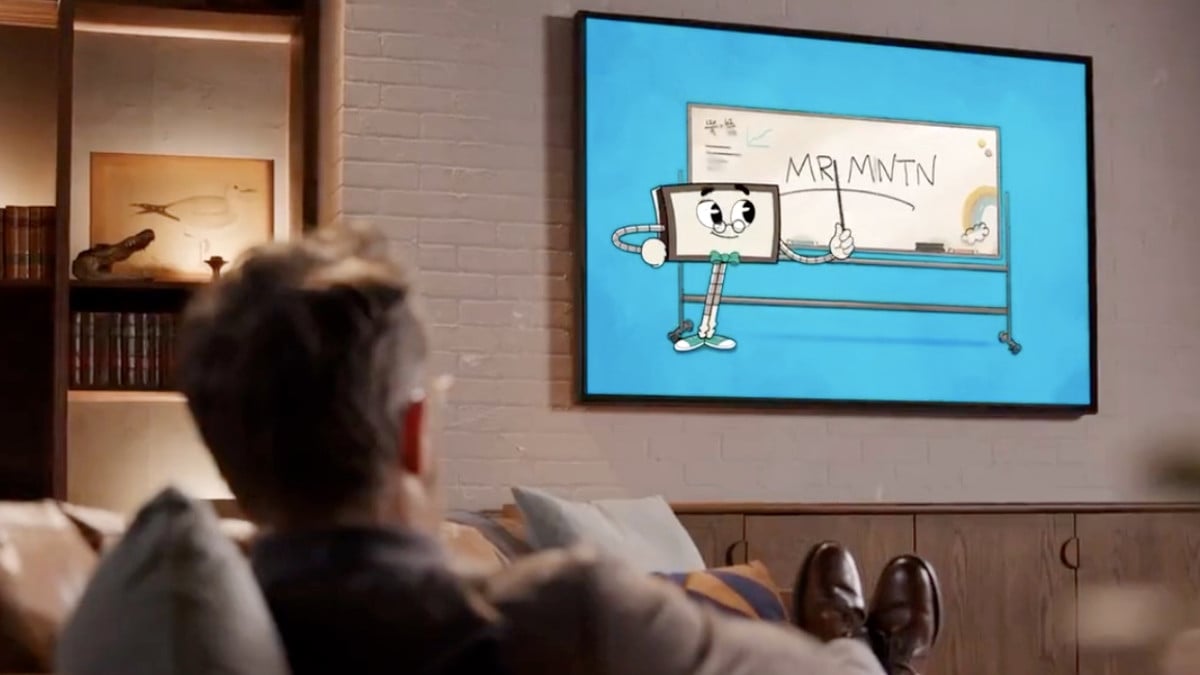

Ryan Reynolds' MNTN: Details On The Planned IPO Launch

Table of Contents

MNTN's Business Model and Market Position

MNTN operates on a direct-to-consumer (DTC) business model, cutting out intermediaries and connecting directly with its target audience. This strategy allows for greater control over branding, pricing, and customer relationships, a significant competitive advantage. MNTN focuses on a specific niche market, offering premium products (details on exact products are currently limited, pending official announcements), appealing to discerning consumers willing to pay a premium for quality and exclusivity.

MNTN's current market position is rapidly evolving. While precise market share data is not yet publicly available, early indications suggest strong growth potential within the DTC sector. The company faces competition from established players in the premium consumer goods market, but its unique branding and celebrity endorsement offer a significant point of differentiation.

- Key products and services offered by MNTN: While specifics remain confidential, MNTN's focus is on premium offerings within a carefully defined niche.

- Competitive advantages of MNTN's business model: The DTC model offers enhanced customer relationships, greater control over pricing and branding, and higher profit margins.

- Market analysis: Growth projections and potential challenges: The DTC market is experiencing rapid growth, offering considerable potential for MNTN. However, challenges include intense competition and the need for continuous innovation.

Timeline and Expectations for the MNTN IPO

The exact timeline for the MNTN IPO remains unconfirmed. While there have been no official announcements regarding the IPO date, industry speculation suggests it could occur within [insert timeframe, if available, or “the next year”]. The anticipated valuation is subject to various factors, including market conditions and investor sentiment, but early estimates place it within a [insert valuation range, if available, or “substantial range”].

- Speculated IPO date: [Insert speculated date or timeframe, if available, or "To be announced."]

- Expected valuation range: [Insert estimated range, if available, or "To be determined."]

- Potential investors and investment firms: [Insert names of potential investors, if available, or "A diverse range of investors is expected."]

- Risks and uncertainties related to the IPO: As with any IPO, there are inherent risks, including market volatility, competition, and the potential for the company to underperform expectations.

