S&P 500 Downside Insurance: Is Now The Time To Buy?

Table of Contents

Assessing Current Market Conditions for S&P 500 Downside Protection

Before diving into specific S&P 500 insurance strategies, it's crucial to assess the current economic climate. Understanding prevailing market conditions is paramount to making an informed decision about downside protection. Several factors influence the need for S&P 500 downside protection:

-

Inflation and Interest Rates: High inflation and rising interest rates typically put downward pressure on stock valuations. The Federal Reserve's actions directly impact the market, making accurate prediction challenging. A hawkish monetary policy (aggressive interest rate hikes) increases the risk of a market correction, increasing the appeal of S&P 500 insurance strategies.

-

Geopolitical Factors: Global events, such as the ongoing conflict in Ukraine or rising tensions in other regions, can create significant market uncertainty and volatility. These geopolitical risks contribute to the need for robust S&P 500 downside protection.

-

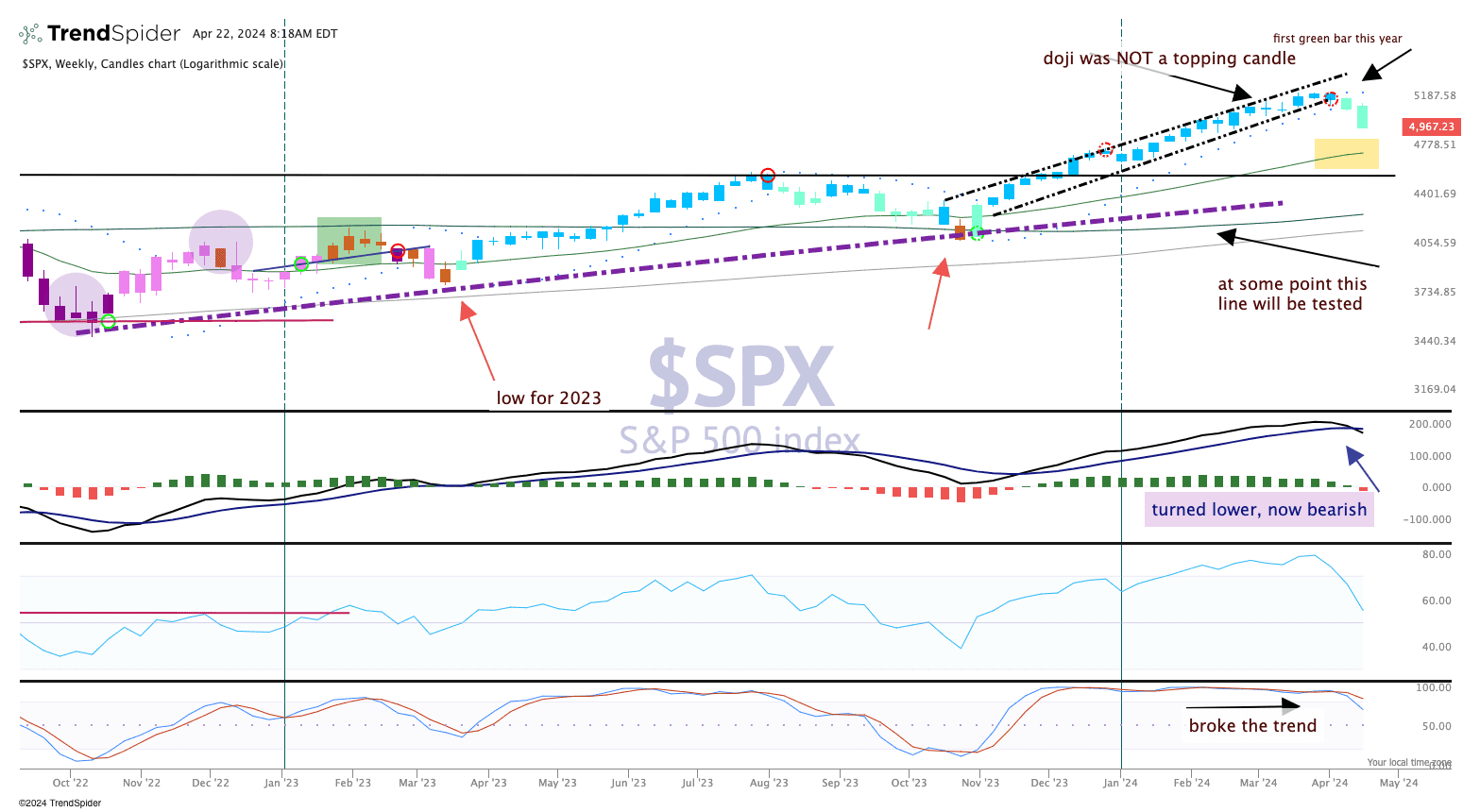

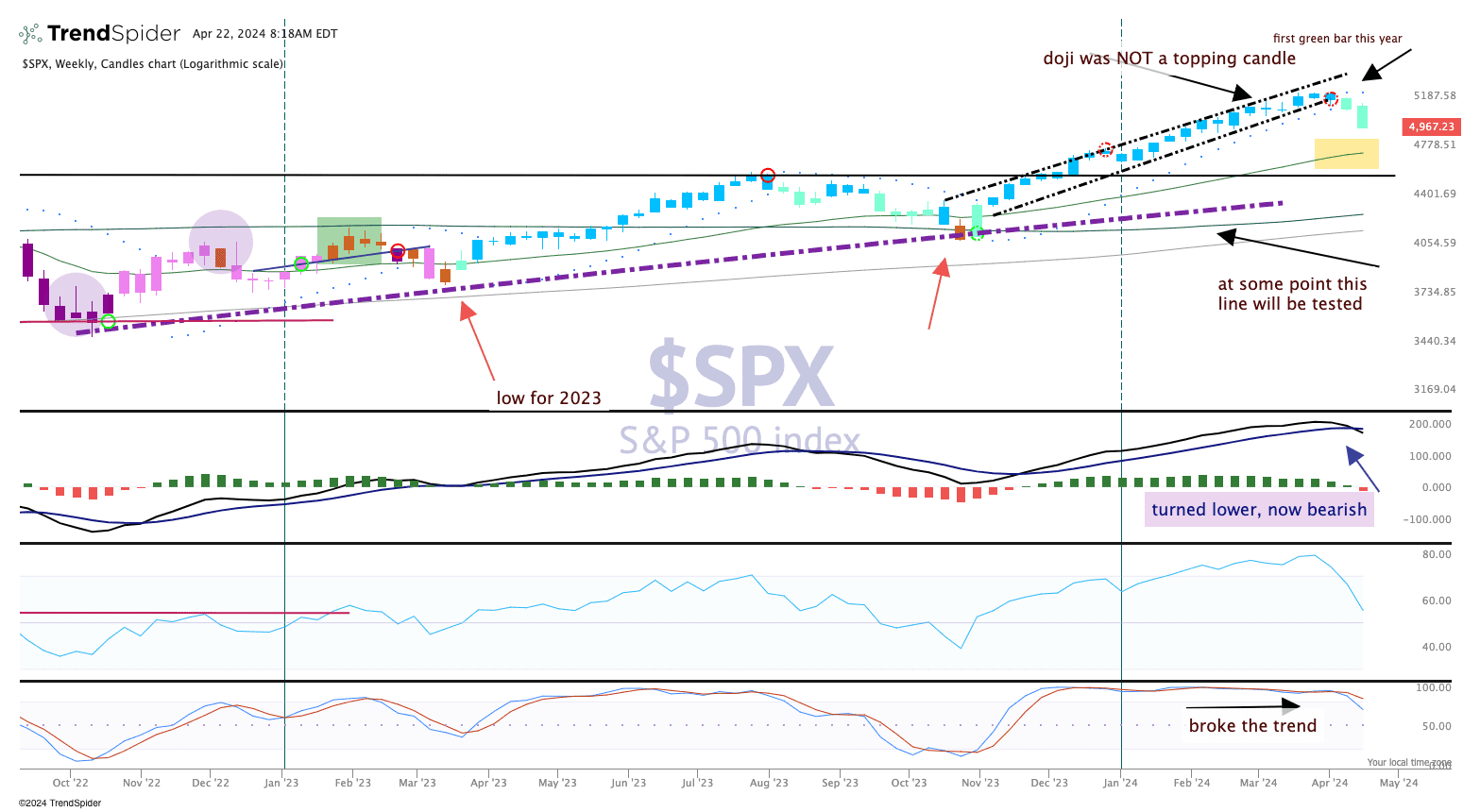

Recent S&P 500 Performance and Volatility: Analyzing recent trends in the S&P 500's performance, including its volatility index (VIX), provides valuable insights. A period of high volatility suggests a greater need for downside insurance.

Bullet Points:

- Example: The recent banking sector turmoil significantly impacted market sentiment and increased volatility, underscoring the importance of S&P 500 downside protection.

