Rising Taiwan Dollar: Pressure Mounts For Economic Overhaul

Table of Contents

Impact of a Strong Taiwan Dollar on Exports

A strengthening Taiwan dollar (TWD) significantly impacts Taiwan's export-oriented economy. The increased value of the TWD makes Taiwanese goods and services more expensive in international markets, directly impacting competitiveness and profitability.

Reduced Export Competitiveness

A stronger TWD reduces the competitiveness of Taiwanese exports. This translates to several key challenges:

- Reduced profitability for export-oriented businesses: Higher production costs in TWD terms, coupled with unchanged or lower prices in foreign currencies, squeeze profit margins. This forces businesses to either cut costs, potentially impacting quality or employment, or absorb losses.

- Increased competition from countries with weaker currencies: Competitors in nations with depreciating currencies gain a significant price advantage, making Taiwanese products less attractive to international buyers. This intensifies competition and threatens market share.

- Potential job losses in export sectors: Decreased export orders and reduced profitability can lead to layoffs and business closures within export-oriented industries, impacting employment levels across the nation.

Diversification Strategies

To mitigate the negative effects of a strong TWD, Taiwanese businesses must adopt diversified strategies:

- Focus on higher-value-added products: Shifting towards producing more sophisticated and specialized goods commands higher prices and reduces sensitivity to currency fluctuations. Investing in R&D is critical for this transition.

- Exploring new markets with stronger purchasing power: Diversifying export markets beyond those traditionally reliant on price-sensitive consumers reduces dependence on any single market and minimizes currency risk.

- Investing in research and development to enhance product competitiveness: Innovation is crucial to maintaining a competitive edge in the global market. Investment in new technologies and product development is essential for survival in a strong TWD environment.

Government Support for Export Diversification

The Taiwanese government plays a crucial role in supporting export diversification efforts:

- Targeted subsidies for businesses exploring new markets: Financial assistance can help offset the costs of market research, establishing new distribution channels, and adapting products for different markets.

- Improved trade agreements and partnerships with other countries: Negotiating favorable trade agreements reduces tariffs and other barriers to entry in new markets, increasing export opportunities.

- Investment in infrastructure to facilitate international trade: Modernizing ports, airports, and logistics networks reduces costs and improves efficiency for businesses engaged in international trade.

The Effects on Foreign Investment and Capital Flows

The appreciation of the TWD also impacts foreign investment and capital flows into and out of Taiwan.

Reduced Foreign Direct Investment (FDI)

A strong TWD can deter foreign direct investment (FDI):

- Higher costs for setting up operations in Taiwan: The increased cost of setting up operations, purchasing assets, and employing local workers in TWD terms discourages foreign companies.

- Reduced attractiveness compared to countries with weaker currencies: Countries with weaker currencies offer lower investment costs, making them more attractive destinations for foreign capital.

- Potential slowdown in economic growth: Reduced FDI can lead to slower economic growth as it limits investment in new projects, infrastructure, and job creation.

Impact on Capital Outflows

Businesses might move capital to other countries with more favorable exchange rates:

- Loss of domestic investment opportunities: Capital flight reduces investment in domestic projects and opportunities for economic growth within Taiwan.

- Reduced economic activity within Taiwan: A decline in investment leads to decreased economic activity, impacting various sectors and potentially causing job losses.

- Potential negative impact on employment and GDP growth: Overall economic performance is negatively impacted by reduced investment and economic activity.

Central Bank Intervention

The Central Bank of China (Taiwan) plays a critical role:

- Strategies to maintain exchange rate stability: The central bank may intervene in the foreign exchange market to manage the pace of appreciation and prevent excessive volatility.

- Attracting long-term foreign investment through policy initiatives: Policies that make Taiwan an attractive investment destination, such as tax incentives or regulatory reforms, can counteract the negative impact of a strong TWD.

- Balancing monetary policy with domestic economic needs: The central bank must balance its efforts to manage the exchange rate with the need to maintain price stability and support domestic economic growth.

Necessary Economic Overhauls for a Sustainable Future

Addressing the challenges posed by the rising Taiwan dollar requires a comprehensive overhaul of Taiwan's economic structure and strategy.

Structural Reforms

Deep structural reforms are needed to enhance long-term competitiveness:

- Labor market reforms to enhance competitiveness: Addressing high labor costs through reforms that improve productivity and flexibility is essential.

- Regulatory reforms to encourage innovation and entrepreneurship: Streamlining regulations and reducing bureaucratic hurdles fosters innovation and attracts investment in new technologies and businesses.

- Investing in domestic consumption-driven economic growth: Reducing reliance on exports by stimulating domestic demand and consumer spending is crucial for long-term sustainability.

Technological Innovation and Upskilling

Investment in innovation and human capital is crucial:

- Promoting technological advancement in key industries: Investing in R&D and fostering collaboration between industry and academia strengthens technological leadership.

- Investing in education and training programs for the workforce: Upskilling the workforce equips individuals with the skills needed to compete in a globalized economy and participate in higher-value-added industries.

- Attracting and retaining high-skilled talent: Creating a welcoming environment for skilled workers, including competitive salaries and attractive living conditions, is vital for long-term economic success.

Promoting Domestic Consumption

Shifting the economic focus towards domestic demand is essential:

- Encouraging consumer spending through economic stimulus: Government initiatives that boost consumer confidence and spending can drive economic growth independent of export performance.

- Improving income distribution to enhance purchasing power: Fairer income distribution increases the purchasing power of consumers, stimulating domestic demand and reducing reliance on exports.

