Rising Copper Prices: China's Role In US Trade Negotiations

Table of Contents

China's Dominance in Copper Production and Consumption

China's massive consumption of copper stems from its ambitious infrastructure projects, including the Belt and Road Initiative and rapid urbanization. This phenomenal growth has cemented China's position as not only a major consumer but also a significant importer and processor of copper. Its influence on global copper prices is undeniable.

- Percentage of global copper consumption attributable to China: Estimates place China's consumption at over 50% of the global total, a figure that continues to grow.

- Key Chinese industries driving copper demand: Construction, electronics manufacturing, and renewable energy projects are key drivers, consistently demanding vast quantities of copper.

- Impact of Chinese government policies on copper demand: Government stimulus packages and infrastructure investments directly influence copper demand, creating periods of high consumption followed by potential slowdowns depending on policy shifts. This volatility directly impacts global copper prices.

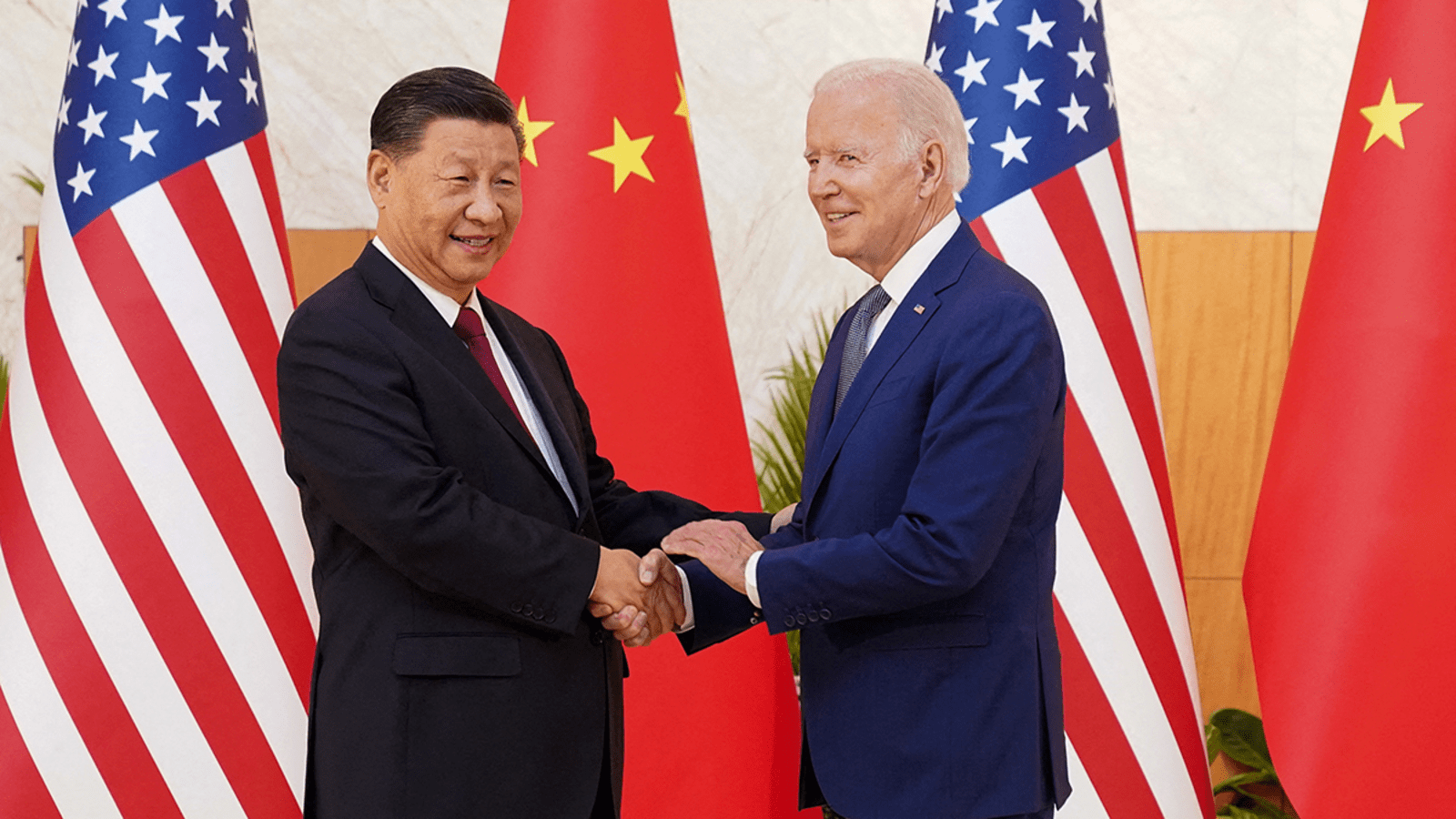

The US-China Trade War and its Impact on Copper Prices

The US-China trade war significantly impacted copper supply chains and prices. Tariffs and trade tensions disrupted the flow of copper between the two nations, leading to price instability and uncertainty for businesses in both countries. These disruptions highlighted the interconnected nature of the global copper market.

