Risk Assessment And Mitigation Strategies For 270MWh BESS Financing In Belgium

Table of Contents

Technological Risks and Mitigation

The technological landscape of BESS projects presents several significant risks that can impact project profitability and longevity. Effective mitigation strategies are crucial for securing financing.

Battery Degradation and Lifespan

Battery degradation is a major concern impacting the long-term performance and profitability of BESS projects. The capacity of lithium-ion batteries, commonly used in BESS systems, diminishes over time. This reduced capacity translates directly into lower revenue generation and potential financial losses. Selecting high-quality battery technologies with robust performance guarantees is paramount.

- Warranty considerations: Negotiate comprehensive warranties covering performance degradation and potential replacements.

- Performance guarantees: Ensure the chosen battery technology meets stringent performance standards and guarantees a minimum lifespan.

- Regular health checks: Implement a program of regular battery health checks and maintenance to monitor performance and identify potential issues early.

- Advanced Battery Management Systems (BMS): Invest in sophisticated BMS to optimize battery performance, extend lifespan, and minimize degradation.

These measures are crucial for mitigating the risk of premature battery failure and ensuring the long-term viability of your BESS investment in Belgium. Understanding BESS technology in Belgium, specifically battery storage lifespan, is key to successful project development.

BESS System Failures and Outages

Unplanned downtime due to system failures can significantly impact project revenue and investor confidence. Robust system design and redundancy are essential to minimize such risks.

- Regular maintenance schedules: Implement preventative maintenance schedules to detect and address potential problems before they lead to outages.

- Disaster recovery plans: Develop comprehensive plans to ensure rapid recovery in case of unexpected events like natural disasters.

- Insurance coverage for equipment failure: Secure comprehensive insurance policies covering equipment failure, damage, and business interruption.

- Cybersecurity measures: Implement robust cybersecurity measures to protect the BESS system from cyberattacks that could lead to outages or data breaches.

Minimizing the risk of BESS system reliability issues is crucial for demonstrating the long-term viability of the project to potential investors, addressing a major concern within the Belgian energy storage risk landscape.

Integration with the Belgian Grid

Integrating a large-scale BESS into the Belgian power grid presents unique challenges. Securing necessary approvals and adhering to regulations is paramount.

- Grid connection studies: Conduct thorough grid connection studies to assess the impact of the BESS on the grid and ensure seamless integration.

- Compliance with Elia (Belgian TSO) requirements: Fully comply with all technical and regulatory requirements set by Elia, the Belgian transmission system operator.

- Power quality management: Implement measures to maintain high power quality and avoid disruptions to the grid.

Successful grid integration is crucial for the project's success, making understanding grid integration BESS Belgium and Elia grid connection requirements vital for any BESS project developer.

Regulatory and Policy Risks and Mitigation

Navigating the regulatory landscape in Belgium is crucial for BESS project success. Proactive mitigation of regulatory and policy risks is essential.

Permitting and Licensing

The permitting process for BESS projects in Belgium can be complex and time-consuming. Potential delays can significantly impact project timelines and costs.

- Environmental impact assessments: Conduct thorough environmental impact assessments to comply with environmental regulations.

- Planning permissions: Obtain all necessary planning permissions from relevant local authorities.

- Engagement with local authorities: Maintain proactive and transparent communication with local authorities throughout the permitting process.

Understanding the nuances of BESS permitting in Belgium and ensuring regulatory compliance in Belgium are critical for smooth project implementation.

Policy Changes and Subsidies

Changes in Belgian energy policy can significantly impact the profitability of BESS projects. Monitoring policy changes and accessing available subsidies are crucial.

- Monitoring policy changes: Stay informed about changes in Belgian energy policy and their potential impact on BESS projects.

- Applying for subsidies: Actively seek and apply for any relevant government subsidies or incentives for BESS projects.

- Understanding feed-in tariffs: Thoroughly understand and leverage available feed-in tariffs for energy produced by the BESS.

