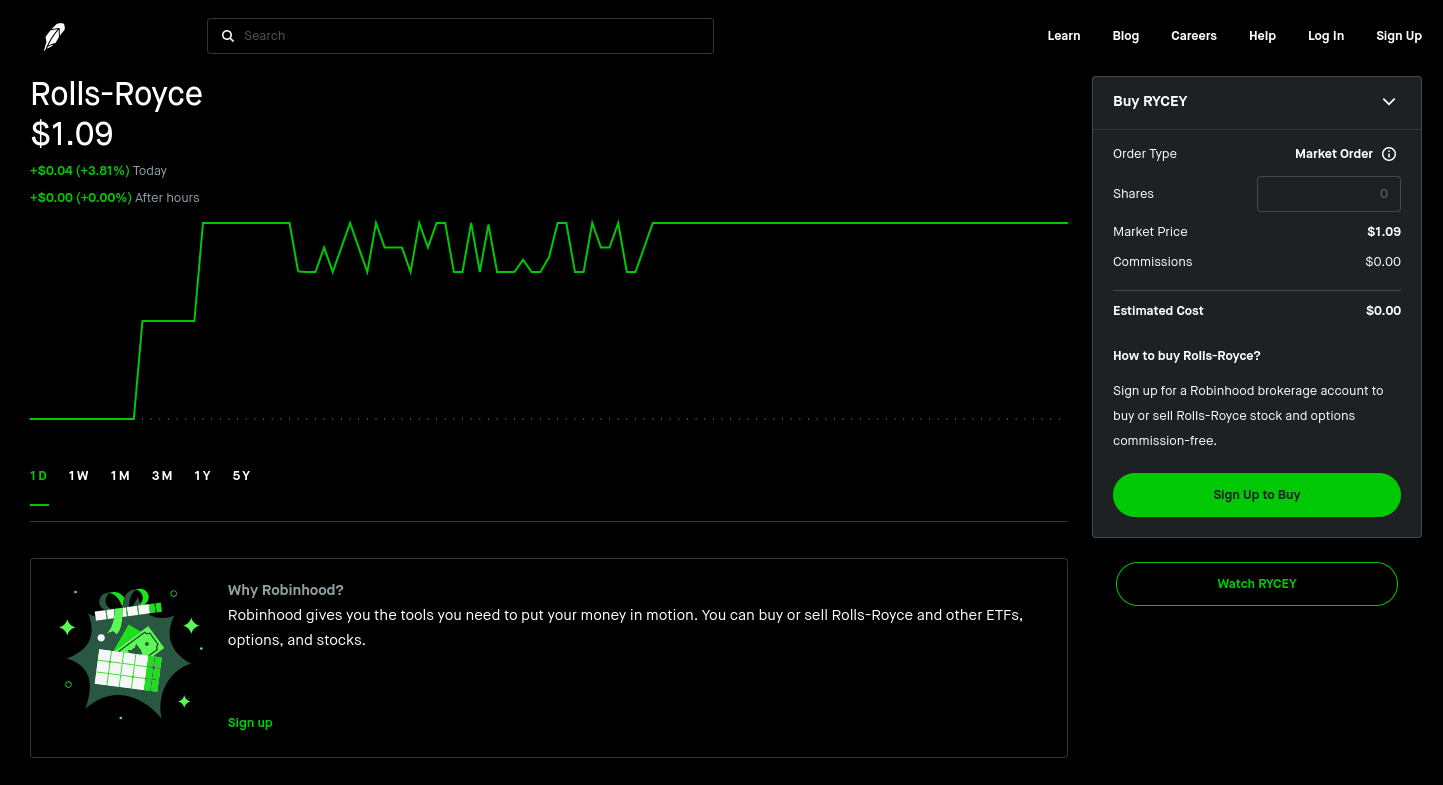

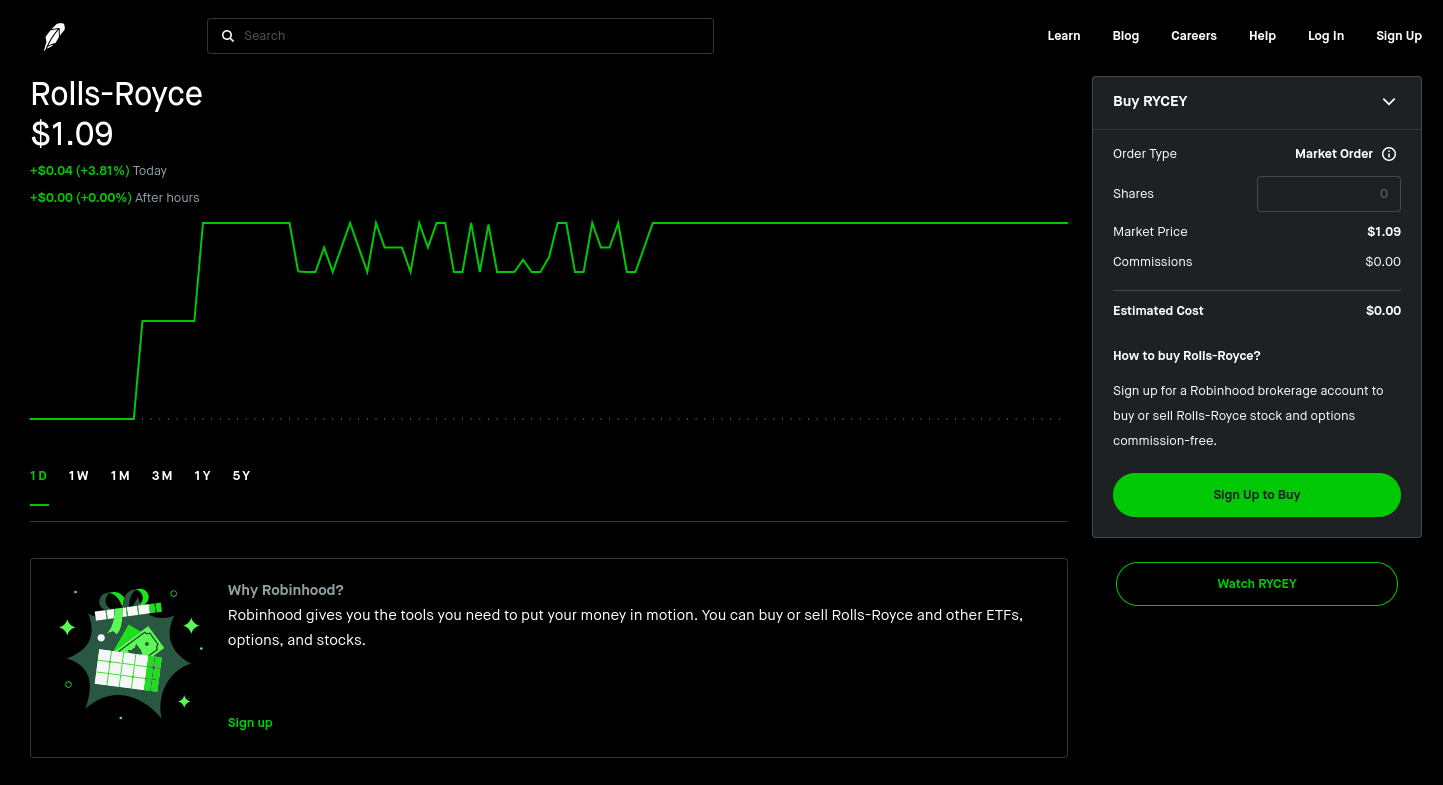

Rolls-Royce Maintains 2025 Outlook Amidst Trade Tariff Concerns

Table of Contents

Rolls-Royce's 2025 Financial Projections Remain Unchanged

Rolls-Royce has publicly maintained its financial projections for 2025, demonstrating a degree of resilience in the face of global trade headwinds. While specific figures may vary depending on the reporting period and market conditions, the company consistently highlights its expectations for growth across key sectors. Although precise numbers are subject to change, Rolls-Royce's projections generally indicate a positive trajectory.

-

Specific revenue projections for key sectors: While exact figures are not always publicly released until financial reports, Rolls-Royce anticipates growth in both its civil aerospace and defense divisions. Civil aerospace, a historically significant sector for the company, is expected to see sustained demand, driven by the global need for air travel. The defense sector is also anticipated to contribute positively to overall revenue.

-

Expected growth rates compared to previous years: Rolls-Royce aims for a steady increase in revenue and profit margins compared to previous years, indicating an ambitious yet attainable growth strategy. The precise growth percentages are subject to investor relations releases, and fluctuate with market conditions.

-

Key performance indicators (KPIs) that support the positive outlook: Rolls-Royce's positive outlook is supported by several key performance indicators, including a strong order backlog, improvements in operational efficiency, and the successful implementation of cost-saving measures. These KPIs demonstrate the company's commitment to financial stability and sustainable growth.

Assessing the Impact of Trade Tariffs on Rolls-Royce's Operations

The impact of trade tariffs on Rolls-Royce's operations is a significant factor influencing its long-term strategy. The company, with its global supply chains and international customer base, is directly exposed to the effects of protectionist measures.

-

Increased production costs due to tariffs on raw materials or parts: Tariffs on imported components, including those sourced from various global locations, can significantly increase production costs. This can impact profit margins if not effectively mitigated.