- Key Data Point: A sustained increase in the VIX (Volatility Index) often signals increased market uncertainty and a higher likelihood of a correction.

- Expert Opinion: Many financial analysts are predicting a period of continued market uncertainty, recommending that investors consider incorporating downside protection into their portfolios.

Understanding Different Types of S&P 500 Downside Insurance

Several financial instruments can provide S&P 500 downside insurance. Choosing the right one depends on your risk tolerance, investment timeline, and understanding of the underlying mechanics.

Put Options:

Put options give the buyer the right, but not the obligation, to sell a specified number of S&P 500 index shares (or equivalent ETFs) at a predetermined price (the strike price) before a set expiration date. If the market falls below the strike price, the put option becomes valuable, offering downside protection. The premium paid for the put option is the cost of this insurance. Calculating potential profits and losses requires understanding option pricing models.

Bullet Points:

- Pros: Targeted downside protection, flexible expiration dates.

- Cons: Premium costs can erode potential gains, requires understanding of options trading.

- Example: Buying a put option with a strike price of 4000 on the SPY ETF (an S&P 500 tracker) would protect against a drop below that level.

Inverse ETFs:

Inverse exchange-traded funds (ETFs) aim to deliver the opposite performance of the underlying index. Investing in an inverse S&P 500 ETF is essentially a bet against the market. However, it's crucial to remember that leveraged inverse ETFs amplify both gains and losses, increasing risk significantly.

