Ryanair's Growth Outlook Dampened By Tariff Wars; Buyback Initiative Unveiled

Table of Contents

H2: The Impact of Tariff Wars on Ryanair's Operations

Increased tariffs have significantly impacted Ryanair's operational efficiency and profitability. The airline, like many others, is heavily reliant on fuel, a commodity directly affected by international trade disputes. Higher fuel costs translate directly into increased operational expenses, squeezing profit margins and potentially leading to higher ticket prices. This, in turn, can affect demand, particularly in a price-sensitive market like budget air travel.

The ripple effect of tariff wars extends beyond fuel. Trade disputes can disrupt supply chains, impacting the timely procurement of essential aircraft maintenance parts and potentially leading to delays or even cancellations of flights. The uncertainty surrounding international trade also makes long-term strategic planning more challenging, impacting route expansion and investment decisions.

- Increased fuel costs due to tariffs: Higher fuel prices directly reduce Ryanair's profitability, forcing difficult choices regarding pricing and expansion.

- Reduced passenger numbers due to higher fares: As Ryanair passes on increased costs to consumers, demand may soften, impacting overall revenue.

- Potential route cancellations or delays in new route launches: Uncertainty in the global market may lead to a more cautious approach to expansion.

- Impact on aircraft maintenance and spare parts sourcing: Disruptions to global supply chains increase the risk of delays and higher maintenance costs.

H2: Ryanair's Revised Growth Projections and Strategic Response

Ryanair has recently revised its growth projections downward, reflecting the challenges posed by the current economic climate. The company has cited a combination of factors, including the increased fuel costs associated with tariff wars, weakening economic conditions in certain regions, and increased competition within the budget airline sector. To counteract these pressures, Ryanair is implementing a multi-pronged strategic response. This may include intensified cost-cutting measures, a more focused approach to route selection, and a greater emphasis on ancillary revenue streams.

- Specific figures regarding revised passenger growth targets: While precise figures may vary depending on the reporting period, downward revisions are evident in Ryanair's recent announcements.

- Explanation of the impact on revenue and profit margins: Lower passenger growth and higher operating costs are expected to affect Ryanair's bottom line.

- Details of any new cost-cutting measures implemented: This could involve streamlining operations, negotiating better deals with suppliers, or reducing staffing levels in specific areas.

- Focus on specific regions or routes affected: Areas experiencing weaker economic growth or facing intensified competition might see adjustments to flight schedules or capacity.

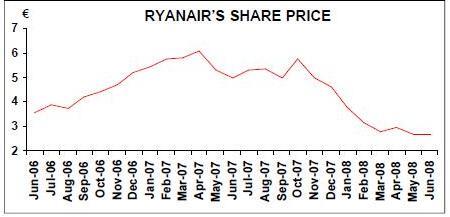

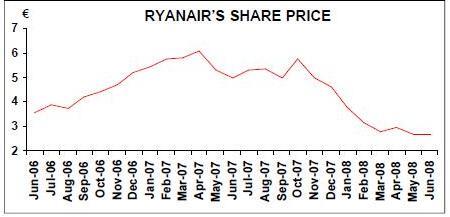

H2: The Significance of the Ryanair Share Buyback Program

Against this backdrop of challenges, Ryanair's announcement of a share buyback program is noteworthy. The buyback demonstrates a level of confidence in the company's long-term prospects, suggesting that management believes the current share price undervalues the airline's potential. For shareholders, the buyback represents an opportunity to potentially increase their returns, assuming the share price appreciates following the buyback.

- Amount of shares to be repurchased: The specific number of shares will be detailed in Ryanair's official announcements.

- Timeline for the buyback program: The buyback is likely to be phased over a period of time.

- Potential impact on the share price: The buyback could lead to increased demand for Ryanair shares, potentially driving up the price.

- Ryanair's rationale for the buyback – confidence in future prospects, etc.: The buyback signals a belief in the company's ability to navigate current challenges and achieve long-term growth.

H2: Industry-Wide Implications and Competitive Landscape

The challenges faced by Ryanair are not unique. Many budget airlines are grappling with similar issues, including escalating fuel costs and increased competition. This situation could lead to further consolidation within the industry, with potential mergers and acquisitions reshaping the competitive landscape. The long-term effects could include changes in air travel pricing and seat availability, as airlines seek to optimize routes and pricing strategies in response to prevailing economic conditions.

- Comparison to other budget airlines facing similar challenges: Competitors like EasyJet and Wizz Air are also dealing with similar headwinds.

- Analysis of market share dynamics: The current economic climate may lead to shifts in market share among budget airlines.

- Potential mergers and acquisitions within the industry: Consolidation is a possible outcome as airlines seek to improve efficiencies and gain market share.

- Long-term effects on air travel pricing and availability: Consumers may experience changes in ticket prices and the availability of routes.

3. Conclusion: Analyzing Ryanair's Future and the Outlook for Growth

Ryanair's growth outlook remains complex, impacted significantly by global tariff wars and their resulting effects on fuel costs and operational efficiency. While revised growth projections reflect these challenges, the company's share buyback program suggests a degree of confidence in its long-term prospects. The competitive landscape in the budget airline industry is also evolving, with potential for further consolidation. The coming years will be crucial for Ryanair as it navigates these economic headwinds and adapts its strategies. Stay tuned for updates on Ryanair's performance and how it navigates these complex economic headwinds. Continue to follow our coverage of Ryanair's growth outlook for the latest insights.

Featured Posts

-

Manchester Citys Next Manager Could An Arsenal Legend Replace Guardiola

May 21, 2025

Manchester Citys Next Manager Could An Arsenal Legend Replace Guardiola

May 21, 2025 -

Bp Valuation To Double Ceos Plans And Uk Listing Commitment Confirmed By Ft

May 21, 2025

Bp Valuation To Double Ceos Plans And Uk Listing Commitment Confirmed By Ft

May 21, 2025 -

Check The Latest Rain Forecasts And Timing

May 21, 2025

Check The Latest Rain Forecasts And Timing

May 21, 2025 -

Why Did D Wave Quantum Qbts Stock Price Rise Today An In Depth Analysis

May 21, 2025

Why Did D Wave Quantum Qbts Stock Price Rise Today An In Depth Analysis

May 21, 2025 -

Significant Drop In Bp Chief Executives Salary Down 31

May 21, 2025

Significant Drop In Bp Chief Executives Salary Down 31

May 21, 2025

Latest Posts

-

New Womens Tag Team Champions Emerge On Wwe Monday Night Raw

May 21, 2025

New Womens Tag Team Champions Emerge On Wwe Monday Night Raw

May 21, 2025 -

Latest Wwe News John Cena Randy Orton Rivalry And Bayley Update

May 21, 2025

Latest Wwe News John Cena Randy Orton Rivalry And Bayley Update

May 21, 2025 -

Wwe Raw New Womens Tag Team Champions Announced

May 21, 2025

Wwe Raw New Womens Tag Team Champions Announced

May 21, 2025 -

Wwe News Ripley And Perez To Compete In Money In The Bank Ladder Match

May 21, 2025

Wwe News Ripley And Perez To Compete In Money In The Bank Ladder Match

May 21, 2025 -

New Wwe Womens Tag Team Champions Monday Night Raw Results

May 21, 2025

New Wwe Womens Tag Team Champions Monday Night Raw Results

May 21, 2025