Rise Of The Canadian Dollar: Trump's Influence And Market Implications

Table of Contents

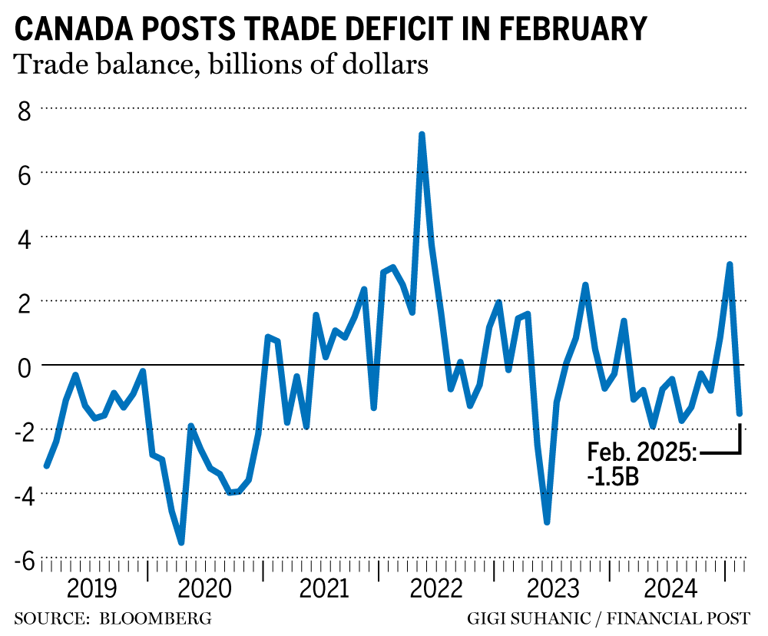

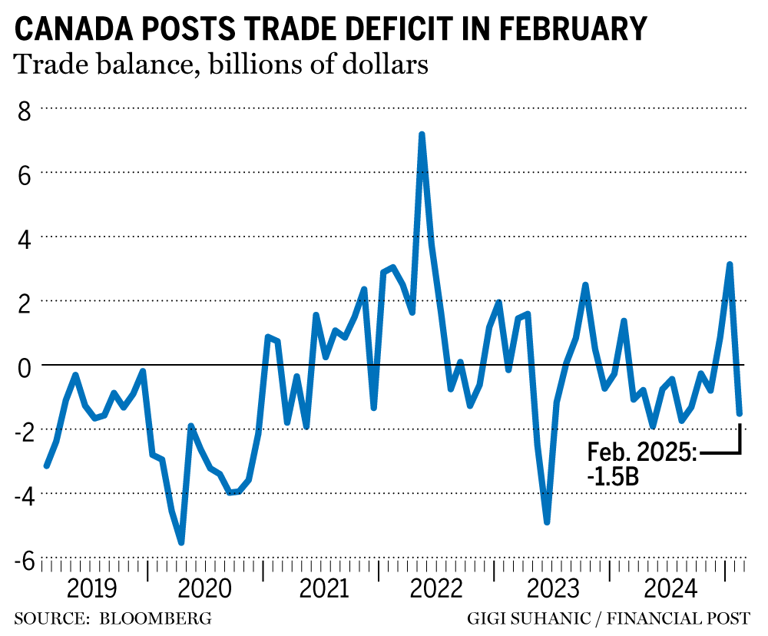

Trump's Trade Policies and Their Impact on the CAD

Donald Trump's trade policies created significant uncertainty and volatility in global markets, directly impacting the Canadian dollar (CAD). His administration's approach significantly influenced the Canadian economy, affecting everything from investor confidence to commodity prices.

NAFTA Renegotiation and Uncertainty

The renegotiation of the North American Free Trade Agreement (NAFTA), eventually replaced by the United States-Mexico-Canada Agreement (USMCA), injected considerable uncertainty into the market. This period of renegotiation, characterized by unpredictable pronouncements and threats of withdrawal, significantly impacted the Canadian dollar.

- Increased Volatility: The CAD experienced heightened volatility throughout the negotiation process, making it difficult for businesses to plan and for investors to make informed decisions.

- Investor Hesitancy: Uncertainty about the future of trade between Canada and the US led to investor hesitancy, causing some capital flight and weakening the Canadian dollar in the short term.

- Short-Term Weakening: The CAD experienced periods of significant decline against the US dollar during the most contentious phases of the NAFTA renegotiation.

- Eventual Stabilization Post-Agreement: Following the finalization of the USMCA, the Canadian dollar stabilized and even strengthened, reflecting a return of investor confidence.

[Insert chart here showing CAD/USD exchange rate fluctuations during NAFTA/USMCA renegotiation]

US-China Trade War Spillovers

The US-China trade war, while not directly targeting Canada, had significant indirect impacts on the Canadian economy and the CAD. The conflict disrupted global supply chains and created uncertainty in international trade.

