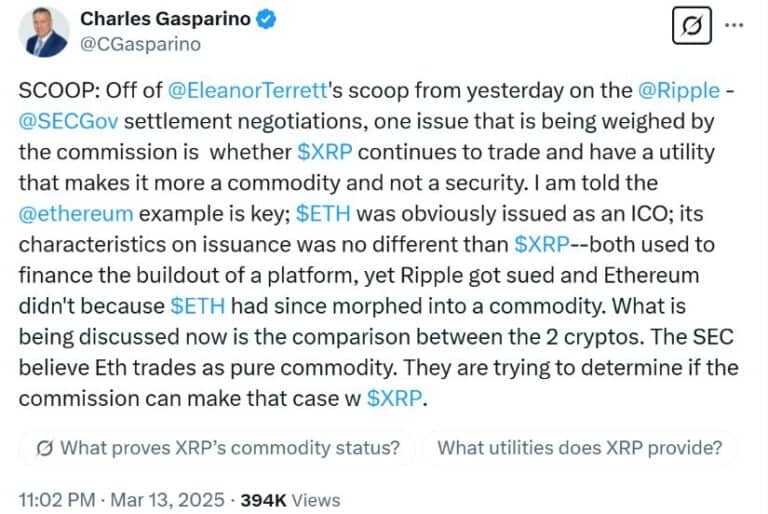

Ripple Settlement Talks: SEC May Classify XRP As A Commodity

Table of Contents

The SEC's Case Against Ripple

The SEC's initial lawsuit against Ripple, filed in December 2020, alleged that Ripple sold XRP as an unregistered security, violating federal securities laws. The lawsuit targeted Ripple Labs, its CEO Brad Garlinghouse, and its co-founder Chris Larsen. The SEC argued that XRP sales constituted an "investment contract," meeting the criteria of the Howey Test, a landmark Supreme Court decision defining securities.

-

The Howey Test and XRP: The SEC argued that XRP investors purchased the cryptocurrency with a reasonable expectation of profit derived from Ripple's efforts, fulfilling the "investment contract" element of the Howey Test. They pointed to Ripple's active involvement in promoting and selling XRP, along with its alleged control over the market supply.

-

Key Figures and Potential Penalties: The case centered around Brad Garlinghouse and Chris Larsen, who faced significant personal financial penalties if found guilty of violating securities laws. The potential penalties for Ripple itself included substantial fines and reputational damage.

The Potential for XRP Commodity Classification

Classifying XRP as a commodity would fundamentally alter its regulatory landscape. A commodity is generally considered a raw material or primary agricultural product that can be bought and sold, unlike a security which represents an ownership interest in a company or a claim on its assets.

-

Regulatory Implications: If classified as a commodity, XRP would likely fall under the purview of the Commodity Futures Trading Commission (CFTC) rather than the SEC. This would significantly reduce regulatory burdens compared to the strict requirements for registered securities.

-

Impact on Price and Trading Volume: A commodity classification could positively impact XRP's price and trading volume. Increased regulatory clarity could attract more institutional investors and enhance market confidence. This contrasts sharply with the uncertainty surrounding XRP's status as a security.

-

Comparison to Other Cryptocurrencies: Many believe Bitcoin, for example, functions more like a commodity given its decentralized nature and lack of a central issuing entity. This comparison lends weight to the argument that XRP could similarly be classified as a commodity depending on its usage and distribution.

Implications of a Settlement and XRP's Future

A settlement in the Ripple case, especially one involving an XRP commodity classification, would have far-reaching implications for both Ripple and the broader crypto market.

-

Increased Regulatory Clarity: A clear classification of XRP would contribute to much-needed regulatory clarity in the cryptocurrency space, providing a framework for future legal interpretations of digital assets.

-

Impact on Investor Confidence: A favorable settlement could restore investor confidence in XRP and potentially influence the valuations of other digital assets. However, a negative outcome could severely damage trust in the entire cryptocurrency market.

-

Future Legal Challenges: The outcome of the Ripple case will set a significant precedent, potentially influencing future legal challenges surrounding the classification of other cryptocurrencies. The legal battles surrounding token classification are far from over.

Ripple's Strategy and Arguments

Ripple's defense has consistently argued that XRP is a decentralized, functional cryptocurrency and not a security.

-

XRP's Functionality and Intended Use: Ripple emphasized XRP's utility as a payment mechanism on its network and its decentralized nature, highlighting its use for cross-border transactions.

-

Expert Testimony and Legal Precedent: Ripple presented expert testimony and cited legal precedent to support its arguments, aiming to demonstrate that XRP sales did not meet the criteria for an "investment contract."

-

Concessions in Settlement Negotiations: While specific details remain confidential, reports suggest that Ripple might be making certain concessions as part of settlement negotiations, potentially related to past sales practices or marketing materials.

Conclusion

The ongoing Ripple settlement talks and the potential classification of XRP as a commodity represent a watershed moment for the cryptocurrency industry. A favorable outcome for Ripple could bring much-needed regulatory clarity, potentially boosting investor confidence and driving further innovation in the digital asset space. Conversely, an unfavorable ruling could have far-reaching consequences for other crypto projects. Understanding the intricacies of the XRP classification debate is crucial for anyone invested in or interested in the future of cryptocurrencies. Stay informed on the latest developments in the Ripple case and learn more about the potential ramifications of this landmark legal battle. Keep up-to-date on the XRP classification developments to make informed decisions about your cryptocurrency investments.

