ROCK Stock Earnings Preview: Potential Impacts And Investment Strategies

Table of Contents

Analyzing ROCK's Recent Performance and Key Financials

Understanding ROCK's recent financial performance is crucial for predicting the upcoming earnings announcement's impact. Analyzing key financials provides a strong foundation for informed investment decisions. We'll focus on ROCK Stock Performance and ROCK Financials, examining the Q[Quarter] earnings to gauge the company's health.

-

Review of Recent Performance: We need to examine ROCK's performance in the preceding quarter(s). This includes a deep dive into revenue growth, scrutinizing the percentage increase or decrease compared to the same period last year. Equally important is the earnings per share (EPS), a key indicator of profitability. We must also analyze key performance indicators (KPIs) relevant to ROCK's industry, such as customer acquisition cost, customer churn rate, or average revenue per user (ARPU), depending on the company's business model.

-

Operational Efficiency and Cost Structure: Significant changes in ROCK's operational efficiency and cost structure can greatly affect its profitability. Did the company implement new cost-cutting measures? Has there been a noticeable improvement in supply chain management or production processes? These factors all influence the bottom line and should be carefully considered.

-

Acquisitions, Partnerships, and Divestitures: Any recent acquisitions, strategic partnerships, or divestitures significantly impact earnings. A successful acquisition could boost revenue, while a poorly performing acquisition or divestiture could negatively affect financials. We need to analyze the financial implications of these corporate actions.

-

Industry Trends and Macroeconomic Factors: It's vital to analyze the broader industry trends and macroeconomic factors impacting ROCK's financial performance. Economic downturns, changes in regulations, or increased competition can all significantly affect a company's results. Understanding these external pressures is crucial.

Potential Impacts of the Earnings Announcement on ROCK Stock Price

The upcoming earnings announcement could significantly impact ROCK Stock Price. The market's reaction is often volatile, influenced by various factors. Predicting the exact price movement is impossible, but analyzing potential scenarios helps prepare for different outcomes.

-

Beating, Meeting, or Missing Expectations: If ROCK beats expectations, we can anticipate a positive market reaction, potentially leading to a stock price increase. Conversely, missing expectations will likely result in a negative reaction and a price decline. Meeting expectations might cause minimal price fluctuation, or a slight movement based on other market factors.

-

Historical Market Reactions: Studying ROCK's past earnings announcements reveals typical market reactions. Analyzing historical data helps determine the usual volatility surrounding these events. Understanding this historical context provides a more informed expectation of the upcoming announcement's potential impact.

-

Overall Market Sentiment: The overall market sentiment significantly influences the reaction to ROCK's earnings. A generally positive market might lessen the negative impact of a slightly disappointing earnings report, while a bearish market could amplify negative reactions.

-

Investor Sentiment Influencers: News events, analyst ratings, and competitor performance can all sway investor sentiment. A positive news story or a strong competitor report could positively influence the ROCK Stock price, regardless of the earnings announcement's outcome.

Understanding the Risk and Reward

Investing always involves risk. Understanding the potential risks and rewards associated with ROCK stock is essential for making informed decisions.

-

Inherent Risks: Investing in ROCK stock carries several risks, including market risk (overall market downturns), company-specific risk (issues specific to ROCK), and industry risk (challenges facing the specific industry). Diversification can help mitigate some of these risks.

-

Potential Rewards: The potential rewards should be considered against the inherent risks. This involves analyzing historical performance and future growth prospects. A robust growth trajectory and strong market position can justify higher risk tolerance.

-

Risk Tolerance: The suitability of investing in ROCK stock depends greatly on an individual's risk tolerance. Risk-averse investors might prefer to avoid significant exposure before the earnings announcement, while aggressive investors may view it as a buying opportunity depending on their analysis.

Investment Strategies for Navigating ROCK Stock Earnings

Navigating ROCK Stock earnings requires a well-defined investment strategy. This should account for the potential volatility and the different scenarios. Remember, this is not financial advice; always conduct your own thorough research.

-

Pre-Earnings Strategies: Before the announcement, investors may choose to buy, hold, or sell based on their analysis of ROCK's fundamentals and technical indicators.

-

During and Post-Earnings: The immediate reaction to the earnings announcement presents both opportunities and risks. This period demands close monitoring and potentially rapid responses based on pre-defined strategies.

-

Technical and Fundamental Analysis: Combining technical indicators (chart patterns, moving averages) and fundamental analysis (financial statements, industry trends) is often beneficial. This helps formulate a comprehensive view and informs decision-making.

-

Diversification: Diversifying your portfolio across different asset classes and stocks reduces your overall risk. Don't put all your eggs in one basket.

-

Options Trading (Caution): Options trading can amplify both gains and losses. It should only be undertaken by experienced investors with a thorough understanding of the risks involved.

Conclusion

This ROCK Stock Earnings Preview has highlighted key factors to consider before, during, and after the upcoming earnings announcement. Understanding ROCK's recent performance, potential market impacts, and various investment strategies will help you make informed decisions about your investment in ROCK stock. Remember to conduct thorough research and consider your own risk tolerance before making any investment decisions. Stay tuned for further analysis and updates on the ROCK Stock earnings and consider developing a comprehensive ROCK stock investment strategy to navigate future announcements effectively. Develop your ROCK Stock investment strategy today to capitalize on future earnings announcements.