- Specific examples of tariffs imposed on copper or copper-related products: Tariffs on various copper products, imposed during periods of heightened trade tension, led to increased costs for US importers and manufacturers.

- Analysis of price fluctuations during periods of heightened trade tensions: Periods of trade conflict witnessed sharp fluctuations in copper prices, reflecting the uncertainty and disruption in supply chains.

- Impact on US manufacturers reliant on imported copper: US manufacturers heavily reliant on imported copper experienced increased costs and potential supply shortages, impacting their production and profitability. This underscores the vulnerability of US industries to geopolitical factors influencing copper price trends.

China's Strategic Reserves and Their Influence on Market Prices

China's substantial strategic copper reserves play a significant role in influencing global supply and, consequently, copper prices. The release or withholding of these reserves can manipulate market dynamics, creating both opportunities and challenges for other nations.

- Estimated size of China's copper reserves: While precise figures are not publicly available, estimates suggest China holds significant reserves, giving them considerable leverage over the global market.

- Examples of past instances where reserve releases affected market prices: Although not always publicly declared, market analysts believe past instances of reserve releases or the threat thereof have impacted copper prices.

- Geopolitical implications of China's control over copper reserves: China's control over its copper reserves has significant geopolitical implications, impacting global trade negotiations and potentially influencing other countries' economic policies.

