Ripple Lawsuit: SEC's Potential XRP Commodity Designation And Settlement Progress

Table of Contents

The SEC's Case Against Ripple

The Core Argument:

The SEC alleges Ripple sold XRP as an unregistered security, violating federal securities laws. Their core argument hinges on the assertion that XRP's sales constituted an investment contract, promising investors profits based on Ripple's efforts. This is a critical point, as the SEC's case relies heavily on convincing the court that XRP investors were expecting profits derived from Ripple's business activities, rather than simply participating in a currency exchange.

- Focus on the "Howey Test": The SEC's case relies heavily on the Howey Test, a legal framework used to determine whether an investment constitutes a security. The test considers whether there's an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC argues that XRP sales fulfill all criteria of the Howey Test.

- Accusations of Fraudulent Intent: The SEC also accuses Ripple of intentionally defrauding investors by not registering XRP as a security. They claim Ripple knew XRP sales qualified as securities offerings and deliberately avoided regulatory compliance.

- Specific Instances Cited: The SEC cites specific instances of XRP sales, highlighting alleged misrepresentations and omissions made by Ripple to investors. These instances, detailed in their filings, form the evidentiary basis for their claims.

- Relevant Documents: [Link to SEC Filings] [Link to Court Documents] (Insert actual links to relevant documents here)

Ripple's Defense and Arguments

Decentralization and Market Functionality:

Ripple vehemently denies the SEC's accusations. Their central defense revolves around the argument that XRP is a decentralized digital asset, functioning as a currency on public exchanges, not a security. They emphasize XRP's operational independence from Ripple's business activities.

- Decentralized Nature of XRP: Ripple highlights XRP's decentralized nature, emphasizing its operation on public ledgers and its availability on numerous exchanges independent of Ripple's control. They argue this distinguishes XRP from traditional securities.

- Denial of Investment Contracts: Ripple contests the SEC's interpretation of the sales as investment contracts, asserting that XRP purchasers were primarily interested in utilizing XRP as a medium of exchange, not as an investment expecting profits solely from Ripple's efforts.

- Counterarguments to the Howey Test: Ripple challenges the SEC's application of the Howey Test, arguing that the test does not apply accurately to a decentralized digital asset like XRP, given its distinct characteristics and market functionality.

- Official Statements: [Insert quotes from Ripple's legal team or official statements supporting their arguments here.]

Potential Outcomes and Their Implications

XRP as a Commodity:

If the court rules XRP is a commodity, it would remove it from the purview of securities laws, significantly impacting its price and regulatory treatment. This outcome would have far-reaching consequences for the cryptocurrency market.

- Impact on XRP Trading and Adoption: A commodity designation would likely lead to increased trading volume and broader adoption of XRP, as it would simplify regulatory compliance for exchanges and businesses using XRP.

- Effect on Other Cryptocurrencies: The ruling could set a precedent for other cryptocurrencies, potentially influencing how regulators classify similar digital assets.

- Regulatory Framework Changes: A commodity classification for XRP could spur further regulatory clarity and development of frameworks specifically addressing digital assets.

Settlement and its Impact:

A settlement between Ripple and the SEC remains a possibility. Such an agreement could involve Ripple accepting certain conditions in exchange for the SEC dropping the charges.

- Terms of a Potential Settlement: A settlement might involve Ripple agreeing to stricter compliance measures, paying fines, or altering certain aspects of its business practices relating to XRP distribution and sales.

- Impact on Ripple's Business and Reputation: The terms of any settlement would significantly impact Ripple's reputation and its ability to operate within the regulated financial landscape.

- Effects on Market Stability: A settlement, depending on its terms, could either stabilize or further disrupt the cryptocurrency market's confidence, impacting investor sentiment and the prices of various cryptocurrencies.

Latest Developments and Expert Opinions

Recent Court Proceedings and Key Decisions:

The Ripple lawsuit is a dynamic legal battle, with ongoing court proceedings and evolving arguments. Recent events and expert opinions offer crucial insights into the case's trajectory.

- Significant Filings and Hearings: [Summarize recent key filings, hearings, and any significant developments here.]

- Expert Opinions: [Include expert opinions from legal professionals specializing in securities law and crypto analysts.]

- Timeline Updates: [Provide a concise update on the anticipated timeline of the case, including upcoming court dates or significant milestones.]

Conclusion:

The Ripple lawsuit remains a pivotal case for the cryptocurrency industry, with the SEC's potential designation of XRP as a commodity or a negotiated settlement carrying immense consequences. Understanding the arguments, potential outcomes, and the latest developments is crucial for anyone invested in the crypto market. The implications extend beyond XRP, impacting the regulatory landscape for cryptocurrencies as a whole. Stay informed about the progress of the Ripple lawsuit to navigate the evolving regulatory landscape and make informed decisions about your investments in XRP and other digital assets. Keep checking back for further updates on the Ripple Lawsuit and its implications for the future of crypto.