- Increased Demand for Canadian Resources: As businesses sought to diversify their supply chains away from China, demand for Canadian resources like lumber, oil, and minerals increased.

- Positive Impact on Commodity Prices: This increased demand led to higher commodity prices, benefiting the Canadian economy and strengthening the CAD. Canada's status as a reliable and stable trading partner also became more appealing.

- Strengthened CAD: The combined effects of increased demand and higher commodity prices contributed to a strengthening of the Canadian dollar.

[Insert chart or table here showing correlation between US-China trade tensions and CAD performance]

Other Factors Contributing to the Rise of the Canadian Dollar

While Trump's trade policies played a significant role, other factors contributed to the rise and fall of the Canadian dollar. These factors often interact in complex ways, making it challenging to isolate the impact of any single variable.

Oil Price Fluctuations

Canada is a major oil producer, and oil prices have a strong correlation with the CAD. Fluctuations in global oil markets directly impact the Canadian economy and its currency.

- Rising Oil Prices Strengthen CAD: When global oil prices rise, Canada's export earnings increase, boosting economic activity and strengthening the CAD.

- Falling Oil Prices Weaken CAD: Conversely, falling oil prices weaken the Canadian dollar as export revenues decline.

- Recent Trends: Recent trends in oil prices have, at times, supported the Canadian dollar, but this is just one piece of a larger puzzle.

[Insert graph here showing the correlation between oil prices (e.g., WTI Crude) and the CAD/USD exchange rate]

Interest Rate Differentials

Interest rate differentials between Canada and the US play a crucial role in influencing the CAD. Investors seek higher returns, and interest rate differences can significantly affect capital flows.

- Higher Canadian Interest Rates Attract Foreign Investment: When Canadian interest rates are higher than US rates, foreign investors are attracted to Canadian assets, increasing demand for the CAD and strengthening it.

- Compare Rates Historically: Historical comparisons of Canadian and US interest rates reveal a clear correlation between rate differentials and CAD performance.

[Insert table here comparing historical Canadian and US interest rates]

Global Economic Conditions

Global economic conditions significantly impact the Canadian dollar, often influencing investor sentiment and capital flows.

- Flight to Safety During Global Uncertainty: During periods of global uncertainty or risk aversion, investors often seek the relative safety of Canadian assets, strengthening the CAD. Canada is perceived as a politically stable and economically sound country.

- Impact of Global Recessions: Global recessions or economic downturns generally weaken the Canadian dollar as demand for Canadian exports falls.

[Reference relevant economic indicators and news events showing the influence of global economic conditions on the CAD]

Conclusion

The rise of the Canadian dollar is a complex phenomenon influenced by multiple interacting factors. While former US President Donald Trump's trade policies, particularly the renegotiation of NAFTA and the US-China trade war, played a significant role, it's crucial to understand that other forces, including oil price fluctuations, interest rate differentials, and global economic conditions, are equally important. The interplay of these elements dictates the strength and weakness of the CAD. Understanding this interconnectedness is crucial for investors and businesses operating in or with Canada.

Call to Action: Stay informed on the ongoing fluctuations of the Canadian dollar and its relationship to global events. Monitor economic indicators such as oil prices, interest rates, and global growth, and consider expert advice to make informed decisions regarding investments and business strategies related to the Canadian dollar. Further research into the impact of USMCA, commodity prices, and global economic uncertainty on the Canadian dollar is highly recommended.

Featured Posts

-

Exclusive The U S Armys Ambitious Plan For Drone Dominance

May 03, 2025

Exclusive The U S Armys Ambitious Plan For Drone Dominance

May 03, 2025 -

Macau Casinos Outperform Expectations Ahead Of Golden Week

May 03, 2025

Macau Casinos Outperform Expectations Ahead Of Golden Week

May 03, 2025 -

Limited Time Fortnite Captain America Freebies Available Now

May 03, 2025

Limited Time Fortnite Captain America Freebies Available Now

May 03, 2025 -

Fortnite Cowboy Bebop Skins The Cost Of The Faye Valentine And Spike Spiegel Bundle

May 03, 2025

Fortnite Cowboy Bebop Skins The Cost Of The Faye Valentine And Spike Spiegel Bundle