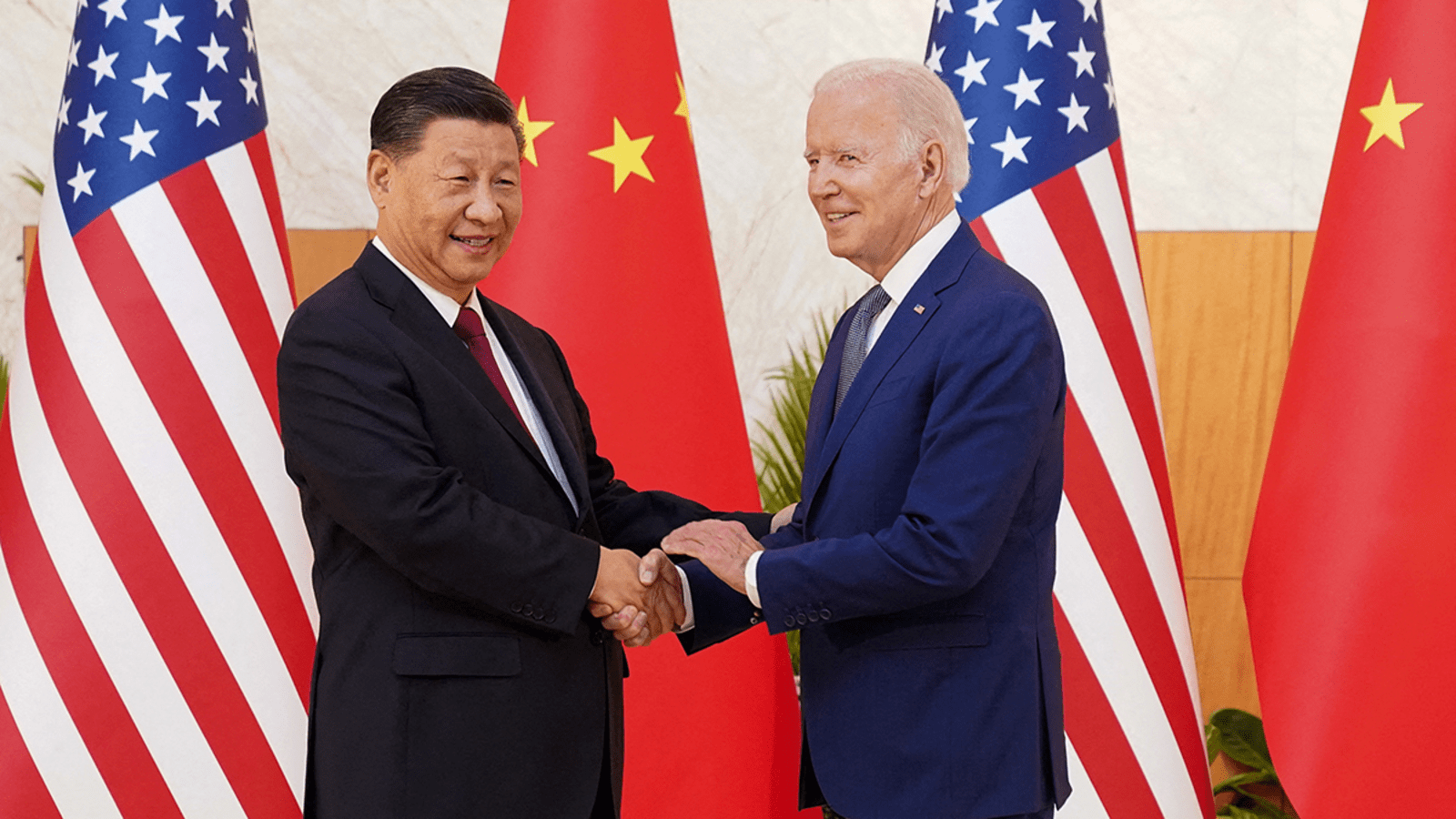

Future Outlook and Potential for Negotiation

Predicting future copper prices requires considering various factors. The ongoing US-China relationship, technological advancements, and global economic conditions will all play significant roles. Future trade agreements could potentially stabilize copper markets, but their success depends on the cooperation and willingness of both nations.

- Potential impacts of technological advancements on copper demand: Technological advancements in areas like electric vehicles and renewable energy could significantly increase copper demand, potentially leading to further rising copper prices.

- Predictions for future copper price trends: Experts predict continued volatility in copper prices, influenced by factors like supply chain disruptions, geopolitical tensions, and fluctuating global demand.

- Strategies for US businesses to mitigate risks associated with volatile copper prices: US businesses should implement strategies like hedging, diversification of suppliers, and careful long-term planning to minimize the impacts of copper price fluctuations.

Conclusion

This article has highlighted China's considerable influence on rising copper prices and the complexities within US trade negotiations. China's dominance in copper production and consumption, combined with the US-China trade war's effects and strategic reserve management, creates a volatile market for this essential metal. Understanding the intricate relationship between China's economic actions and rising copper prices is crucial for businesses and policymakers. Stay informed about US-China trade relations and the global copper market to effectively navigate this dynamic landscape and mitigate the risks associated with fluctuating copper prices. Further research into the intricacies of copper price fluctuations and their correlation with geopolitical events is strongly recommended.

Featured Posts

-

Shopify App Developers Navigating The New Revenue Share Structure

May 06, 2025

Shopify App Developers Navigating The New Revenue Share Structure

May 06, 2025 -

Building The Everything App A Comparison Of Sam Altmans And Elon Musks Strategies

May 06, 2025

Building The Everything App A Comparison Of Sam Altmans And Elon Musks Strategies

May 06, 2025 -

T Mobile To Pay 16 Million For Data Security Failures Over Three Years

May 06, 2025

T Mobile To Pay 16 Million For Data Security Failures Over Three Years

May 06, 2025 -

Celtics Eastern Conference Semifinals Game Start Date And Schedule

May 06, 2025

Celtics Eastern Conference Semifinals Game Start Date And Schedule

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Role Maria Shriver Speaks Out

May 06, 2025

Patrick Schwarzeneggers White Lotus Role Maria Shriver Speaks Out

May 06, 2025

Latest Posts

-

Nike Hyperice Hyperboot Release Date Confirmed

May 06, 2025

Nike Hyperice Hyperboot Release Date Confirmed

May 06, 2025 -

Elite Track Runner And Walmart Employee Dylan Beards Dual Life

May 06, 2025

Elite Track Runner And Walmart Employee Dylan Beards Dual Life

May 06, 2025 -

Dylan Beard Life As A Walmart Deli Worker And Elite Runner

May 06, 2025

Dylan Beard Life As A Walmart Deli Worker And Elite Runner

May 06, 2025 -

Juggling A Deli Job And Elite Track Dylan Beards Journey

May 06, 2025

Juggling A Deli Job And Elite Track Dylan Beards Journey

May 06, 2025 -

From Walmart Deli To Track Star Dylan Beards Story

May 06, 2025

From Walmart Deli To Track Star Dylan Beards Story

May 06, 2025