Ripple And SEC Settlement: XRP's Commodity Classification In The Balance

Table of Contents

H2: The Core Arguments of the SEC's Case Against Ripple

The Securities and Exchange Commission (SEC) alleges that Ripple's sale of XRP constituted the unregistered sale of securities, violating federal securities laws. Their central argument rests on the application of the Howey Test.

H3: The "Howey Test" and XRP Sales

The Howey Test, a cornerstone of US securities law, determines whether an investment contract exists. It comprises three elements: an investment of money, a common enterprise, and the expectation of profits primarily from the efforts of others. The SEC argues that XRP sales satisfy all three:

-

Bullet Point 1: Investment Contracts and Expectation of Profits: The SEC contends that XRP purchasers invested money with the expectation of profits derived from Ripple's efforts in developing the XRP ecosystem and increasing its value. They point to Ripple's marketing and promotional activities as evidence of this expectation.

-

Bullet Point 2: Common Enterprise: The SEC argues that XRP purchasers participated in a common enterprise with other XRP holders, sharing in the risks and potential profits of Ripple's endeavors. The interconnected nature of the XRP ecosystem and Ripple's influence are cited as supporting evidence.

-

Bullet Point 3: Ripple's Role in Distribution and Promotion: The SEC emphasizes Ripple's significant role in the distribution and promotion of XRP, arguing that this central involvement created an expectation of profit for investors dependent on Ripple's actions. They highlight Ripple's institutional sales and marketing campaigns as crucial elements.

H3: Ripple's Defense and Arguments for XRP as a Commodity

Ripple vehemently denies the SEC's claims, arguing that XRP is a decentralized digital asset, similar to Bitcoin and other cryptocurrencies, and therefore not a security. Their defense rests on these key points:

-

Bullet Point 1: Decentralized Nature and Lack of Central Control: Ripple asserts that XRP operates on a decentralized, public blockchain, with no single entity controlling its value or functionality. They highlight the open-source nature of the XRP Ledger and its independent validators.

-

Bullet Point 2: XRP's Use Cases Beyond Investment: Ripple emphasizes XRP's utility beyond mere investment, highlighting its use in cross-border payments and other applications. They argue that its functionality distinguishes it from securities primarily held for speculative gain.

-

Bullet Point 3: Comparison to Other Cryptocurrencies: Ripple frequently draws parallels between XRP and other cryptocurrencies widely considered commodities, arguing for similar regulatory treatment. They highlight the lack of similar SEC actions against Bitcoin and Ethereum.

H2: Potential Outcomes of a Ripple-SEC Settlement

The potential outcomes of a Ripple-SEC settlement are significant and carry broad implications for the crypto market.

H3: A Favorable Outcome for Ripple (XRP as a Commodity)

A settlement favorable to Ripple, confirming XRP as a commodity, would bring much-needed regulatory clarity to the cryptocurrency industry.

-

Bullet Point 1: Increased Regulatory Clarity: This would provide a crucial legal precedent, guiding future regulatory decisions regarding other digital assets.

-

Bullet Point 2: Positive Impact on XRP's Price and Market Capitalization: A positive outcome is likely to trigger a significant surge in XRP's price and market capitalization, driven by increased investor confidence.

-

Bullet Point 3: Potential for Wider Adoption of XRP: The resulting regulatory certainty could accelerate the adoption of XRP in cross-border payments and other applications.

H3: An Unfavorable Outcome for Ripple (XRP as a Security)

Conversely, a settlement deeming XRP a security would have severe consequences.

-

Bullet Point 1: Negative Impact on XRP's Price and Market Standing: Such a ruling would likely cause a sharp decline in XRP's price and significantly damage its market reputation.

-

Bullet Point 2: Increased Regulatory Scrutiny for Other Cryptocurrencies: It would set a precedent for increased regulatory scrutiny of other cryptocurrencies, potentially leading to similar lawsuits and regulatory crackdowns.

-

Bullet Point 3: Uncertainty for XRP Investors: Investors holding XRP would face significant uncertainty, potentially including the delisting of XRP from major cryptocurrency exchanges.

H2: The Broader Implications for the Cryptocurrency Market

The Ripple case's outcome will profoundly impact the regulatory landscape for all cryptocurrencies.

-

Bullet Point 1: Impact on Other Cryptocurrencies Facing Similar Legal Challenges: The ruling will set a precedent for other crypto projects facing similar legal challenges, impacting their regulatory status and future development.

-

Bullet Point 2: Influence on Future Regulatory Frameworks for Digital Assets: The case will significantly influence how regulators worldwide approach the classification and regulation of digital assets.