May 03, 2025 -

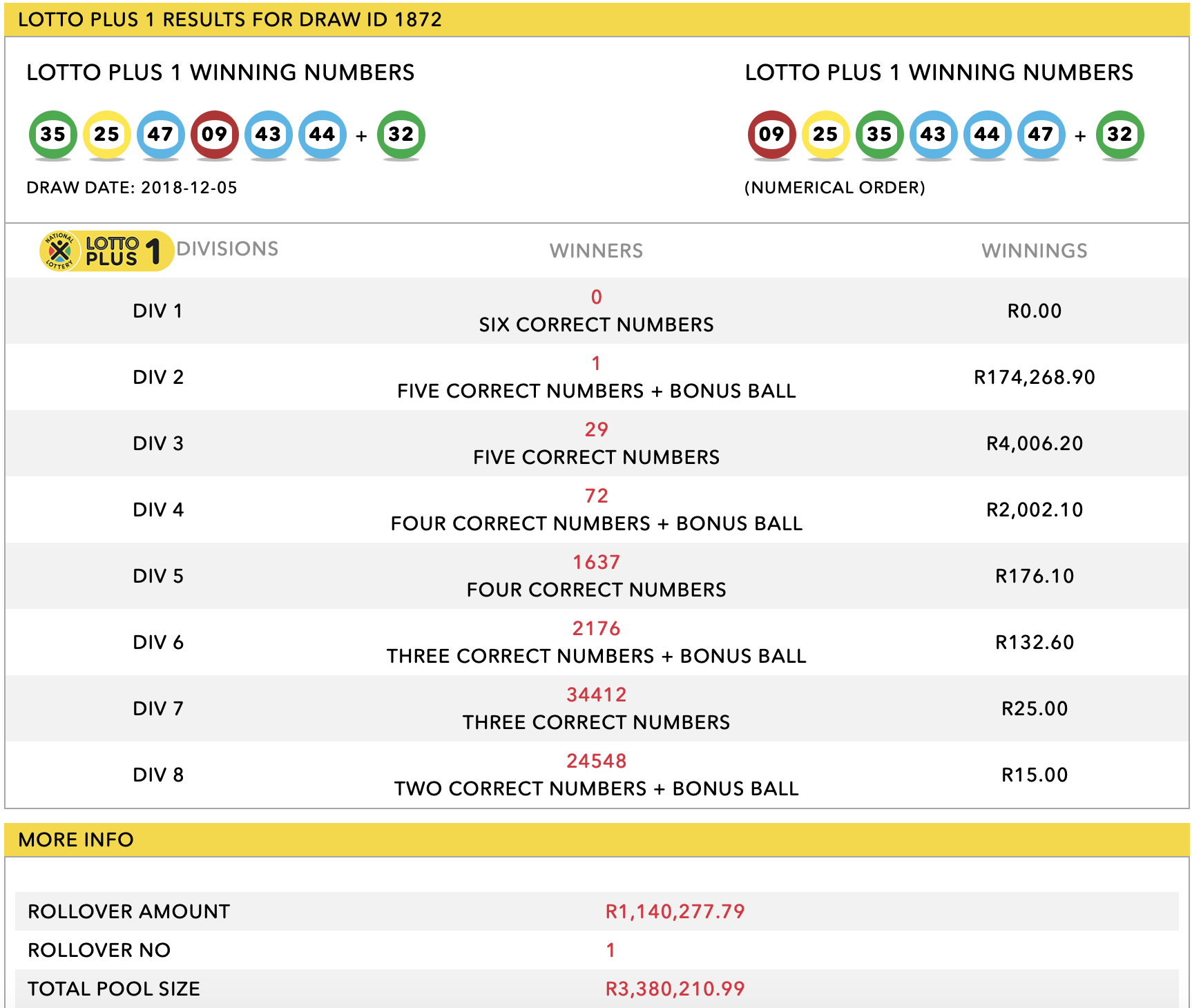

Lotto Results Check Lotto Plus 1 And Lotto Plus 2 Numbers

May 03, 2025

Lotto Results Check Lotto Plus 1 And Lotto Plus 2 Numbers

May 03, 2025

Latest Posts

-

Lakazet S 157 Gola Vv Frantsiya Triumf Za Lion

May 03, 2025

Lakazet S 157 Gola Vv Frantsiya Triumf Za Lion

May 03, 2025 -

157 Iyat Gol Na Lakazet Lion Na Praga Na Vtoroto Myasto

May 03, 2025

157 Iyat Gol Na Lakazet Lion Na Praga Na Vtoroto Myasto

May 03, 2025 -

Lakazet Izprevarva Papen Lion Se Priblizhava Do 2 Ro Myasto

May 03, 2025

Lakazet Izprevarva Papen Lion Se Priblizhava Do 2 Ro Myasto

May 03, 2025 -

Lakazet 157 Gola Vv Frenskoto Prvenstvo Nov Rekord

May 03, 2025

Lakazet 157 Gola Vv Frenskoto Prvenstvo Nov Rekord

May 03, 2025 -

Poleodomiki Diafthora Kai Ethniki Anagennisi O Dromos Pros Ena Dikaio Kratos

May 03, 2025

Poleodomiki Diafthora Kai Ethniki Anagennisi O Dromos Pros Ena Dikaio Kratos

May 03, 2025