Bullet Points:

- Pros: Simple to implement, readily available.

- Cons: High risk due to leverage, potential for significant losses.

- Example: A 3x inverse S&P 500 ETF would theoretically deliver three times the inverse performance of the S&P 500.

Volatility ETFs (VIX):

Volatility ETFs track the VIX index, a measure of market volatility. When market uncertainty rises, the VIX increases, and these ETFs can appreciate. They act as a hedge against market volatility rather than direct downside protection on the S&P 500.

Bullet Points:

- Pros: Diversification benefit, protects against market crashes.

- Cons: Doesn't directly correlate with S&P 500 performance, can be volatile themselves.

- Example: Investing in a VIX ETF like VXX provides a hedge against market uncertainty, regardless of direction.

Evaluating the Cost and Benefits of S&P 500 Downside Insurance

The cost of S&P 500 downside insurance varies significantly depending on the chosen strategy. Put options have premiums, while ETFs have expense ratios. The potential payoff must be weighed against these costs.

Bullet Points:

- Cost-Benefit Analysis: Consider the likelihood of a market downturn against the cost of the insurance. A high-probability downturn justifies higher insurance costs.

- Break-Even Point: Calculate the market decline required for the insurance strategy to be profitable after factoring in costs.

- Comparison: Put options offer tailored protection but have higher upfront costs. ETFs offer broader diversification but might not fully protect against sharp declines.