-

Bullet Point 3: Effects on Investor Confidence and Market Volatility: The outcome will directly impact investor confidence and market volatility, potentially triggering significant price swings across the cryptocurrency market.

3. Conclusion:

The Ripple-SEC case concerning XRP's classification is a landmark legal battle with far-reaching consequences for the entire cryptocurrency industry. The potential outcomes will significantly shape the regulatory landscape and the future of digital assets. Understanding the arguments and potential implications is crucial for navigating this dynamic market. Stay informed about further developments in the Ripple and SEC settlement to make informed decisions regarding your XRP investments and participation in the cryptocurrency market. The future of XRP and its classification remains in the balance, demanding continued attention and analysis. Keep monitoring the situation for updates on the Ripple and SEC settlement and its effect on XRP’s commodity classification.

Featured Posts

-

Stroomuitval Breda Oorzaken En Gevolgen Van De Grote Storing

May 01, 2025

Stroomuitval Breda Oorzaken En Gevolgen Van De Grote Storing

May 01, 2025 -

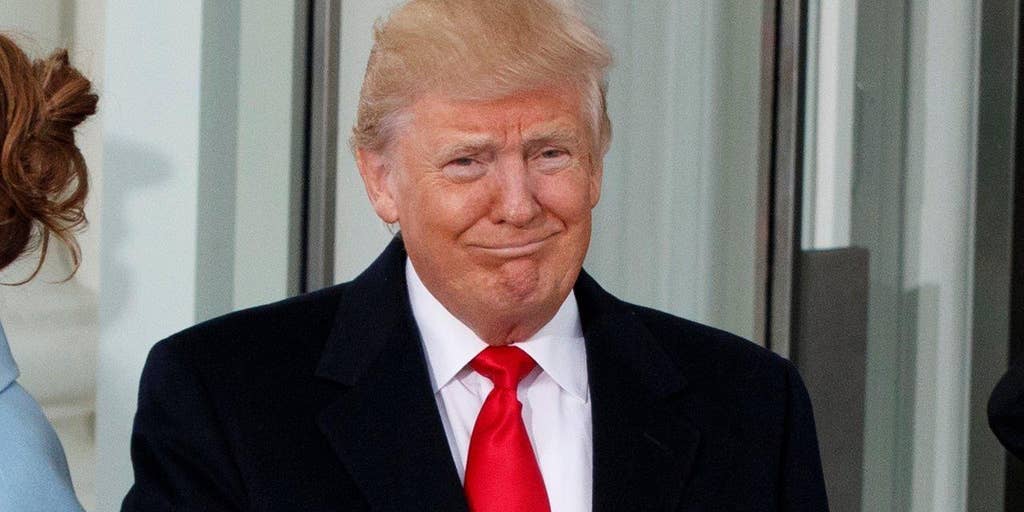

The First 100 Days Trumps Low Approval And Travel Challenges

May 01, 2025

The First 100 Days Trumps Low Approval And Travel Challenges

May 01, 2025 -

New Us Plant Merck Invests In Domestic Manufacturing Of Key Medicine

May 01, 2025

New Us Plant Merck Invests In Domestic Manufacturing Of Key Medicine

May 01, 2025 -

Dragons Den Beyond The Television Show Real World Applications

May 01, 2025

Dragons Den Beyond The Television Show Real World Applications

May 01, 2025 -

Frances Rugby Dominance Duponts Impact Against Italy

May 01, 2025

Frances Rugby Dominance Duponts Impact Against Italy

May 01, 2025

Latest Posts

-

Addressing Canadas Economic Crisis The Prime Ministers Agenda

May 01, 2025

Addressing Canadas Economic Crisis The Prime Ministers Agenda

May 01, 2025 -

Economic Hurdles Facing Canadas Next Leader

May 01, 2025

Economic Hurdles Facing Canadas Next Leader

May 01, 2025 -

Canadian Staycation Boom Airbnb Domestic Bookings Up 20

May 01, 2025

Canadian Staycation Boom Airbnb Domestic Bookings Up 20

May 01, 2025 -

Top Economic Priorities For Canadas Incoming Prime Minister

May 01, 2025

Top Economic Priorities For Canadas Incoming Prime Minister

May 01, 2025 -

V Mware Pricing To Explode At And T Reports 1050 Increase Following Broadcom Deal

May 01, 2025

V Mware Pricing To Explode At And T Reports 1050 Increase Following Broadcom Deal

May 01, 2025