Rising Retail Sales Figures Delay Expected Bank Of Canada Interest Rate Cut

Table of Contents

Robust Retail Sales Figures Exceed Expectations

The latest retail sales data release revealed a substantial increase in consumer spending, exceeding all previous forecasts. The percentage growth compared to the previous month and year-over-year figures signals a considerable surge in economic activity. This unexpected jump has significantly altered the outlook for a Bank of Canada interest rate cut.

Several factors likely contributed to this rise in retail sales:

- Increased Consumer Spending: Canadians may be spending more due to factors such as improved job security, accumulated savings from the pandemic, or simply a greater willingness to engage in discretionary spending.

- Government Stimulus Measures: While recent stimulus measures have tapered off, any lingering effects could still be contributing to increased consumer spending.

- Pent-up Demand: The pent-up demand from the pandemic's restrictions might still be fueling purchases across various sectors.

- Resilience of Specific Sectors: Certain retail sectors, such as automotive sales or home improvement, may be experiencing particularly strong growth, pulling up the overall figures.

For example, Statistics Canada reported a [insert percentage]% increase in retail sales for [insert month, year], significantly higher than the predicted [insert percentage]%. This robust performance across multiple sectors underscores a healthier-than-expected consumer spending environment.

Impact on Inflation and Monetary Policy

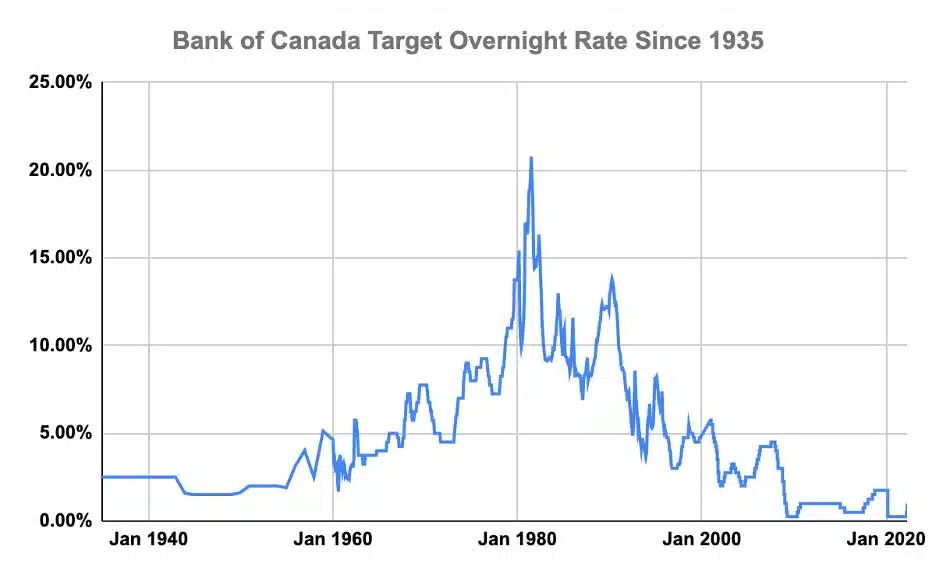

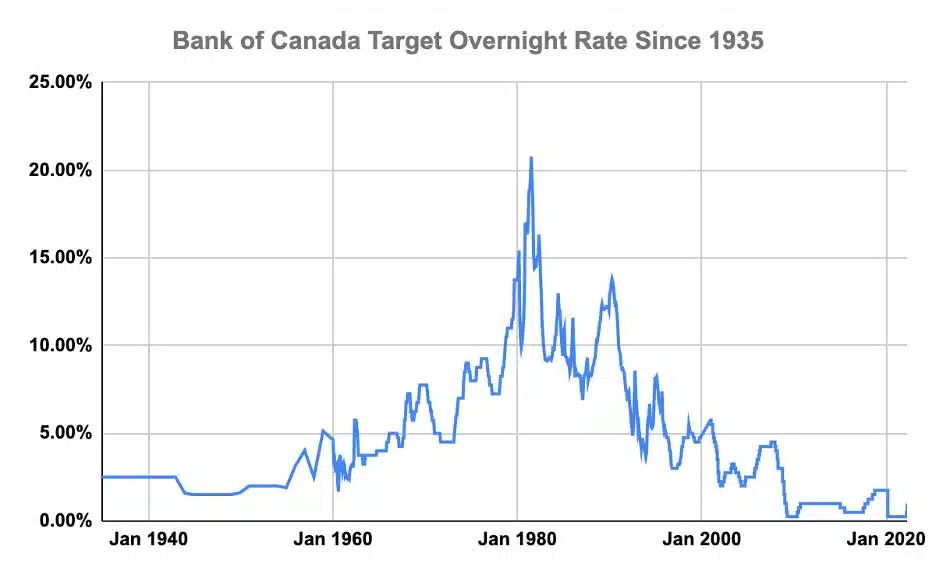

Robust retail sales figures often translate into increased inflationary pressure. Higher consumer spending translates to increased demand for goods and services, potentially pushing prices upward. The Bank of Canada closely monitors inflation and aims to maintain its target inflation rate of [insert target inflation rate]%.