- Investing in infrastructure to improve quality of life: Improvements in infrastructure, such as transportation and public services, enhance the quality of life and encourage domestic spending.

Conclusion

The rising Taiwan dollar necessitates a comprehensive economic overhaul. Simply managing the exchange rate isn't sufficient; Taiwan needs to address underlying structural issues, boost innovation, and diversify its economy to maintain long-term competitiveness and prosperity. Ignoring these challenges will only exacerbate the pressure of a strong Taiwan dollar. The time for proactive measures to counter the impact of a rising Taiwan dollar is now. Ignoring the implications could lead to substantial economic consequences. Therefore, strategic planning and decisive action are crucial to navigating this significant economic shift and ensuring a sustainable future for Taiwan’s economy. Let's discuss the implications of this rising Taiwan dollar and the necessary solutions to build a resilient and prosperous future for Taiwan.

Featured Posts

-

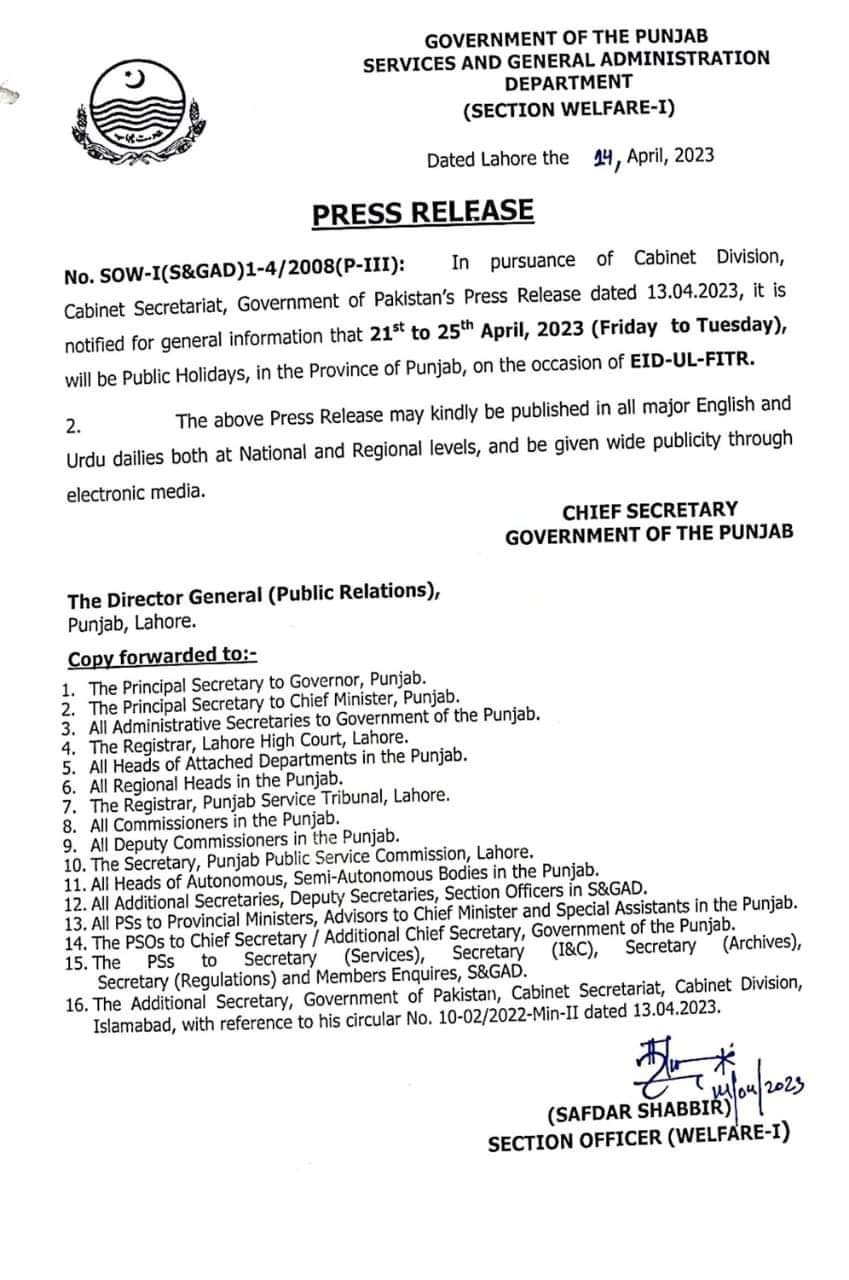

Lahore Punjab Eid Ul Fitr Weather A 2 Day Outlook

May 08, 2025

Lahore Punjab Eid Ul Fitr Weather A 2 Day Outlook

May 08, 2025 -

Arsenal Vs Ps Zh Barselona Vs Inter Polufinal Ligi Chempionov 2024 2025 Chto Ozhidat

May 08, 2025

Arsenal Vs Ps Zh Barselona Vs Inter Polufinal Ligi Chempionov 2024 2025 Chto Ozhidat

May 08, 2025 -

The Mystery Planet Star Wars Finally Reveals A 48 Year Old Teaser

May 08, 2025

The Mystery Planet Star Wars Finally Reveals A 48 Year Old Teaser

May 08, 2025 -

Transferred Data A Comprehensive Guide

May 08, 2025

Transferred Data A Comprehensive Guide

May 08, 2025 -

Increased Earnings For Uber Drivers And Couriers In Kenya Plus Cashback For Customers

May 08, 2025

Increased Earnings For Uber Drivers And Couriers In Kenya Plus Cashback For Customers

May 08, 2025