in making informed investment decisions, but should not be the sole basis for investment strategies.

- Moving Averages: Observing moving averages (e.g., 50-day, 200-day) can help identify trends.

- Support/Resistance Levels: Identifying support and resistance levels can offer insights into potential price reversals.

- Disclaimer: Technical analysis is not a foolproof method. Investors should consult with financial advisors and conduct thorough research. (Include charts and graphs to illustrate technical analysis concepts).

Conclusion: Making Informed Decisions on Riot Stock

Riot Platforms' 52-week low is a result of several interconnected factors: market volatility, rising energy costs, and regulatory uncertainty. A long-term perspective and diversification are crucial for managing investment risks associated with Riot stock. Thorough research and consultations with financial advisors are essential before making any investment decisions regarding Riot stock price. Stay informed about the latest developments affecting Riot Platforms and continue your own research into Riot stock price analysis to make well-informed investment decisions.

Featured Posts

-

The Closure Of Anchor Brewing Company Whats Next

May 02, 2025

The Closure Of Anchor Brewing Company Whats Next

May 02, 2025 -

Us Economic Slowdown A Review Of Bidens Economic Policies And Their Effects

May 02, 2025

Us Economic Slowdown A Review Of Bidens Economic Policies And Their Effects

May 02, 2025 -

Grote Stroompanne Breda 30 000 Huishoudens Zonder Elektriciteit

May 02, 2025

Grote Stroompanne Breda 30 000 Huishoudens Zonder Elektriciteit

May 02, 2025 -

Stroomnetaansluiting Kampen Gemeente Start Kort Geding Tegen Enexis

May 02, 2025

Stroomnetaansluiting Kampen Gemeente Start Kort Geding Tegen Enexis

May 02, 2025 -

Kivalo Minosegu Baromfihus A Mecsek Baromfi Kft Tol Kme Vedjegyes Termekek

May 02, 2025

Kivalo Minosegu Baromfihus A Mecsek Baromfi Kft Tol Kme Vedjegyes Termekek

May 02, 2025

Latest Posts

-

Emmanuel Macron Pression Accrue Sur Moscou A Venir

May 03, 2025

Emmanuel Macron Pression Accrue Sur Moscou A Venir

May 03, 2025 -

Situatsiya Vokrug Makronov Kommentariy Marii Zakharovoy

May 03, 2025

Situatsiya Vokrug Makronov Kommentariy Marii Zakharovoy

May 03, 2025 -

Ofitsialnoe Zayavlenie Zakharovoy O Seme Makron

May 03, 2025

Ofitsialnoe Zayavlenie Zakharovoy O Seme Makron

May 03, 2025 -

Zakharova Prokommentirovala Otnosheniya Makronov Detali Zayavleniya

May 03, 2025

Zakharova Prokommentirovala Otnosheniya Makronov Detali Zayavleniya

May 03, 2025 -

Chto Skazala Zakharova O Makronakh Podrobnosti Situatsii

May 03, 2025

Chto Skazala Zakharova O Makronakh Podrobnosti Situatsii

May 03, 2025