Staying updated on Belgian energy policy and securing BESS subsidies in Belgium can significantly enhance project financial viability.

Market Risk and Revenue Streams

The profitability of BESS projects is influenced by various market factors. Diversifying revenue streams is essential to mitigate market risks.

- Market price forecasting: Develop accurate market price forecasts to anticipate potential fluctuations in energy prices.

- Revenue stream diversification: Diversify revenue streams by participating in multiple markets, such as arbitrage, frequency regulation, and capacity markets.

- Hedging strategies: Implement hedging strategies to mitigate the impact of price volatility.

Understanding BESS revenue streams within the Belgian energy market is key to maximizing profitability and reducing financial exposure.

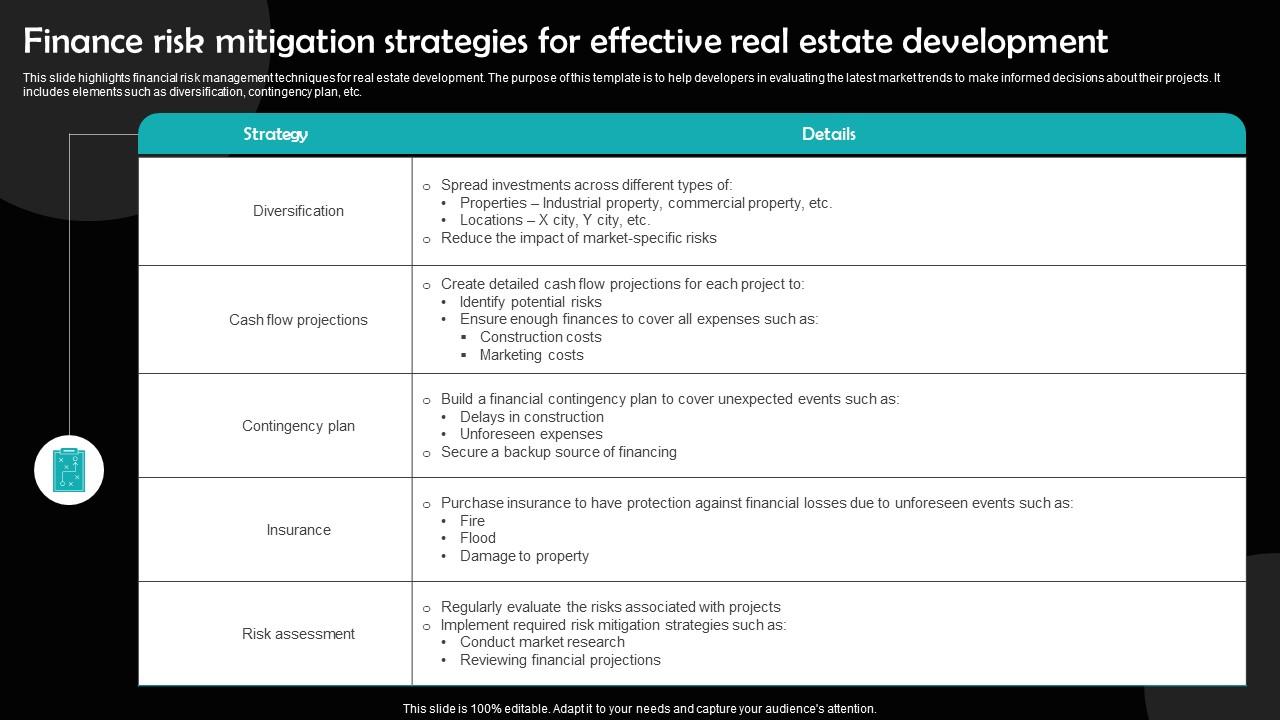

Financial Risks and Mitigation

Financial risks associated with BESS financing in Belgium require careful consideration and robust mitigation strategies.

Debt Financing and Equity Investment

Choosing the right financing structure is crucial for BESS projects. Different options have advantages and disadvantages.