-

Potential reduction in export sales due to higher prices: Increased production costs resulting from tariffs can force Rolls-Royce to increase prices for its products, potentially reducing export sales competitiveness in certain markets.

-

Impact on supply chain efficiency and global operations: Trade tariffs can disrupt supply chain efficiency by increasing lead times, creating uncertainty in procurement, and requiring adjustments in sourcing strategies. These disruptions can affect overall global operations and logistical efficiency.

Mitigation Strategies Implemented by Rolls-Royce

To counter the potential negative impacts of trade tariffs, Rolls-Royce has implemented several mitigation strategies.

-

Specific examples of supply chain diversification: The company is actively diversifying its supply base by sourcing components from multiple regions, thereby reducing reliance on any single supplier and mitigating risk stemming from tariffs imposed on specific countries.

-

Details on strategic partnerships and collaborations: Rolls-Royce has enhanced collaboration with strategic partners and suppliers to ensure a robust and flexible supply chain capable of withstanding trade disruptions. These partnerships offer diversified sourcing options and support operational resilience.

-

Quantifiable cost-saving measures implemented: Rolls-Royce is actively implementing quantifiable cost-saving measures across its operations. These cost-saving initiatives help offset the impact of increased costs arising from trade tariffs, thereby protecting profit margins and contributing to their 2025 outlook.

Positive Factors Contributing to Rolls-Royce's Confidence

Despite global trade uncertainties, several factors contribute to Rolls-Royce's confidence in its 2025 outlook.

-

Strong order backlog for key products: A substantial order backlog indicates a strong market demand for Rolls-Royce's products, signifying a degree of future revenue stability.

-

Technological advancements and innovation within the company: Continuous investment in research and development, combined with ongoing technological advancements, positions Rolls-Royce at the forefront of aerospace innovation, bolstering its long-term competitiveness.

-

Government support or favorable regulatory environments: Government support and favorable regulatory environments in key markets can create a stable and supportive operating climate, further reinforcing the company’s positive financial outlook.

-

Growth in specific market segments: Growth in specific high-demand market segments enables Rolls-Royce to focus its resources on opportunities with the greatest potential for return, supporting their growth projections and sustained performance.

Conclusion

Rolls-Royce’s continued confidence in its 2025 outlook, even amidst concerns surrounding global trade tariffs, reflects a proactive approach to managing risk and leveraging opportunities. By diversifying its supply chain, implementing cost-saving measures, and capitalizing on positive market trends, the company is well-positioned to navigate current challenges and achieve its long-term strategic goals. The strong order backlog, continued technological innovation, and government support are further bolstering their projected growth. To learn more about Rolls-Royce's financial performance and future strategies, visit their investor relations website [insert link here] and stay updated on further analyses of the Rolls-Royce 2025 outlook and the impact of global trade tariffs.

Featured Posts

-

Bbc Two Hd Programme Guide Including Newsround

May 02, 2025

Bbc Two Hd Programme Guide Including Newsround

May 02, 2025 -

Rare Seabird Research A Focus By Te Ipukarea Society

May 02, 2025

Rare Seabird Research A Focus By Te Ipukarea Society

May 02, 2025 -

500 Nhl Points Clayton Keller Makes Missouri Hockey Proud

May 02, 2025

500 Nhl Points Clayton Keller Makes Missouri Hockey Proud

May 02, 2025 -

Fortnite Music Update A Source Of Player Frustration

May 02, 2025

Fortnite Music Update A Source Of Player Frustration

May 02, 2025 -

Success For A Harry Potter Remake Six Necessary Elements

May 02, 2025

Success For A Harry Potter Remake Six Necessary Elements

May 02, 2025

Latest Posts

-

Challenges For Reform Uk A Former Deputys Threat Of A New Party

May 03, 2025

Challenges For Reform Uk A Former Deputys Threat Of A New Party

May 03, 2025 -

Reform Uk Leader Nigel Farage Visits Shrewsbury Local Pub Flat Cap And Political Commentary

May 03, 2025

Reform Uk Leader Nigel Farage Visits Shrewsbury Local Pub Flat Cap And Political Commentary

May 03, 2025 -

Afghan Migrant Threatens Nigel Farage On Uk Bound Journey

May 03, 2025

Afghan Migrant Threatens Nigel Farage On Uk Bound Journey

May 03, 2025 -

Shrewsbury Visit Nigel Farage Criticizes Conservatives Enjoys Local Pub

May 03, 2025

Shrewsbury Visit Nigel Farage Criticizes Conservatives Enjoys Local Pub

May 03, 2025 -

Afghan Migrants Threat To Kill Nigel Farage During Uk Travel

May 03, 2025

Afghan Migrants Threat To Kill Nigel Farage During Uk Travel

May 03, 2025