Factors to Consider Before Buying S&P 500 Downside Insurance

Before investing in any S&P 500 downside insurance, consider these factors:

- Investment Timeline: Longer-term investors might tolerate more risk and need less downside protection than short-term investors.

- Risk Tolerance: Your personal risk tolerance significantly influences the appropriate level of downside protection.

- Portfolio Diversification: Ensure your overall portfolio is adequately diversified before adding downside protection. Overreliance on any single strategy increases risk.

Bullet Points:

- Checklist: Assess your risk tolerance, investment horizon, and understanding of the chosen strategy.

- Professional Advice: Consult a qualified financial advisor for personalized guidance.

- Risk Profile: Understanding your personal risk profile is key to selecting the appropriate S&P 500 insurance strategy.

Conclusion: Is Now the Right Time for S&P 500 Downside Insurance?

Determining the optimal time to purchase S&P 500 downside insurance requires careful consideration of current market conditions, your risk tolerance, and the mechanics of various S&P 500 insurance strategies. While market uncertainty remains high, the decision depends on your specific circumstances and investment goals. The analysis presented suggests that now might be a prudent time to consider S&P 500 downside protection for some investors, particularly those with a shorter investment horizon or lower risk tolerance.

Call to Action: Further research your chosen S&P 500 insurance strategy, consult a financial advisor, and make informed decisions about protecting your portfolio. Explore specific options like SPY put options, inverse ETFs like SH or SDS, or VIX ETFs like VXX to understand how they can help you manage your exposure to market volatility. Remember that this information is for educational purposes and not financial advice.

Featured Posts

-

Slslt Alteawn Almmyzt Astratyjyat Mwajht Alshbab

May 01, 2025

Slslt Alteawn Almmyzt Astratyjyat Mwajht Alshbab

May 01, 2025 -

Cruises Com Launches Innovative Rewards Program For Cruisers

May 01, 2025

Cruises Com Launches Innovative Rewards Program For Cruisers

May 01, 2025 -

How Michael Sheen Erased 1 Million In Debt For 900 People

May 01, 2025

How Michael Sheen Erased 1 Million In Debt For 900 People

May 01, 2025 -

Dragons Den A Comprehensive Guide To The Investment Show

May 01, 2025

Dragons Den A Comprehensive Guide To The Investment Show

May 01, 2025 -

Tbs Klinieken Overvol Wachttijden Van Meer Dan Een Jaar

May 01, 2025

Tbs Klinieken Overvol Wachttijden Van Meer Dan Een Jaar

May 01, 2025

Latest Posts

-

Ryys Shbab Bn Jryr Mthm Mlkhs Alqdyt Walhkm

May 01, 2025

Ryys Shbab Bn Jryr Mthm Mlkhs Alqdyt Walhkm

May 01, 2025 -

Arqam Jwanka Nqat Def Nady Alnsr Fy Almwsm Aljdyd

May 01, 2025

Arqam Jwanka Nqat Def Nady Alnsr Fy Almwsm Aljdyd

May 01, 2025 -

Giai Bong Da Thanh Nien Sinh Vien Quoc Te Nha Vo Dich Dau Tien Va Hanh Trinh Dang Quang

May 01, 2025

Giai Bong Da Thanh Nien Sinh Vien Quoc Te Nha Vo Dich Dau Tien Va Hanh Trinh Dang Quang

May 01, 2025 -

Alqdae Yhkm Ela Ryys Shbab Bn Jryr Balsjn

May 01, 2025

Alqdae Yhkm Ela Ryys Shbab Bn Jryr Balsjn

May 01, 2025 -

Truong Dh Ton Duc Thang Tinh Than The Thao Va Chien Thang Tai Giai Bong Da Sinh Vien Quoc Te 2025

May 01, 2025

Truong Dh Ton Duc Thang Tinh Than The Thao Va Chien Thang Tai Giai Bong Da Sinh Vien Quoc Te 2025

May 01, 2025