Ryan Reynolds' Role and Influence on the MNTN IPO

Ryan Reynolds' involvement transcends mere celebrity endorsement; he’s deeply involved in MNTN's strategy and operations. His marketing savvy and established brand recognition are critical assets, giving MNTN a substantial head start in building brand awareness and attracting customers. His presence also significantly influences investor interest; the "Ryan Reynolds effect" attracts attention and confidence from investors who recognize his successful entrepreneurial track record.

- Reynolds' marketing strategies for MNTN: His involvement includes creative campaigns, strategic partnerships, and leveraging his social media presence to build brand awareness.

- His influence on attracting investors: His celebrity status and business acumen lend significant credibility to the MNTN brand, attracting investors seeking high-growth potential.

- Potential impact of his celebrity status on the IPO's success: Reynolds' involvement is expected to significantly boost investor interest and contribute to a successful IPO.

Financial Performance and Investment Highlights

Detailed financial information about MNTN is limited pending the official IPO documents. However, based on available information (if any, otherwise replace with general statements), MNTN shows [insert positive financial indicators like strong revenue growth, high profit margins, etc. or "promising financial performance"]. This, coupled with the company's unique business model and strong brand recognition, makes it an attractive investment opportunity.

- Key financial data (revenue, profit margins, etc.): [Insert key financial data, if available, otherwise replace with general statements about expected growth and profitability.]

- Growth projections and future financial outlook: [Insert growth projections, if available, or a general optimistic statement about future outlook.]

- Investment highlights and potential returns: [Highlight potential returns based on market analysis and company projections, or make a general statement about high-growth potential.]

Conclusion: Investing in the Future with Ryan Reynolds' MNTN IPO

The Ryan Reynolds' MNTN IPO presents a compelling investment opportunity. MNTN's direct-to-consumer business model, premium product offerings, and strong brand recognition, fueled by Ryan Reynolds' involvement, position it for significant growth. While the exact timeline and valuation remain to be seen, the potential for substantial returns makes it an intriguing prospect. Stay tuned for updates on the Ryan Reynolds' MNTN IPO and learn more about investing in the MNTN IPO. Don't miss out on this exciting opportunity to be part of the future of the DTC market.