Featured Posts

-

Investing In Childhood A Critical Investment In Future Generations Well Being

May 02, 2025

Investing In Childhood A Critical Investment In Future Generations Well Being

May 02, 2025 -

Ripples Xrp Soars Presidents Post Links Trump To Price Increase

May 02, 2025

Ripples Xrp Soars Presidents Post Links Trump To Price Increase

May 02, 2025 -

Tulsa Public School Closings Wednesday Weather Update

May 02, 2025

Tulsa Public School Closings Wednesday Weather Update

May 02, 2025 -

Tulsa Roads Pre Treated Ahead Of Expected Sleet And Snow

May 02, 2025

Tulsa Roads Pre Treated Ahead Of Expected Sleet And Snow

May 02, 2025 -

Social Media Frenzy Leaves Kashmir Cat Owners Anxious

May 02, 2025

Social Media Frenzy Leaves Kashmir Cat Owners Anxious

May 02, 2025

Latest Posts

-

Kocaelide 1 Mayis Kutlamalarinda Yasanan Arbede Ayrintilar Ve Gelismeler

May 02, 2025

Kocaelide 1 Mayis Kutlamalarinda Yasanan Arbede Ayrintilar Ve Gelismeler

May 02, 2025 -

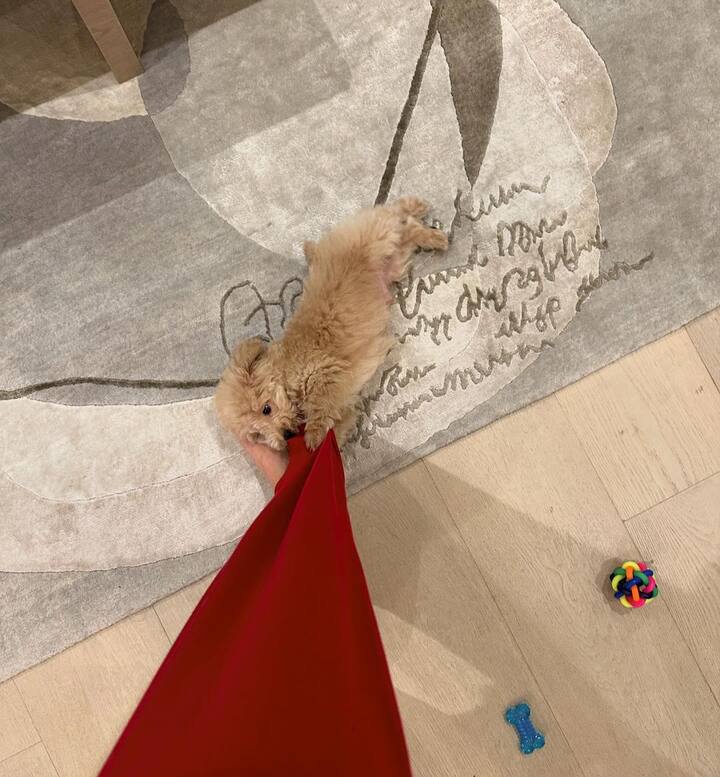

Ananya Pandays Dog Riots First Birthday Photos And Details Of The Celebration

May 02, 2025

Ananya Pandays Dog Riots First Birthday Photos And Details Of The Celebration

May 02, 2025 -

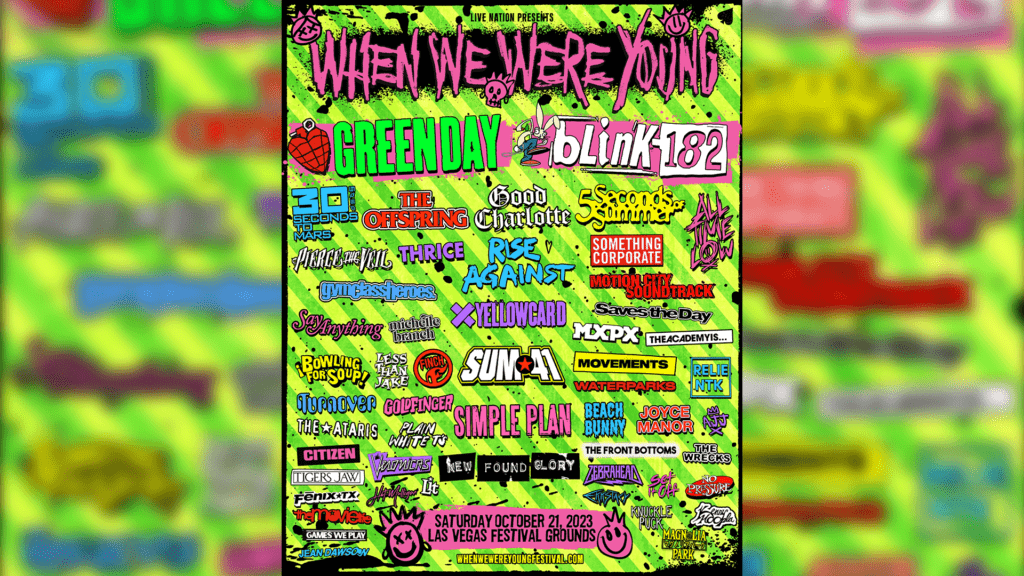

Riot Fest 2025 Green Day Blink 182 And Weird Al Yankovic Headline

May 02, 2025

Riot Fest 2025 Green Day Blink 182 And Weird Al Yankovic Headline

May 02, 2025 -

Ananya Panday Celebrates Riots First Birthday A Look At The Puppys Special Day

May 02, 2025

Ananya Panday Celebrates Riots First Birthday A Look At The Puppys Special Day

May 02, 2025 -

1 Mayis In Oeykuesue Emek Ve Dayanisma Icin Verilen Muecadeleler

May 02, 2025

1 Mayis In Oeykuesue Emek Ve Dayanisma Icin Verilen Muecadeleler

May 02, 2025