Sustained high retail sales, if coupled with other inflationary pressures, could push inflation above the Bank of Canada's target range. This would likely influence the central bank's approach to monetary policy, making an interest rate cut less likely. The Bank of Canada's mandate is to maintain price stability and foster sustainable economic growth; therefore, managing inflation remains a key priority.

The Bank of Canada's Response and Future Outlook

Given the strong retail sales data, the Bank of Canada is likely to adopt a more cautious approach regarding interest rate adjustments. Several scenarios are plausible:

- Maintaining Current Interest Rates: The most likely immediate response is to maintain current interest rates, closely monitoring economic indicators for any signs of cooling.

- Delaying a Rate Cut: The anticipation of a Bank of Canada interest rate cut has been pushed back considerably, as the robust retail sales figures suggest the economy is not as weak as previously thought.

- Considering a Rate Hike: In a less likely scenario, persistent inflationary pressures fueled by strong retail sales might even prompt the Bank of Canada to consider a rate hike to curb inflation.

Market analysts are closely watching upcoming Bank of Canada announcements and press conferences for clues regarding their future policy decisions. Experts predict [insert expert opinion and prediction about future interest rate movements].

Alternative Economic Indicators and Their Influence

While retail sales are significant, the Bank of Canada considers a range of economic indicators before making interest rate decisions. These include:

- Employment Rate: A robust job market can support consumer spending, potentially contributing to inflation.

- Housing Market Activity: The housing market's performance influences overall economic activity and can have significant indirect impacts on inflation.

- Consumer Confidence: Measures of consumer confidence provide insights into future spending habits and economic outlook.

The interplay between these economic signals is complex. Conflicting signals—for example, strong retail sales coupled with weakening employment numbers—might prompt a more cautious and data-driven approach by the central bank, potentially delaying any significant adjustments to interest rates.

Rising Retail Sales Figures Delay Expected Bank of Canada Interest Rate Cut - What's Next?

The unexpectedly strong retail sales figures have significantly altered the outlook for a Bank of Canada interest rate cut. The robust consumer spending suggests a more resilient economy than previously anticipated, potentially adding to inflationary pressures. This development has likely pushed back the timeline for any potential interest rate reductions. The Bank of Canada will likely maintain a watchful eye on various economic indicators before making any decisions about interest rate adjustments.

The significance of the retail sales data in influencing monetary policy cannot be overstated. It highlights the complex interplay between various economic factors and the central bank's crucial role in maintaining economic stability. The future trajectory of interest rates in Canada remains uncertain, and it’s vital to stay informed about the evolving economic situation.

Call to Action: Stay tuned for updates on the Bank of Canada's interest rate policy. Understanding the Bank of Canada's next move on interest rates is crucial for informed financial decision-making. Consult the Bank of Canada's official website and reputable financial news sources for up-to-date information regarding the Bank of Canada interest rate cut and future monetary policy decisions.

Featured Posts

-

The Ultimate Taylor Swift Album Ranking 11 Albums Compared

May 27, 2025

The Ultimate Taylor Swift Album Ranking 11 Albums Compared

May 27, 2025 -

Gaza Doctor Loses Nine Of Ten Children In Israeli Airstrike

May 27, 2025

Gaza Doctor Loses Nine Of Ten Children In Israeli Airstrike

May 27, 2025 -

Gucci Re Motion White Original Gg Canvas Bag May 2025 Release 832461 Aaew 39045

May 27, 2025

Gucci Re Motion White Original Gg Canvas Bag May 2025 Release 832461 Aaew 39045

May 27, 2025 -

Lizzos Britney Spears Janet Jackson Comparison Fans Debate

May 27, 2025

Lizzos Britney Spears Janet Jackson Comparison Fans Debate

May 27, 2025 -

Nora Fatehi And Jason Derulos Snake A Uk British Asian Chart Topping Hit

May 27, 2025

Nora Fatehi And Jason Derulos Snake A Uk British Asian Chart Topping Hit

May 27, 2025

Latest Posts

-

Gorillaz Celebrate 25 Years With House Of Kong Exhibition And Special London Concerts

May 30, 2025

Gorillaz Celebrate 25 Years With House Of Kong Exhibition And Special London Concerts

May 30, 2025 -

Gorillaz Celebrate 25 Years With House Of Kong Exhibition And London Concerts

May 30, 2025

Gorillaz Celebrate 25 Years With House Of Kong Exhibition And London Concerts

May 30, 2025 -

Gorillaz 25th Anniversary House Of Kong Exhibition And London Shows

May 30, 2025

Gorillaz 25th Anniversary House Of Kong Exhibition And London Shows

May 30, 2025 -

Gorillazs 25th Anniversary House Of Kong Exhibition And London Shows

May 30, 2025

Gorillazs 25th Anniversary House Of Kong Exhibition And London Shows

May 30, 2025 -

Gorillaz 25 Years Of Music Exhibition And Special Shows

May 30, 2025

Gorillaz 25 Years Of Music Exhibition And Special Shows

May 30, 2025