S&P 500 Downside Insurance: A Smart Strategy For Volatility

Table of Contents

Understanding Downside Risk in the S&P 500

Defining Market Volatility and its Impact

Market volatility refers to the rate and extent of price fluctuations in the market. High volatility in the S&P 500, a leading indicator of US stock market performance, can lead to significant gains or losses in a short period. This unpredictability makes effective risk management crucial.

- Examples of recent volatile periods: The COVID-19 market crash of 2020 and the dot-com bubble burst of 2000 are prime examples of periods with extreme S&P 500 volatility.

- Impact on investor confidence: Sharp declines can severely impact investor confidence, leading to panic selling and further market drops. This creates a downward spiral that can be difficult to escape.

- Potential for significant losses: Without proper downside protection, investors can experience substantial losses during volatile periods. A significant correction in the S&P 500 can wipe out years of gains.

Statistics show that the S&P 500 has experienced average annualized volatility of around 15%, but this can fluctuate wildly. Understanding this historical volatility is vital for appropriate risk management.

Identifying Your Risk Tolerance

Before implementing any S&P 500 downside insurance strategy, it’s crucial to assess your personal risk tolerance. Your risk tolerance dictates how much potential loss you're comfortable with in pursuit of higher returns.

- Different investor profiles:

- Conservative investors: Prefer lower risk and prioritize capital preservation. They may opt for more robust downside protection.

- Moderate investors: Balance risk and return, seeking a blend of capital preservation and growth potential.

- Aggressive investors: Accept higher risk for potentially higher returns, potentially opting for less downside protection.

- How risk tolerance influences investment decisions: Your risk tolerance will shape your investment choices and the level of downside insurance you deem appropriate.

Consulting a financial advisor can be invaluable in determining your risk tolerance and designing a suitable investment strategy.

Strategies for S&P 500 Downside Insurance

Utilizing Put Options for Protection

Put options are a powerful tool for implementing S&P 500 downside insurance. A put option gives the holder the right, but not the obligation, to sell an underlying asset (in this case, an S&P 500 index fund or ETF) at a specific price (the strike price) before a specific date (the expiration date).

- Explanation of put option contracts: Put options act as a form of insurance, offering protection against price declines. If the market falls below your strike price, you can exercise the option to sell your holdings at the higher strike price, limiting your losses.

- Strike price selection: The strike price should be carefully chosen based on your risk tolerance and market outlook. A lower strike price provides greater protection but costs more in premiums.

- Premium costs: Purchasing put options involves paying a premium, which is the cost of the insurance.

- Expiration dates: Put options have expiration dates. Choose an expiration date that aligns with your investment timeframe and anticipated market volatility.

- Benefits and drawbacks of put options: Benefits include limiting potential losses. Drawbacks include the cost of the premiums, which reduces potential profits if the market rises significantly.

Examples of put option strategies include protective puts (buying put options to protect an existing long position) and collars (combining put and call options for a defined risk profile).

Exploring Alternative Hedging Strategies

While put options are a common approach, other strategies can mitigate downside risk in the S&P 500:

- Index funds with lower volatility: Investing in index funds that track less volatile sectors can help reduce overall portfolio risk.

- Diversification across asset classes: Diversifying investments across different asset classes (stocks, bonds, real estate) reduces exposure to the fluctuations of a single market segment like the S&P 500.

- Stop-loss orders: These orders automatically sell your holdings if the price falls below a predetermined level.

- Managed futures: Managed futures funds can provide diversification and hedge against market downturns.

Each of these strategies has its benefits and drawbacks; a well-diversified portfolio often incorporates multiple approaches. Compared to put options, some methods might offer less precise control over downside protection but may involve lower upfront costs.

Calculating Costs and Benefits of S&P 500 Downside Insurance

The Cost of Premiums vs. Potential Losses Avoided

The decision to use S&P 500 downside insurance involves weighing the cost of premiums against the potential losses it may prevent. The effectiveness of the insurance directly correlates with the volatility of the market.

- Example scenarios illustrating the cost-benefit analysis: A small premium paid might protect against a significant market downturn, resulting in net positive returns even when accounting for the insurance cost. Conversely, if the market rises significantly, the premium might represent a lost opportunity.

- Factors affecting premium costs: Volatility (higher volatility means higher premiums), time to expiration (longer-term options are generally more expensive).

Careful consideration of potential market movements is essential for determining the cost-effectiveness of downside protection.

Assessing the Overall Return on Investment

Evaluating the success of S&P 500 downside insurance requires a long-term perspective and a comparison of portfolio performance with and without the insurance.

- Comparing portfolio performance with and without downside insurance: This comparison reveals whether the cost of the insurance was justified by the losses it prevented.

- Highlight the importance of long-term perspective and risk management: Downside protection isn't about avoiding all losses; it's about reducing the impact of significant downturns on long-term investment goals.

Conclusion

Employing S&P 500 downside insurance provides a strategic approach to managing market volatility and protecting your portfolio. Understanding your personal risk tolerance is crucial for selecting the appropriate level of protection and understanding the trade-offs involved. Different strategies exist, offering various levels of downside protection at different costs.

Call to Action: Consider incorporating S&P 500 downside insurance into your investment strategy to protect your portfolio from unexpected market downturns. Consult with a financial advisor to determine the best approach for your individual circumstances and risk profile. Learn more about effective strategies for managing S&P 500 downside risk today!

Featured Posts

-

Target Starbucks Vs Standalone 9 Key Differences

Apr 30, 2025

Target Starbucks Vs Standalone 9 Key Differences

Apr 30, 2025 -

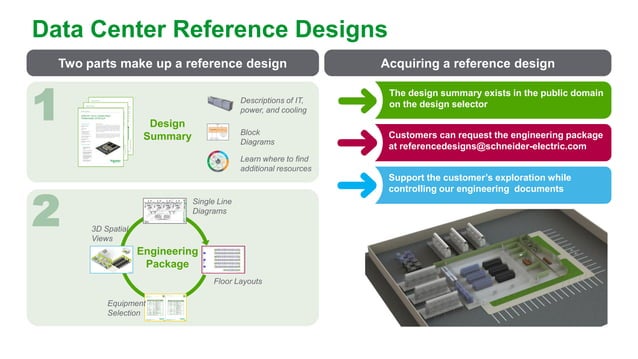

Strong 2024 Performance For Schneider Electric Data Center Market Drives Growth

Apr 30, 2025

Strong 2024 Performance For Schneider Electric Data Center Market Drives Growth

Apr 30, 2025 -

How To Watch Cavaliers Vs Heat Game 2 Time Tv Channel And Free Live Stream Options

Apr 30, 2025

How To Watch Cavaliers Vs Heat Game 2 Time Tv Channel And Free Live Stream Options

Apr 30, 2025 -

Our Yorkshire Farm Amanda Owen Breaks Down In Emotional Farewell

Apr 30, 2025

Our Yorkshire Farm Amanda Owen Breaks Down In Emotional Farewell

Apr 30, 2025 -

Document Amf Mercialys Rapport Cp 2025 E1022016 25 02 2025

Apr 30, 2025

Document Amf Mercialys Rapport Cp 2025 E1022016 25 02 2025

Apr 30, 2025