Featured Posts

-

Scarlett Johanssons Alleged Stalker Arrested Bomb Threat Against Saturday Night Live

May 13, 2025

Scarlett Johanssons Alleged Stalker Arrested Bomb Threat Against Saturday Night Live

May 13, 2025 -

Disney Film Promotion Eva Longorias Choice Of Michael Kors

May 13, 2025

Disney Film Promotion Eva Longorias Choice Of Michael Kors

May 13, 2025 -

Negociations Post Brexit Gibraltar A Un Tournant Decisif

May 13, 2025

Negociations Post Brexit Gibraltar A Un Tournant Decisif

May 13, 2025 -

Leonardo Di Caprios Dating Rule Debunked The Truth Revealed

May 13, 2025

Leonardo Di Caprios Dating Rule Debunked The Truth Revealed

May 13, 2025 -

Leonardo Di Caprio 30 Eve Doentoett A Heroin Ellen

May 13, 2025

Leonardo Di Caprio 30 Eve Doentoett A Heroin Ellen

May 13, 2025

Latest Posts

-

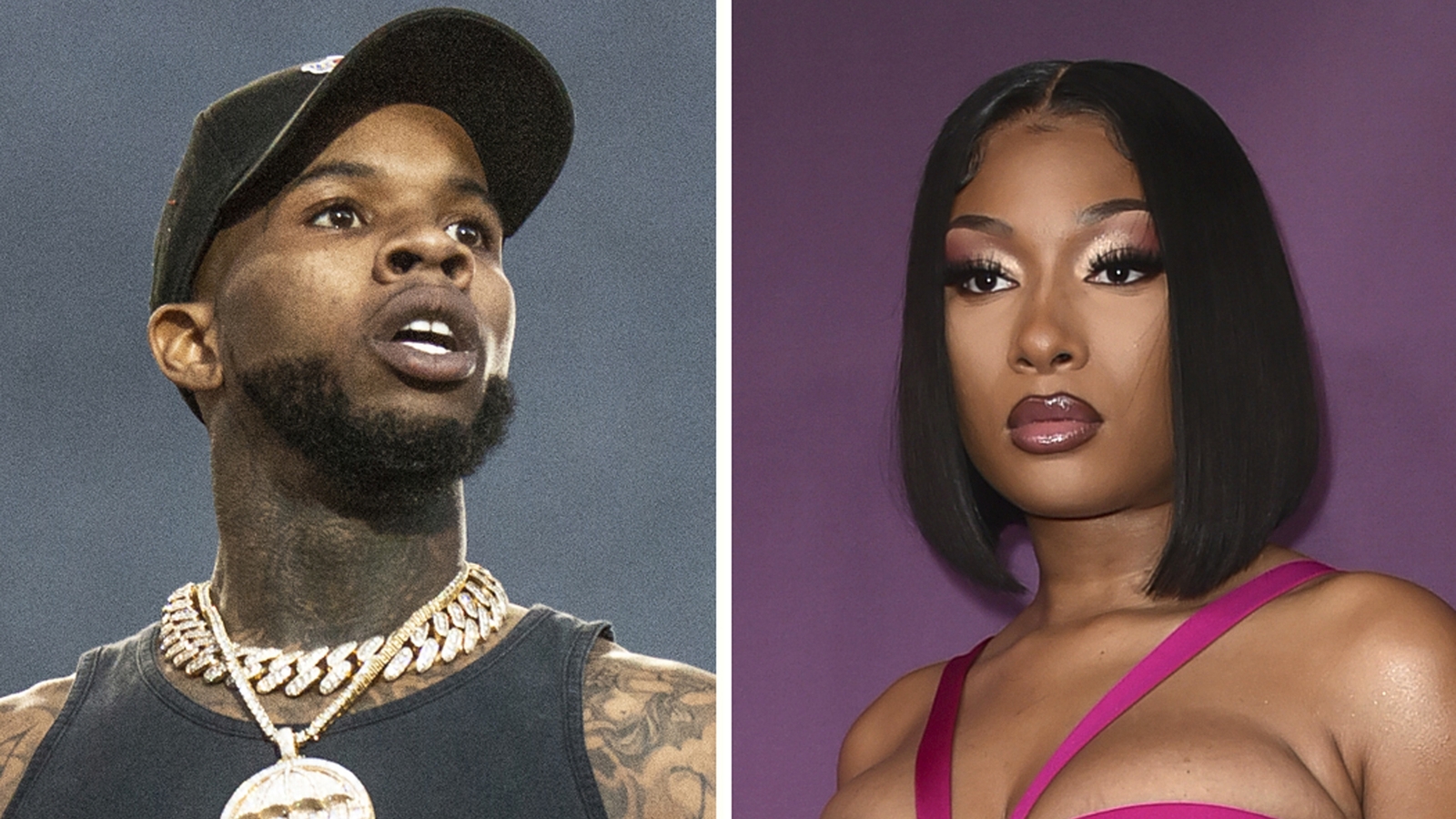

Tory Lanez Prison Attack Singer Stabbed Hospitalized

May 13, 2025

Tory Lanez Prison Attack Singer Stabbed Hospitalized

May 13, 2025 -

Megan Thee Stallion And Tory Lanez Examining The Allegations Of Deposition Interference

May 13, 2025

Megan Thee Stallion And Tory Lanez Examining The Allegations Of Deposition Interference

May 13, 2025 -

Tory Lanez Deposition Sabotage Allegations Impact On The Megan Thee Stallion Case

May 13, 2025

Tory Lanez Deposition Sabotage Allegations Impact On The Megan Thee Stallion Case

May 13, 2025 -

Tory Lanez Allegedly Sabotaged Megan Thee Stallions Deposition Key Details And Timeline

May 13, 2025

Tory Lanez Allegedly Sabotaged Megan Thee Stallions Deposition Key Details And Timeline

May 13, 2025 -

Megan Thee Stallion Shooting Trial Tensions Rise As Tory Lanez Targets His Defense

May 13, 2025

Megan Thee Stallion Shooting Trial Tensions Rise As Tory Lanez Targets His Defense

May 13, 2025