Featured Posts

-

Unlocking Payton Pritchards Potential A Deep Dive Into His Improved Performance

May 11, 2025

Unlocking Payton Pritchards Potential A Deep Dive Into His Improved Performance

May 11, 2025 -

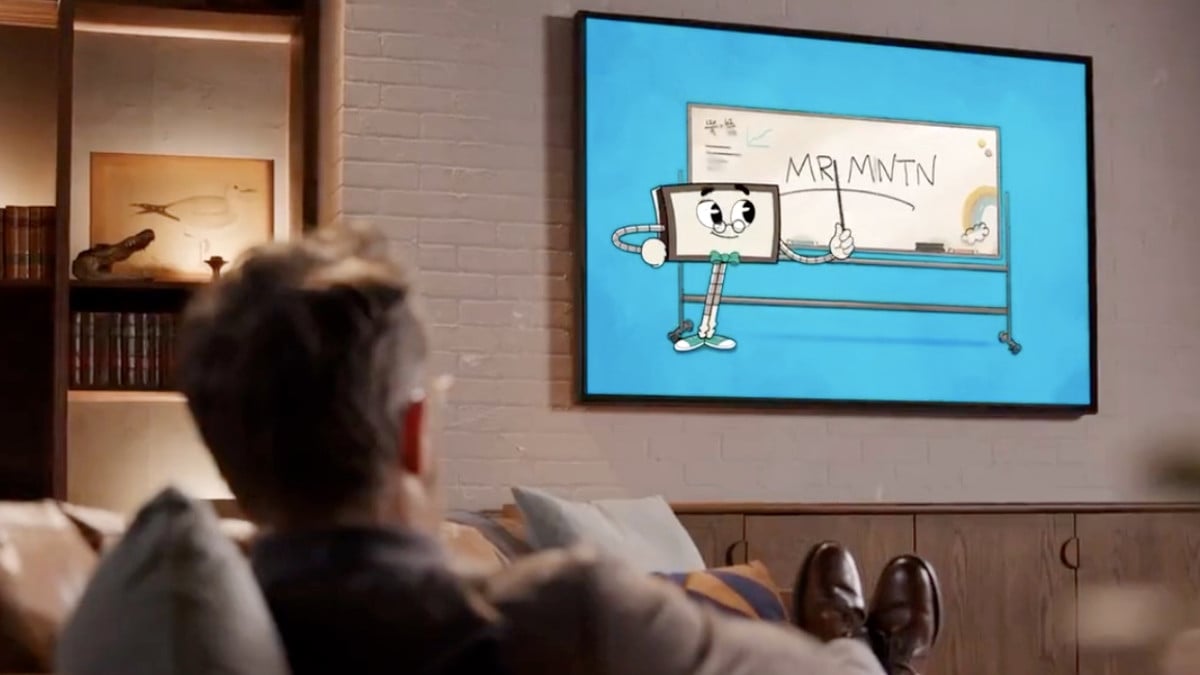

Boris Johnson Y El Ataque De Un Avestruz Detalles De Lo Sucedido En Texas

May 11, 2025

Boris Johnson Y El Ataque De Un Avestruz Detalles De Lo Sucedido En Texas

May 11, 2025 -

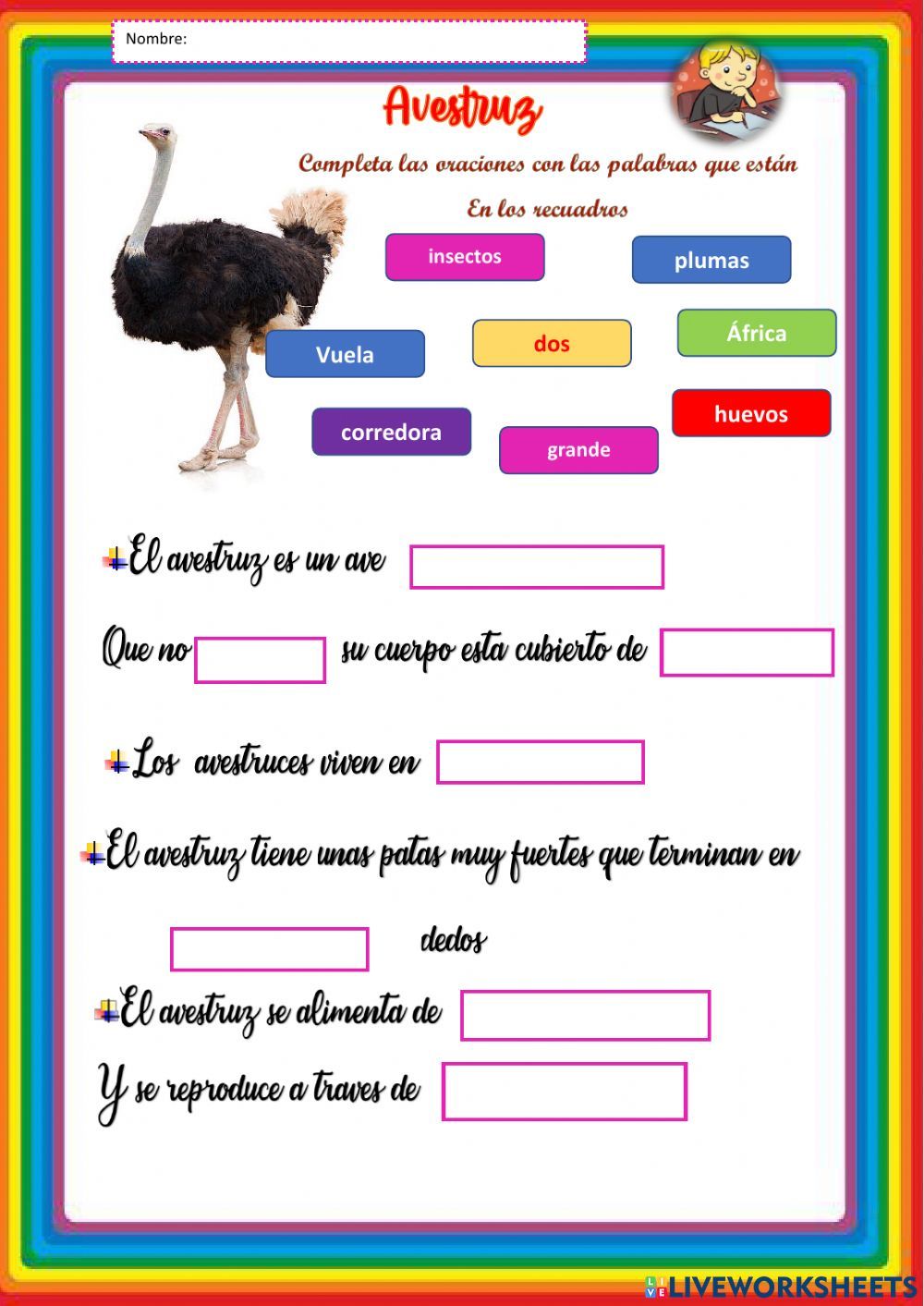

Lower Box Office Receipts Contribute To Cineplexs Q1 Financial Loss

May 11, 2025

Lower Box Office Receipts Contribute To Cineplexs Q1 Financial Loss

May 11, 2025 -

Celtics Guard Payton Pritchards Sixth Man Of The Year Bid

May 11, 2025

Celtics Guard Payton Pritchards Sixth Man Of The Year Bid

May 11, 2025 -

Is Black Gold Within Reach The Challenges And Opportunities Of Offshore Drilling In Uruguay

May 11, 2025

Is Black Gold Within Reach The Challenges And Opportunities Of Offshore Drilling In Uruguay

May 11, 2025