- Bank loans: Explore bank loans as a source of debt financing.

- Project finance: Consider project finance structures tailored to the specific characteristics of the BESS project.

- Equity partnerships: Seek equity partners to share the financial risk and contribute expertise.

- Green bonds: Explore the possibility of issuing green bonds to attract environmentally conscious investors.

Understanding the intricacies of BESS project finance in Belgium and making informed investment decisions is critical for securing funding.

Interest Rate Risk and Currency Fluctuations

Changes in interest rates and currency fluctuations can significantly impact project costs. Hedging strategies can mitigate these risks.

- Interest rate swaps: Utilize interest rate swaps to lock in favorable interest rates.

- Currency hedging: Employ currency hedging techniques to mitigate the impact of currency fluctuations.

- Fixed-rate financing options: Prioritize fixed-rate financing options to eliminate interest rate risk.

Effective risk mitigation for BESS financing is essential to ensure project financial stability.

Insurance and Risk Transfer

Comprehensive insurance coverage is vital for protecting against unforeseen events.

- Property damage insurance: Secure insurance against property damage and equipment failure.

- Liability insurance: Obtain liability insurance to protect against potential claims related to the project.

- Business interruption insurance: Secure business interruption insurance to cover losses due to unexpected downtime.

- Political risk insurance: Consider political risk insurance to mitigate the risks associated with policy changes or regulatory uncertainty.

Adequate BESS insurance in Belgium and implementing effective risk transfer strategies are crucial for minimizing financial losses from unexpected events.

Conclusion

Successfully financing a 270MWh BESS project in Belgium requires a thorough risk assessment and the implementation of robust mitigation strategies. This article has highlighted key technological, regulatory, and financial risks, along with practical solutions to minimize their impact. By carefully considering these factors and developing a comprehensive risk management plan, developers can significantly improve the chances of securing financing and achieving the long-term success of their BESS projects. For further guidance on navigating the complexities of BESS financing in Belgium, contact [Your Company/Contact Information].

Featured Posts

-

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

May 04, 2025

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

May 04, 2025 -

Current Weather Conditions West Bengal Temperature Drop

May 04, 2025

Current Weather Conditions West Bengal Temperature Drop

May 04, 2025 -

West Bengal Weather Update Cold Wave Sweeps Across The State

May 04, 2025

West Bengal Weather Update Cold Wave Sweeps Across The State

May 04, 2025 -

Paddy Pimblett Raises Concerns About Michael Chandlers Conduct Before Ufc 314 Fight

May 04, 2025

Paddy Pimblett Raises Concerns About Michael Chandlers Conduct Before Ufc 314 Fight

May 04, 2025 -

Tynna And The German Eurovision Bid A Vocal Assessment

May 04, 2025

Tynna And The German Eurovision Bid A Vocal Assessment

May 04, 2025

Latest Posts

-

2025 Kentucky Derby Chunk Of Golds Profile And Betting Odds

May 04, 2025

2025 Kentucky Derby Chunk Of Golds Profile And Betting Odds

May 04, 2025 -

Get Ready For Kentucky Derby 151 A Pre Race Day Checklist

May 04, 2025

Get Ready For Kentucky Derby 151 A Pre Race Day Checklist

May 04, 2025 -

Kentucky Derby 2025 Odds Top Contenders And Betting Predictions

May 04, 2025

Kentucky Derby 2025 Odds Top Contenders And Betting Predictions

May 04, 2025 -

Louisiana Derby 2025 A Comprehensive Guide To Odds Field And Kentucky Derby Contenders

May 04, 2025

Louisiana Derby 2025 A Comprehensive Guide To Odds Field And Kentucky Derby Contenders

May 04, 2025 -

2025 Kentucky Derby Analyzing The Potential Race Pace

May 04, 2025

2025 Kentucky Derby Analyzing The Potential Race Pace

May 04, 2025