Featured Posts

-

South Koreas Supreme Court Reverses Lees Acquittal Jeopardizing Presidential Bid

May 02, 2025

South Koreas Supreme Court Reverses Lees Acquittal Jeopardizing Presidential Bid

May 02, 2025 -

Fortnite Rare Skins You Might Never See Again

May 02, 2025

Fortnite Rare Skins You Might Never See Again

May 02, 2025 -

Tulsa Firefighters Respond To 800 Winter Weather Emergencies

May 02, 2025

Tulsa Firefighters Respond To 800 Winter Weather Emergencies

May 02, 2025 -

Ely Rda Syd Ka Mwqf Kshmyrywn Ka Msylh Awr Khte Myn Amn

May 02, 2025

Ely Rda Syd Ka Mwqf Kshmyrywn Ka Msylh Awr Khte Myn Amn

May 02, 2025 -

Donkey Roundup Celebrating Community In Southern California

May 02, 2025

Donkey Roundup Celebrating Community In Southern California

May 02, 2025

Latest Posts

-

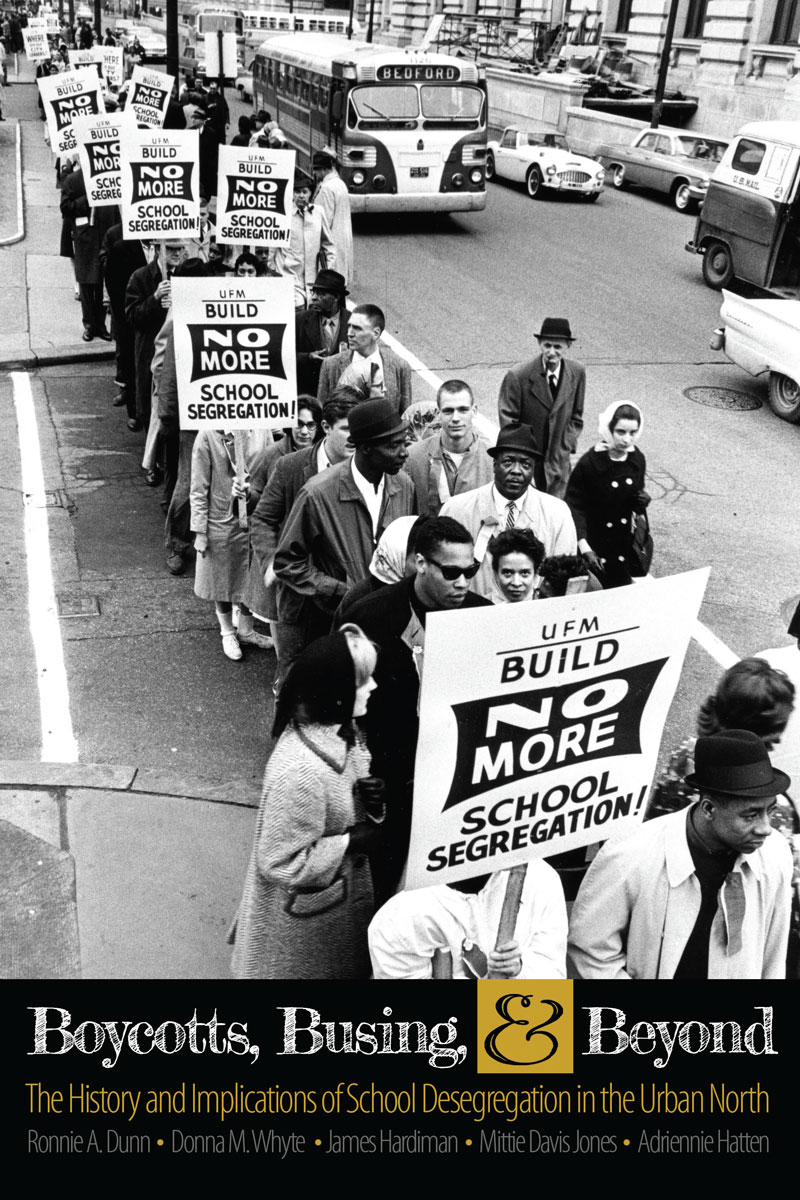

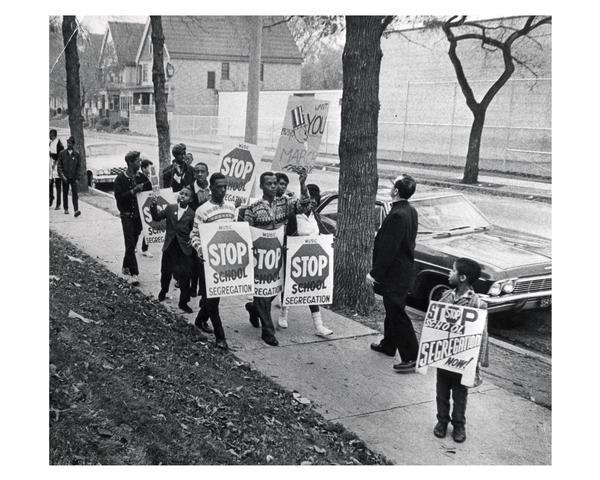

School Desegregation Order Ended Analysis And Future Outlook

May 02, 2025

School Desegregation Order Ended Analysis And Future Outlook

May 02, 2025 -

Justice Departments Decision A Turning Point In School Desegregation

May 02, 2025

Justice Departments Decision A Turning Point In School Desegregation

May 02, 2025 -

School Desegregation Order Rescinded Analysis And Future Outlook

May 02, 2025

School Desegregation Order Rescinded Analysis And Future Outlook

May 02, 2025 -

The Justice Department And School Desegregation A Shifting Landscape

May 02, 2025

The Justice Department And School Desegregation A Shifting Landscape

May 02, 2025 -

School Desegregation The End Of An Era Examining The Dojs Decision

May 02, 2025

School Desegregation The End Of An Era Examining The Dojs Decision

May 02, 2025